Divergences Continue

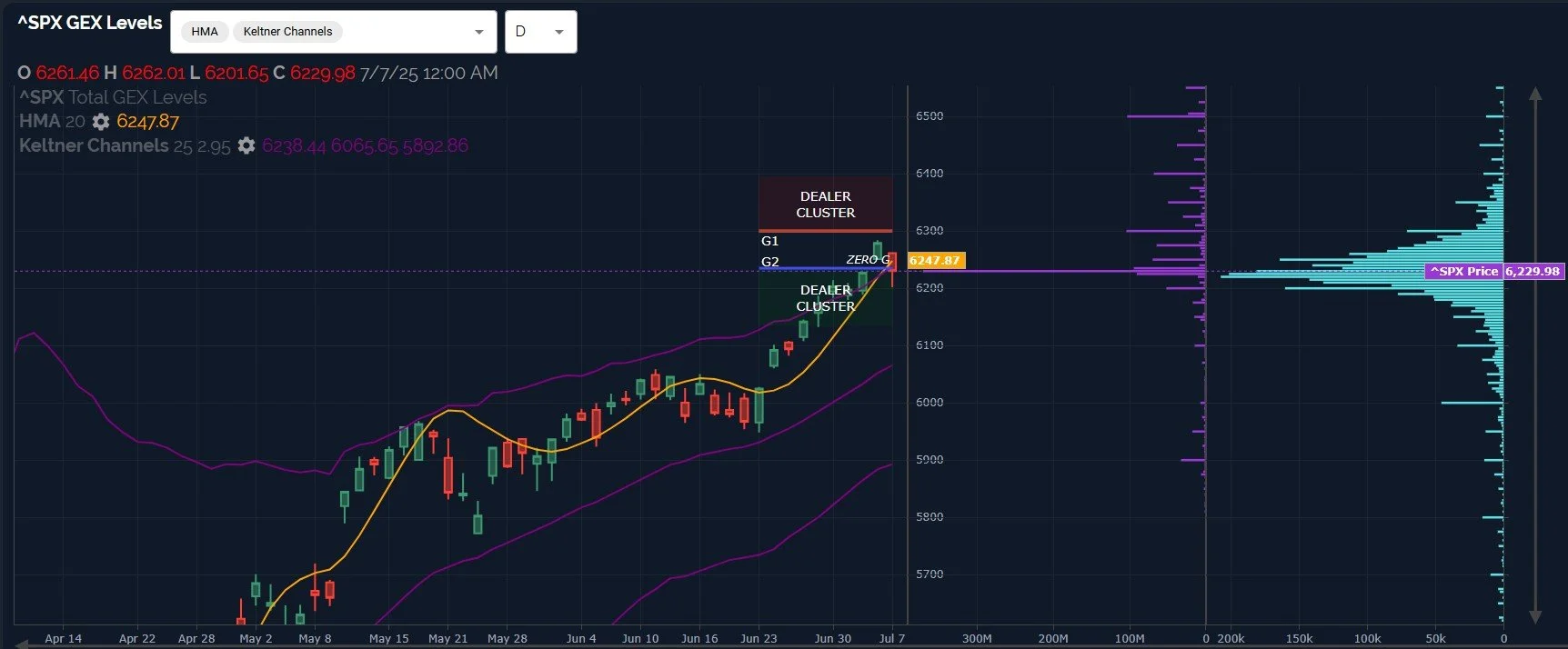

Our recognition of a possible attempt back up by indices proved correct today, with the VIX has quickly plunged toward an extreme lower target, almost reaching the 4-hour Keltner bottom at 15.76 before rebounding back to almost 16. With indices stretching even higher toward their respective upper Dealer Cluster zones and beyond the upper limit of the Keltner channels, we are likely still on the doorstep of a larger pullback.

Consolidating Before The Next Move

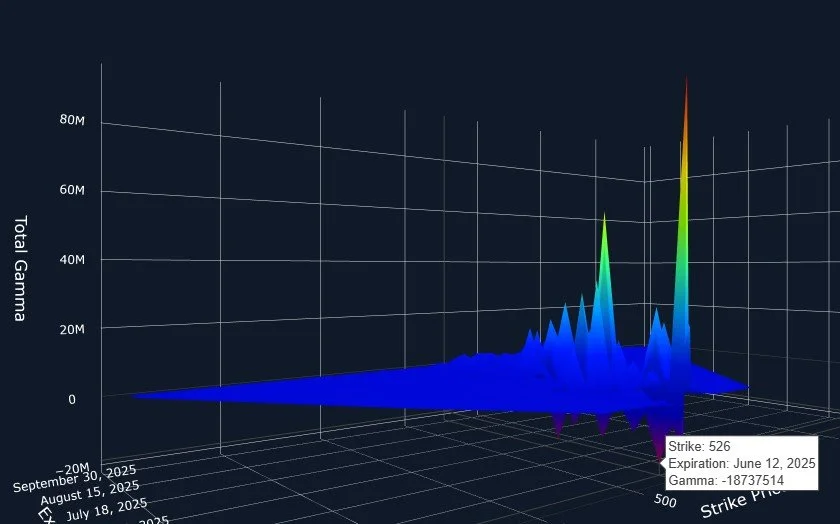

QQQ and SPX remain below the Hull Moving Average, though IWM closed above the Hull today, and the VIX looks like it could go either way..So we are at a point of uncertainty. We also have positive GEX increasing modestly across the board, lending credit to the idea that we may see some choppy ups and downs before a more significant pullback.

Is That A Red Candle?

We finally saw a break below the daily Hull Moving Average today, complete with a sharp drop in positive GEX across the board. Odds are increasingly shifting toward the beginning of a pullback, though we will entertain scenarios that may involve further upside attempts before any meaningful downside. Let’s take a look at the big picture, including the VIX.

