On A Mission Into Quarter End

The market appears to be on a mission of destruction into quarter end, so while we’ll continue watching intraday GEX changes for signs of reversal, let’s zoom out and look at weekly charts just to have some contingencies in mind.

On The Brink…Brink of What?

Conflicting signals as the VIX continues rising above the Hull. Does the VVIX reversal and action in the indices tell us we’re heading south, or is this just another buying opportunity?

The Pullback Is Here..Now What?

Yesterday’s VVIX divergence played out today, and while this pullback could be a fakeout, we see several short-term signals that suggest the selling may not be over.

Divergences Form: False Alarm?

Indices gapped up again today, though the rally stalled right at the middle Keltner channel, also coinciding with a VIX/VVIX divergence and a weak IWM. Will markets push through this spot toward new post-correction highs, or are bulls in for a negative surprise?

Un”bear”able Rebound In Play

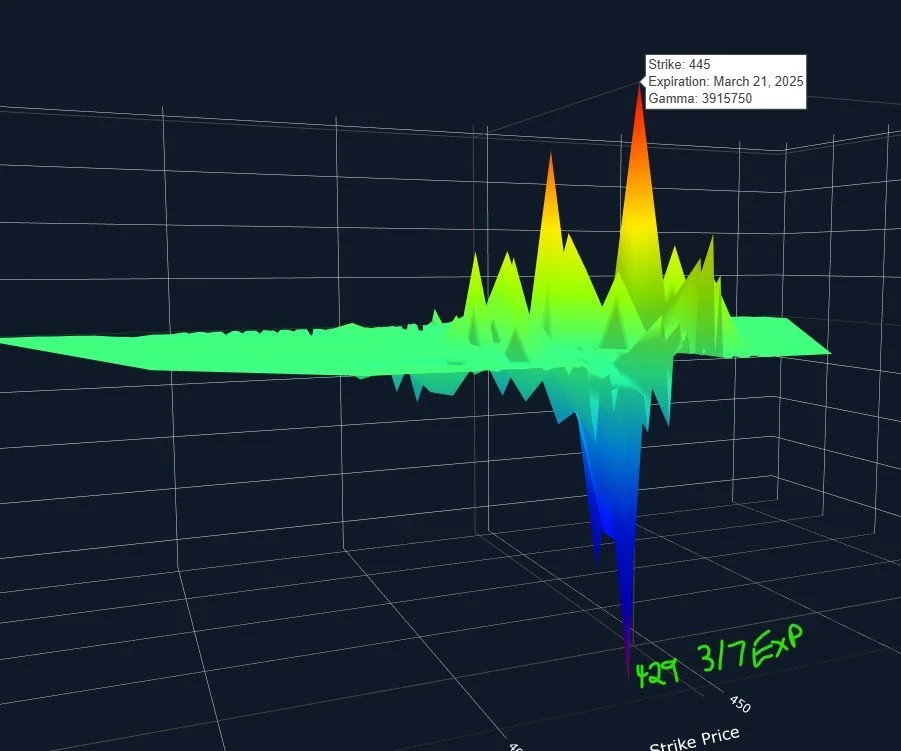

Monday saw GEX dramatically increase for many tickers, crossing the zero line into positive territory for many indices and rallies accompanied this increase in GEX. Will we have an easy glide into quarter end this coming Monday?

The End of Q1 Already?

We saw a relatively large gap down Friday that ended up representing a great buying opportunity, and we called it early on when we pointed out the extreme negative GEX in Discord. With the last week of the quarter ahead, let’s look at where the GEX landscape stands and throw in a few chart indicators to see if we can increase our odds of success.

OpEx Chop Continues: What Awaits Us Friday?

The chop continues, with intraday volatility in both directions during the cash session for SPX. The VIX couldn’t stay above 20, yet we will have to see whether or not that is a harbinger of a more bullish market move next week and beyond or if the suppression is strictly related to OpEx week.

New Highs- Out Of The Woods?

Nice follow through for markets today after holding the 5600 mark on SPX. SPX made a higher intraday high than two days ago, and it also closed higher, though barely. With OpEx Friday and both sides seeing premium disappear every other day, what lies ahead as we approach Friday?

