Monthly VIX Expiration & FOMC

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $200 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, it won’t last long! Enter code JUNE2025 at checkout to lock in a great annualized cost for access to our highest-level subscription!

Today’s YouTube video gives a glance toward how we traded the GEX setup this morning (as presented in Discord at the time), as well as an in-depth yet short discussion on the indices and the VIX. You can view the short video by clicking here.

Tomorrow has the potential to be the most impactful and decisive day this week, with the monthly VIX options expiring at 9am ET and the FOMC announcement and press Q&A beginning at 2pm ET. We’re hesitant to draw any major conclusions of a trend change at the moment, but we can still look at signs that point to the most likely short-term move and what we’ll be watching next.

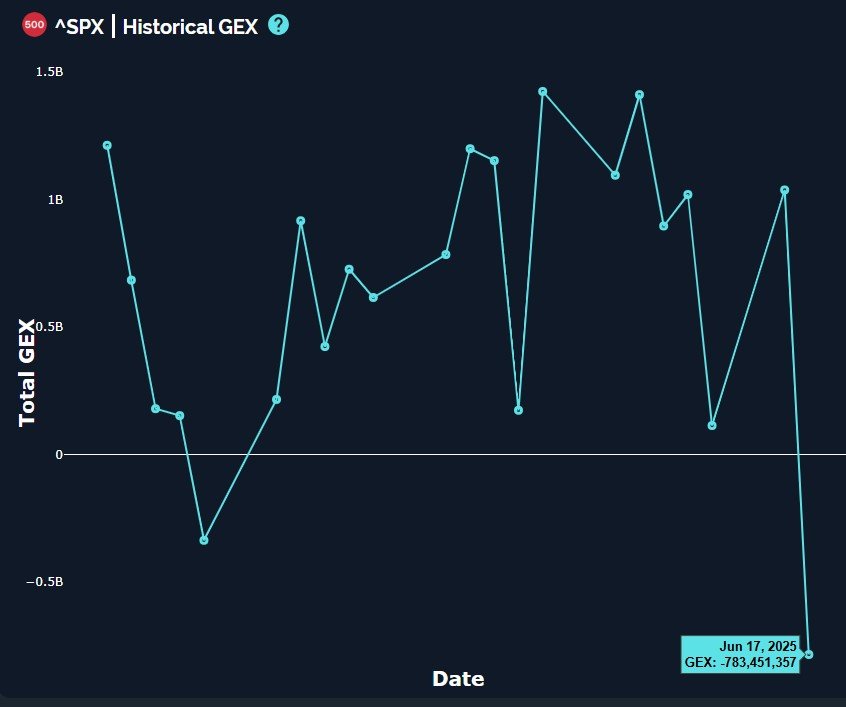

SPX is firmly below the Hull moving average, and net GEX took a sharp dive today, though we should note most of that GEX (roughly 592M) is centered around today’s 0 DTE closing price, and thus the negative GEX associated with that strike will be gone in the morning as today’s 0 DTE expiration rolls off, absent any new negative GEX added in the morning.

We continue to see the Keltner channels rising in bullish fashion, and the Hull is not signaling a strong downtrend, in fact it’s more sideways at the moment. I maintain my bias of selling rips below the yellow line (the Hull), but I also see the possibility of breaching the Hull to the upside to tag the 6100 level that appeared to be more likely last week. I will flip my bias if the situation changes, in other words. If we continue lower, we have 5900 as the lower edge of the Dealer Cluster zone, and eventually I could see 5800 again, which will soon match with the lower Keltner if the line continues rising with some additional time. For now, 5900 looks like a buy and anywhere from 6000-6041 looks like a sell to me, with a bias flip to the upside with a daily close over 6041.

Somewhat similar story with QQQ, though QQQ didn’t see a huge outsized 0 DTE negative GEX pile on, so we’re left with a GEX bias still leaning to the upside, with 540 as the upside target. Total net GEX is also still positive, though within neutral territory.

While I believe tomorrow will see at least part of the day spent in negative territory, I find the 3D graph interesting in that we see the largest GEX clusters for Friday representing 535 and 540, 1-2% higher from here. If these clusters remain, we need to be on the lookout for tomorrow’s dip to possibly be the low for the week, with a sharp rebound Friday (Thursday is the relatively new Juneteenth Holiday, so markets are closed).

The VIX shows positive GEX heading into tomorrow morning’s expiration, with a bullish rising Hull and price holding above the Hull, making both higher lows and higher highs today. We talked a lot about 16-17 likely being the floor, and now we’re looking higher, with 24-25 a possible target tomorrow. Upside for the VIX is notoriously difficult to predict, given that the most extreme spikes accompany very disorderly liquidation and short covering by volatility shorts, so take upside targets with a grain of salt. I tend to look toward indices for a greater sense of valid levels when the VIX is spiking.

Even if this drop ends up being a total of 5-7%, with all of the positive GEX at higher strikes, we still believe the odds of higher prices look good into the 2nd half of the year, so we’ll be closing hedges and adding to longs when the time seems appropriate. We hope you’ll join us in Discord tomorrow where we’ll share what GEX is telling us on a big day for everyone. Thanks for reading and thanks to those of you who participate in our group!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.