CPI And VIX Expiration: What Could Go Wrong? And For Whom?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a YouTube video today (as we do most days), which you can watch by clicking here. We take a slightly different look at the indices tactically as well as a few individual tickers including AAPL an HAL, amongst others.

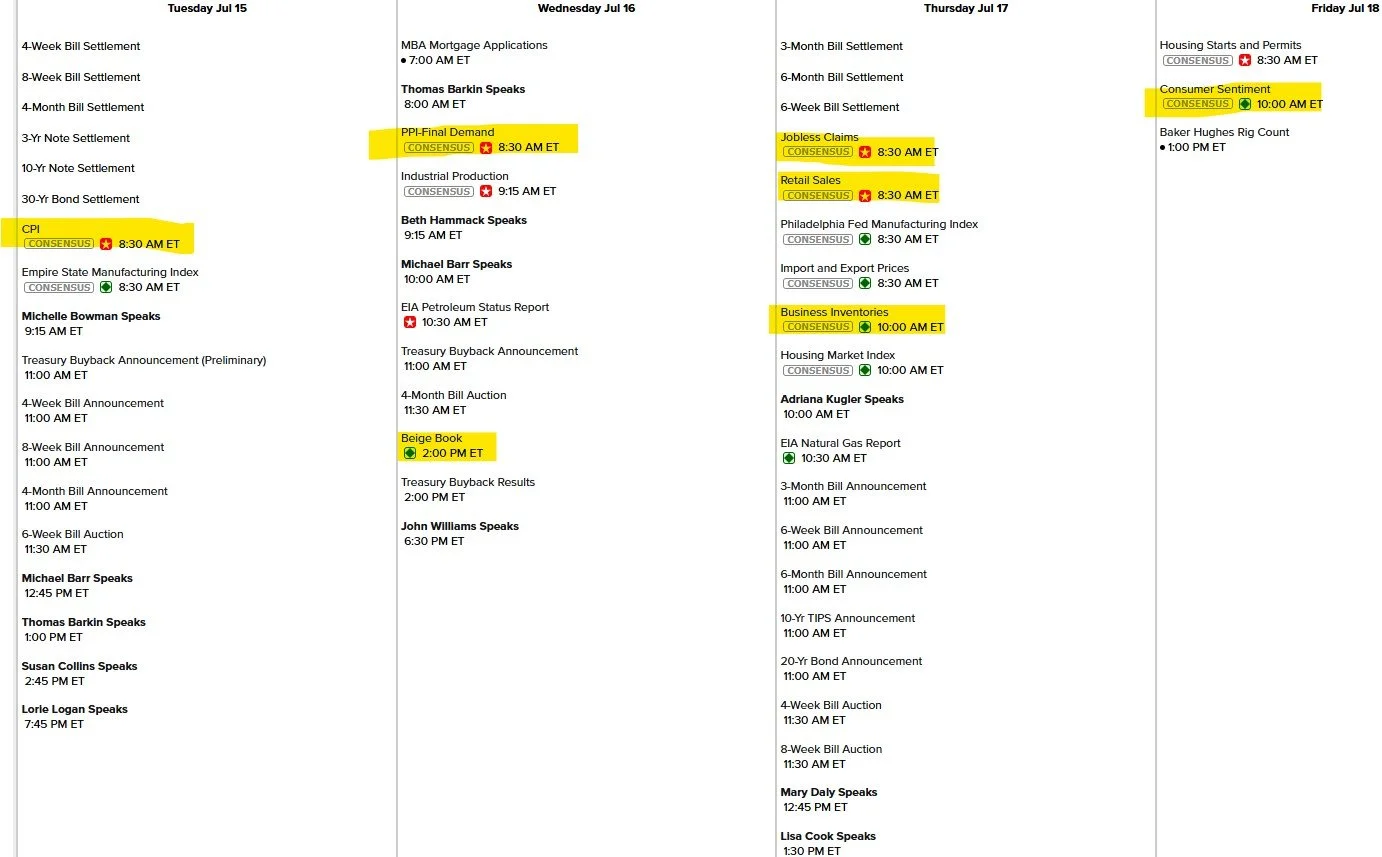

Bulls haven’t met a gap down they didn’t like to buy since April, and today was no exception, with a rebound following the opening gap down across the board. IWM showed early strength, followed by QQQ. The VIX is still a bit more perky than bulls would like to see, but bulls also need to recognize they’re likely hard-pressed to get the VIX to sustain below 16 without a larger volatility regime shift. As we approach VIX monthly option expiration Wednesday at 9AM ET, things may get interesting, given the large negative GEX currently showing for the VIX. A brief overview of economic events this week reveals plenty of excuses for volatility, though OpEx week is typically a tough one for the bears to conquer. Nonetheless, some intraweek volatility may catch both sides offsides at some point.

CPI tomorrow premarket and PPI Wednesday are the first big reports we’ll see, with each accompanying an initial move in markets that the cash session participants will just have to watch while biting their already mangled nails (except for my friends broker Mugatu, he always has immaculate manicured nails).