Pre-FOMC Premium Kill: What’s Next?

We the important retest of SPX 5600 today, with initial signs of holding 5600 leaning positive. Will tomorrow’s FOMC announcement pour cold water on bulls and result in a rejection of 5600, or will Powell give markets a reason to rebound toward the next higher target?

The Rebound Is Here: How Far Can We Go?

Friday’s glaring signal from the Hull Moving Average and the 2-day collapse in the VIX and VVIX saw follow-through today, with indices sticking it to the bears yet again. Today we’ll look at a couple of interesting changes with the VIX as we approach Wednesday’s VIX expiration as well as a brief look at QQQ and SPX.

3rd Friday’s A Charm?

SPY hasn’t closed this far above the Hull moving average since January 22, which I view as a bullish sign. In fact, since February 19, SPY has closed at or below the Hull every single day. Despite the risk that Friday was a “threepeat” of the last two Fridays, we have a number of signs that this move was more bullish. Will it prove to be another short-term top, or the beginning of a larger rebound?

No Bounces Allowed

Yet another seemingly positive inflation number today with PPI coming in lower than expected, yet the stock market didn’t seem to care. Yet volatility markets did care, with the VIX remaining below the Hull and VVIX dropping for the 2nd day in a row. Can bulls muster the strength to incinerate some put premium next week? A lot of premium is counting on more downside at the moment.

VIX & VVIX: Forward Indicator Or Fakeout?

CPI arrived with lower than expected results, a positive for markets. Despite the lower inflation read, indices still struggled, vacillating back and forth from negative to positive as the day progressed. The VIX and VVIX deflating were perhaps the biggest attention getters today, though the indices did not bounce as one might expect given the drop in volatility. Is the VIX leading the way, or is it ready for another spike?

She’s Gonna Blow, Cap’n!

We started out with weakness yet again in indices, with the VIX and VVIX also climbing higher. But then a glimmer of hope emerged for bulls, and more than once we pushed higher into positive territory for the day before fading right before the close. With CPI tomorrow pre-market and PPI Thursday, we may be on the cusp of a pivotal moment of either an “emotional” spike low or a rebound into Friday before dropping into OpEx Friday. Change is in the air and we will be ready to react.

This Dip Will Never Stop Dipping

We repeated a similar pattern to last week: Positive Friday, market bloodbath Monday. With certain economic catalysts ahead, including CPI Wednesday and PPI Thursday, this week may be pivotal and possibly even more volatile. Let’s see how the tea leaves read.

This Time Is Different!

Friday was an emotional roller coaster from one perspective, initially appearing to repeat the now “stale” pattern of giving bulls hope of a rebound but then failing, but this Friday was different: The rally stuck, and we closed right around the Hull Moving Average, a potentially important line-in-the-sand. Will this prove to be ephemeral like last Friday, or are we on the brink of the real deal?

Will The Intraday Reversals Ever End?

Signals over the last few days have been challenging, with yesterday’s seemingly bullish close failing to follow through today. While a larger rebound hasn’t begun, we are seeing positive divergences yet again, and the new lows were only incrementally lower and not for every index. Let’s look at new reasons why we’re imminently looking for a larger bounce, even if we see additional downside tomorrow.

Signs Of Relief

Several ingredients fell into place today to raise the odds that a rebound has begun, though (as usual) the picture is not entirely clear. Let’s look at why (though it’s still early) we are starting to shift our short-term bias toward the long side, with an eye toward remaining risks in the background.

Another Failed Rebound

The spilloff continued today, surpringly reaching our SPX 5800 target fairly quickly, dumping almost to 5732 before staging an impressive rebound late in the afternoon, then fading again. This volatility is a great example of negative GEX at work. IWM may have some important clues regarding a larger turn that may ne close.

Are Bulls Panicking Yet?

An old saying says markets don’t bottom on Fridays, and today at least anecdotally fit the saying, collapsing into the end of the day after failing to gain ground early on. Markets maintain negative GEX, but we are approaching lower targets that might represent a better opportunity to enter longs.