Month End Preview

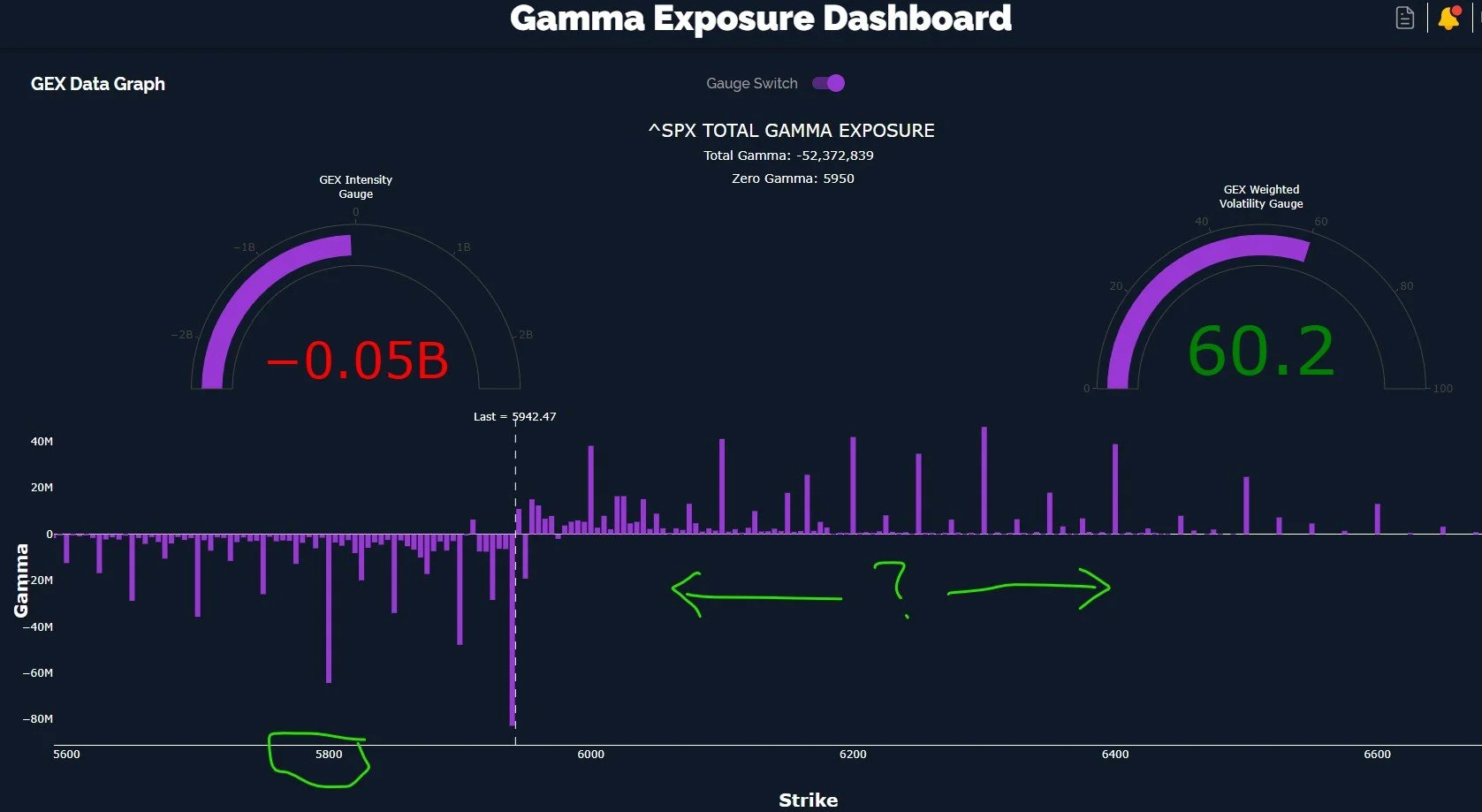

While overall gamma (GEX) remains neutral, we see growing interest at higher strikes, implying higher odds that we eventually reach those targets. We still have the Hull moving average to contend with short term, and a VIX that triggered a bullish volatility signal on the 2-hour chart. Pullback and then rip? The first month of 2025 ends tomorrow, so it may be an interesting day.

A Bullish Shift For SPX?

Today was relatively tame by FOMC standards, with markets slightly weaker most of the day. We see a bullish overall shift in SPX, but we also see undeniably large volume at two VIX strikes (30 and 60) that may cause bulls to at least consider an effective hedge. How do the two divergences make sense?

Resistance Into FOMC

We saw a nice rebound today and (in some cases) yesterday, but we are at or approaching resistance heading into FOMC tomorrow and big tech earnings immediately after. Will more pain be delivered to late bears or are we ready for another leg lower?

“Markets In Turmoil?”

