6000 Tag Finally Imminent?

THE ANNUAL SUBSCRIPTION PROMO ENDS SOON- We’re currently offering $300 off of the annual Portfolio Manager subscription. We recently released new mobile interface improvements, and we’re working on more, as well as our recently started daily livestream. Enter code MAY2025 at checkout to lock in a great annualized cost for access to our highest-level subscription! This promotion will last for a few more days.

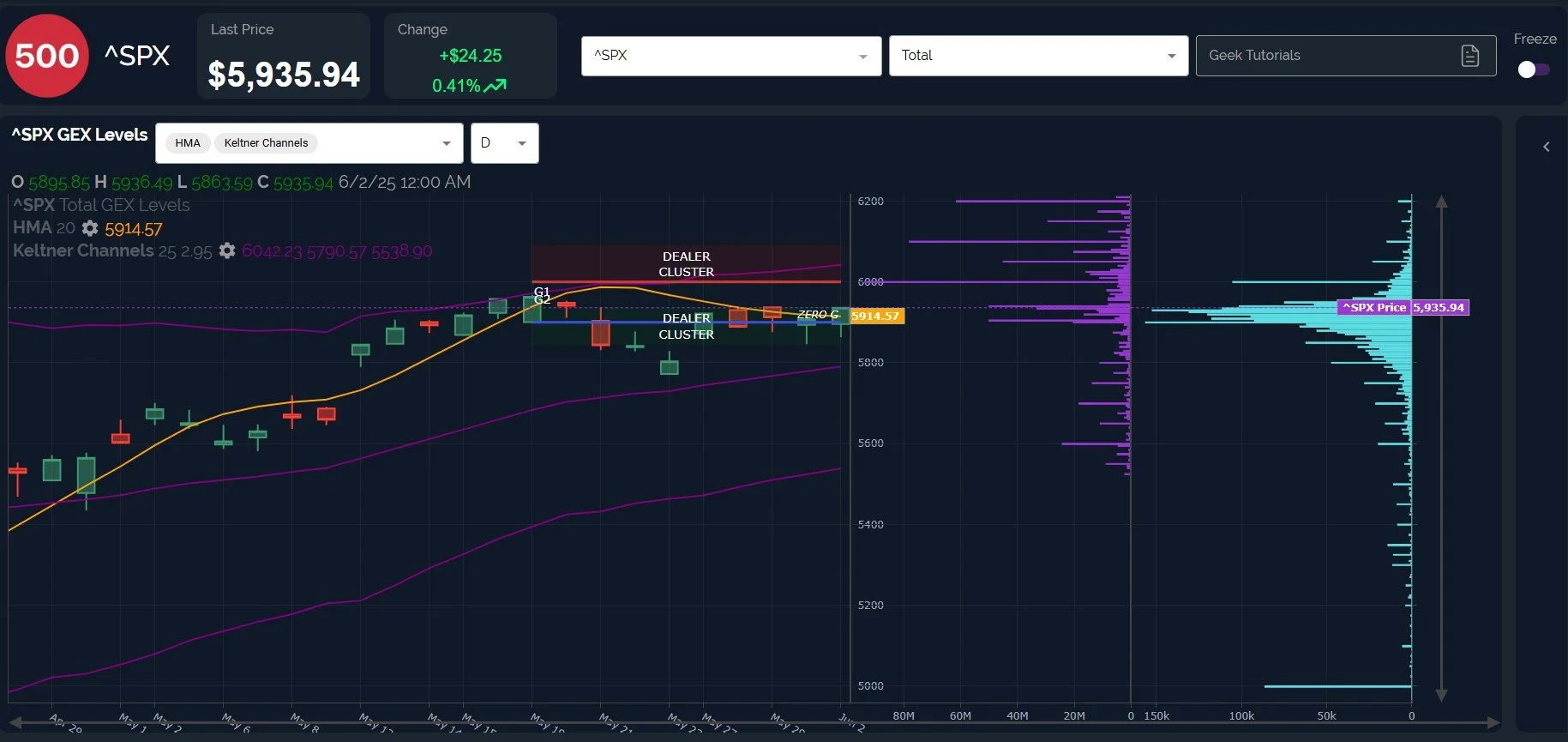

Indices closed above the daily Hull moving average for the first time since May 19 in SPX’s case, potentially marking a turning point in the recent consolidation and opening the pathway to finally tagging the upper Dealer Cluster zone. In the event that we tag the zone, DIA caught my attention given the larger percentage gain necessary to reach its upper Dealer Cluster, and we discuss DIA more in our YouTube video recently posted, which you can view by clicking here.

