Is That A Red Candle?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a YouTube video today, which you can watch by clicking here. We take a brief and complementary look at SPX, QQQ, GLD, and IWM, as well as a few individual tickers, so check it out if you have 10 minutes or so.

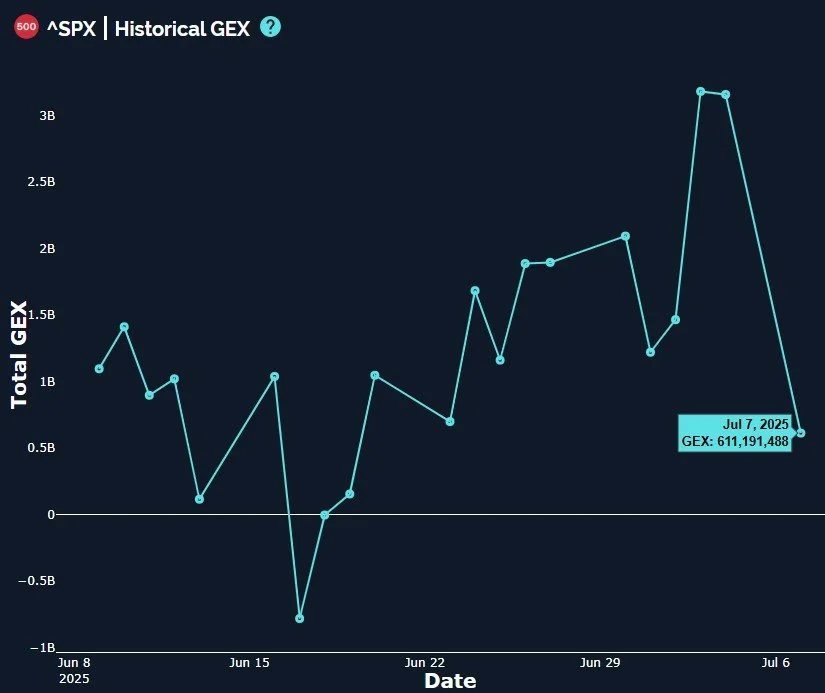

The VIX divergences and extreme positive GEX reading on SPX seem to have led to the expected early stages of a pullback, with the VIX continuing to rise (and VVIX, the index measuring future expected volatility of the VIX, up almost 6 points) and indices dropping across the board.

The VIX 4-hour chart shows two possible pathways, both of which indicate higher highs for the VIX are likely, whether immediately or after a small pullback for volatility (“small” is relative in the world of volatility). The scenario in which the VIX spikes first involves reaching somewhere around VIX 19-20, then possibly a pullback, though I have the lowest confidence in predicting when a VIX spike reverses back down, due to the nature of how many participants seem to enjoy shorting volatility and the immediate spike that can be caused by too many VIX shorts crying “Uncle!” all at once. The volatility correction scenario would see the VIX likely finding support at 17 given the multiple technical averages and the middle Keltner converging between 17-17.28, and the Keltners have turned upward as well.

