Consolidating Before The Next Move

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a YouTube video today, which you can watch by clicking here. We take at major indices, the VIX, and several others, including USO and BRK.B, one of several new additions to our GEX dashboard.

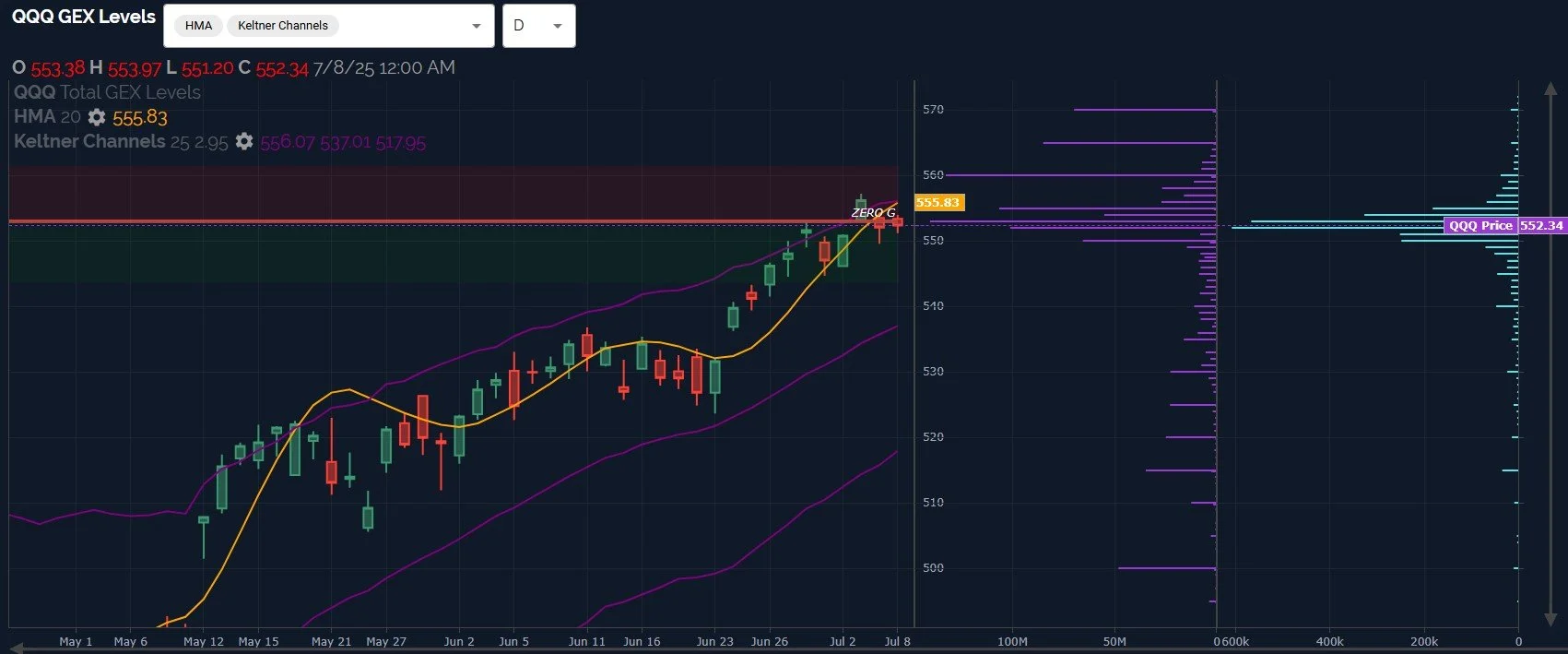

QQQ completed its second day below the Hull Moving Average (the yellow line), which continued rising today, right into the upper Keltner channel. With both indicators still rising, a situation is created that might allow QQQ to test the Hull from below at the previous high or even a little higher. Eventually the Hull may turn down, like it did after the May 21 drop, and you can see 3 days of a quick drop were reversed with one gap up at that time, even though QQQ dropped for a gap fill a few days later. Long story short- the bullish trend combined with the bearish hold below the Hull could result in a difficult and choppy few days ahead.

