Gaining Steam

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

Before we start, I’ll share our YouTube video link from today, which you can view by clicking here. We take a slightly different look at the indices tactically as well as a few individual tickers including TSLA and AMZN, so give it a look!

We have CPI out of the way, and now we look toward PPI tomorrow premarket, another potential catalyst for market volatility. We’ll also be approaching monthly VIX expiration 30 minutes following the PPI release, so we may see some interesting action even before the cash session begins. Today’s reversal was pretty brutal, particularly for IWM, which declined almost 2%, closing just shy of the daily middle Keltner channel. We also saw the VIX reverse from red to green after once again approaching the 16-area, and (as shown on the chart below) we see the Hull Moving Average starting to curl upward (the yellow line) as the VIX also closes above key support at the 9 SMA and the 15 EMA. All ingredients appear to be in place for a VIX spike as soon as tomorrow. A quick look back at every recent time visible on the chart where we saw the Hull curl upward for the VIX reveals a VIX spike (maybe this time is different?).

In yesterday’s newsletter, we said “…the powerful trend higher has created some room between the Hull and the current price while the Keltner channels continue to climb, so SPX (as the first example) shows room up to the GEX cluster at 6300 just to retest the Hull from below. This move would place SPX above the upper Keltner channel, which would continue to validate my expectation of a larger pullback..” and we tagged that Hull today, rejecting with gusto and closing at lows of the day, also below the weekly Hull at 6245.72, which I view as the true “danger zone” for a continued pullback lower.

GEX dropped too, though not dramatically so in the case of SPX, possibly tied to the fact that this is OpEx week. We have some danger ahead of choppy waters up and down before accelerating further into a pullback, but the initial signs are encouraging (or discouraging, depending on whether or not you’re opportunistically looking for a pullback versus clinging to gains from the past without a desire to sell).

Another factor to point out is the curling down of the Hull, which didn’t happen until today. In theory, this gives us a constantly declining boundary of resistance if price attempts to push higher, and you can see how well the Hull has held as resistance or support until the key moments where a trend change occurs, for the most part. The implication is that we may still push up this week, but indices will meet resistance sooner at lower prices, with the bias lower, for the time being. GEX has grown across the board at higher prices, which is bullish, and that’s why any immediate pullback will be treated as a solid buying opportunity by us Geeks, so we want to have an idea in mind of where we want to buy.

As shown on the chart above, IWM is already almost to the middle Keltner channel, a quick escalation of its pullback and a possible warning sign for the comatose QQQ and SPX. Days ago we mentioned 210-212 as a target for IWM, and I still think GEX backs that idea as an initial spot to watch, particularly in light of the confluence with the lower Keltner channel.

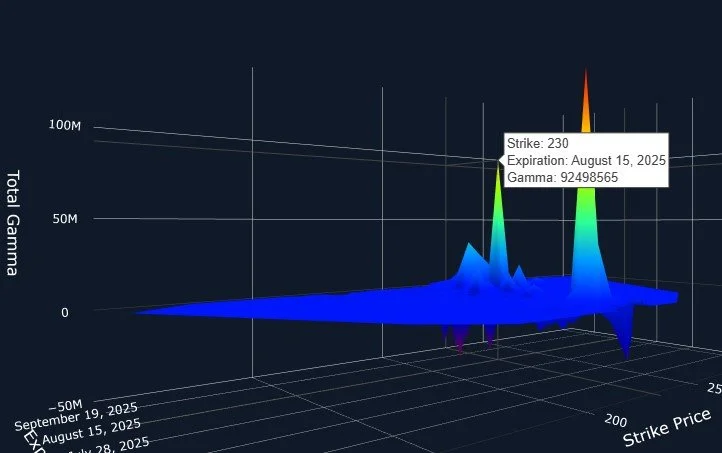

To expand upon the point of the importance of timeframe in assessing the bullish GEX picture, IWM’s GEX at 230 is primarily concentrated at the August expiry, a full month away. Four weeks is plenty of time for an opportunistic selloff and a rebound, so we’ll stay on our toes with our sell finger (the pinky) on our hedges and our buy finger (the index finger) on the available cash once GEX+charts back our next actions.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.