Intraday Shake ‘N Bake: Next Up- Headfake?

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $200 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, it won’t last long! Enter code JUNE2025 at checkout to lock in a great annualized cost for access to our highest-level subscription!

Today saw some welcome volatility both up and down, with an 85 point range during the cash session for SPX. We discuss some aspects of what we’re watching that aren’t covered in the newsletter, so be sure to check it out (you can view by clicking here).

SPX touched 5943 intraday, hitting the 5950 GEX cluster that we were watching Friday as well. Just when it seemed that more downside was inevitable, a big intraday reversal occurred, seeing SPX rally right into Hull Moving Average resistance. The close merely 7 points above the Hull technically counts as a bullish change, but we are too close to the line to take any degree of comfort, and QQQ closed below the Hull, as we’ll discuss shortly. The upper Dealer Cluster now stretches from 6025 up to 6100, and the upper Keltner channel is at 6125. Since 6100 is merely 1.5% away, we could definitely reach that mark in a single day with follow through above the Hull.

While SPX and QQQ have their own conflicting data points, SPX has internal conflict as well, seeing a sizable drop in positive GEX today after reaching 1B Friday. The drop to 697 million net positive GEX is still significant, but technically neutral from our view. The 3D graph still shows 5905 expiring 6/30 as the largest single GEX cluster other than today’s 0 DTE GEX at 6025, so keep that in mind. If we do end up tagging 6100 first, a drop of 200 points is actually a fairly modest pullback, so just be ready for anything if we don’t immediately fail and hold below the Hull tomorrow.

While SPX closed above the Hull but showed a decline in positive GEX, QQQ was exactly the opposite, closing below the Hull but seeing a sharp rise in positive GEX. Given that QQQ saw GEX swing wildly Friday into negative territory, while SPX moved positively Friday (and was proven correct today), maybe QQQ’s move today was more of a correction to the negativity Friday than a vote of confidence that tomorrow sees the market up a lot. We’ll find out soon enough..Futures are up quite a bit at the moment, so we have a good shot at higher prices at least initially, barring any early morning reversals.

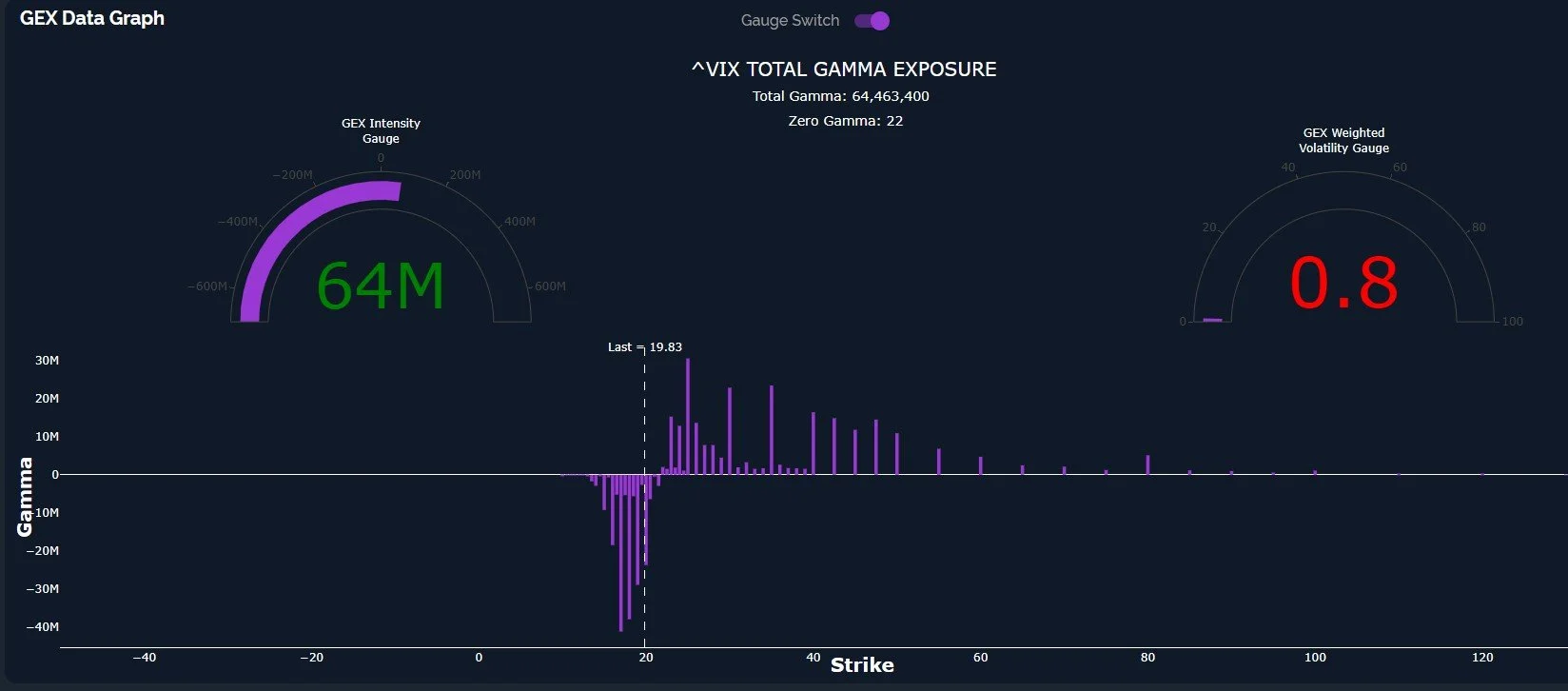

The VIX tagged the zero gamma line (again), rejecting and closing just below the Hull, with the highest option volume also occurring at 17.5. The VIX needs to see a reversal immediately back above 20 if the bears want to stay out of hibernation for now. Regardless of the near-term direction, there is very little GEX below 17, so 19.83 is not far away from what might be a volatility floor (maybe 6100=VIX 17? we’ve been saying that for what seems like an eternity).

An interesting shift since last week is the VIX showing net positive GEX, with the large negative clusters appearing to be more of a support area between 17 and the current level and the positive GEX stemming from participants positioned from 25 up to 50 with positive GEX. We don’t know exactly what will happen tomorrow, but we have some parameters to watch and some possible actions in mind depending on what comes first. We’ll post our observations in Discord and we’ll also discuss them in the morning live stream, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.