All Of The Boxes Are Checked

What a day! We saw early weakness turn into a nice squeeze right into the 6000 SPX target we’ve been mentioning for a long time (well, 5999.70 to be exact), and we also hit the QQQ 533 level we’ve been targeting since Monday based on what GEX was telling us. The early 0 DTE reading also led us to form a correct bias for a rally off of 5950. We discuss SPX, QQQ, DIA, IWM, and even the drama known as TSLA in today’s YouTube video, so check it out by clicking here.

Taking a brief look at SPX, the lower edge of the upper Dealer Cluster zone was essentially tagged, with 5999.70 close enough for us to consider it a “hit.” From a functional perspective, any time a GEX target is in play, we have to consider likely behavior as we approach the target. Other participants know that a lot of open interest exists at 6000. Early birds will sometimes look to sell just ahead of the exact tag. Other times, we see the zone exceeded before a fast and harsh retracement back below the zone. By today’s close, we actually didn’t see a huge overall shift though, so GEX is still indicating expectations for ultimately higher prices.

However, closing below the Hull moving average is a short signal in my book. But is a few pennies below the line after a large downward move intraday enough to take out a second mortgage to buy put options? I would rather wait for confirmation, a more decisive move below the line. We could easily gap up and test 6000 again, or possibly 6050-6100, especially given that we’ve been rising all week and tomorrow is a Friday. Or we could “seal the deal” to the downside with a more decisive gap down below the Hull, but that would likely be a higher probability short with some momentum beyond tomorrow’s open to the downside if so.

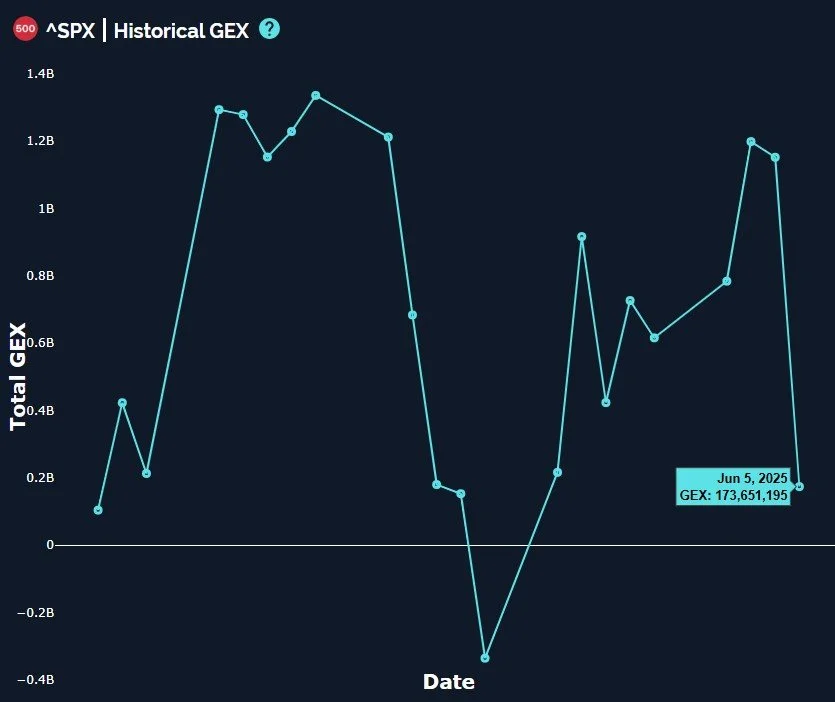

SPX net total GEX definitely declined today, and by a lot. But we still see positive overall GEX for SPX, so we are not yet in a bearish environment, as far as GEX is concerned.

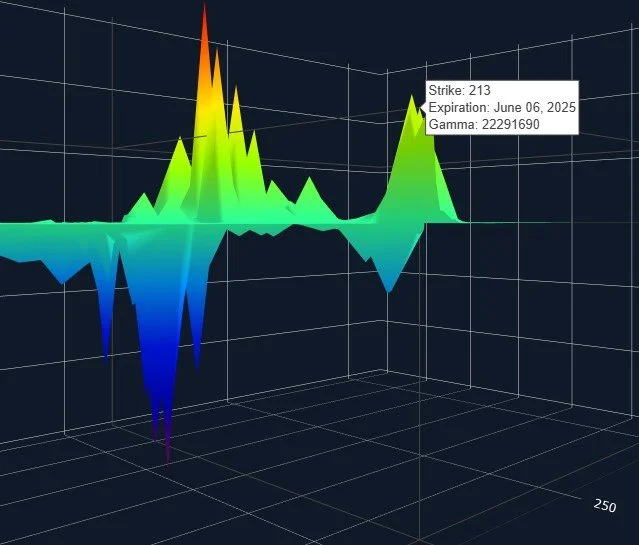

QQQ had an almost perfect tag of 533 today as well, another level we’ve been highlighting all week, based on what our 3D GEX graph showed to be outsized for Friday’s expiration. QQQ also closed mere pennies below the Hull, a bearish close.

