Pre-FOMC Premium Kill: What’s Next?

THE SPRING PROMO IS HERE- We’re offering $300 off of the annual Portfolio Manager earlier than usual in March as we wrap up the 1st quarter of 2025 and celebrate the release of major updates last week! We now have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code SPRING2025 at checkout to take advantage of this limited time offering.

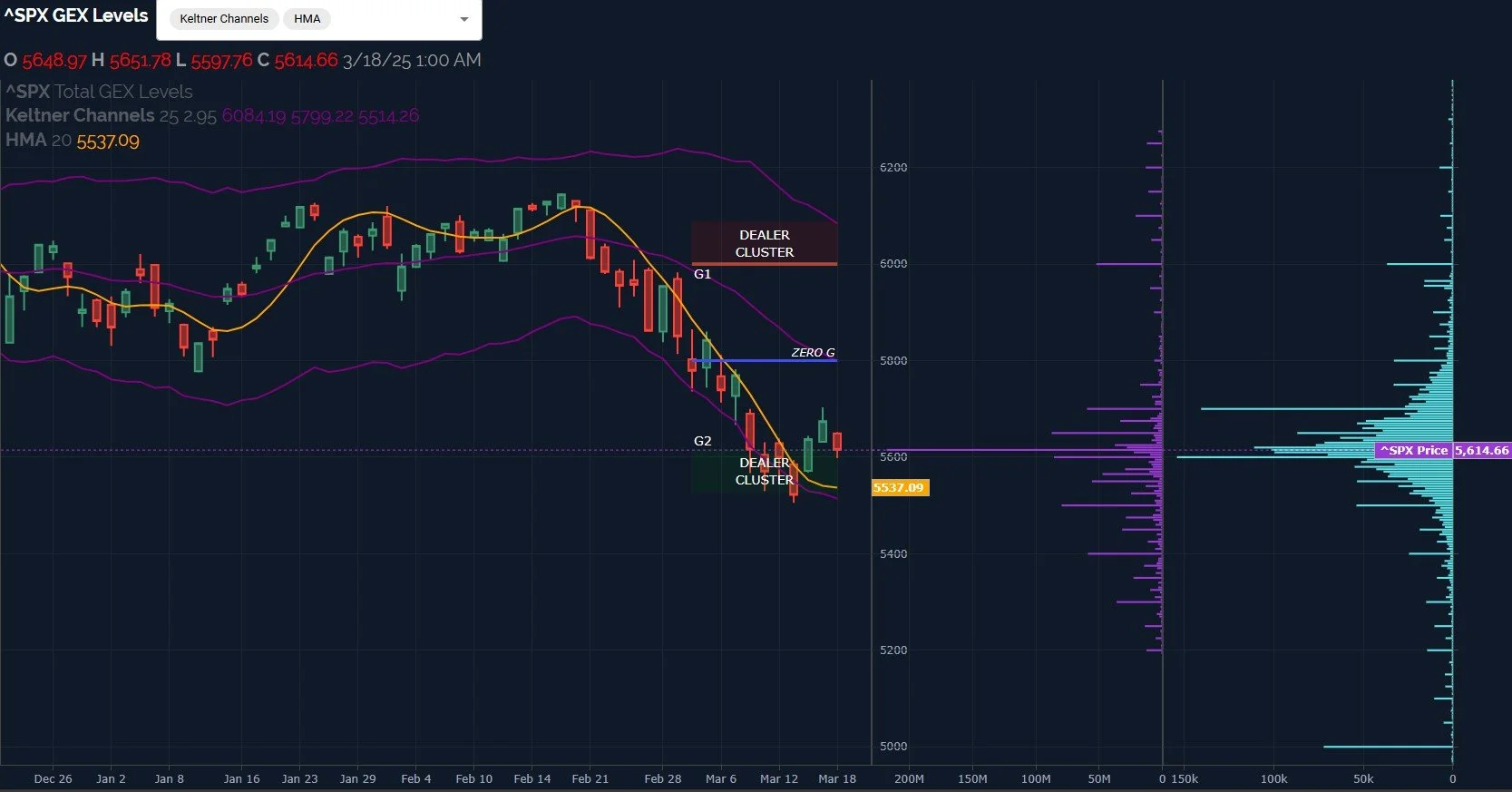

In yesterday’s newsletter, despite our celebration of a larger rally seen since Friday, we said “ with the Hull and the lower Keltner still below 5600 (yet showing early signs of attempting to turn higher), we can’t be surprised by a down day this week that attempts to retest or break that area again, it would be natural after staying below the Hull since late February.” Sure enough, today we retested 5600, successfully holding that zone for now. We’re at an important juncture, one that may determine whether or not we continue the trend lower versus continue the rebound to higher levels. Given that it’s OpEx week, I still believe in maintaining an open mind toward a pathway that could result in the greatest amount of option premium being burned, both calls and puts. Puts lost yesterday, calls lost today. Who loses tomorrow? Sorry, let’s keep it positive- who wins tomorrow?

