Pivot Approaching: Pullback Or Next Leg To New Lows?

Today’s YouTube video can be viewed by clicking here. It’s relatively short (even shorter than yesterday’s video) and we cover a few ideas like TSLA, DG, CRWD, and we also take a look at some of the major indices.

Indices spent a lot of time today trying to push deeper into the upper Dealer Cluster zones, but the zones didn’t shift higher, and price was eventually dragged back down toward the lower end. Our 0 DTE GEX channel in Discord identified this target early on today after the cash session started. SPX still has a large GEX cluster at 5800 and also at 6000, so the forward picture of where we go and the timing of achieving those targets is something we’ll have to address as we have more clarity. I guess if it were easy, everyone would be doing it, right?

Adding consideration of how net total GEX changed today, which increased, I don’t think we can assign high odds at this time of new lows ahead in the near-term, and GEX is far from being near an extreme as we look back over the last year (enter the GEX Intensity Gauge from our website). But with volatility as extreme as it’s been, we can still see a harrowing short-term pullback that might convince many that we’re heading for new lows, simply based on price action. We’ll be open-minded to such a shift, but we’ll want to see GEX and other factors for added confidence. Until then, I think we’ll see a pullback, but my bias is that we’ll be looking at a higher low.

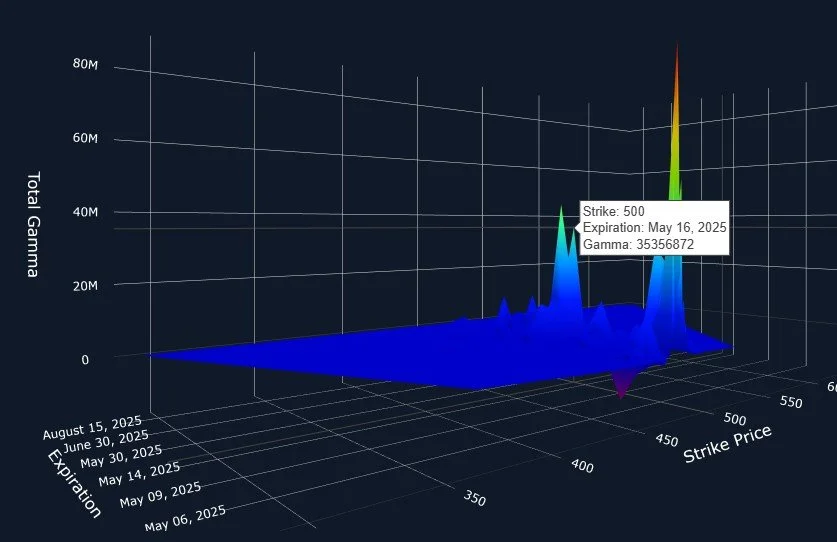

We could repeat a lot of the same commentary for QQQ, with the main difference at this time being that QQQ doesn’t have meaningful higher targets (yet) beyond the 500 strike. if we see the 4.5% move to reach 500, without accompanying GEX at higher targets, we may have a good opportunity to position for a drop toward the lower Dealer Cluster zone.

QQQ has some notable and potentially informative GEX clusters as we look at the 3D graph, with 490 and 500 both being very concentrated at the 5/16 OpEx date. Might we see a pullback over the next few days, then a move higher into mid-May? Oh, we might. At least today’s positioning makes sense to keep that as a possibility with good odds of happening..We’ll continue to watch for further changes.

The VIX is another potentially confirming index for the idea of a pullback and then a move higher: The GEX at the 20-strike is large, and most of it is focused on the May VIX expiration, the Wednesday following OpEx Friday this month (5/21). In the meantime, we see large GEX at higher strikes, including a variety of strikes between 30-50, and we see volume at those higher strikes, especially 32 today. We just closed for the 2nd day above the Hull, so I am on immediate watch for a larger VIX spike. If the indices maintain their GEX picture in general as we embark on such a pullback, we may have a good dip buy just ahead.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out back tested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.