OpEx Chop Continues: What Awaits Us Friday?

THE SPRING PROMO IS HERE- We’re offering $300 off of the annual Portfolio Manager earlier than usual in March as we wrap up the 1st quarter of 2025 and celebrate the release of major updates last week! We now have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code SPRING2025 at checkout to take advantage of this limited time offering.

The sell-buy-sell pattern continues this week as option sellers pocket premium heading into OpEx Friday. Will the pattern continue, giving us a positive last day of the week? Not only would such a move continue the pattern we see this week, it would also continue the trend of Friday being positive for the 4th time in a row. Since tomorrow is OpEx, and March in particular (the end of the 1st quarter), I think we should remain open-minded. We discuss SPX and QQQ today’s YouTube video, as well as other tickers not covered in the newsletter, so give it a view by clicking here.

Referencing the VIX chart above, we’ll focus on the highlights: The option market has shifted, reflecting lower strikes than we saw earlier in the week for both Dealer Cluster zones. This is likely a mark in favor of market bulls in the short term. The VIX is also below the Hull moving average, the largest GEX clusters are between 16-20, and the smaller 2-hour and 4-hour timeframes also look bearish for volatility. In terms of the Hull, market bulls will want to see the 22.57 retest rejected as a sign that the VIX is truly done. I say retest because it would be very normal to see some sort of VIX bounce, perhaps Monday if not Friday.

We do see volume at higher strikes today, especially the 30 strike, and the market rebound after such a sharp decline has actually been pretty disappointing in terms of magnitude. This may not be a signal of impending doom, maybe it’s just going to take more time given the way the drop unfolded, but it’s possible that the rebound will run out of steam before we see higher prices. I don’t lean in that direction, but let’s just be honest with what we know and what we don’t know.

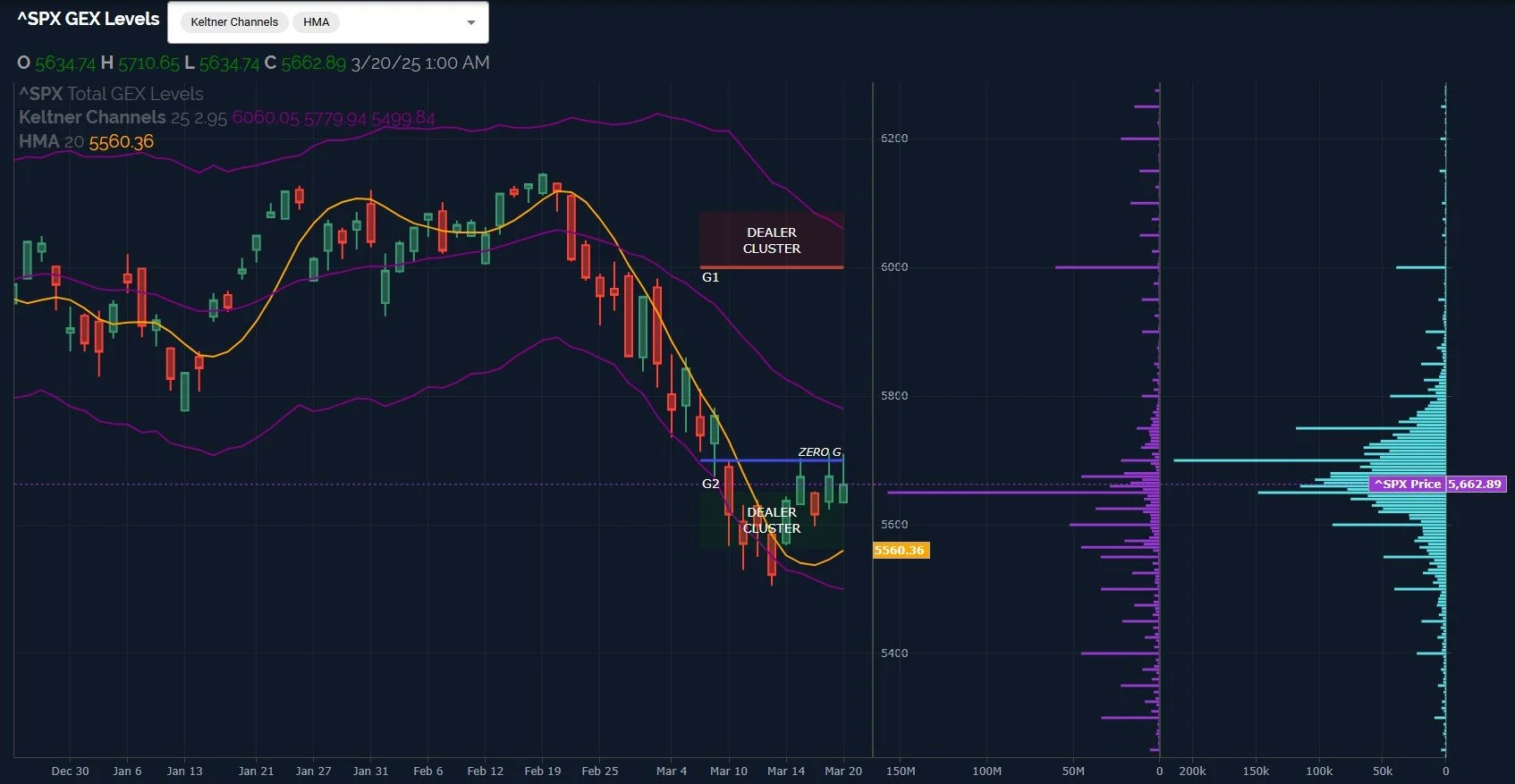

Let’s turn to SPX, which made a lower high today, and we closed lower than yesterday’s close, yet we did close above today’s open, which is a sign of some buying in the cash session. It’s hard to make a lot of it going into OpEx tomorrow, though we do see notable volume today at higher strikes, especially 5700 and 5750. 6000 is present as well, including the largest GEX cluster other than today’s closing price, which I find to be a significant mark in favor of bulls looking beyond tomorrow. The Hull is finally turning higher, but 5560 is still just over one hundred points below today’s close, so we could see a sharp drop and still maintain a bullish bias according to my methodology. Regardless, SPX looks constructive within the context of greater volatility and an eye toward the Hull as a possible line-in-the-sand.

IWM saw negative GEX increase again, still not far from the extreme negative GEX area of 2B. Yet the picture for IWM is so one-sided, it looks like a solid possible contrarian play. Today’s elevated volume at 218 and 220 as well as accompanying GEX at that area definitely has my attention.

Same story for DIA, except that DIA’s total GEX has been the most positive of major indices, flirting with positive GEX instead of being deeply negative. While we do need to keep an eye on the 400 GEX cluster, an area not visited since September, we see both GEX and volume at 430 and higher that could potentially be reached quickly with any upside move, given the lack of meaningful GEX between 420 and 430. In other words, a move to 430 wouldn’t take much if the bias of the day is toward upside. 412 is where I think bulls need to make a stand if we end up lower Friday.

Either way, we will be watching intraday developments tomorrow and reacting accordingly as opportunities present themselves. We share a lot in our free channel too, so join us in Discord if you haven’t already.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.