3rd Friday’s A Charm?

THE SPRING PROMO IS HERE- We’re offering $300 off of the annual Portfolio Manager earlier than usual in March as we wrap up the 1st quarter of 2025 and celebrate the release of major updates last week! We now have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code SPRING2025 at checkout to take advantage of this limited time offering.

One of the first notable observations that we made in Discord Friday morning was that SPX opened the cash session above the daily Hull Moving Average for the first time since 2/19. We saw an unconvincing GEX profile early on, but we noted that GEX flow was positive on a net basis, and the GEX-indicated range worked quite well, initially rejecting within 6 points of 5610 and then bouncing just above 5560 as we approached the next largest cluster lower at 5550. We then saw a great rebound as the day went on, giving us the highest close above the Hull since January 23. We also had big Friday rallies for the last two weeks in a row, and those didn’t end so well. Will this coming Monday also be a repeat, or is change in the air with VIX monthly option expiration coming up Wednesday morning and monthly index options expiring Friday?

Let’s look at what a couple of leading stocks as well as several indicators have to say in the newsletter tonight. Our YouTube video (which can be viewed by clicking here) also discusses SPY, the VIX, and several additional tickers, like TSLA and NVDA.

Looking at SPX above, we see the noteworthy gap above the Hull Friday as well as the close near the high of the day. Friday certainly marked the most meaningful close above the Hull since the decline started. Gamma exposure (GEX) improved significantly overall as negative GEX was cut in half to -798M, but it’s still negative, so we keep an open mind regarding this bounce being the beginning of a move to new highs versus a selling opportunity before we see new lows. 5700, 5800, and 6000 above represent large GEX clusters. Friday also saw elevated volume at the 6000 level.

IWM made a similar effort Friday, closing well above the Hull. 215 is the largest target overhead, and despite a slight improvement in total GEX, IWM remains near a negative extreme reading at almost 1.9B. I can recall several occasions over the last two years where IWM’s extremes were good contrarian signals, so we’ll see if this potential bottom and rebound follows the same script or not. In regard to both IWM and SPX (and anything else for that matter), I still stick to my own rule about maintaining a long bias above the Hull and a short bias below the Hull.

With SPX and QQQ both giving some suggestion that we may see more upside, though not convincingly so, I thought we could do a check-up on two of their largest individual holdings, META and MSFT.

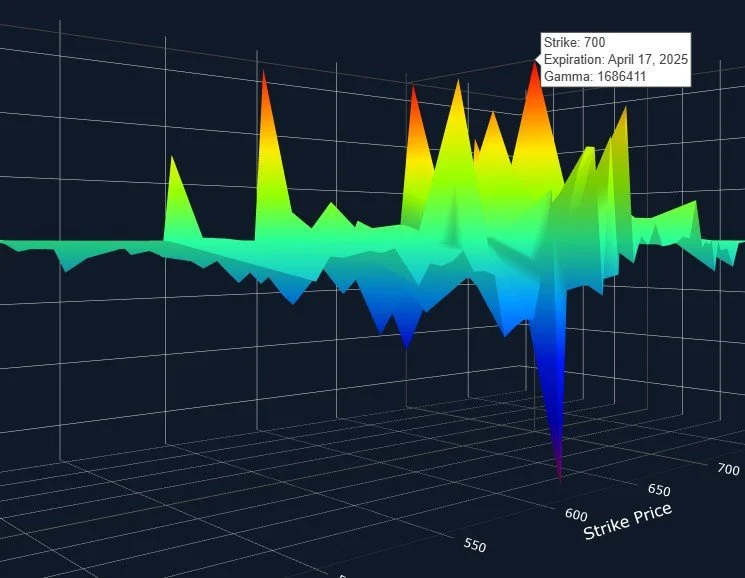

META erased gains back to December, but it closed above the Hull Friday, and we see huge GEX clusters at 700 and even 750. GEX is positive, too, which is an encouraging sign. We can’t say the same about the major indices.

I’ll note that most of the 700 cluster appears to be clustered around the April 17 expiration, but the largest negative cluster is still higher than the current price at 610 expiring this coming Friday.

MSFT has had one of the worst looking charts out of the Maleficent Seven, but even MSFT gives reason to believe in the bounce. MSFT closed aboe the hull, and most volume (in light blue) occurred at higher strikes. We see 400-420 as a potential range for a target if the upside continues, with both GEX and volume bringing attention to those areas.

MSFT’s total GEX swung from negative to positive, though the last time this happened, it was a brief stop before another plunge to negative territory, so we’ll want to keep an eye on developments as they occur. The bottom line for at least these two important index components is that they look cautiously constructive and they may represent two good reasons why broader indices can continue higher as well. It’s entirely possible that other major components could offset any positive contribution, but that risk can be hedged as well.

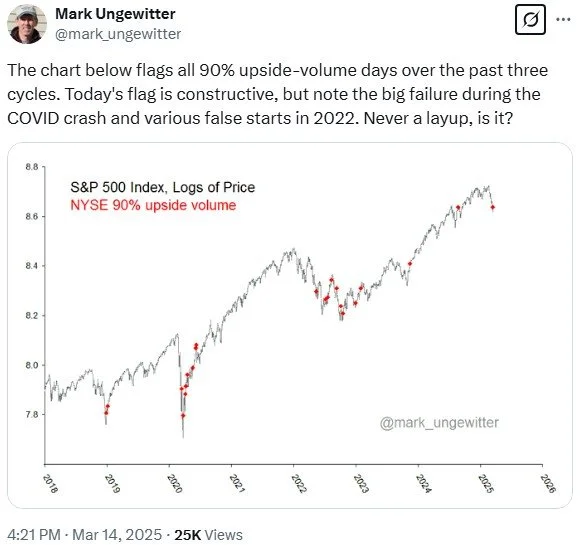

Lastly for tonight, Mark Ungewitter points out that Friday’s 90% positive upside volume appears constructive, but we’ve seen instances where such an occurrence didn’t see follow through. Zooming out though, even if performance was shaky to downright disgusting over the next few days, price action tended to resolve higher (2022-2023 seem to have been a very recent exception). We’ll likely get more clarity in the next couple of days and we hope you’ll join us in Discord where we’ll keep up with developments!

www.x.com

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.