Is The Ship Listing Far Enough To One Side?

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $200 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, only 1 day remains! Enter code JUNE2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

In today’s YouTube video, which you can watch by clicking here, we take a look at some important points about SPX as well as the VIX, which we don’t cover in the newsletter this evening. We also introduce a couple of new ideas like SE (originally discovered by some of our members), so check it out.

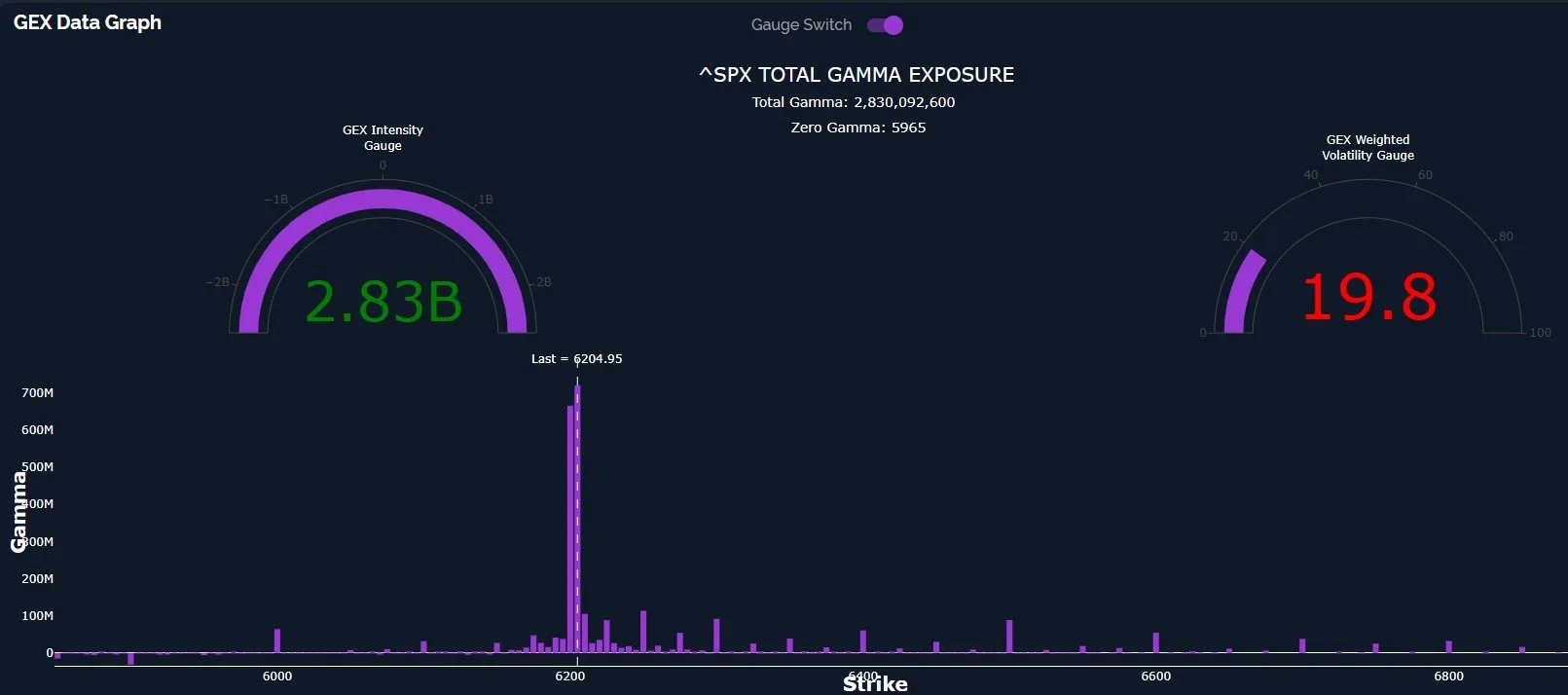

The melt up continued today, with the current pattern increasingly looking like a blow-off, particularly because this sort of move is occurring over 2 months from the market lows, with barely a modest pullback in between. Recognizing the likely lack of longevity doesn’t mean that the rally can’t continue long enough to cause massive pain for those exiting longs too early or becoming net short too early, but in general, we want to think critically about our long exposure at times of elevated risk for long positions. And make sure to have an oxygen mask at high altitudes. Notice the volume at 6000 today, also showing the largest GEX cluster below 6200.

