Awaiting A VIX Spike

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

Today’s YouTube video can be viewed by clicking here. OpEx week is often challenging for those looking for downside follow through, and today was right in line with that tendency. Following expiration of the monthly VIX options at 9am ET, we saw a sizable VIX spike up to almost 20 by mid-morning, the attributed reason being rumors of an effort to fire Powell. Nothing better to kill option premium in both directions than a well-placed rumor. Unsurprisingly, once the calls were killed, the headlines flipped to “No Powell Firing,” then killing the puts. In Discord, we shared the two big intraday negative GEX targets premarket, mentioning 6180 and 6240 as identified targets. We saw 6200 hit, so the bias was correct initially, and then had a killer lotto trade using IWM calls that saw multi-bag profits for some subscribers. Amazing what can happen when the data drives decisions instead of reaction to news..But I digress.

The VIX still maintains a setup to spike up toward 23 or more, even with the late day VIX crush that sent us back toward 17. Notice the Hull Moving Average is curling higher and the VIX is holding the Hull as support so far, also holding important moving averages I like to use as indicators. While the VIX can rise while the market rises, my bias is long volatility and short indices as long as we remain above the Hull for the VIX and below the Hull for the indices, to oversimplify. Let’s get into a bit more detail with the indices, though.

QQQ saw a sharp rebound from intraday lows, still falling short of the now flattened Hull, a line I consider to be important resistance as long as price is below the Hull. The Keltners are rising sharply, a bullish pattern. In light of the momentum that helped indices to reach these levels, and the impact on the indicators I use, I think the best case for bears (though I do think the odds are favorable) is a quick drop to the lower Keltner channel near 530, then resuming the climb toward 570+. This is speculative at this stage, so we will withhold further judgment until we see additional indicators reflecting the likelihood of a conclusion to a so far elusive “correction,” but note the positive GEX diminishes at each successive higher strike and we are still near the upper Keltner channel and below the Hull. Diminishing concentration of net GEX at 5-point increments is not what bulls want to see in order to pinpoint a solid higher target, though we can note that the big picture clearly shows a greater interest in higher strikes as we see the lack of GEX at lower strikes.

On a net basis, QQQ GEX has gone nowhere in a week, which leans bearish in my view. Today saw a negative shift in GEX despite the attempt to bid QQQ back to yesterday’s close.

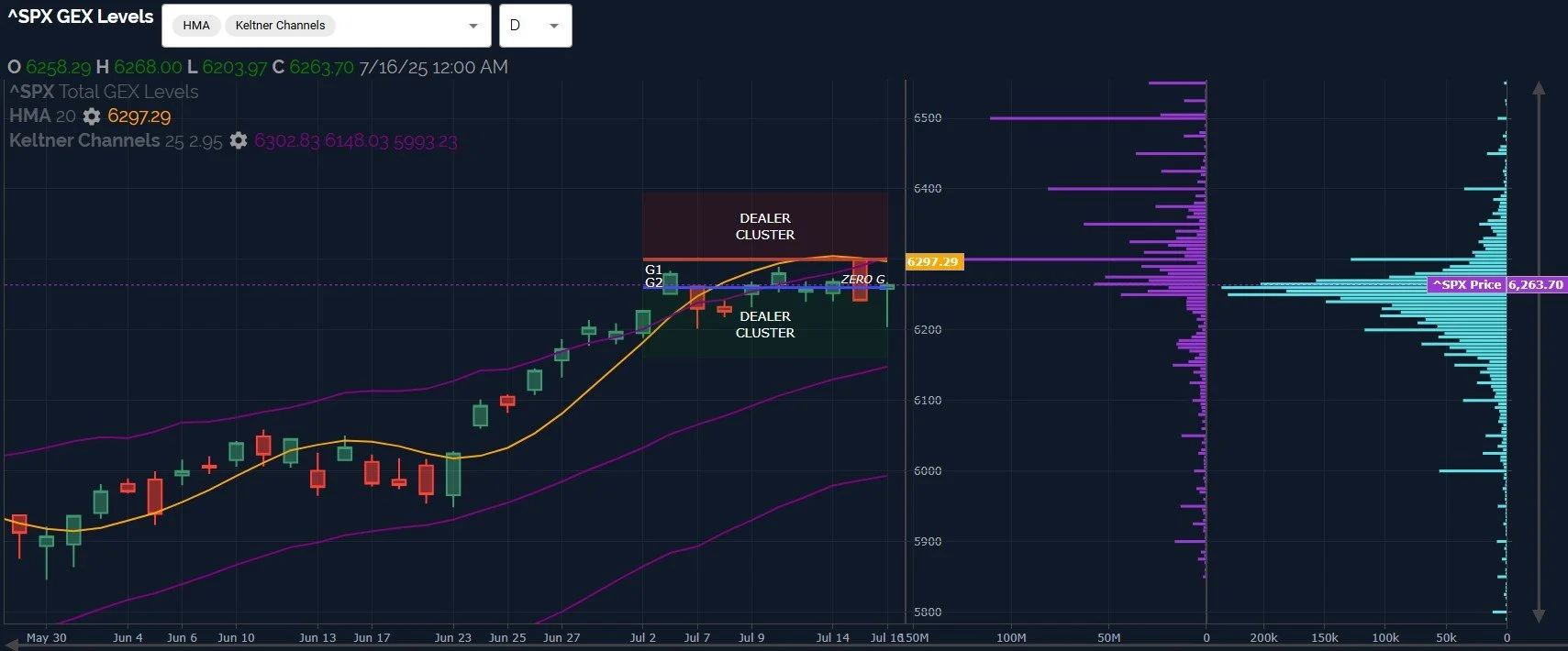

SPX looks very similar to QQQ, getting close to 6200 intraday before mounting an impressive rebound to almost the halfway point of yesterday’s decline. The daily Keltners are too far away from the big GEX at 6500 to expect that level to be touched in the near term, in my view, but it looms large as a high probability target if we look far enough out. I don’t think we need to look very far, given the concentration of 6500 GEX at dates 30-60 days from now.

IWM has seen the most action this week, retesting the middle Keltner channel and making up about half of yesterday’s decline. The descending Hull will provide a lower trending resistance point for IWM’s price, giving us a good guide that may apply to other indices in terms of when we might shift our bias to immediately higher targets. IWM’s Keltners are close to the big 230 GEX cluster, bringing it within reach over the next few days. This is interesting in that a daily close over the 224 area may bring 230 into focus sooner than the mid-August to September timeframe I was originally suspecting. I’ll let the Hull be the guide on this point, and as long as rallies this week stop around 224 for the daily close, I’ll be looking to buy 210-212 instead.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.