IWM: Triggering A Signal Unseen Since 6/20

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our highest level subscription!

We posted a brief 8-minute YouTube video today, which you can watch by clicking here. We give a synapsis of where we are with the indices as well as several major stocks, and we also go over some new channels we’ve added to Discord recently.

As we enter OpEx week, with monthly VIX expiration Wednesday premarket and monthly index options expiring Friday, we also see an interesting “achievement” by IWM as of this past Friday: The first daily close below the Hull Moving Average since June 20. Does this mean we crash? No, it also doesn’t guarantee that we immediately see a sharp pullback. But IWM was the last of the major U.S. indices to lose the Hull. I like to watch IWM for possible leading signals that pertain to other major indices based on past experience, even though IWM obviously doesn’t follow the exact pathway that we see with SPX or QQQ.

Notice the elevated volume (the light blue horizontal line in the chart above) at 212, just above the current lower Dealer Cluster zone at 210. Within the next few days, the lower Keltner channel will also rise toward the 210-212 area, atching the largest GEX cluster we see below 220. I think the implication is that we may start a larger pullback sometime between this week (preferably) or next week, with a 210-212 target before resuming a climb to a more important early Fall high. The ascending channel formed by the Keltners is bullish, so until proven otherwise, we will treat any upcoming dip as a buying opportunity.

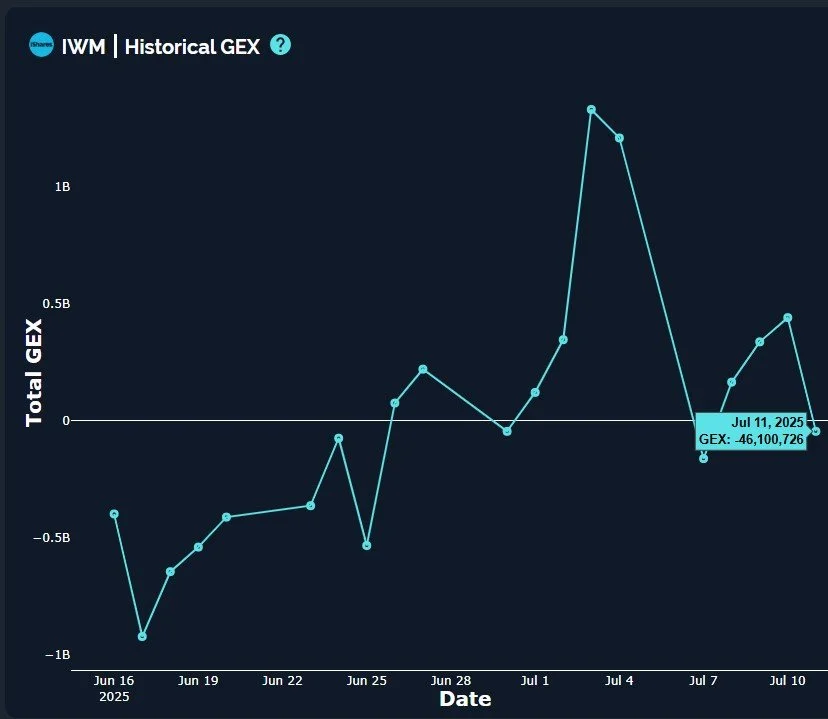

A quick glance at the Historical GEX below shows IWM is back in negative territory as of Friday, another possible confirmation that we may be looking at weakness ahead.

