Here’s The Bounce

The first trading day of October pretty much met our expectations, so now we watch gamma for clues as to the next move, Geopolitics are heating up and we have new inflation threats emerging.

Volatility Is Back(ish?)!

The first trading day of October pretty much met our expectations, so now we watch gamma for clues as to the next move, Geopolitics are heating up and we have new inflation threats emerging.

The Pin Is Over. Now What?

We are getting the VIX pullback we wanted to see, and we have a loaded week of inflation data and more. What's next?

Mission Accomplished! Almost…

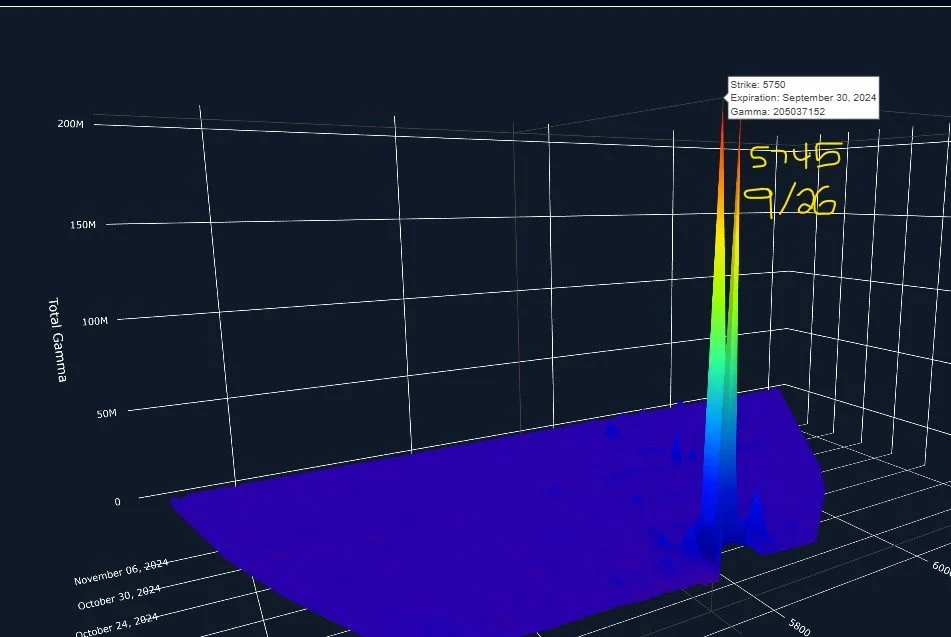

The GEX magnet at 5750 that we've noted for days finally hit with this morning's gap up before fading. Does this mean the bull move is over?

Running Out The Clock

It's starting to feel like participants are running out the clock into quarter-end. Today, we look at where we might see a little more volatility despite SPX seemingly being pinned to 5750 into 9/30.

One Stop Run To Go?

With election year seasonality looming, markets appear to be gearing up for what might be the final push higher in the short run.

VIX Below 16: Pushing On A String?

No relief for volatility as the VIX gets crushed to below 16 today. Does election year seasonality hold, or will this year be a rare inversion?

Approaching Quarter-End

We approach the end of the 3rd quarter this week into the following Monday. How will the market finish up (or down) for the quarter?

Bears On The Ropes, Jerome Pumping Hope

With monthly VIX expiration in the morning and the Fed's interest rate decision later, we are set for a potential shift in the volatility regime soon. Which direction is first?

