Divergences Continue

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a YouTube video today, which you can watch by clicking here. We don’t cover a huge number of tickers today, but we do go in-depth on PLTR, QQQ, SPX, and the VIX, so check it out for some additional commentary you won’t read here.

We had another VIX divergence from VVIX today, with VVIX moving higher as the VIX dropped. VVIX moving higher potentially signals expectations that the VIX could become more volatile looking forward. I would say this possibility has good odds, given that we are right at the largest GEX cluster and the lower Dealer Cluster zone at 16. The Hull Moving Average is also just over 16 and the Hull has turned higher, with volume almost exclusively at higher strikes. So we might be at a spot where the VIX is ready to turn up..Will we see a VIX high as we approach monthly VIX expiry Wednesday the 16th premarket, or will we see the VIX move sideways or down into Wednesday?

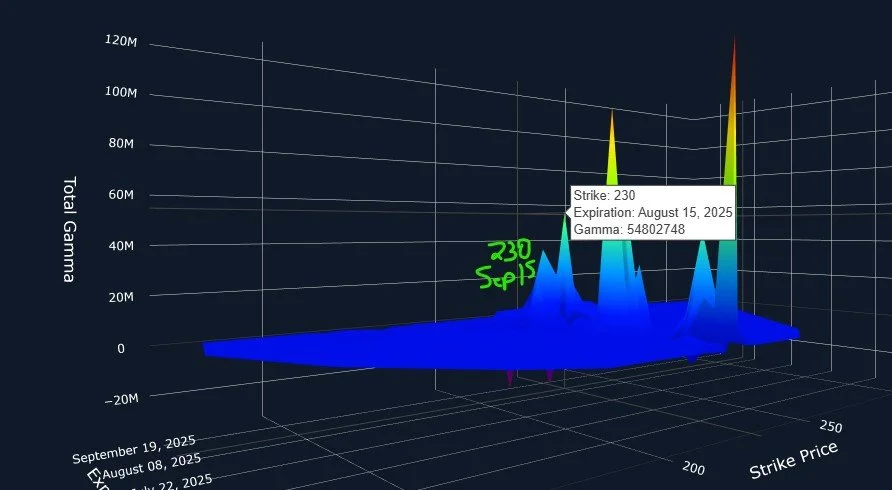

We saw a divergence today which may or may not mean anything in particular: SPX made a lower high while QQQ made a higher high, both still stuck below the Hull, which I view as support-turned-resistance, matching up with the upper Keltner channel as well. The “pullback” that started Monday is looking more like sideways consolidation for now, but with the VIX at what may be a short-term low, the higher GEX targets mostly concentrated at August and September expiries, and certain technical resistance, sideways may yet become down as bulls attempting to buy micro dips start to become a little more worried that the recent momentum might be ready to take a larger pause.

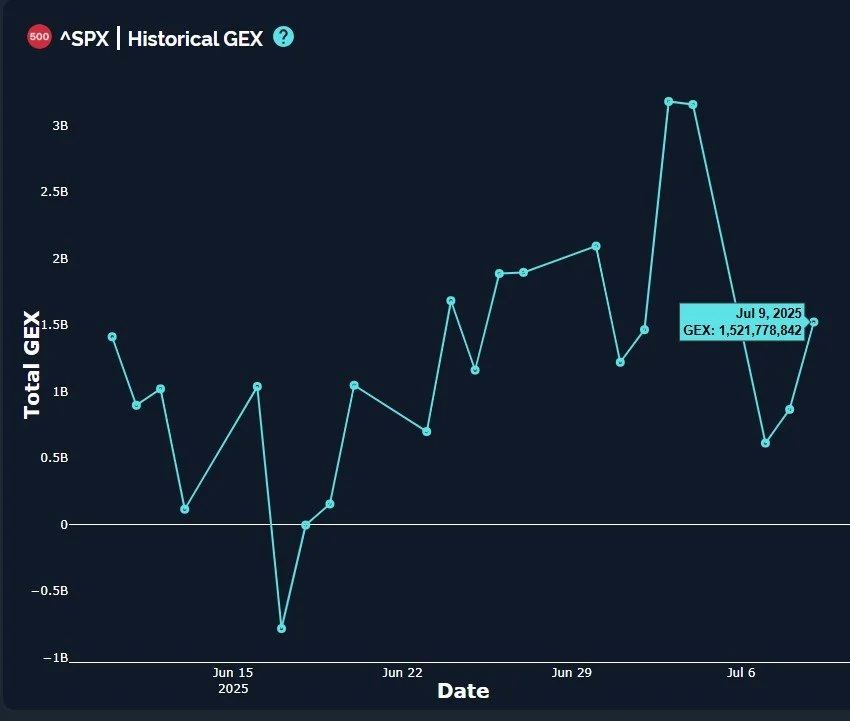

QQQ saw GEX rise dramatically today, but SPX saw a more modest increase, still in solid positive territory, which we consider to be bullish for the bigger picture.

Let’s switch gears to IWM, which we noted as having a more bullish picture given its inability to lose the Hull Moving Average, and sure enough, it’s pushed higher toward 225. I liked 225 as a possible target given the confluence with the upper Keltner channel, and we’re close to it now. Note that IWM was mired in stubbornly negative GEX ever since the April lows, only recently flipping positive. I would call that more of a capitulation by bearish participants than a forward-looking vote of confidence, though I guess there’s no reason the two can’t simultaneously occur.

Our 3D graph shows most of the 230 GEX clusters at the August and September expirations, so we have at least some suggestion that a period of weakness is possible between now and mid-August, at least judging by a lack of individual large GEX clusters and higher strikes between now and then. Given the location of the lower Dealer Cluster zone and the lower Keltner channel, I think a drop to 210 is realistic before a final push toward 230. Let’s see how the next few days unfold and we’ll update our views accordingly.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.