Despite the gap down, the cash session longs won the day with one of the larger one-day gains in 2025 so far. Who would have guessed? We may not be out of the woods yet, but with the FOMC announcement and press conference Wednesday and big tech earnings largely starting that same evening, we may see a few surprises for everyone this week.

Futures Dip (As Anticipated)

We’ve recently highlighted potentially bullish developments in markets as we see gamma growing at higher strikes, though we also said we expect a short-term pullback given the extended nature of indices. Looks like the dip is upon us. What levels are we looking for to validate/invalidate a potential opportunity?

Preparing For A Dip Buy

“Straight to target” continues as all indices closed higher, despite pockets of weakness earlier. Similar to prior tops in recent history, QQQ is the late bloomer, outperforming over the last 2 days. QQQ has enough large components that are near lows to justify another day or so of upside. Let’s take a look at how we might end the week and what lies ahead.

Heading Straight To Target

VIX expiration is now behind us, with the 15 strike serving as the target at the time of the 8am ET completion. This opened up the pathway to new hedging, and thus a rising VIX even as QQQ and SPX barreled higher. IWM was less optimistic, so we’re starting to see more divergences that potentially justify at least a pullback in the near term.

Key Resistance Breached

indices gapped up over key Hull moving average resistance today, managing to hold most gains into the close while the VIX dropped to the key 15 area we’ve mentioned. Earnings are starting to heat up, with NFLX kicking off big tech, and we have VIX monthly option expiration in the morning. Let’s take a look at where we stand.

A Pivotal (shortened) Week

Gamma once again helped us to lean in the right direction last week for monthly option expirations, with SPX 6000 being an important draw into Friday’s close. Let’s look ahead at a shortened 4-day week which includes the important monthly VIX option expiration Wednesday and a pivotal area for broader indices as a new United States presidential regime signals potential major change for world markets.

Choppy Waters- What’s Next?

Indices experienced a modest selloff today, unsurprisingly given the large move higher over the last 2-3 days. Importantly, indices are holding above key levels so far, maintaining the bias toward the long side. In our last newsletter until Sunday, let’s look at where GEX stands and we’ll look ahead at Friday and next week.

Put Options Incinerated!

Most of today’s move was in the pre-market gap up, but with some technical resistance overcome, let’s reassess where we are and incorporate GEX into that picture. DIA vindicated our idea that it would lead the way higher, so the positive divergence worked this time around.

Pivotal Resistance Pre-CPI

Indices tested important resistance today, with SPX and QQQ surpassing the Hull moving average intraday before retreating to close below the Hull and red for the day. Meanwhile, DIA diverged positively, closing above the Hull and near highs of the day. With CPI tomorrow and OpEx approaching Friday, we are at an interesting juncture and hopefully we’re at the doorstep of big opportunity at the middle of the first month of 2025.

Dips, Jumps, And Surprises

DIA led the bounce Morning, which was identified as a logical possibility in our recent newsletters and YouTube videos. As we proceed through OpEx week, let’s look more closely at potential catalysts on the earnings and economic calendar, as well as a current look at GEX as of the end of today.

January Option Expiration Week

Friday ended the week on a negative note, with indices gapping down and sliding further while the VIX climbed. As we enter monthly option expiration week, and earnings are right around the corner, is this really the time to be doubling down on a short bias? Let’s take a look at what clues we see using GEX for the indices.

Approaching A Possible Pivot

Volatility continued today, with indices struggling at different moments to erase the onset of more red. While concerning signals remain, we see the anticipated outperformance by DIA and the traditionally bullish OpEx week approaching as reasons to stay on our toes as we look toward the next and last trading day of the week on Friday.

Dropping From Resistance

Today gave us the answer to yesterday’s question of whether or not we’re out of the woods, but as we pointed out, these up and down moves are all within the context of the broader trend. While we have specific levels we’re watching to signal invalidation of the bull market, for now, we need to think tactically about what is next and what will trigger our next moves.

Out Of The Woods?

Today’s gap up annihilated bears counting on Friday’s gains to be reversed. This move fits in with our assessment of the odds favoring some sort of rebound from oversold conditions. But are we out of the woods? DIA and IWM might be signaling a weaker, temporary rebound, even if we do rally this week and next.

Flirting With Key Resistance

Was Friday a relief bounce, or the beginning of something larger? It may be the beginning of a larger move, especially with the January 17 concentration of some of the postive clusters we’re watching, but volatility is also near support and may rebound soon, potentially dampening further bullishness.

How Much Lower Can We Go?

The first trading day of the year saw over a 100-point range on SPX, ending the day 1 point above the 12/19 closing low. Today we look at how we might end the week and whether or not the bull picture is dead.

Bringing In 2025 With a Nail Biter

The last trading day of the year went out with a whimper, but the full year was impressive for the S&P and the Nasdaq especially. Let’s look ahead at some expectations for first two weeks of 2025. Happy New Year and thanks for joining us!