Indicators Expected The Unexpected

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $200 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, it won’t last long! Enter code JUNE2025 at checkout to lock in a great annualized cost for access to our highest-level subscription!

You can view our latest YouTube video by clicking here. We discuss some of the latest developments in the indices (before the Iran strike) as well as GLD, the VIX and more, so check it out!

With news that Israel initiated strikes against Iran, something we certainly did not see coming (at least within any sort of predictable timeframe), let’s review this weeks newsletter headlines just to make a point (I’m not going to get preachy, I promise!):

Sunday (following Friday’s market close at 5939): DON’T DISCOUNT THE BULLS YET

Monday- POTENTIAL CATALYSTS FOR VOLATILITY AHEAD

Tuesday-PUSHING ON A STRING INTO CPI

Wednesday- VIX TRIGGERS A LONG VOLATILITY SIGNAL?

It wouldn’t take a rocket scientist to add 2+2 together to conclude that perhaps within the boundaries of these short newsletters and beneath those headlines there were some points of concern explained regarding where the market and the VIX were leading up to tonight’s drop in futures. We certainly highlighted reasons to expect at least some indices to attempt higher prices, and (especially after our more bullish headline Sunday) we did eventually climb to almost 6060 SPX, quite a bit higher than Friday’s close. GEX still looks supportive of attempts back toward 6100 and beyond. But the warning signs were enough to cause us to take profits in recent days and review our hedges, plus we initiated a long LMT trade on the one-day selloff to 443 based on GEX we saw at 500. We’ll likely be closing that position in the morning. We also sold puts on GLD as an income strategy. We’re not trying to predict the future with exactness, but we want to highlight that considering probabilities based on existing data often leads to positioning that benefits the portfolio when unexpected headlines emerge, and we’re sharing a lot of what we’re seeing in the newsletter and in YouTube and Discord.

