Signs of Cracks In The Nasdaq?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a YouTube video today, which you can watch by clicking here. We always cover a few individual names not discussed in the newsletter, and sometimes additional observations on the indices, so be sure to check it out.

Let’s start with a quick look at the VIX before we jump into QQQ and SPX. After Monday’s VIX spike, markets have rallied ever since in choppy fashion. Today was the first time since Monday that we see the VIX closing above the Hull Moving Average on the 4-hour chart, also printing a doji candle. This is suggestive of a possible VIX move back over 16 at a minimum, consistent with the big GEX cluster we see at 16, but I will also note that the lower Keltner is closer to 15, so watch out for an “unexpected” attempt to move higher on a Friday following a strong rebound from Monday’s low (I know, futures are currently lower). Also keep in mind, next Wednesday is when monthly VIX options expire premarket, so we could still see a reversal early next week to assist in creating some pain for VIX put holders as we approach Wednesday.

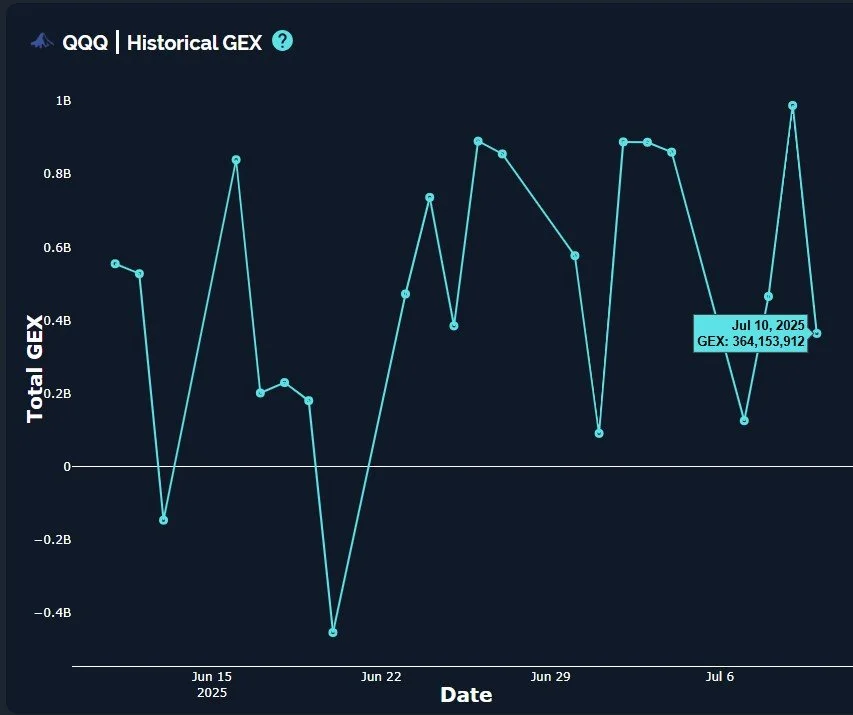

QQQ and SPX have been flip-flopping, with SPX making a lower high yesterday as QQQ made a higher high, then today SPX made an incremental higher high while QQQ floundered. In the meantime, these “records” are all technicalities within a few pennies as red paint becomes more visible under the hood (don’t look at the software sector today, or everything but the Magnificent Seven yesterday). Weakness is present under the surface. QQQ’s GEX structure shows diminishing GEX clusters beyond 560, and we are still below the daily Hull. A break below the weekly Hull at 553 carries potential to see a more meaningful drop of 3-5% or slightly more.

QQQ GEX also decreased today, chopping around in neutral territory despite the outlier positive spikes. While certainly not bearish, and QQQ does have a good shot at higher highs before the year is over (based on GEX), we shouldn’t be surprised by a little more downside after such a strong upside move right into overhead resistance. A tag of 560 should see a stronger reaction, in my opinion.

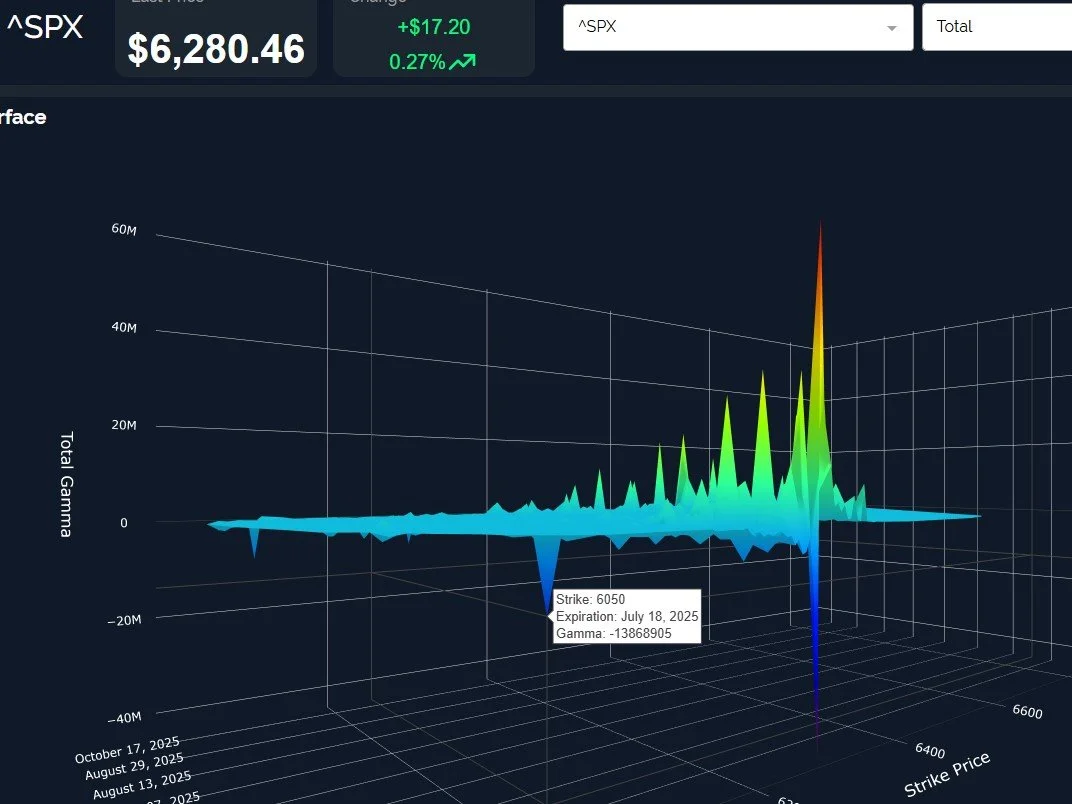

SPX is at the doorstep to the 6300 upper Dealer Cluster zone, following the upper Keltner channel higher while remaining below the Hull. It’s amazing that each week has been about 100 points for SPX. Trading is easy, right?

SPX still shows most of the GEX above 6300 to be focused on the Aug/Sept timeframe, and we are clearly in a positive GEX environment, but I want to point out a standout negative cluster we now see at 6050 for OpEx Friday, the 18th. I find the level interesting because it may end up representing the lower Keltner channel as the Keltners rise with the uptrend, and the lower channel would be a natural spot for a bounce, not that we’re guaranteed to always span the entire channel with the ups and downs of the market. But I ask you to look back on other corrections during steep uptrends. They are sometimes very sharp (the entire move in 1-3 days), then we resume the climb higher. The 2022 grinding downtrends for extended periods of time are far more difficult to trade, in my view. So let’s hope that whatever the next “real” pullback looks like, it concludes in fairly short order with a nice buying opportunity for the next leg higher.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.