Anticipating The Turn

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

We’re happy to see the follow through for indices after closing above the Hull moving average yesterday, with QQQ now firmly in the upper Dealer Cluster zone and IWM effectively on the lower edge. SPX is within 30 points of 6000 and DIA still has the largest potential move necessary to reach the lower edge of its upper zone. We go over some complementary points and a few different tickers in our YouTube video posted tonight, which you can view by clicking here.

SPX appears poised to tag and potentially exceed 6000 this week, with the upper Keltner channel at 6047 matching up with the noticeable GEX cluster at 6050 pretty well. I think a pullback from this area has fairly good odds and might potentially dip more than the mid-May decline, but regardless, the Keltner channel is rising and we see GEX growing at higher strikes. The market appears to want higher prices at some point this year.

A somewhat contrarian point of caution- lately, the market has been reaching GEX highs at reversal areas, sometimes reaching extreme readings compared to the last year of data, but not always. As we approach the GEX reading that we saw at the mid-May high, it only makes sense to start thinking defensively, particularly given the other factors we’ve been highlighting (upper Dealer Cluster zones, indicators, the VIX, etc).

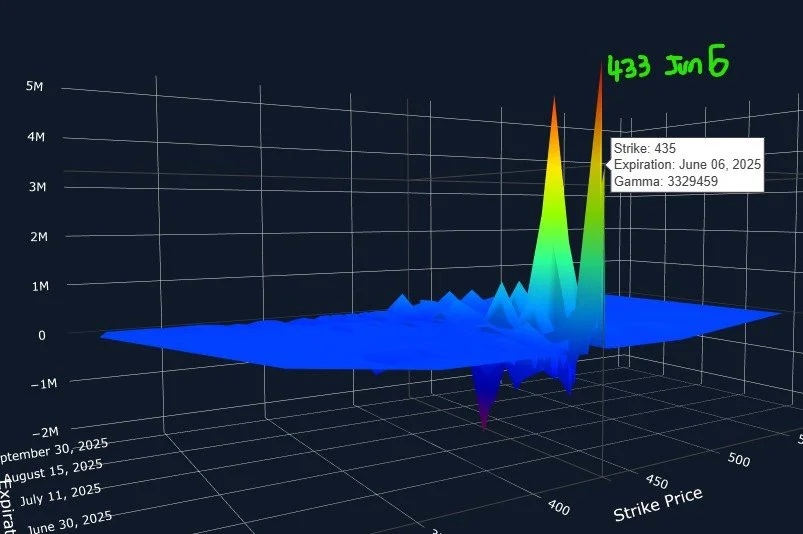

While our questions regarding other indices center around how far into the upper dealer clusters we will see those indices climb before reversing, DIA still needs to reach the lower edge of the target at 435, and by a lot more than SPX needs to gain to reach 6000. I find this particular point noteworthy because we might be able to use DIA’s initial tag of 435 (if it happens) as a guide for where SPX, IWM, and QQQ might reverse. We still think QQQ has good odds of reaching 533 by Friday, and IWM might reach 215, but if we can get DIA to reach 435, we can potentially have more confidence in a reversal if those targets are simultaneously being tagged, as an example.

Looking at DIA’s 3D graph, 433 and 435 are both large clusters expiring Friday, which makes the timing of reaching the upper zone relevant as well.

We can look at yet another potential “guide” that might instruct us regarding a likely turning point for the indices: The VIX. We are below the largest GEX cluster at 18, opening the door to potentially tagging the 16 or 17 strikes, the next largest clusters below the current level. Given a major lack of GEX below 16, it’s reasonable in our view to expect the VIX to hold the 16-17 area, and perhaps a tag of 17 can coincide with SPX reaching 6000 and possily DIA reaching 433-435. Volume (the light blue bars) suggests participants are interested in higher strikes for the VIX, also explainable by hedging while the VIX is low, so we can only speculate. A VIX reversal would see 25 as a likely initial target based on current positioning.

The 2-hour Keltner channels backs the idea of tagging the GEX cluster at 17, with the lower Keltner matching 17 quite well. As the Hull (the yellow line) is declining, a crossover may soon occur, which will trigger a bullish volatility signal for me. Regardless, it appears that this week has good odds of seeing a meaningful short-term high and it’s great to see us breaking out of the recent consolidation. Join us in Discord and we’ll share some of what we’re seeing intraday!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.