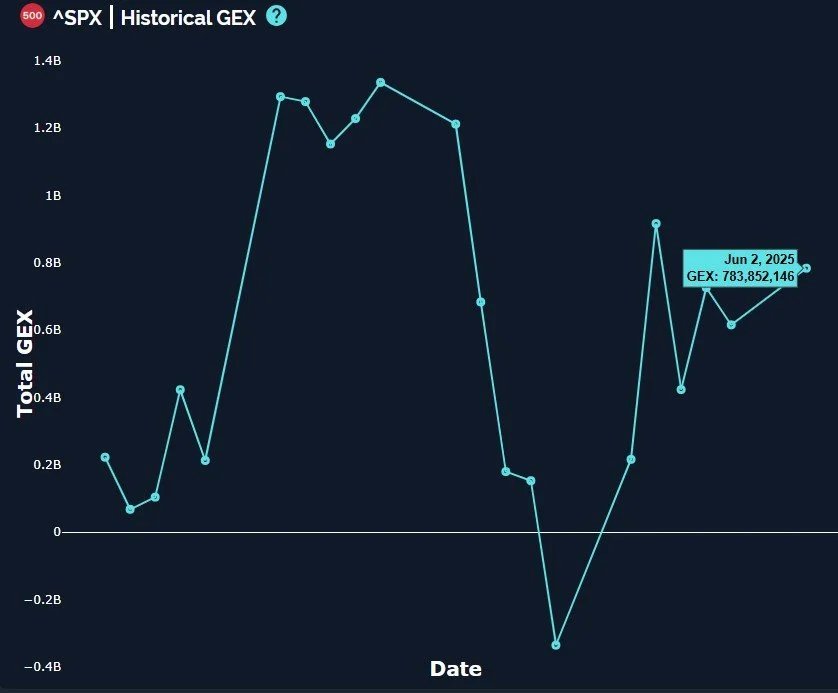

Let’s take a closer look at SPX, with an initial observation that SPY looks slightly different, with SPY sitting at the upper Dealer Cluster zone right now, and showing a decrease in net GEX by almost 500M while SPX shows a modest increase. This difference is not uncommon, and I typically find SPX to be more relevant to the most likely pathway when they disagree on shorter term shifts. Even with SPY showing a decrease in net GEX and showing 593 as the beginning of the upper Dealer Cluster, the box does extend to the 600 level, and SPY still shows meaningful positive GEX. In other words, we do see overlap between the two despite my granular analysis.

SPX closed 21 points over the Hull, a seemingly decisive margin that catches my attention. We also see noteworthy daily option volume at the 6000 strike, denoted by the light blue line next to the 6000 GEX cluster visible in purple on the chart above. 6000-6100 becomes more likely (in my opinion) with today’s close, but keep in mind that the slightly over 1% to possibly 3% move could easily be wrapped up in a day with most of the move overnight, so we have to be ready to react and adjust our positions accordingly. We can also gap down, in which case I will look at the 0 DTE GEX picture to see whether or not we are likely rejecting the Hull again (a very bad sign in my view) or if we are likely to trap more bears and then close above the line for a 2nd day. Oh, and the 5000 strike troll is still out there trolling the options market, as shown by the big blue line at the 5000 level. Tomorrow will certainly be interesting (not 5000 interesting, yet)!

SPX saw a modest increase in positive GEX, in contrast to SPY and QQQ, which I believe signals more strength ahead, particularly given the close over the Hull and the gradual increase in positive clusters all the way up to 6400 that we’ve seen recently.