SPX could drop all the way to the Hull moving average at 5537 and my bias will still be toward the upside on a swing basis, that’s a shift that occurred as of Friday. A daily close below 5537 and I will lean toward continuation of the negative trend, inclusive of gamma exposure (GEX) in my analysis. Can we see any other clues that might sway us in one direction or another? The light blue line represents daily option volume, which I would say is indecisive. We do see the greatest volume concentrated toward higher strikes, including 5700 and 6000 (again) today, yet we see noteworthy volume (without corresponding GEX) at 5000 as well. I give more credit to the positive strikes given that we’re currently above the Hull and the volume at 5000 lacks corresponding GEX, just to be transparent about my own process. I may be wrong, and hopefully you can draw your own conclusions from this information.

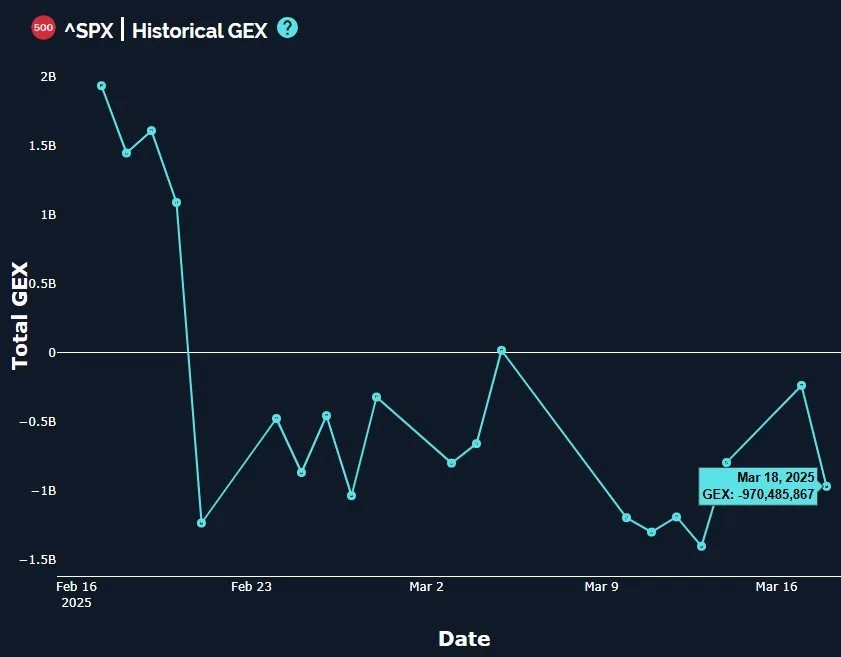

SPX GEX dropped to just under 1B today, an increase in negative GEX, though falling short of the 1B line-in-the-sand we draw between definitively bearish environments versus neutral environments. With the FOMC announcement tomorrow, and OpEx Friday merely days away, we have a headline driven week that may mean greater volatility and risk than usual.