On the one hand, we’ve been on “Pullback Watch” for the better part of a week as SPX and QQQ closed below their daily Hull Moving Averages, but on the other hand, the powerful trend higher has created some room between the Hull and the current price while the Keltner channels continue to climb, so SPX (as the first example) shows room up to the GEX cluster at 6300 just to retest the Hull from below. This move would place SPX above the upper Keltner channel, which would continue to validate my expectation of a larger pullback, but this pattern in theory could go on indefinitely. GEX at 6500 has grown and participants are still overall quite bullish in terms of option market positioning.

We see a very similar story for QQQ. In both cases, let’s take note that we are talking about a move higher of less than 1%, though given recent achievements of new highs and accompanying sentiment, this will likely feel like a huge achievement and appear to be a continued breakout from the perspective of buyers (those who aren’t swayed by pesky lines like the Keltners or the Hull).

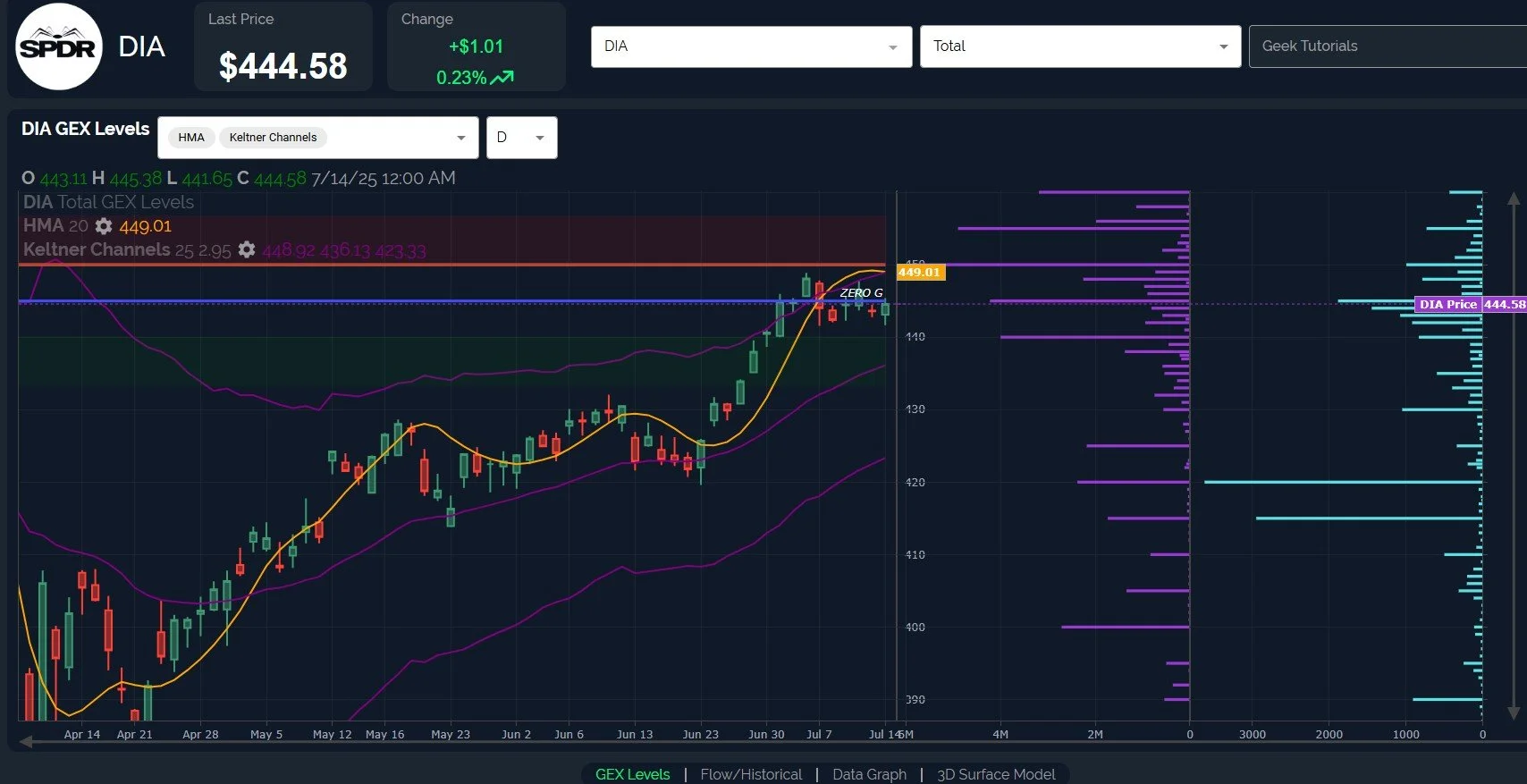

I did want to highlight DIA, which appears to at least have greater room overhead to reach the Hull, currently just over 449, roughly 1% higher. Any push higher by the markets may see DIA outperforming other indices, and we did highlight a weekly opportunity with AAPL in the YouTube video linked above, which would presumably help DIA. Looking lower, which is still ultimately where I believe upside moves will resolve from this general vicinity (give or take 1%), we see elevated volume at DIA 415 and 420, about 6% lower. This would be a great buying opportunity for an early Fall high if we could get it, but in the meantime, we’ll continue taking it one day at a time.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.