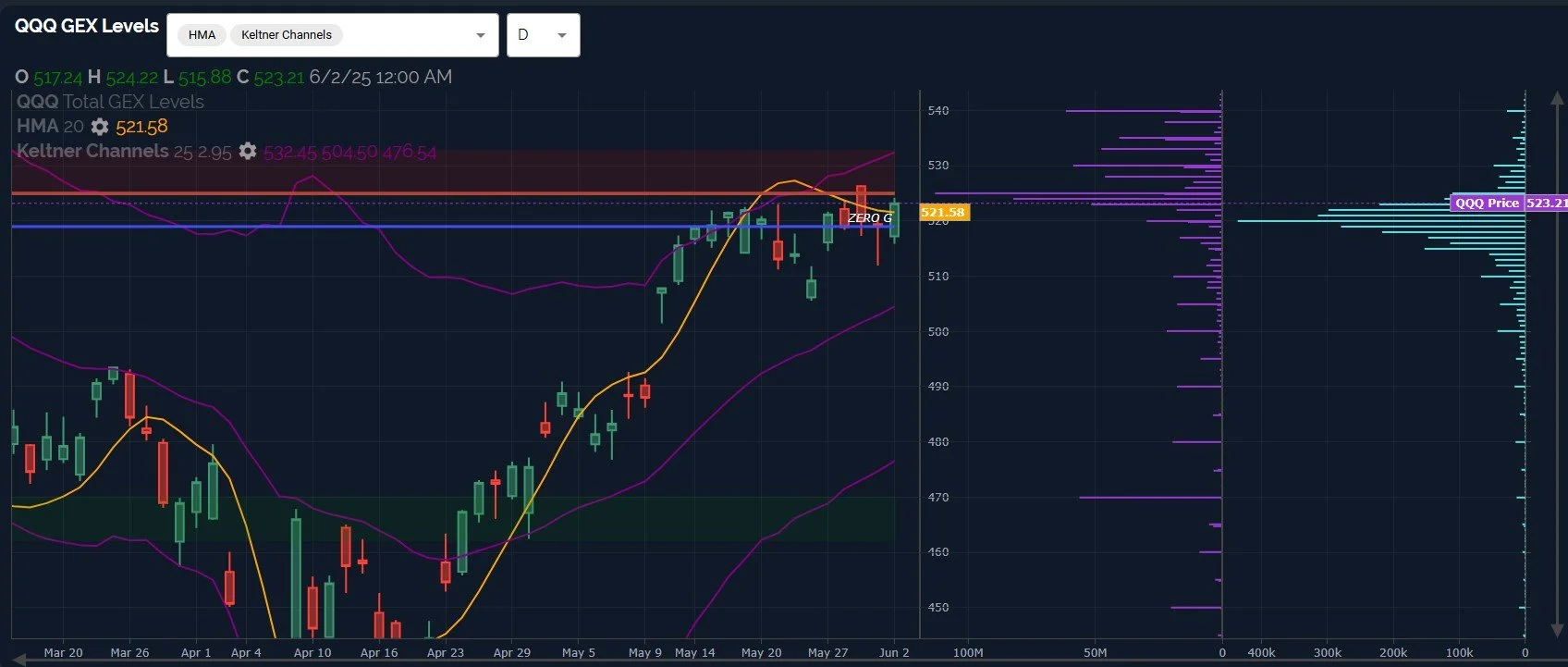

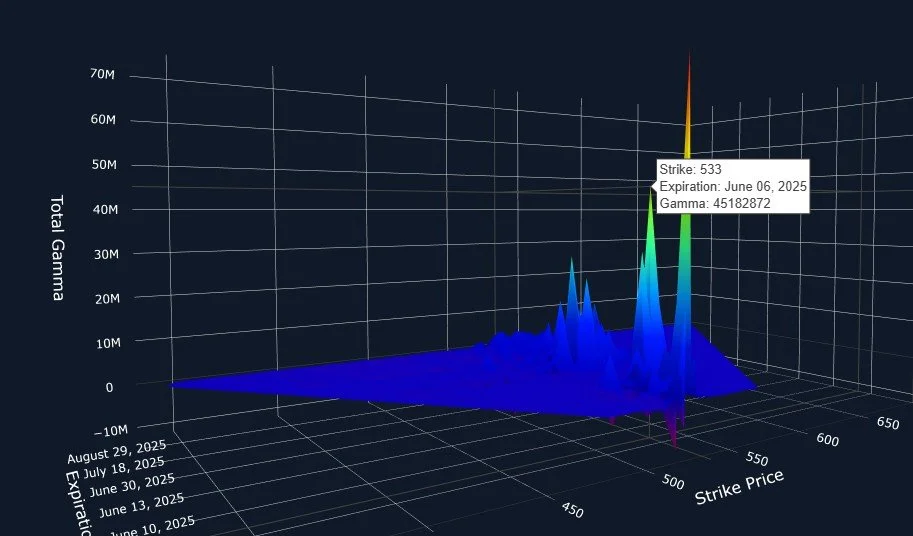

QQQ is right at the doorstep of the 525 upper Dealer Cluster, but QQQ also closed above the Hull, so if SPX can muster the energy to breach 6000, perhaps QQQ can travel toward the higher end of the range. I’ve noted that 540 has shown increased interest in the last week or so in terms of GEX, but we also have a possible target presented by the 3D GEX map that we’ll review next.

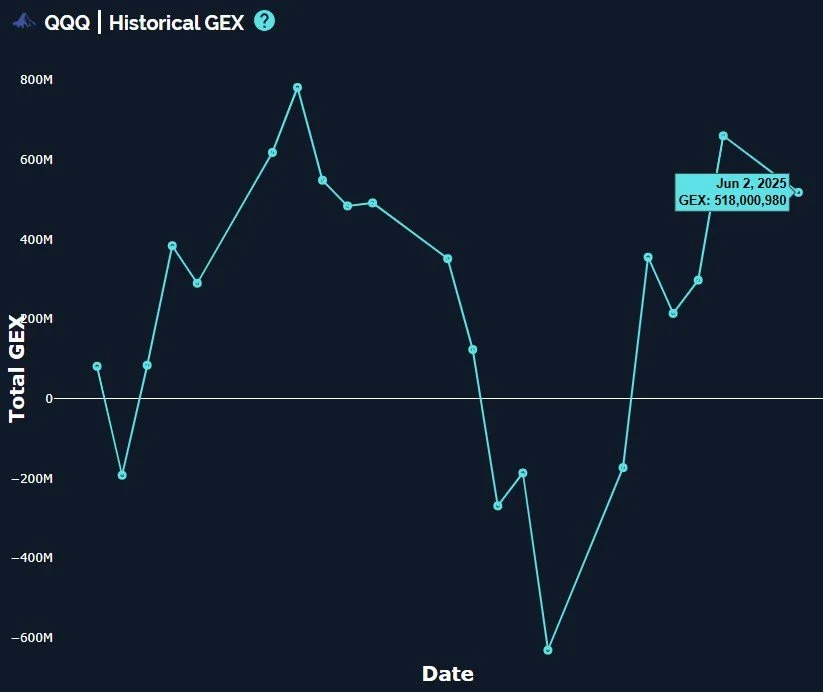

QQQ shows a slight decrease in positive GEX, in contrast to SPX.

Looking at QQQ’s 3D graph, we see that 533 is the largest GEX cluster on the map outside of the cluster that expired at today’s close (it will disappear in the morning premarket). 528 is the 2nd runner up. What I find more compelling is the fact that the upper Keltner channel visible on the QQQ GEX Levels chart shown earlier is at 532.45, remarkably close to the 533 cluster. Might we see 533 before Friday while SPX reaches 6000-6100? The data would certainly suggest so, though we don’t know whether this happens tomorrow, by Friday, or at all. The charts and GEX appear to be aligned with the stars to allow these zones to be tagged though, so let’s see if we can get it over with and then see another pullback.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.