On The Brink…Brink of What?

THE SPRING PROMO IS HERE- We’re offering $300 off of the annual Portfolio Manager earlier than usual in March as we wrap up the 1st quarter of 2025 and celebrate the release of major updates last week! We now have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code SPRING2025 at checkout to take advantage of this limited time offering.

You can view today’s YouTube discussion by clicking here, which covers an overview of SPX and a few select tickers as well. As for the newsletter, let’s discuss a few complementary observations and a deeper dive into conflicting signals that we see. It’s no mystery that a day without much net movement leaves a variety of possible pathways ahead, and with tomorrow being Friday, we’re right at the doorstep to Monday’s end of the first quarter.

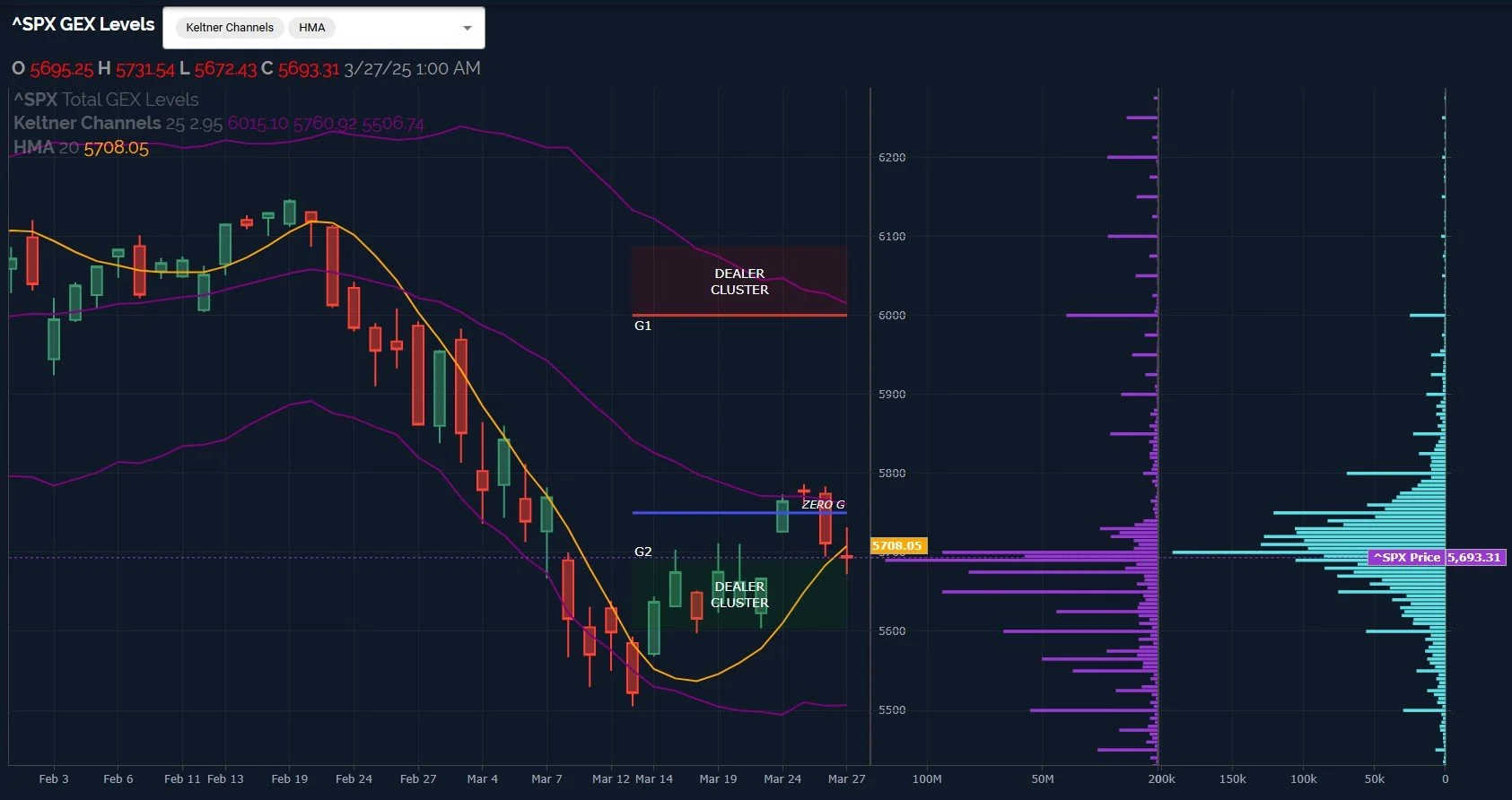

SPX is technically below the Hull moving average, which I don’t like, and indecision candles can go either way, despite their reputation as strong signs of impending reversal. The stats on that candle (I use thepatternsite.com to check out different candles and patterns, just for reference) aren’t that convincing. At least SPX is close enough to the Hull to not give the bears a decisive victory, it’s more like we’re teetering on the edge of a larger move that will define the next most likely destination several trading sessions out, in my view. As mentioned in the YouTube video, the two largest GEX clusters expiring tomorrow are at SPX 5675 and 5650, so we do have the risk that tomorrow visits those strikes at some point. Regardless, we will be watching for shifts in GEX starting at tomorrow’s cash session open.

DIA continues to look more bullish, though it did see a decline in total net GEX today. Bullish points in favor of DIA: Price is still above the Hull, we see large positive GEX clusters, and very strong volume at 435 and 437. Other indices stand in contrast to many of those points, creating an overall picture of uncertainty.

Even the VIX complex was confused. We have the VIX continuing to validate my preference of being long anything above the Hull and short below it, and the VIX saw lively volume at higher strikes. But (not shown on the chart) I did notice the 2-hour VIX crossed below the Hull, a bearish potential short-term signal for volatility.

Even more than that, VVIX had a surprisingly sharp reversal lower intraday despite the VIX maintaining a positive change. Is VVIX diving to signal a lower VIX sometime soon? VVIX is still above the Hull at 80, but a drop to 80 is still over 10% and we would potentially see markets rally on such a drop, in theory.

Even with the hazy view a few days out, we’re still identifying intraday trading opportunities in Discord, so we hope you’ll join us by clicking the link below.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.