SPX has climbed in a straight line to the revised upper Dealer Cluster zone at 6200 (previously 6100, which turned into support for the launch), also importantly exceeding the upper Keltner channel. Reaching this point with GEX at higher strikes not growing more at this moment likely means that indices need more time before tackling higher prices in any sort of sustainable fashion. Reaching the upper Keltner channel alone is usually a good reason to expect consolidation sideways or possibly a more meaningful move down. Given that the Keltners are pointing higher in bullish fashion, and backed by the GEX picture between now and October, we expect any drop to end up being a nice buying opportunity.

Do we need more reasons to expect a contrarian pullback? Let’s keep going. Our GEX Intensity Gauge, which measures current net GEX to readings from the prior 52 weeks, is finally at a positive extreme, an infrequent event for SPX and sometimes a great contrarian reversal indicator. The proverbial ship that is listing due to everyone being on one side of the boat. Enough people scrambling in the other direction can rightsize the imbalance, but it might be a volatile experience in the seas.

QQQ looks very similar to SPX: Over the upper Keltner channel, within the upper Dealer Cluster zone, and the sharply rising Hull will likely soon work its way over QQQ’s price, similar to mid-May. When price ends up below the Hull, I consider the shift a short signal, so we may need a little more time (1-2 days?) to see the momentum shift temporarily to the downside. 500 is the lower Dealer Cluster zone at the moment, but we may end up looking at anything from 510-520 as a buyable dip, depending on how the first down day materializes.

A difference relative to SPX and a negative divergence has been QQQ’s net GEX decreasing two days in a row. Net GEX is still positive, but we do see a reduction in positive GEX, even as price rises. SPX showed an increase, but that increase was largely due to the 6200 strike seeing massive GEX on a 0 DTE basis today, so that will go away tomorrow.

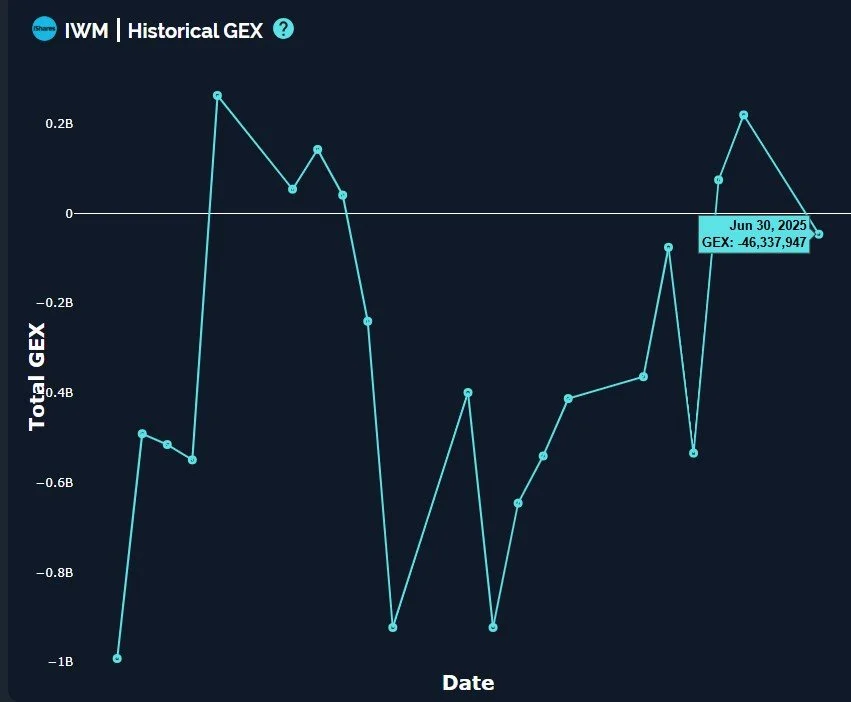

IWM is looking stronger lately, which may be a contrarian signal, but the upper Keltner channel matching with the large GEX at 220 really makes me think we need to see IWM reach 220 before we see a meaningful drop. If this proves to be true, the implication for SPX and QQQ may be an overshoot deeper into their own respective upper Dealer Cluster zones,

IWM actually saw GEX dive back into negative territory, sad times for the small caps. Sometimes shifts in GEX can precede price moves (hey, I guess that makes it useful), so we’ll see if IWM can diverge further with a 220 tag prior to a potentially sharp pullback toward 200-205. With the VIX close to 17, the lower Dealer Cluster zone and support for months, and indices at upper Keltner resistance within their own upper Dealer Cluster zones, now might not be the time to go “all-in” on long positions. We had a clear intraday signal early this morning suggesting 6200 would finally be reached, so we will continue adapting based on what GEX tells us each day. We hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.