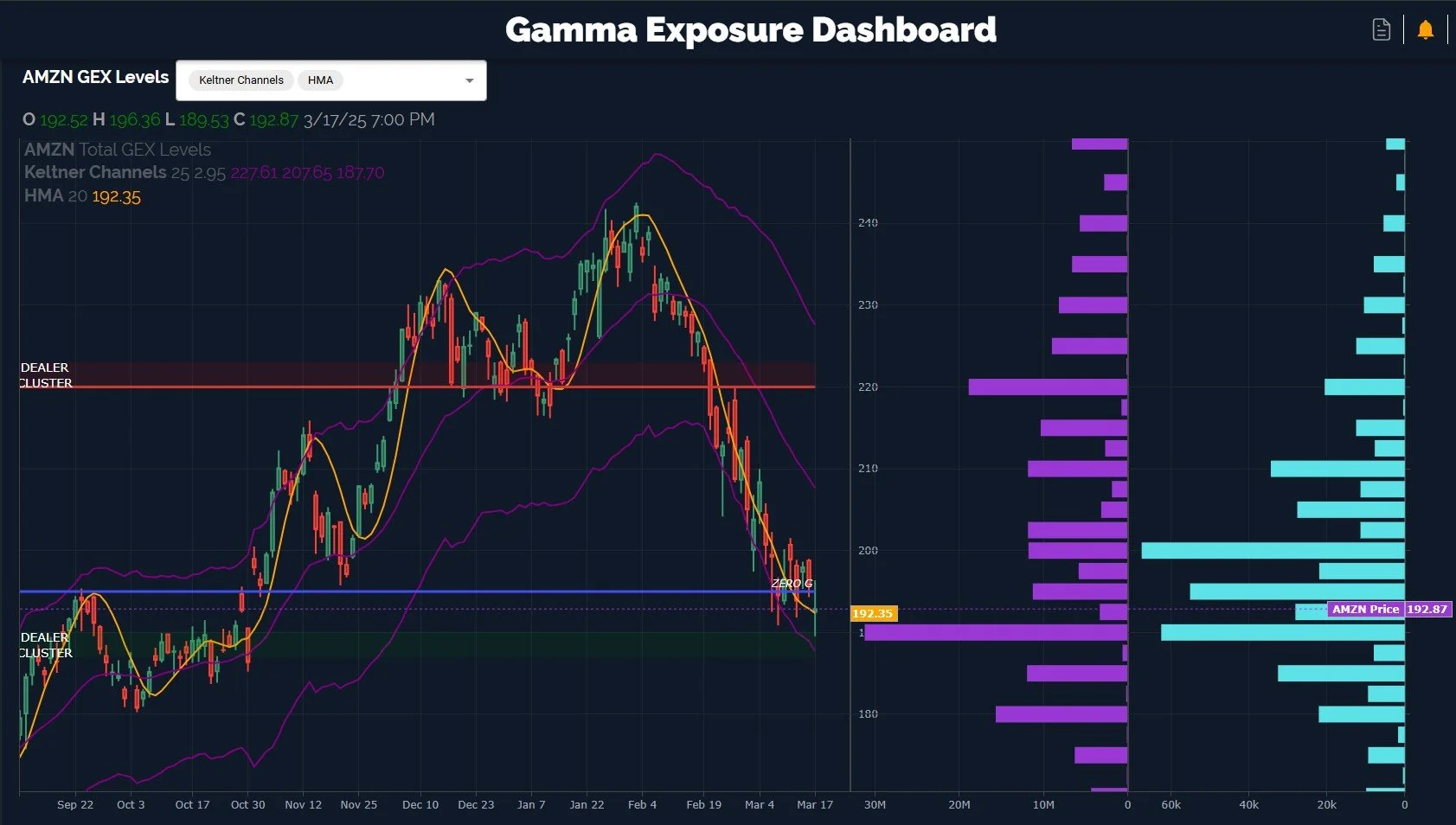

We still see additional positive signs despite today’s backtest, including AMZN, which appears to be intent on demonstrating the importance of the Hull moving average, testing above and below the level before closing right on the line. AMZN GEX is positive, and volume today was mostly at higher strikes. AMZN also tested the green lower Dealer Cluster zone, something that was lacking in prior days. These are all constructive points that seem to tilt the odds toward upside in coming days.