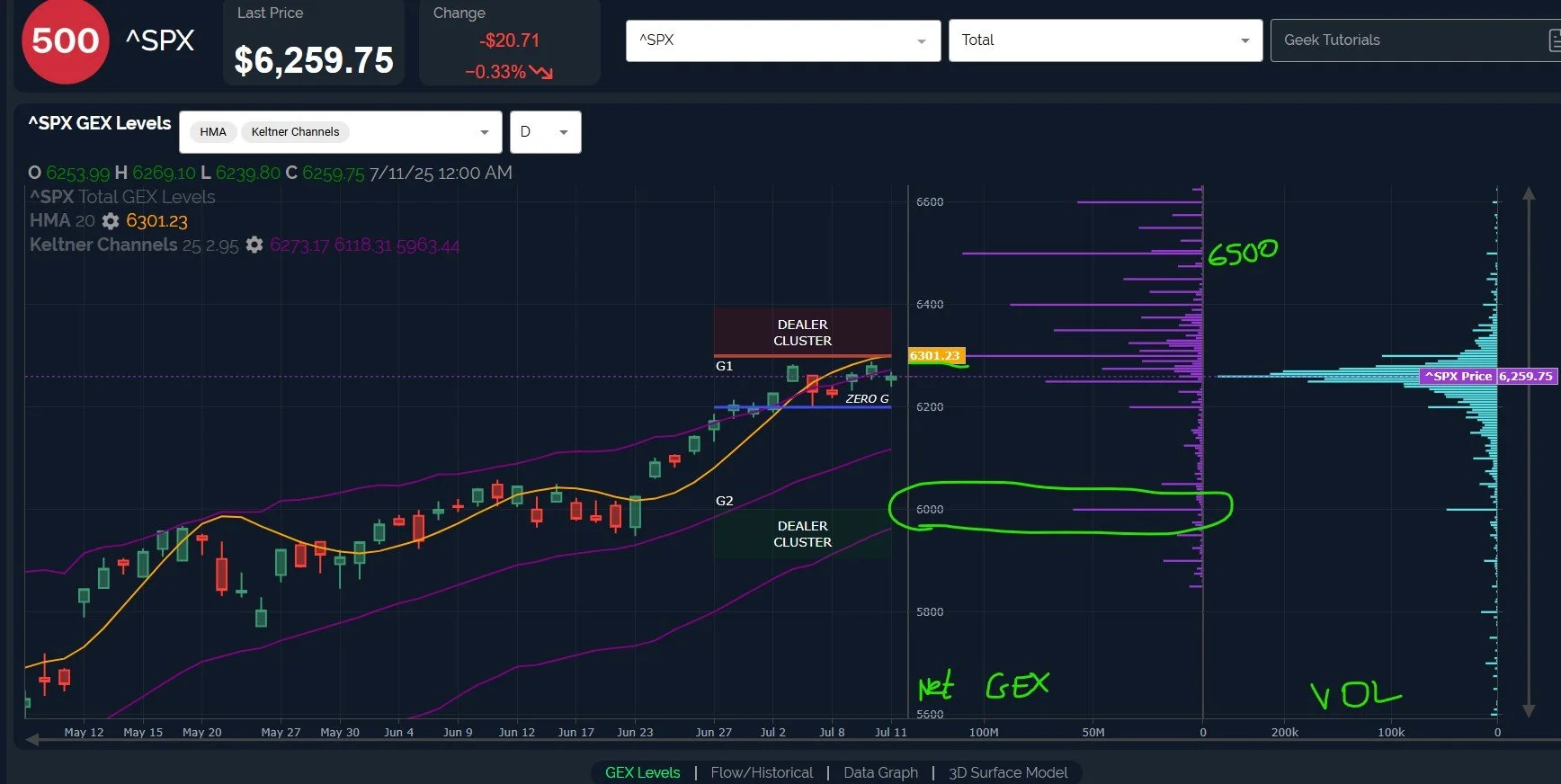

SPX closed below the Hull Monday, and (surprise!) struggled to move higher, actually closing 2 points below Monday’s open.volume and GEX have been noticeable at 6000, also the lower Dealer Cluster zone, where we expect dealers may become dip buyers based on assumed behavior. Overall GEX is still very positive, with 6500 growing in recent days. Despite the positive tilt, we still don’t see much near-term concentration of the higher GEX clusters, so we have a period of possible weakness between now and the presumed resumption of the climb toward higher highs into the Fall.

