She’s Gonna Blow, Cap’n!

THE SPRING PROMO IS HERE- We’re offering $300 off of the annual Portfolio Manager earlier than usual in March as we wrap up the 1st quarter of 2025 and celebrate the release of major updates last week! We now have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code SPRING2025 at checkout to take advantage of this limited time offering.

The famous line from Star Trek seems to fit quite well with where markets find themselves today: Oversold according to many metrics, driven lower in determined fashion (and yet with volatility controlled), and ending the day lower as we head into the much-anticipated CPI number Wednesday morning at 8:30am ET, ready to either completely capitulate to the downside in disorderly fashion, or stage a surprisingly strong bear-choking rally, even if only temporary. I can think of numerous times where volatility became elevated due to hedging going into CPI, then deflated once J-Pow started muttering his sweet nothings in response to pre-selected questions. Who gets the surprise tomorrow? We’ll find out soon enough! Tonight’s YouTube video (which can be viewed by clicking here) covers a few different topics than what we discuss in the newsletter, so check it out.

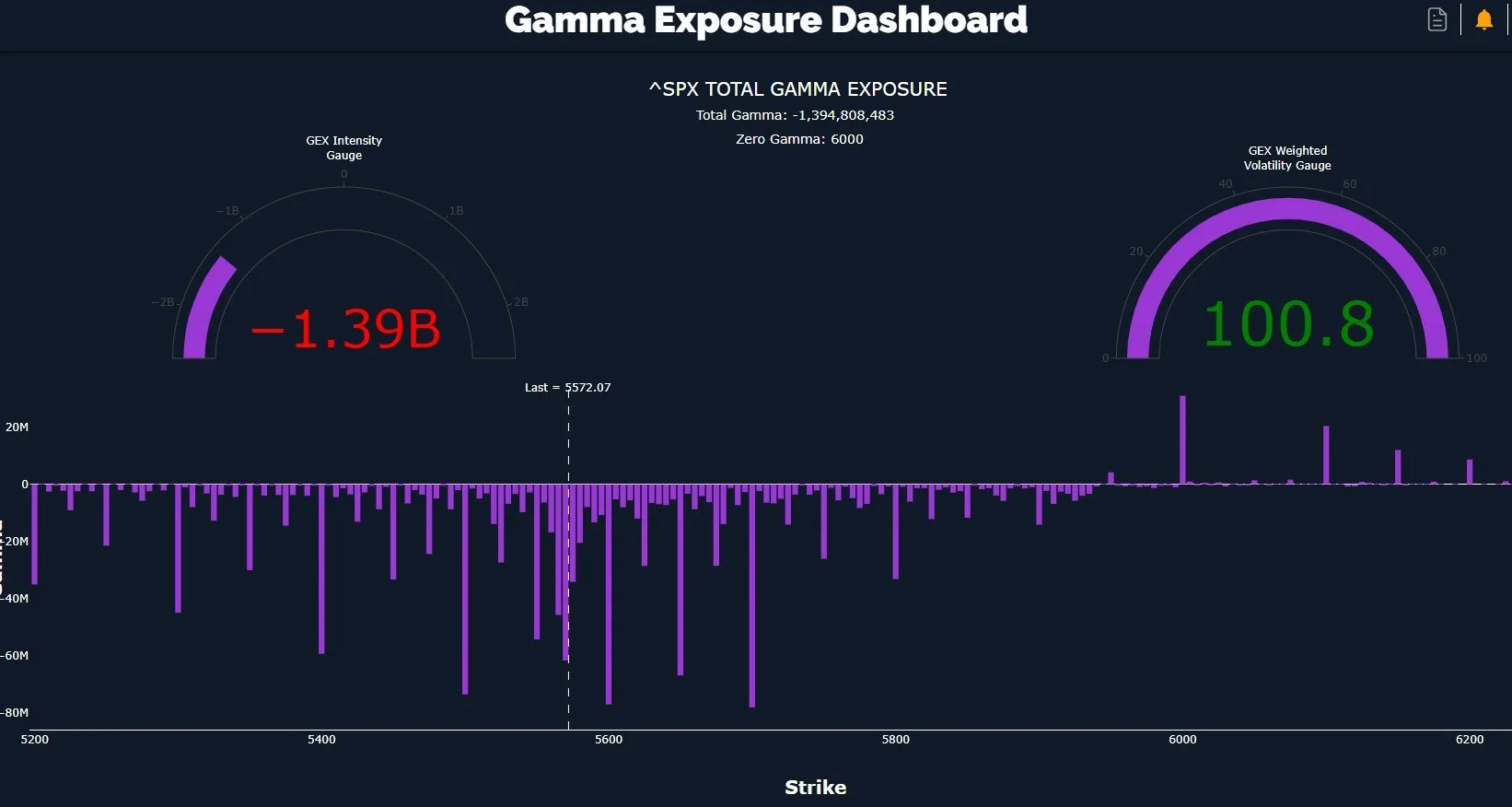

SPX looked like it might end the day with a green indecision candle about 30 minutes before the close, but I guess participants decided that would be too predictable, so we saw one last sell-off into the close, like one last kick for the dead horse. We saw volume today (the light blue horizontal bars) in many expected areas, but the volume at 6000 caught my attention. 6000 still represents the most meaningful positive GEX, though it’s dwarfed by the large negative clusters, of course. The rapidly declining Hull at 5680 is the first important resistance area I’ll watch, but above that, we don’t see a lot of GEX to slow down an advance toward 5800 or beyond. Lots of negative GEX down to 5400 is visible as well.

SPX’s total net GEX is -1.39B, which is solid negative territory. I view large GEX clusters as potential support/resistance areas, and from the looks of the graph currently, we need to get above 5700 to really see a big squeeze higher. I say that because currently we don’t see too much in terms of meaningful GEX between 5700 and 6000. The move down can continue, and that’s the prevailing momentum, but other factors suggest a rebound could occur at any time, even if we don’t resume the bull trend.