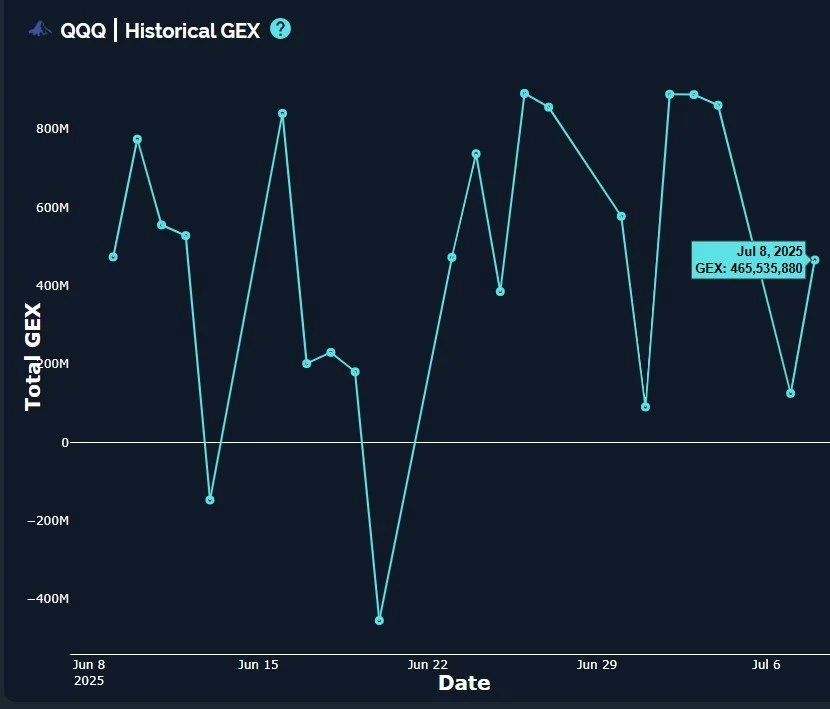

One possibility that I think may emerge is an intermittent bounce before further downside as bulls attempt to re-exert momentum to the upside, only to fail at or around QQQ 560. 552 is very important on the weekly chart (the weekly Hull), so I will watch what happens at 552 if we attempt to continue lower. GEX increased today for all major indices, adding some evidence that a bounce may be forthcoming. I also see 560 is a meaningful GEX strike for Friday’s expiry, which brings the top end of the upper Dealer Cluster zone into focus.

IWM has also refused to go “full bear” so far, closing back above the Hull today. We would expect IWM to be leading the way lower if some recent pullbacks are our guide, so this is something to watch. 230 is a major GEX cluster overhead, though I like the idea of an upside push targeting 225 for now, given the confluence with the upper Keltner channel. If QQQ proceeds to 560 by Friday, it may be IWM that sees the larger gain between now and then (in percentage terms).

IWM GEX increased back to positive territory in similar fashion to QQQ and SPX. While my view of recent developments is less negative for this week, I am still biased toward expecting a deeper pullback as long as we’re below the Hull for SPX and QQQ, and IWM may be suggesting we still need a little more time before a 3-5% drop can happen. The next few days will be telling.

The VIX has been cooperating with the Hull quite well, gapping higher after closing above the Hull for the first time in days, though the move right into the zero gamma level at 18 was rejected, leading to today’s gap down. The VIX had also moved quite far away from the Hull, which rarely lasts, so seeing the VIX come back down toward 16 is not surprising. The Hull is turning up though, and we are still above the line, so any decline in volatility may be temporary. A drop toward 16 by Friday combined with the indices pushing higher fits into the view that we might see indices push again this week, only to fail next week as the VIX rebounds off of the Hull. We’ll keep an eye on developments tomorrow and we’ll post any major changes in Discord, as usual!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.