As of today’s close, however, 533 still remains as the largest expiring GEX cluster tomorrow (the big negative cluster expired today, so ignore that). The potential implication is that today’s microscopic close below the Hull is too soon to be short, but rather a trap for one more attempt by bulls to move higher on Friday, potentially reaching or exceeding 533 this time. The starting point tomorrow morning (a big gap down invalidating the likelihood of retesting 533) will have a big part to play in giving an early clue as to what is possible tomorrow.

DIA is yet another cautionary signal to not get too bearish too quickly, with a close above the Hull. Today’s pullback didn’t invalidate the bullish move higher (yet) for DIA. DIA has yet to tag the upper Dealer Cluster zone, though I’ll note that the zone dropped from 435 to 430, so we’re looking at a tag of 430 to have pretty good odds as long as DIA remains above the Hull and as long as we don’t see GEX shift a lot lower beforehand.

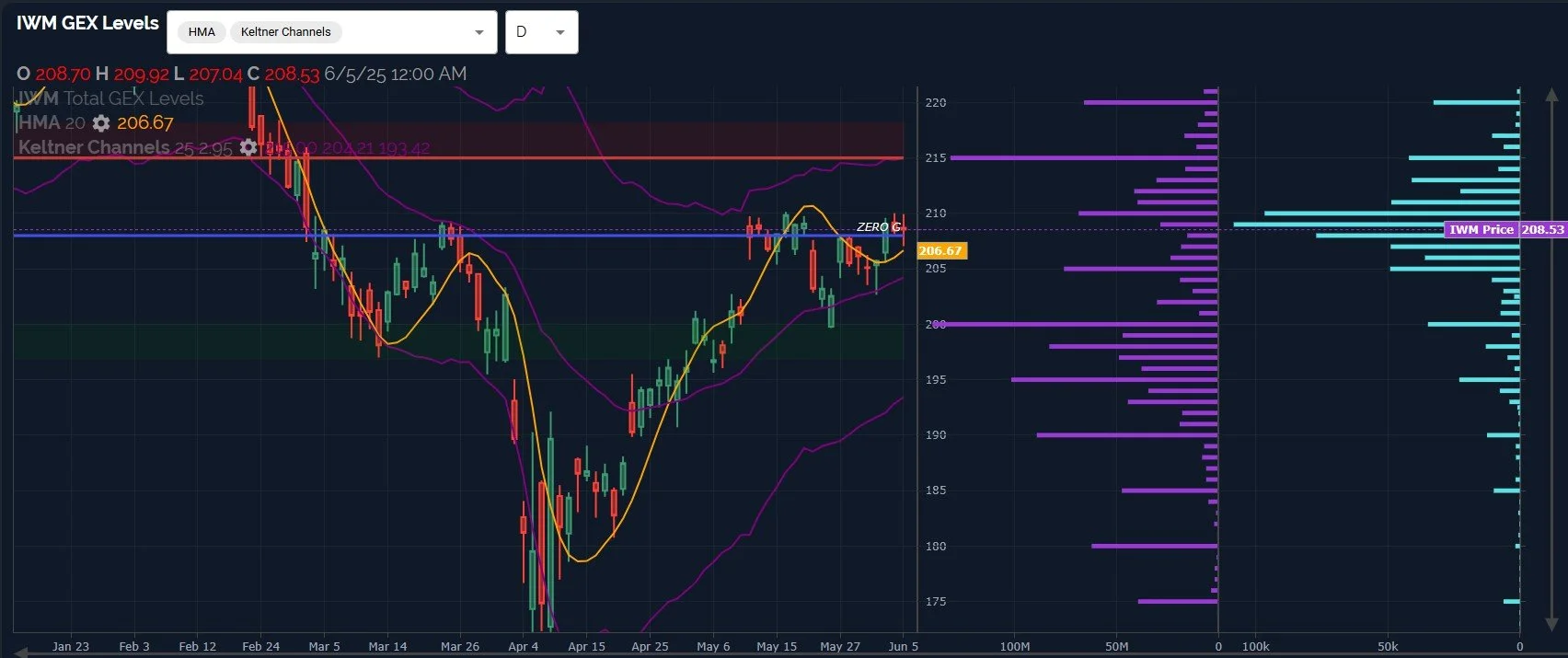

IWM is telling a similar story to DIA- a close well above the Hull, making IWM appear to be the most bullish play at the moment in my opinion, and the upper Dealer Cluster zone at 215, a cluster that has grown significantly in the last two days.

IWM’s largest expiring GEX clusters for tomorrow are at 211 and 213, so we might not reach 215 in a single day. A lot of the 215 GEX is out at 6/20, so keep that in mind. Across the board, we have seen the largest indices touch their upper Dealer Cluster zones, and we’re very close to the upper Keltner channels, so my bias is going to be to sell rips, even if I’m expecting a rip higher imminently. We can prepare for what we expect now as well as position for what might be just ahead of the current move. With the VIX having tested 17, we might have enough ingredients in place for a larger pullback, but the current challenge will be to navigate final attempts higher (which might reach higher highs in the short run) while transitioning to a more fully hedged or short position, depending on one’s level of risk. Join us in Discord where we’ll share intraday analysis as we see new information to help along the way.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.