The Rebound Is Here: How Far Can We Go?

Friday’s glaring signal from the Hull Moving Average and the 2-day collapse in the VIX and VVIX saw follow-through today, with indices sticking it to the bears yet again. Today we’ll look at a couple of interesting changes with the VIX as we approach Wednesday’s VIX expiration as well as a brief look at QQQ and SPX.

3rd Friday’s A Charm?

SPY hasn’t closed this far above the Hull moving average since January 22, which I view as a bullish sign. In fact, since February 19, SPY has closed at or below the Hull every single day. Despite the risk that Friday was a “threepeat” of the last two Fridays, we have a number of signs that this move was more bullish. Will it prove to be another short-term top, or the beginning of a larger rebound?

No Bounces Allowed

Yet another seemingly positive inflation number today with PPI coming in lower than expected, yet the stock market didn’t seem to care. Yet volatility markets did care, with the VIX remaining below the Hull and VVIX dropping for the 2nd day in a row. Can bulls muster the strength to incinerate some put premium next week? A lot of premium is counting on more downside at the moment.

VIX & VVIX: Forward Indicator Or Fakeout?

CPI arrived with lower than expected results, a positive for markets. Despite the lower inflation read, indices still struggled, vacillating back and forth from negative to positive as the day progressed. The VIX and VVIX deflating were perhaps the biggest attention getters today, though the indices did not bounce as one might expect given the drop in volatility. Is the VIX leading the way, or is it ready for another spike?

She’s Gonna Blow, Cap’n!

We started out with weakness yet again in indices, with the VIX and VVIX also climbing higher. But then a glimmer of hope emerged for bulls, and more than once we pushed higher into positive territory for the day before fading right before the close. With CPI tomorrow pre-market and PPI Thursday, we may be on the cusp of a pivotal moment of either an “emotional” spike low or a rebound into Friday before dropping into OpEx Friday. Change is in the air and we will be ready to react.

This Dip Will Never Stop Dipping

We repeated a similar pattern to last week: Positive Friday, market bloodbath Monday. With certain economic catalysts ahead, including CPI Wednesday and PPI Thursday, this week may be pivotal and possibly even more volatile. Let’s see how the tea leaves read.

This Time Is Different!

Friday was an emotional roller coaster from one perspective, initially appearing to repeat the now “stale” pattern of giving bulls hope of a rebound but then failing, but this Friday was different: The rally stuck, and we closed right around the Hull Moving Average, a potentially important line-in-the-sand. Will this prove to be ephemeral like last Friday, or are we on the brink of the real deal?

Will The Intraday Reversals Ever End?

Signals over the last few days have been challenging, with yesterday’s seemingly bullish close failing to follow through today. While a larger rebound hasn’t begun, we are seeing positive divergences yet again, and the new lows were only incrementally lower and not for every index. Let’s look at new reasons why we’re imminently looking for a larger bounce, even if we see additional downside tomorrow.

Signs Of Relief

Several ingredients fell into place today to raise the odds that a rebound has begun, though (as usual) the picture is not entirely clear. Let’s look at why (though it’s still early) we are starting to shift our short-term bias toward the long side, with an eye toward remaining risks in the background.

Another Failed Rebound

The spilloff continued today, surpringly reaching our SPX 5800 target fairly quickly, dumping almost to 5732 before staging an impressive rebound late in the afternoon, then fading again. This volatility is a great example of negative GEX at work. IWM may have some important clues regarding a larger turn that may ne close.

Are Bulls Panicking Yet?

An old saying says markets don’t bottom on Fridays, and today at least anecdotally fit the saying, collapsing into the end of the day after failing to gain ground early on. Markets maintain negative GEX, but we are approaching lower targets that might represent a better opportunity to enter longs.

DIAmond In The Rough

Friday indeed gave us a lower low and then a nice reactive bounce for QQQ back over the 500 level, as other indices bounced too. We may be entering a zone of tricky back-and-forth battling before the next direction is chosen. Positive divergences remain and may imply an overall more volatile market in both directions than we’ve become accustomed to in recent years.