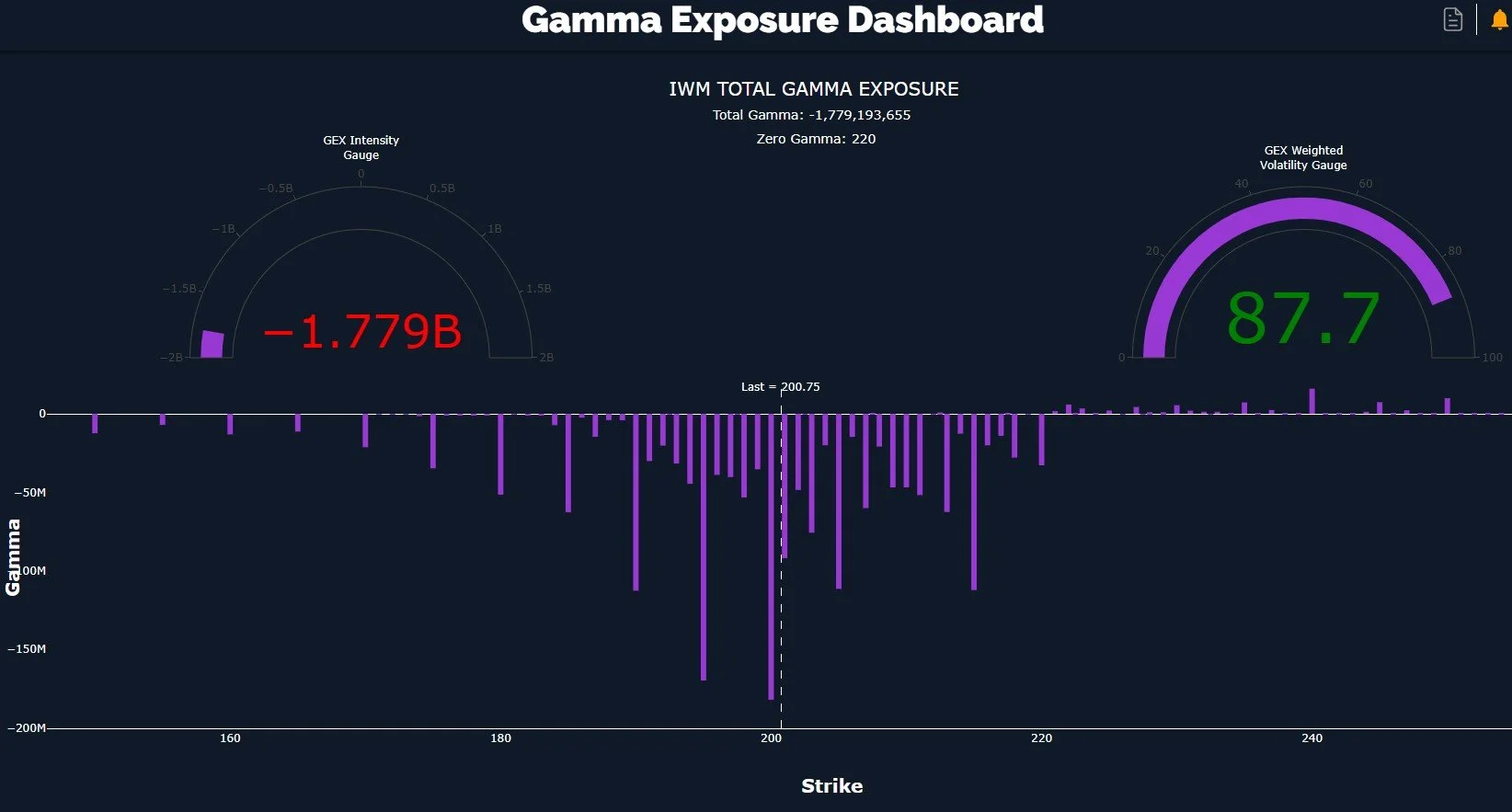

IWM still looks interesting, especially in light of barely making a new low today, and closing amazingly close to the Hull Moving Average. holding above 204 for an hour may spark an exciting little roller coaster ride for bulls and a visit to the Western-style rustic rug factory for the bears. We may still see IWM capitulate toward 190, where we’ve seen volume for 2-3 days, but we are really pressed down at the moment and ready to explore what awaits us in the other direction. 214-215 are upside areas I’ll watch, representing a meaningful GEX area and also the middle Keltner channel.

IWM’s GEX remains near a negative extreme, but it hasn’t changed much overal for 3 days. Negative GEX clusters really taper off after 190, so participants aren’t demonstrating a lot of current interest or expectation of lower prices beyond 190.

