OpEx Capitulation…Of Da Bears

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

Today’s YouTube video can be viewed by clicking here. We take a look at major indices including IWM, which we don’t discuss in the newsletter tonight, so check it out if you have a few minutes!

While we’ve had the conditions in place for a few days to justify a pullback, the OpEx premium kill machine has been turned on, with headlines able to report incremental new highs despite the zoomed-out view that we’re mostly sideways since 7/3, even appearing to be on the verge of breaking down yesterday. The day-to-day (and even intraday) red-green-red-green pattern since just before VIX expiration this week has certainly enriched option sellers on both sides by betting on a lack of follow through in either direction. Since it’s boring to discuss the possibility of another chopfest day tomorrow (though not a possibility to be ignored), and we still believe a pullback can happen imminently, let’s evaluate a potential upside move how that might resolve. No, we have no idea what happens the next few days, but hey, at least we can come up with a gameplan for either up/down/sideways, right?

We’ve been noting the growth in positive GEX at higher strikes for SPX, an undeniably bullish development. We’ve also highlighted the potential timing of such as move as being later than the present, given the expiration dates for the largest concentrations of GEX at those levels as well as certain technical indicators being so far off that anything short of a historic parabolic blow-off top likely requires more time.

SPX pushed right into the Hull Moving Average, closing fewer than 2 points above the Hull and right at the upper Keltner channel and upper Dealer Cluster zone. A push further into the box (and over the top of the Keltner) is possible in the short run. I refer back to the 7/3 top, which made it 62 points above the upper Keltner channel. Breakout, right? Well, it’s not common to stray too far from the upper Keltner, and sadly for the breakout crew, we saw price move sideways for a week, peek a little higher (also peaking a little higher), then consolidate sideways again, giving trend traders half a month of nothing.

Same story for QQQ below, and the GEX picture appears less convincing, though I do give SPX more predictive credit in general.565 is less than 1% away, sure, an overshoot of the top Keltner can certainly reach that point. We see the lower Keltner approaching 530 and it appears we can close a gap if we see a decline to 535, so that’s my physician prescribed “healthy pullback” target, if we ever see downside again in my lifetime (I always exaggerate when the short term feels like forever). bulls wanting higher prices will want some sort of pullback, because a true blow-off may introduce some bearish uncertainty, but we’ll save that paradox for another day.

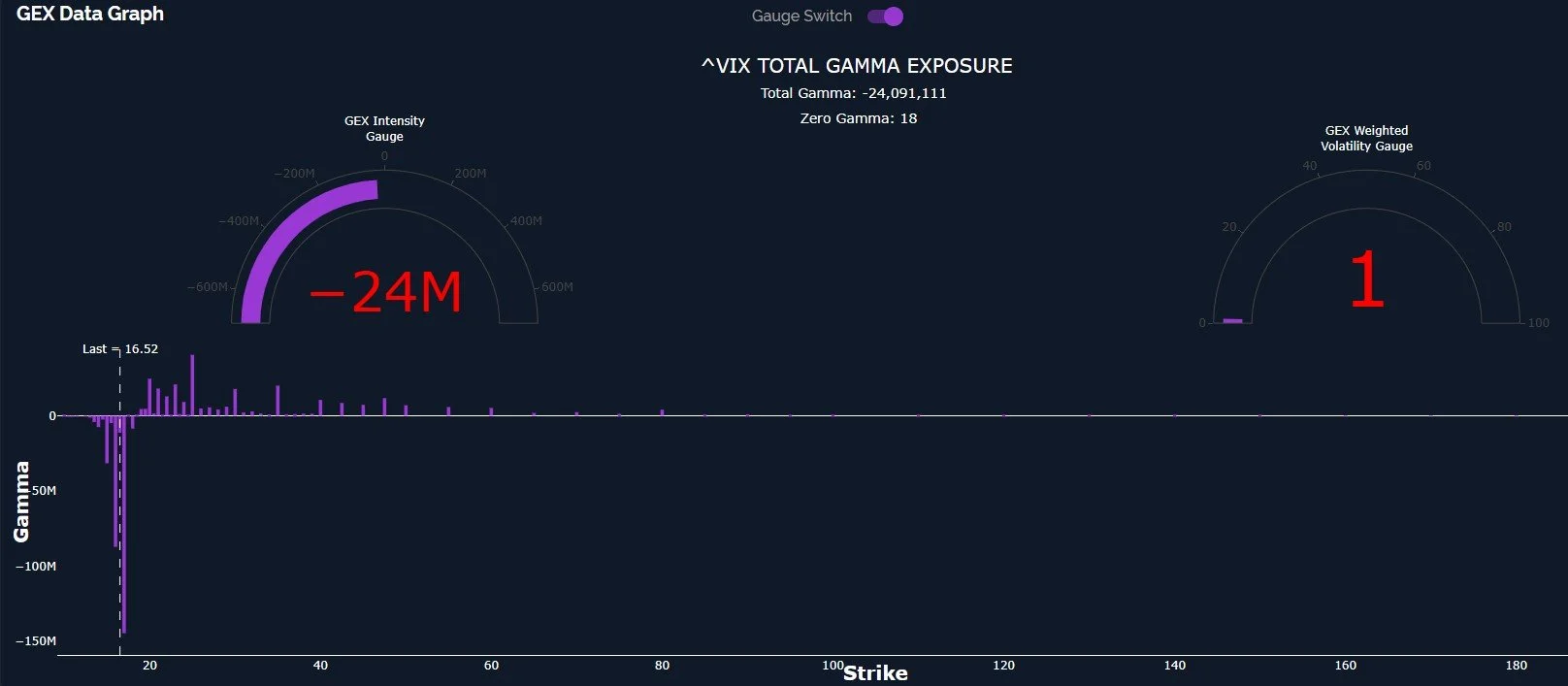

The VIX closed below the daily Hull, and even though we saw over 200M negative GEX expire Wednesday, bringing net GEX less negative, we still see the same focus on VIX 16-17. The Hull is still pointing higher, so as long as the VIX doesn’t stray to far south from the 16.50 area, we could see this trend of a choppy but eventually higher VIX continue as we enter next week.

A graphical view of the current VIX GEX situation: Extremely low implied volatility (a contrarian signal for volatility), an improved negative GEX picture that is almost back to flat since the monthly VIX options expired Wednesday, zero gamma at 18, and daily volume at higher strikes. Protection appears to be fairly cheap right now, which is usually when no one wants it..Maybe it’s time to start looking!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.