Negative GEX: Double-Edged Sword

Early today, DIA was giving bulls hope, showing a positive day in the midst of a negative SPX and QQQ. The rally didn’t last, though, and the failure brought about another wave of selling, this time reaching the lower Keltner channels. Let’s take a look at the prospects for a bounce and where it might occur.

Mixed Signals

We were left with a mixed bag today, with indecisive price action that leaned negative as the day progressed, yet certain positive divergences also exist. Let’s look at our best clues as to what comes next.

Early Signs Of A Pulse?

While it’s still too early to celebrate, DIA was the odd one out, positive for the day and bouncing right where we would like to see it bounce. Is DIA an early signal that indices are about to see a nice rebound, or was today a one-off anomaly?

Getting Closer….

With Friday’s option expiration behind us, we still saw markets fall further today, though under the surface, we see GEX held steady, and in fact, improved in many cases. The VIX is not decisively telling us the drop is over, but we finally saw VIX 20 hit, a target we’ve been watching. What’s next?

Post-VIX Expiration Pullback: Warning Or Opportunity?

The market was tricky Friday, with a difficult GEX reading intraday (outside of the clear negative bias) despite the big picture giving reasons for concern earlier in the week. We may be near an area where a bounce could occur, so let’s look at the reasons why.

February OpEx: What Does GEX Say?

DIA turned a potential downward reversal into a sideways consolidation, appearing primed for a move higher as we head into OpEx Friday. The VIX has been stubbornly above 15, but we still may yet see an attempt toward 14 before the week is over.

Barrelling Toward The Destination

DIA turned a potential downward reversal into a sideways consolidation, appearing primed for a move higher as we head into OpEx Friday. The VIX has been stubbornly above 15, but we still may yet see an attempt toward 14 before the week is over.

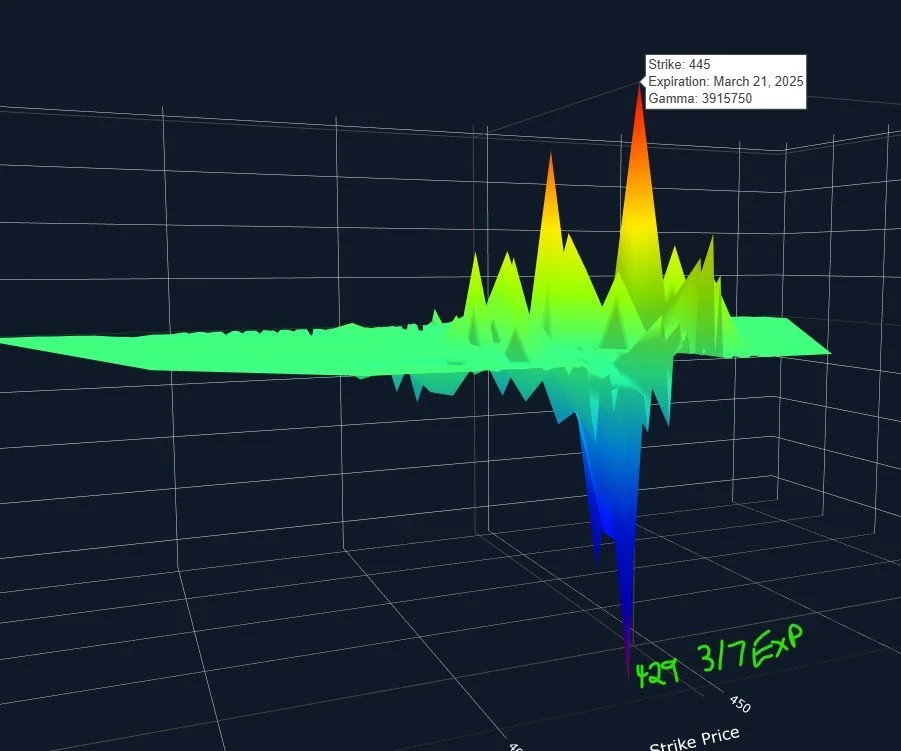

Looking Beyond VIX Expiration

Today we look at what GEX is telling us across the board as we enter VIX expiration premarket tomorrow.