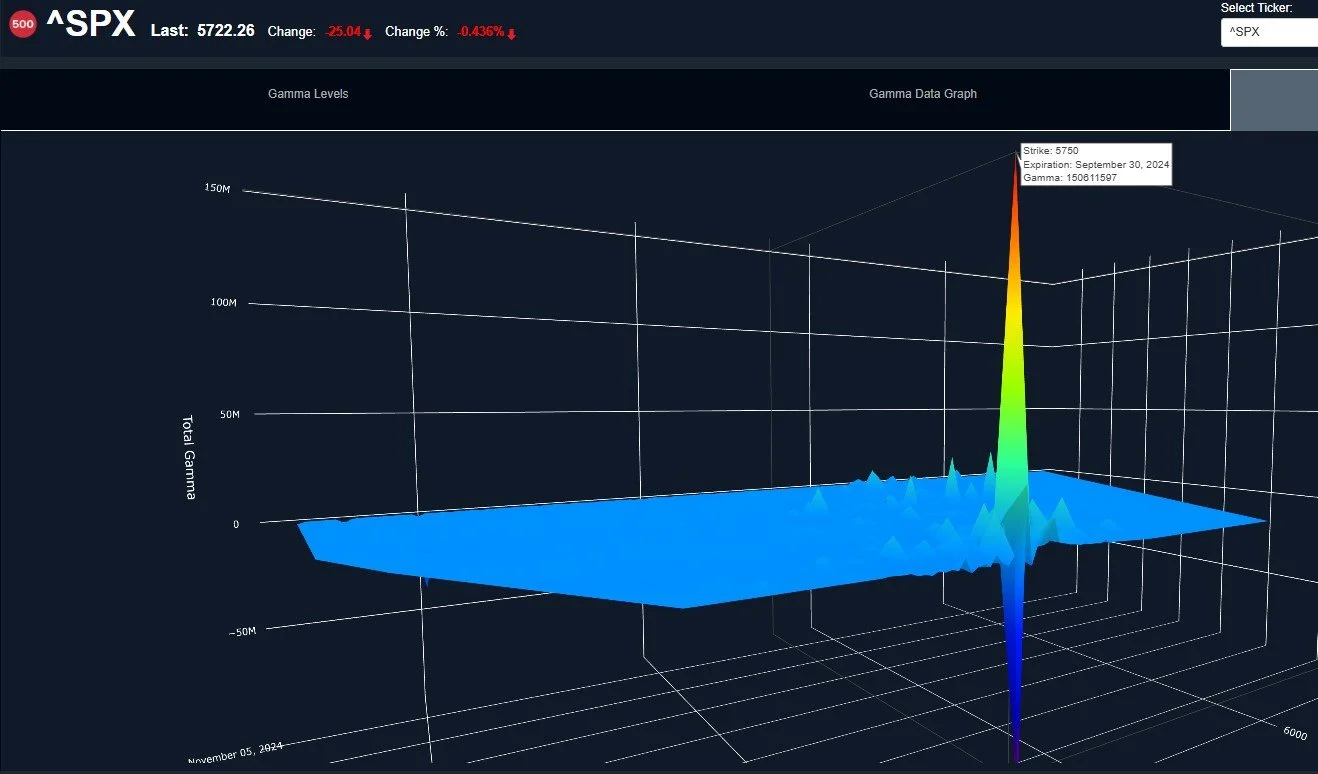

0 DTE GEX: Order Amidst Chaos

Despite the inherent uncertainty of Fed decision day, GEX gave a sense of order, accurately displaying the initial target in advance as well as the post-rally fade.

Time For Another Move In Volatility?

With monthly VIX expiration in the morning and the Fed's interest rate decision later, we are set for a potential shift in the volatility regime soon. Which direction is first?

Countdown To J-Powell

We took some nice gains in our Educational Portfolio today as we prepare for a binary outcome ahead, which we discuss today in addition to some ideas shared on our YouTube channel.

BIG Website Updates, Big Week For Markets!

We're excited to announce a beta rollout of a new website and additional features this evening, and we'll also delve into where we see markets heading into VIX expiration and the Fed this week. Big week ahead!

Friday The 13th & VIX Expiration Wednesday

GEX swings to positive again for SPX and QQQ, but with VIX expiration this coming Wednesday, is it smooth sailing the entire way?

Rally Vindicated-Now What?

Looks like we got it right on 9/11 as far as playing the odds. Where does today's rally leave us?

9/11: Consistently Bullish For 17 Years

9/11 is consistently bullish. Will tomorrow be the same as the last 17 years, or will CPI throw a monkey in the wrench (ignore that it's hard to throw a monkey in a wrench)?

Time For The Market to Choose?

The market is technically in a "danger zone," and gamma flipped negative Friday for SPX in meaningful fashion. Is this another bear trap or are the bulls actually in danger this time?

Ready Or Not, Here It Comes…

The yield curve just un-inverted, markets look like they’re in the process of a large double top formation, and the indices have all.…

Compression Continues: Break Up Or Down?

The guessing game continues as to the market's next big move: Are we setting up for a larger rebound to retest upper resistance or is the plunge just beginning?

Diamonds For Dummies?

We certainly had a Whipsaw Wednesday, but now it's time to look ahead as the market draws closer toward choosing a direction for a larger move.