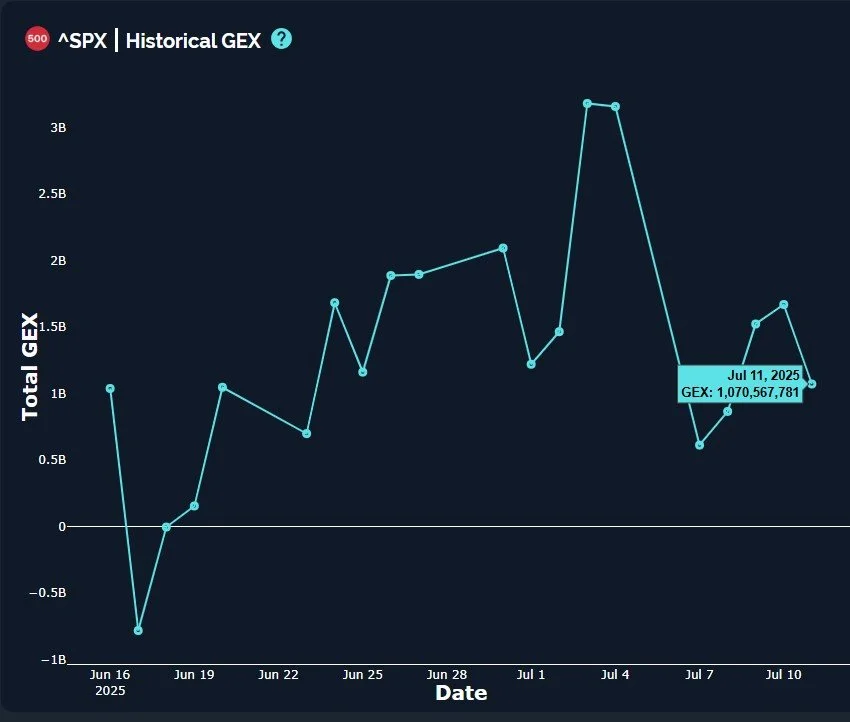

SPX GEX declined in similar fashion to IWM, though SPX is still solidly positive at 1B net GEX. The trend has been somewhat lower since July 4, though.

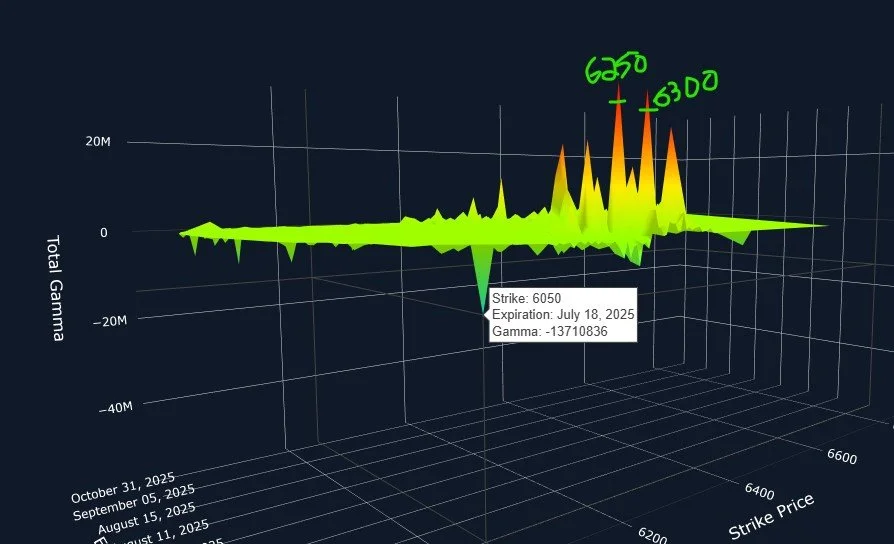

One interesting development I noticed this past week: Negative GEX at 6050 has appeared in a meaningful way for Friday, July 18. I highlighted 6250 and 6300 on the positive side, because they are larger clusters, so we aren’t suggesting the highest probability is a drop to 6050 by Friday, but the recent appearance of the negative has my attention given other signals that point toward a pullback. I’d certainly welcome one last frightening of the bulls to initiate new longs into the next market high, let’s see if we get one.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.