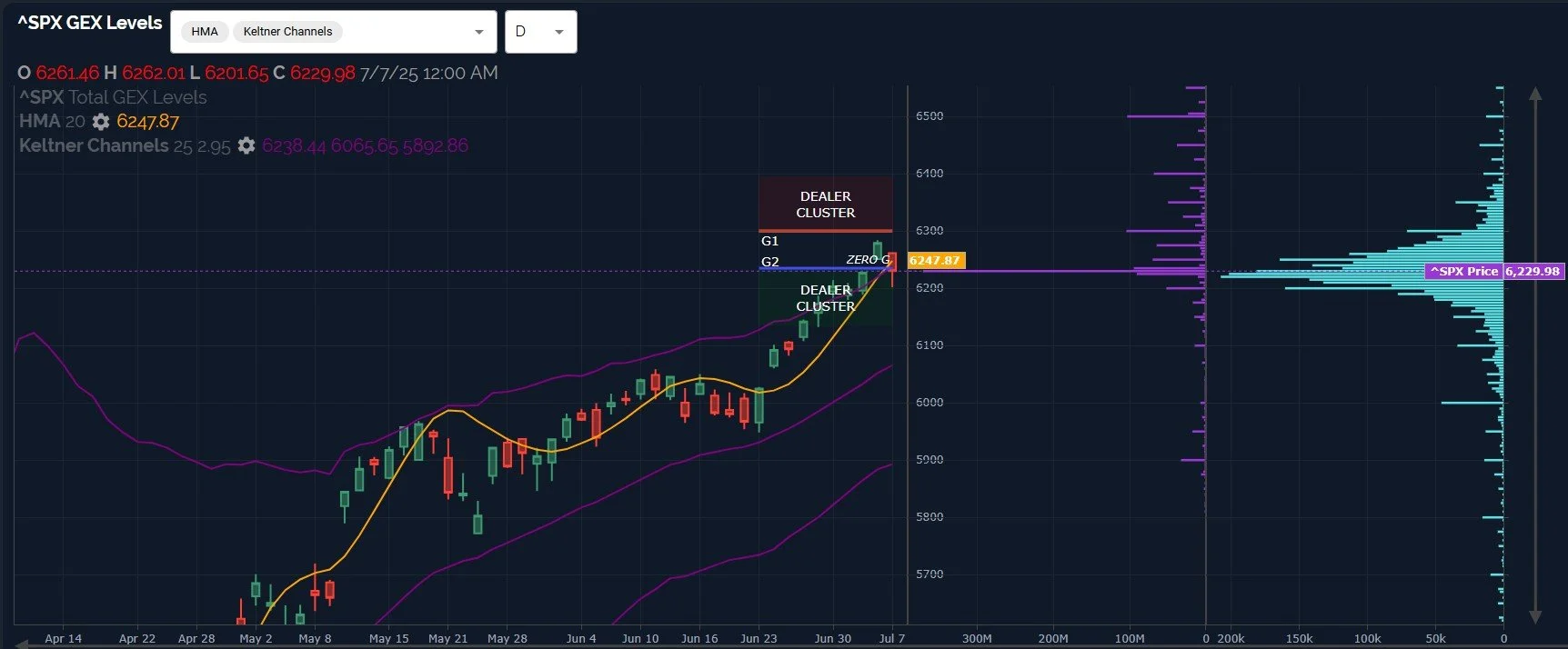

SPX closed nearly 20 points below the daily Hull, which I view as a major danger zone and more decisive than IWM’s close below the line by mere pennies. Even with the close below the Hull, SPX is still near the upper Keltner channel, so any ensuing pullback still has a lot of room to the downside (relatively speaking). I think we need to keep an eye on 6100 for starters. With the Hull still rising, even staying below the Hull could result in choppy ups and downs as opposed to a powerful momentum move lower. We just don’t know (surprise!), so we need to watch how this shift develops. This is the first time we closed below the Hull since June 23, so I do consider the change to be significant.

SPX GEX declined significantly too, back to the lowest positive reading since June 19. 611mm puts us in neutral territory overall, so we don’t have all-in short signal by any means.

QQQ closed with perhaps the most negative look, spending the day below the Hull after failing to retake it. 560 and above appear to be a wall at the moment, and with very little GEX on a net basis between 550 and 515, any momentum to the move lower could quickly take us toward that middle Keltner channel at the 515-520 GEX clusters. We don’t see big momentum now, obviously, so we’re looking at hypotheticals in the event we see follow through tomorrow. I certainly wouldn’t want to be buying here, and even retaking the Hull to the upside likely results in only momentary relief for the bulls (in my view) given that we are still at the upper daily Keltner channel. Outside of a brief spike higher, the bulls are facing headwinds despite the strong move that took us to this point.

QQQ also saw a sharp drop in net GEX, closing at 125mm today. The current picture looks like 555 might present resistance on any rebound attempt, so we are definitely more interested in buying the dip as it unfolds than we are trying to game any smaller moves up at this point. We will typically see price drop, then the Hull catches down to the lower price (similar to what we just saw with the VIX), and then we can better assess timing of new longs as we see the GEX picture and the technical picture start to turn. We’re still getting good signals on a 0 DTE basis related to where the market is likely to go, so we’ll continue watching and sharing those targets in Discord daily.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.