Patience Amidst A Parabola

SPX completed the traditionally bullish week of July 4 with a solid rally right into Thursday’s half-day close. Our headline concern on Thursday evening regarding VIX divergences was quickly met with a noticeable VIX spike on Friday while cash markets were closed, and futures continue to fade. While recognizing the inevitable future pullback that we expect to occur in context of a vertical blow-off, we need to exercise patience and discipline as well. Tops and bottoms are not easy, just ask Tulip bulb investor Isaac Newton.

VIX Divergences Building

The VIX low was actually June 27, despite the market continuing to rise this week, fulfilling the normal bullish lean of the July 4 trading week. With this negative VIX divergence (admittedly still a small divergence), and VIX:VVIX negatively correlated today, we may be approaching a more likely period of weakness in coming days beyond July 4. Let’s take a look at possible final upside targets and where a drop might land.

Upside Targets Met..Now What?

In picture-perfect fashion, we saw major indices struggling today, except for beloved IWM, which rocketed right into the 220 level we’ve discussed for a couple of days as the last target that looked likely for major indices. A bullish overall GEX picture remains, but let’s take a look at what that means as we consider both timeframe and potential pathways to bullish continuation.

Is The Ship Listing Far Enough To One Side?

Is the ship listing far enough to one side yet to see a reversal? Trend changes are rarely neat and perfectly logical, so let’s take a look at a possible overshoot scenario as well as other shifts in GEX today.

Wrapping Up Q2, Looking For A Breather

Monday marks the end of Q2, and an interesting possible inflection point for markets, with GEX pointing higher ultimately, but a shorter term pullback becoming more likely as divergences build. Will normal July 4 bullish seasonality play out as many expect?

Early Divergences Competing With Extreme Upside Targets

We see some smaller early divergences with the VIX and the indices today, and we are in the upper Dealer Cluster zone for IWM, but the upper zones for QQQ and SPX have moved higher as price moves higher. We still have the upper Keltner channel to contend with and possible surprises inherent with tomorrow’s final Q2 weekly expiration and the end of the quarter Monday.

Navigating The End of Q2

SPX is within the upper Dealer Cluster zone and the upper Keltner channel is roughly 1% away at 6155. With the end of the quarter right around the corner, the pathway over the next few days may be treacherous, with volatility in both directions. Our conclusion remains that the easy money has been made since April, and the pathway may be more difficult looking ahead, despite an ultimate upward trajectory looking good into the Fall.

New Highs For SPX!

Indices made a decisive move today, gapping up even more from the Hull Moving Average and propelling markets to their upper Dealer Cluster zones. SPX finally reached 6100. Let’s look ahead and see how far this move may extend, and what the VIX has to say about that as well.

Intraday Shake ‘N Bake: Next Up- Headfake?

The first trading day after OpEx week proved to be a volatile one, with a gap up that got sold off to just below 5950, then a powerful move back up to close the day just over the Hull Moving Average. QQQ wasn’t able to close above the Hull though, and we see mixed moves with net GEX as well. So the question we all want to have answered is: What’s next?

Preparing to Buy The Dip

Indices show mixed GEX signals as of Friday’s close, with SPX and IWM seeing increases in net GEX (a big increase for SPX) while SPY and QQQ show sharp decreases in net GEX. Technically, we see indices holding below the Hull Moving Average and the VIX closed above the line. What comes next?

Sell In May…I Mean, June?

IWM’s Hull moving average has rolled over to a more negative trend and QQQ and SPX are starting to turn. Wednesday’s move lower was not met with a big move lower in net GEX though, in fact SPX saw a rebound in GEX to positive territory again. What pathways look most likely going forward?

Monthly VIX Expiration & FOMC

Downside continued today, a move advertised early on thanks to our 0 DTE GEX graph. As we enter VIX expiration premarket before FOMC, we are on high alert for possible volatility and either a trend change or acceleration, so we’ll be watching for signs in advance of wherever the market is going to move.

Testing Resistance

Monday saw indices rallying into Hull moving average support-turned-resistance, which is exactly what I was wanting to see. IWM and DIA closed weaker, rejecting the Hull (as did QQQ and SPX) but also closing even lower relative to their respective Hulls. Did participants expend all of their purchasing power to get to the line only to fail, or have we seen the start of a larger squeeze into OpEx week and FOMC? Let’s take a closer look.

Breaking Down- For Now

IWM continues to give us the most transparent signals compared to other indices, with Thursday’s close below the Hull leading to more downside Friday. While our bias remains tactically short below the Hull moving average, let’s take a look at a possible tricky pathway that may involve both upside and downside this week prior to reaching the destination for this move lower in SPX, QQQ, and IWM.

Indicators Expected The Unexpected

The VIX and IWM appear to (once again) have been good precursors for risk reappearing in markets. With OpEx and VIX monthly option expiration right around the corner, What are we looking for as we see futures tanking on news of the Iran strike?

VIX Triggers A Long Volatility Signal?

IWM has once again led the way down after breaching the upper Keltner channel this morning. We also see a potentially concerning close above the daily Hull for the VIX, the first of its kind since late May. With a rising Keltner channel, persistent higher GEX for SPX, and VIX monthly option expiration next week, we may see a tricky pathway forward wrought with dangers for bulls and bears alike. Scared? Read further.

Pushing On A String Into CPI

Indices are edging closer to the upper Keltner channels while IWM actually reached the upper Dealer Cluster zone and almost touched the upper Keltner channel. Let’s take a look at some subtle changes that may prove impactful as we enter the timing of CPI at 8:30 AM ET tomorrow morning.