Approaching A Possible “Breather?”

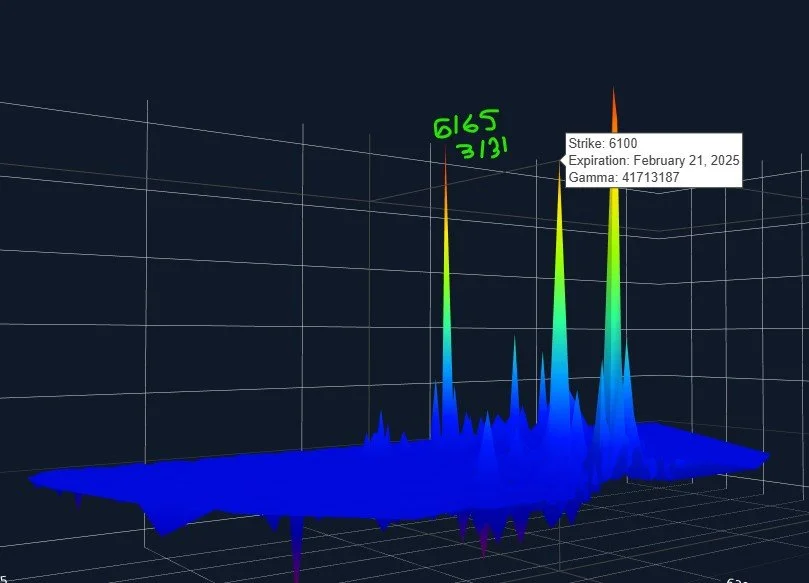

Thursday we mentioned potentially stretching into Friday or Monday to set a possible short-term top, despite overall bullishness appearing to be reasonably expected into March, based on GEX. Monday still looks like a reasonable chance for a short-term reversal, with the VIX quickly approaching the 14-14.3 possible reversal area, SPY total net GEX approaching an extreme, and QQQ not showing meaningful growth in higher GEX targets beyond the next 1.5%-2%. Let’s look more closely as we enter the 2nd half of February.

Love Is In The Air

Today’s action was almost singularly bullish as indices finally broke out of the recent range to the upside. If we see a repeat of the pattern of mid-month pivots, we may be making a short-term top between tomorrow and Monday, even though our sights are still set on higher prices into late March. An intervening pullback would be welcome for wannabe bulls who feel forgotten on the sidelines.

Mid-Month High Or Low?

The chop continues, with false breaks to the downside bought up and breakout attempts rejected. It’s a bloodbath for option premium betting on a directional move. How long can it last? We don’t know, but tonight we’ll look at some cyclical tendencies we’ve seen in recent months that might show the importance of an upcoming mid-month pivot.

Higher Into March..What Happens In Between?

GEX looks bullish into March- what happens between now and then? Smooth sailing? Unlikely, but what happens during the next pullback will be key.

Market On A Mission

SPX regained the Hull moving average again, and GEX looks poised to help SPX get across the finish line soon. Let’s take a close look as well as evaluating MSFT as a potential stock of interest as it pertains to QQQ.

Surviving The Chop Zone

We continue to bounce back and forth in a difficult area without significant short-term clarity. Friday’s drop took us back below the Hull Moving Average, and GEX remains neutral. Let’s see if any signals at all can tilt the odds in our favor, or if not, we may need to patiently wait for more information from Mr. Market.

Early Warning From DIA?

The bullish moves continued today for SPX, and early weakness in QQQ was reversed, bringing both indices closer to their respective targets. AMZN earnings are out after hours, with the initial move being down. Will tomorrow’s employment report join forces with AMZN to deliver a red Friday, or will it offset the selling and allow us to continue pushing higher? Let’s see what gamma has to say about it.

Pushing Higher

The dip today was rather shallow and entirely made up by the opening gap down. Indices proceeded to climb steadily all day, with QQQ painting the clearest positive picture based on chart indicators. With big tech earnings looming Thursday with the likes of AMZN reporting, tech certainly has a catalyst to potentially fulfill what we see with gamma.

Is The Pullback Over?

Gamma (GEX) continues to show positive shifts, both in terms of total GEX and the potential for higher strikes. Given that we’ve had 2 days of rallying, we may see some retracement mid-week, but the current picture points to greater odds of eventual higher prices into Friday, with more concern looking beyond Friday.

Back To Earnings

SPX’s 4-hour Keltner bottom stopped the decline overnight, and we saw a nice rally in the cash session, albeit from a big gap down. It’s clear that volatility is back, but does that mean we’ll keep declining? Let’s look at how SPX closed today and identify what we’re watching for tomorrow.

Starting February In The Red

Thursday we laid out a possible pathway that included an attempt beyond 6100 on SPX, and a possible retracement beginning the same day. This worked out extremely well, and the pullback is continuing in the futures market with a big gap down of over 100 points in SPX. Tonight we’ll look at some levels to watch as we enter the first trading week of February.

Month End Preview

While overall gamma (GEX) remains neutral, we see growing interest at higher strikes, implying higher odds that we eventually reach those targets. We still have the Hull moving average to contend with short term, and a VIX that triggered a bullish volatility signal on the 2-hour chart. Pullback and then rip? The first month of 2025 ends tomorrow, so it may be an interesting day.

A Bullish Shift For SPX?

Today was relatively tame by FOMC standards, with markets slightly weaker most of the day. We see a bullish overall shift in SPX, but we also see undeniably large volume at two VIX strikes (30 and 60) that may cause bulls to at least consider an effective hedge. How do the two divergences make sense?

Resistance Into FOMC

We saw a nice rebound today and (in some cases) yesterday, but we are at or approaching resistance heading into FOMC tomorrow and big tech earnings immediately after. Will more pain be delivered to late bears or are we ready for another leg lower?

“Markets In Turmoil?”

Despite the gap down, the cash session longs won the day with one of the larger one-day gains in 2025 so far. Who would have guessed? We may not be out of the woods yet, but with the FOMC announcement and press conference Wednesday and big tech earnings largely starting that same evening, we may see a few surprises for everyone this week.

Futures Dip (As Anticipated)

We’ve recently highlighted potentially bullish developments in markets as we see gamma growing at higher strikes, though we also said we expect a short-term pullback given the extended nature of indices. Looks like the dip is upon us. What levels are we looking for to validate/invalidate a potential opportunity?

Preparing For A Dip Buy

“Straight to target” continues as all indices closed higher, despite pockets of weakness earlier. Similar to prior tops in recent history, QQQ is the late bloomer, outperforming over the last 2 days. QQQ has enough large components that are near lows to justify another day or so of upside. Let’s take a look at how we might end the week and what lies ahead.

Heading Straight To Target

VIX expiration is now behind us, with the 15 strike serving as the target at the time of the 8am ET completion. This opened up the pathway to new hedging, and thus a rising VIX even as QQQ and SPX barreled higher. IWM was less optimistic, so we’re starting to see more divergences that potentially justify at least a pullback in the near term.

Key Resistance Breached

indices gapped up over key Hull moving average resistance today, managing to hold most gains into the close while the VIX dropped to the key 15 area we’ve mentioned. Earnings are starting to heat up, with NFLX kicking off big tech, and we have VIX monthly option expiration in the morning. Let’s take a look at where we stand.

A Pivotal (shortened) Week

Gamma once again helped us to lean in the right direction last week for monthly option expirations, with SPX 6000 being an important draw into Friday’s close. Let’s look ahead at a shortened 4-day week which includes the important monthly VIX option expiration Wednesday and a pivotal area for broader indices as a new United States presidential regime signals potential major change for world markets.