DIAmond In The Rough

Friday indeed gave us a lower low and then a nice reactive bounce for QQQ back over the 500 level, as other indices bounced too. We may be entering a zone of tricky back-and-forth battling before the next direction is chosen. Positive divergences remain and may imply an overall more volatile market in both directions than we’ve become accustomed to in recent years.

Negative GEX: Double-Edged Sword

Early today, DIA was giving bulls hope, showing a positive day in the midst of a negative SPX and QQQ. The rally didn’t last, though, and the failure brought about another wave of selling, this time reaching the lower Keltner channels. Let’s take a look at the prospects for a bounce and where it might occur.

Mixed Signals

We were left with a mixed bag today, with indecisive price action that leaned negative as the day progressed, yet certain positive divergences also exist. Let’s look at our best clues as to what comes next.

Early Signs Of A Pulse?

While it’s still too early to celebrate, DIA was the odd one out, positive for the day and bouncing right where we would like to see it bounce. Is DIA an early signal that indices are about to see a nice rebound, or was today a one-off anomaly?

Getting Closer….

With Friday’s option expiration behind us, we still saw markets fall further today, though under the surface, we see GEX held steady, and in fact, improved in many cases. The VIX is not decisively telling us the drop is over, but we finally saw VIX 20 hit, a target we’ve been watching. What’s next?

Post-VIX Expiration Pullback: Warning Or Opportunity?

The market was tricky Friday, with a difficult GEX reading intraday (outside of the clear negative bias) despite the big picture giving reasons for concern earlier in the week. We may be near an area where a bounce could occur, so let’s look at the reasons why.

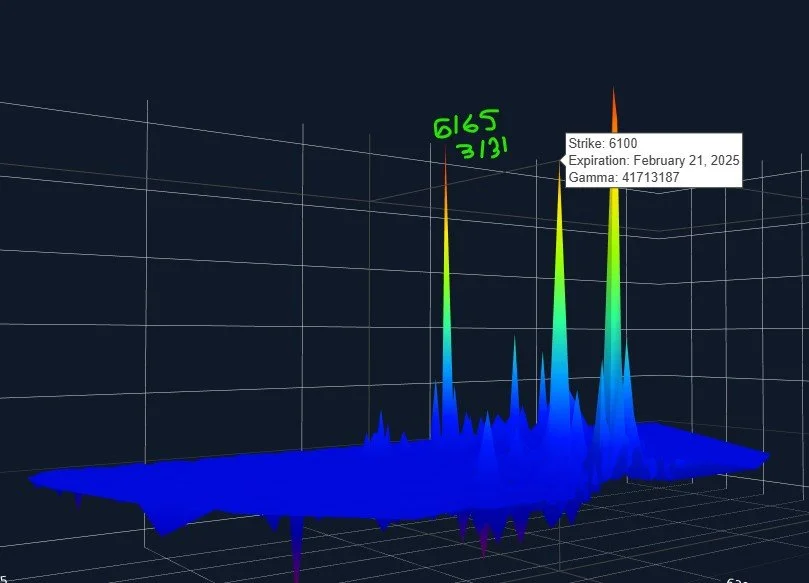

February OpEx: What Does GEX Say?

DIA turned a potential downward reversal into a sideways consolidation, appearing primed for a move higher as we head into OpEx Friday. The VIX has been stubbornly above 15, but we still may yet see an attempt toward 14 before the week is over.

Barrelling Toward The Destination

DIA turned a potential downward reversal into a sideways consolidation, appearing primed for a move higher as we head into OpEx Friday. The VIX has been stubbornly above 15, but we still may yet see an attempt toward 14 before the week is over.

Looking Beyond VIX Expiration

Today we look at what GEX is telling us across the board as we enter VIX expiration premarket tomorrow.

Approaching A Possible “Breather?”

Thursday we mentioned potentially stretching into Friday or Monday to set a possible short-term top, despite overall bullishness appearing to be reasonably expected into March, based on GEX. Monday still looks like a reasonable chance for a short-term reversal, with the VIX quickly approaching the 14-14.3 possible reversal area, SPY total net GEX approaching an extreme, and QQQ not showing meaningful growth in higher GEX targets beyond the next 1.5%-2%. Let’s look more closely as we enter the 2nd half of February.

Love Is In The Air

Today’s action was almost singularly bullish as indices finally broke out of the recent range to the upside. If we see a repeat of the pattern of mid-month pivots, we may be making a short-term top between tomorrow and Monday, even though our sights are still set on higher prices into late March. An intervening pullback would be welcome for wannabe bulls who feel forgotten on the sidelines.

Mid-Month High Or Low?

The chop continues, with false breaks to the downside bought up and breakout attempts rejected. It’s a bloodbath for option premium betting on a directional move. How long can it last? We don’t know, but tonight we’ll look at some cyclical tendencies we’ve seen in recent months that might show the importance of an upcoming mid-month pivot.

Higher Into March..What Happens In Between?

GEX looks bullish into March- what happens between now and then? Smooth sailing? Unlikely, but what happens during the next pullback will be key.

Market On A Mission

SPX regained the Hull moving average again, and GEX looks poised to help SPX get across the finish line soon. Let’s take a close look as well as evaluating MSFT as a potential stock of interest as it pertains to QQQ.

Surviving The Chop Zone

We continue to bounce back and forth in a difficult area without significant short-term clarity. Friday’s drop took us back below the Hull Moving Average, and GEX remains neutral. Let’s see if any signals at all can tilt the odds in our favor, or if not, we may need to patiently wait for more information from Mr. Market.

Early Warning From DIA?

The bullish moves continued today for SPX, and early weakness in QQQ was reversed, bringing both indices closer to their respective targets. AMZN earnings are out after hours, with the initial move being down. Will tomorrow’s employment report join forces with AMZN to deliver a red Friday, or will it offset the selling and allow us to continue pushing higher? Let’s see what gamma has to say about it.

Pushing Higher

The dip today was rather shallow and entirely made up by the opening gap down. Indices proceeded to climb steadily all day, with QQQ painting the clearest positive picture based on chart indicators. With big tech earnings looming Thursday with the likes of AMZN reporting, tech certainly has a catalyst to potentially fulfill what we see with gamma.

Is The Pullback Over?

Gamma (GEX) continues to show positive shifts, both in terms of total GEX and the potential for higher strikes. Given that we’ve had 2 days of rallying, we may see some retracement mid-week, but the current picture points to greater odds of eventual higher prices into Friday, with more concern looking beyond Friday.

Back To Earnings

SPX’s 4-hour Keltner bottom stopped the decline overnight, and we saw a nice rally in the cash session, albeit from a big gap down. It’s clear that volatility is back, but does that mean we’ll keep declining? Let’s look at how SPX closed today and identify what we’re watching for tomorrow.

Starting February In The Red

Thursday we laid out a possible pathway that included an attempt beyond 6100 on SPX, and a possible retracement beginning the same day. This worked out extremely well, and the pullback is continuing in the futures market with a big gap down of over 100 points in SPX. Tonight we’ll look at some levels to watch as we enter the first trading week of February.