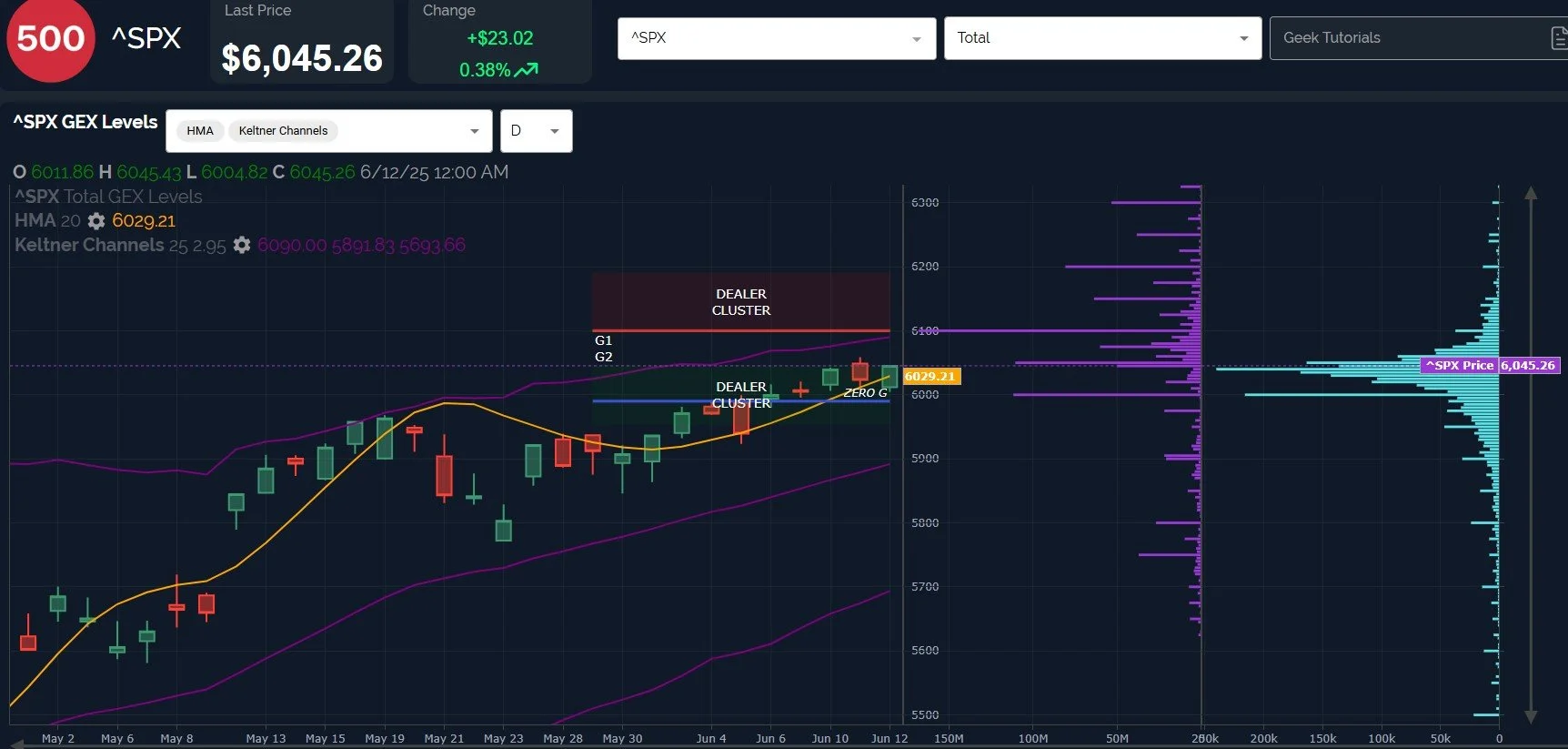

SPX definitely muddied the waters with the gap down below the Hull today (bearish) but a solid close above the Hull (bullish). We’re certain to see shifts in GEX positioning tomorrow, but as of now, the largest GEX cluster is at 6100 and the upper Keltner channel is barely 10 points away. Even a turn lower for the Keltners tomorrow or Monday will still leave higher prices as a possibility, so we’ll want to see what happens to the GEX at 6100-6300.

We highlighted 5905 and 5975 in Sunday’s newsletter as GEX clusters to watch on this spooky Friday the 13th specifically, and they just might come into play tomorrow, which might be a buying opportunity as we enter OpEx week next week (we’ll consider new GEX data in the morning as we evaluate purchases).

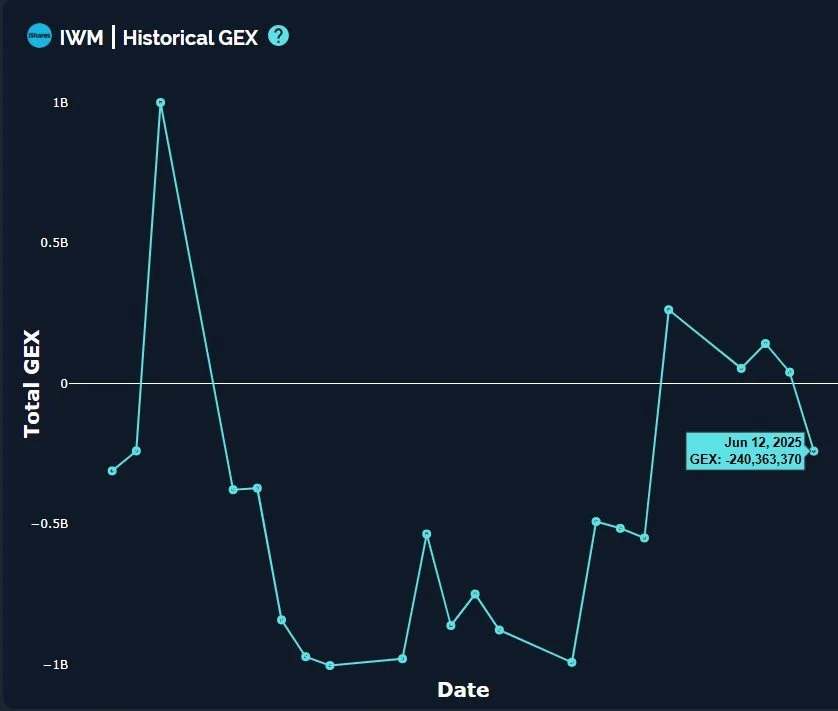

IWM turned bearish Wednesday, reaching the upper Keltner premarket and rejecting hard from the upper Dealer Cluster zone. Today’s gap down potentially sealed the deal, since IWM wasn’t able to close above the Hull like QQQ and SPX. A daily close below the Hull is a short signal for me, as a reminder. We’ve highlighted persistent and recurring daily volume in IWM at 200-205 in recent days and we just might see 200 tagged with the ongoing drop (futures show 207 currently).

IWM has seen a drop in net GEX 3 of the last 4 days, another warning sign, currently well into negative GEX territory.

The VIX generated a solid long signal with its close above the Hull yesterday, which we’ve pointed out a few times, and we saw follow through today and another close above the Hull. A point I make in the YouTube video is that the distance above the Hull (the yellow line) is considerable enough to not be surprised by a dip in volatility back towards the line, but tomorrow will likely change the trajectory of the line, though the VIX will likely still be far away from the line regardless of any shifts in direction for the Hull itself. This lends credit to the possibility that the VIX may still see a drop (from a higher level) to retest that line in coming days. The shift that has already happened as of yesterday is that prior resistance is support, so market bulls have to force these lines to be broken again on the VIX.

While the 2-hour Hull has been on a sell, the 4-hour chart remained on a buy for the VIX all day long, never breaching the Hull to the downside. This creates room for the VIX to reach 20 and possibly even 23-24 before dropping.

The bottom line is that we have a short-term shift to the downside that was suggested as a growing probability days in advance, in conflict with an increasingly positive GEX picture overall for the indices. This leads to a reasonable conclusion that the dip resulting from the news headline is likely a buying oppportunity, and I doubt this dip lasts for very long. As always, we’ll consider new data as changes emerge and we’ll do our best to share our views with you as well, particularly in Discord for more timely posts.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.