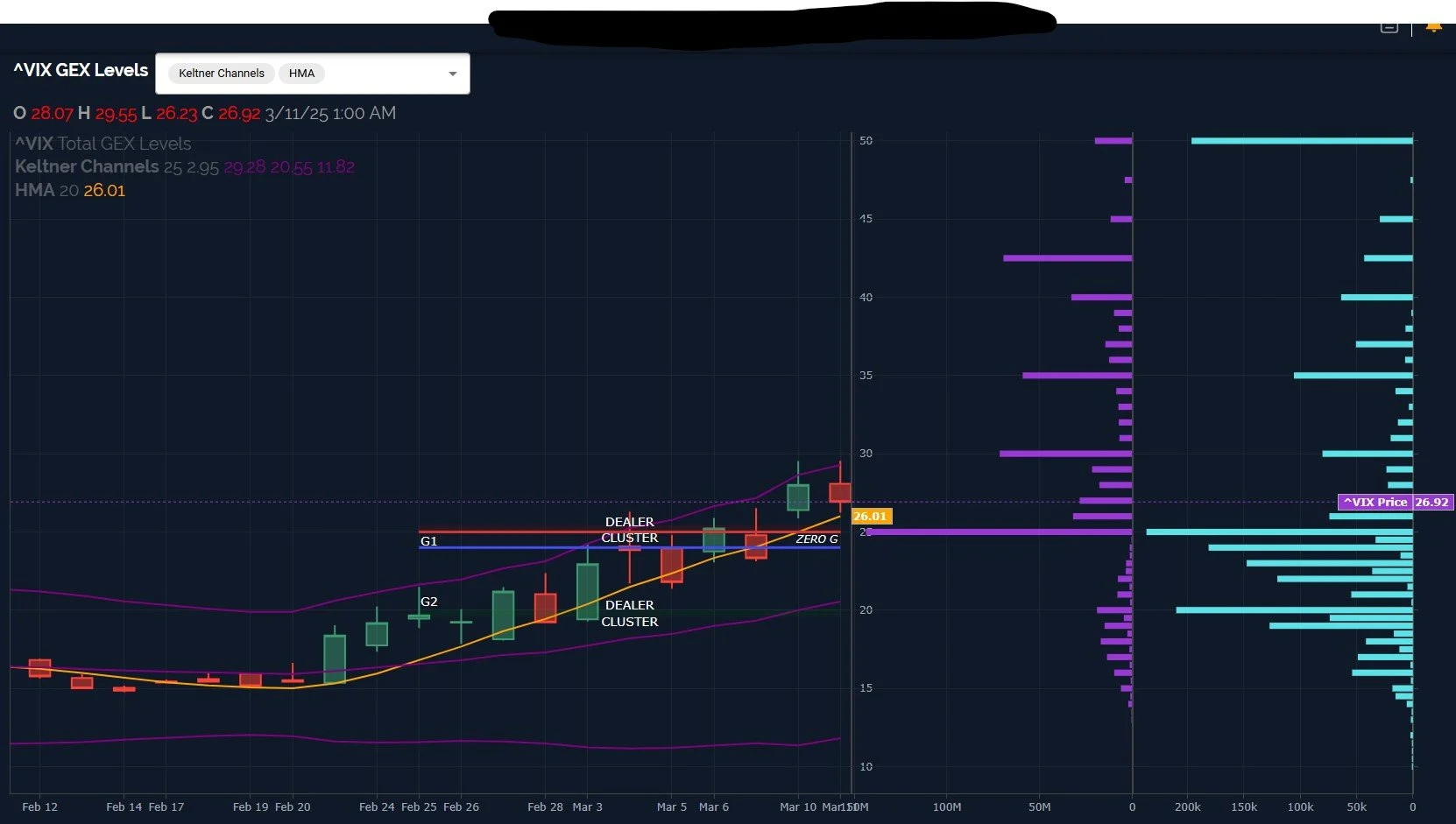

The VIX still maintains above the Hull despite the red candle, which gives continued hope for VIX bulls looking for a final wild spike for this round, and we certainly saw some eye-popping volume at the 50 strike. Of course, being one day before the CPI report, this could be a very nervous, possibly paranoid Wall Street manager hedging his own fears, or it could be a knowledgeable bet by a trader as wise as Solomon, we don’t know. I tend to expect to see hedging going into important data releases, I’ll leave it at that.

Volume today was mostly at lower VIX strikes between 20-25, possibly a mark in favor of market bulls. Any upside move by the VIX will still need to chew through the GEX at 30, 35, and 42.5.

I don’t base my trading on making predictions of data releases, but we can briefly look at what the betting markets are saying about CPI tomorrow: 2.9% would be a drop of 0.1%, so traders are betting on a modest drop. I see egg prices are lower, and gas is a little lower, and I hear Washington DC has a few lower prices here and there (especially on the real estate side?), so maybe CPI comes in lower than 2.9%. Even if it does, how will the market react? I have no idea. Does fear of rate hikes become fear of deep recession? The impossibility of accurately and repeatedly predicting both the data and the markets reaction to the data brings me back to our reliance upon positioning data and charts to at least improve our odds of success. And right now, we’re too late to initiate new shorts (except with pure speculation as the goal), and we don’t yet see the bounce materializing, yet risk/reward favors a bounce to the upside. So we’re buying new long positions while allowing time for such a move to materialize. We’ll see what the intraday picture looks like after the open, regardless of the pre-market move tomorrow.

www.x.com

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.