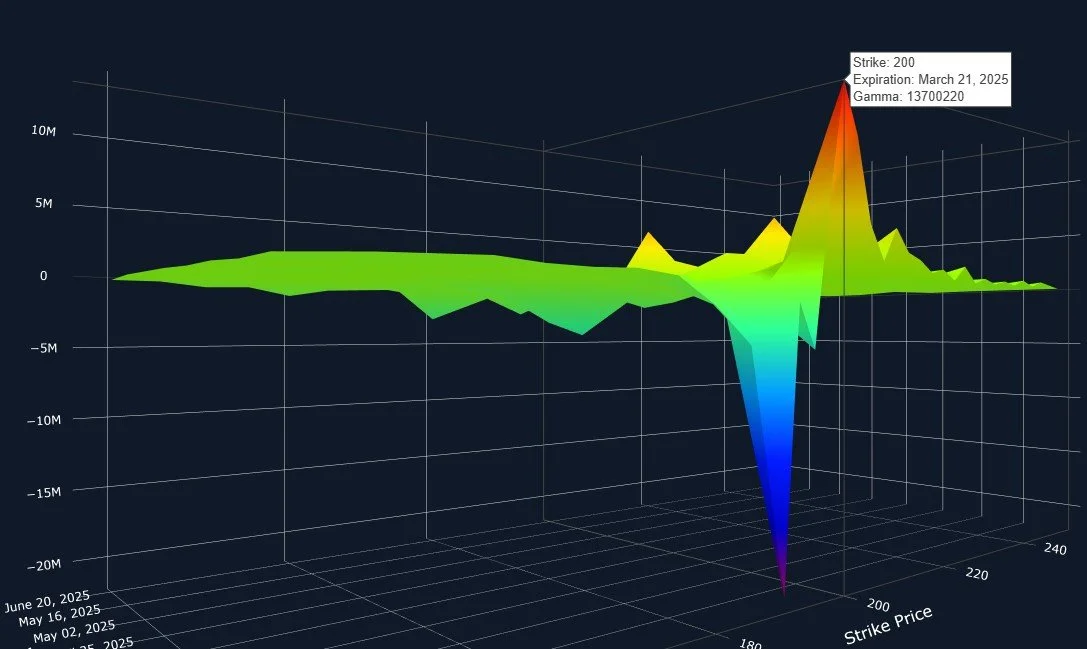

A different look at AMZN reveals the largest negative cluster at 190, a mere 1% downside from current prices, while the largest positive GEX cluster is at 200, roughly 4% higher. Risk/reward based on GEX appears to be tilted toward the upside. AMZN could move contrary to broader indices, but as a large component of both SPY/SPX and QQQ, I’d guess they will all be impacted by AMZN in a positive way if AMZN does indeed move toward the large positive GEX cluster.

We looked at MSFT two days ago, and today, it is still holding the Hull, though the continued drop in the lower Keltner introduces a possible lower target if MSFT loses the 381 area. Encouragingly, volume was mostly at higher strikes up to 420+ today, so 380-381 is a potential line-in-the-sand to watch.

oIf the market drop continues toward the Hull at 5537, which may seem scary despite being merely less than 2% away, market bulls will want to see the VIX hold any rally at the 25 area, which would largely represent a retesting of the Hull from below, prior support turned resistance. Above the VIX Hull at 25 opens the door for higher VIX prices toward 30 and possibly beyond, so bulls have some wiggle room, but they’ll want to see certain lines respected in coming days. Wednesday has the chance of presenting some good opportunities to reposition or add to existing positions, so we’ll be keeping a close eye on near-term developments.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.