Choppy Waters- What’s Next?

Today’s decline in indices is somewhat unsurprising given the large move up over the last 2-3 days, and I actually expected a bit more in terms of the magnitude of selling, the difference in expectations likely attributed to the fact that it’s OpEx week, so volatility has been dampened relative to Monday and previous days in favor of killing premium.

As long as we hold 5856-5904 SPX, the bias is higher in terms of my chart indicators. Our recent YouTube video posted today covers SPX, SPY, AMD, ETH, NFLX, the VIX, and more, which you can view by clicking here.

0-A quick look at the SPX 4-hour chart above shows that we are roughly 13 points away from the middle Keltner channel, and the Hull moving average is rising sharply, currently at 5886. The upper Keltner is at 6032, and (not pictured) I’ll point out the weekly Hull is at 6017 and change, so I think we can reach that range as long as 5886-5903 holds. We also saw outsized volume at 6000 today, which is high enough out of the money that we assume the volume is more likely from bullish bets.

SPX total GEX dropped slightly by the close, but barely, still holding a positive GEX position.

Last night, we focused on the red upper Dealer Cluster zone and its potential negative ramifications within a wide range. We dropped out of the red box, but we’re still very close to it, and we saw eye-popping volume at 6000, well within the zone, though more than halfway through the range to the upper limits. OpEx is notoriously tricky for traders despite the bullish bias, so we can still see a spike toward higher levels tomorrow.

Adding some backup to the bullish view, AAPL has dropped precipitously, bearish on the surface, yet creating a setup that may lend fuel toward a rebound in indices. The location in proximity to the weekly middle Keltner certainly adds credibility to a recovery of 231 and potentially a rally toward higher levels. The Keltners look neutral at worst, and likely more bullish, and we haven’t sustained a breach of the middle Keltner on the weekly chart since February 2024, almost a year ago. Perhaps we’re overdue then, but I would argue that the consolidation from June 2024 until November 2024 and ensuing breakout make it likely that we at least see a larger attempt to bounce from here than what we’ve yet seen. We are currently positioned bullish in our Educational Portfolio, in full disclosure.

AAPL is in a Dealer Cluster zone and we saw the mot volume at 235 today, with 250 marking the upper Dealer Cluster zone.

Lastly, the VIX almost reached the 15 area Keltner channel boundary we mentioned yesterday, but fell short just slightly. We might see volatility rebound here, with 18-21 as potential upside targets, but we also might see 1-2 more days of downward pressure, if 15 is actually a target. Today’s increase in the VIX leaves us unsure of which side of the trade comes first.

GEX levels send the same message: We didn’t quite tag a lower Dealer Cluster, yet we don’t see volume or GEX in a substantial way above 20, so we aren’t yet sure which side comes first.

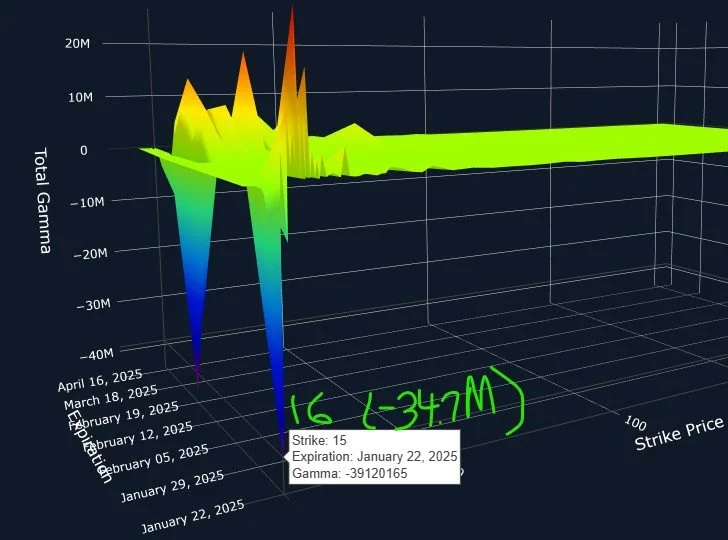

If I look ahead toward VIX monthly option expiration 1/22 this coming Wednesday, I see large negative GEXC at 15-16, so perhaps we close above those levels, but I can’t say how far above.

Join us in Discord for some GEX updates shared in real-time as well as engaging with our talented and experienced subscribers, who are more than willing to share their ideas and experiences.

If you’re interested in accessing our tools and analytics, be sure to check out our website. We just rolled out 500 new tickers and speed enhancements!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.