Intermittent Bounce Ahead?

NEW ANNUAL SUBSCRIPTION PROMO! We’re now offering $300 off of the annual Portfolio Manager! We have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code EASTER2025 at checkout to take advantage of this limited time offering.

We posted a new short video on YouTube this evening(which you can view by clicking here) where we cover the big picture on SPY and QQQ, as well as some individual stock ideas, so give it a watch. We’ll cover SPX, IWM, and the VIX in the newsletter tonight.

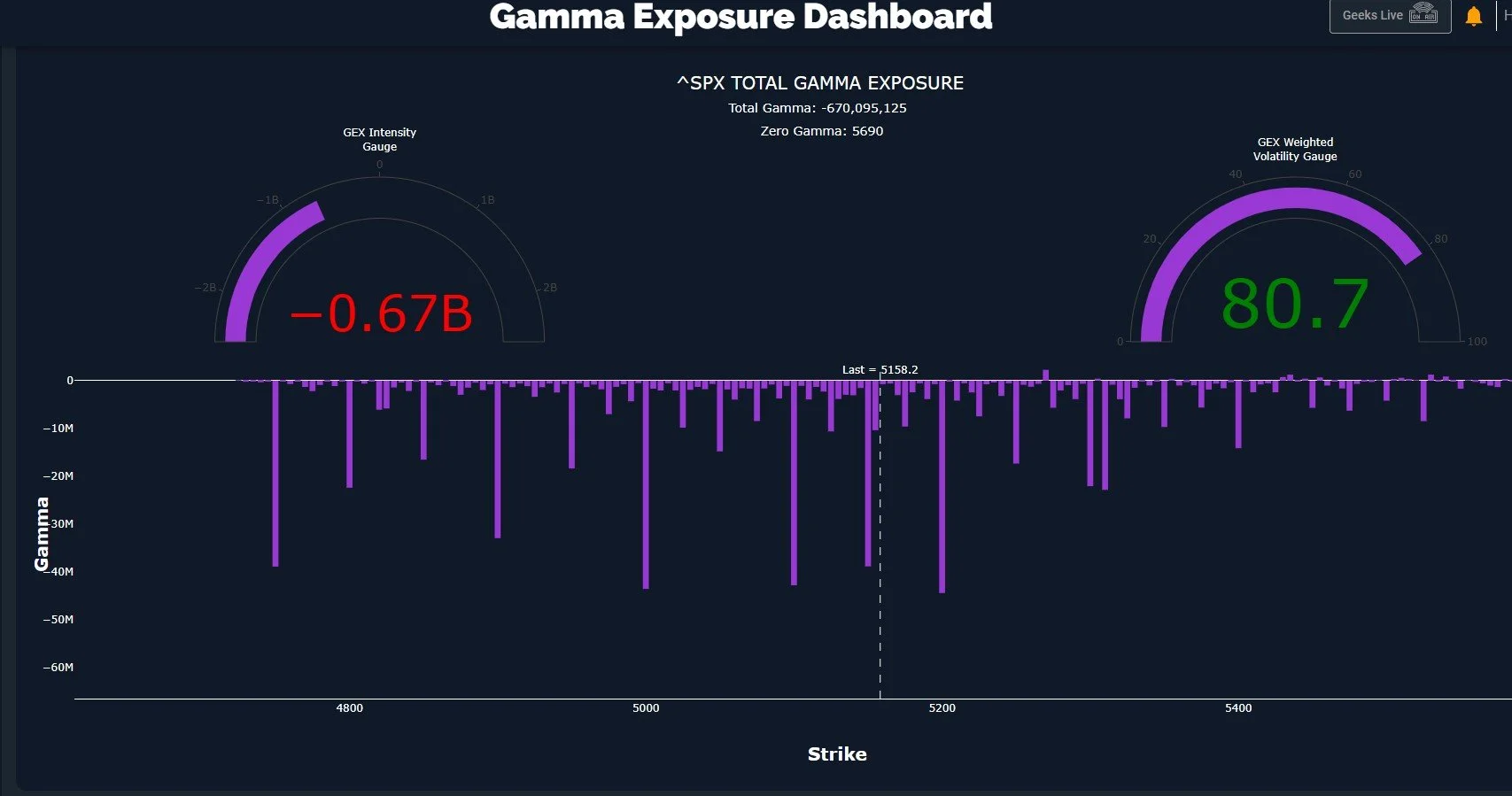

This is our first update post-OpEx, so we’re entering a new cycle heading into mid-May’s OpEx, and the GEX updates are already taking place. We see a continued overall negative tilt toward indices for the near future, and the overarching context for any other observation or potential pathway covered in today’s newsletter is that we see the highest odds for eventual resolution lower as long as the Gamma Exposure (GEX) profile appears the way it does at today’s close.

Starting with the GEX Levels chart for SPX above, today’s gap down below the Hull Moving Average (the yellow line) cements a downward bias already indicated by GEX, with 5000 appearing to be a likely target, and our old nemesis 4750 (jk, we love you 4750!) has popped up again with meaningful GEX. Given the proximity of the lower Keltner channel to the big GEX cluster at 5000, I’ll first watch for a potential secondary low in that area, which would actually be a higher low relative to the April 7 low.

The GEX Data Graph below demonstrates that virtually every meaningful GEX cluster shows net negative GEX, yet we aren’t at a relative 52-week extreme, which is shown by the GEX Intensity Gauge. This implies at least the possibility that GEX can become even more negative. We’re currently seeing a bounce after hours, and though I’m not posting it tonight, we saw a slight positive improvement in SPX GEX today despite the move lower. My base case for tomorrow is that we see a relief rally, potentially to close Friday’s gap or simply to retest the Hull from below, which I will view as a possible opportunity to place hedges back in place that were closed out near today’s lows.

IWM still has a negative GEX bias, but I think it’s worth pointing out that IWM maintains a more bullish short term picture than SPX, showing a positive divergence with a sharp increase in GEX today (decrease in net negative GEX) and IWM is the lone index that tested the Hull today and bounced, still holding above the Hull. To counter these positives, we do see higher volume (the light blue line to the right) at lower strikes, and GEX at 160-170 is more noticeable now than it was 1-2 weeks ago.

IWM’s Historical GEX graph below puts today’s divergent improvement in net GEX in context, still showing an overall solid negative bias, but I think this move in positioning lends credit toward a possible upside move before more downside.

Our intraday GEX signals were great today, we saw an early indication that 5150 and 5100 were potential targets, both of which were hit, and the VIX also cooperated with what we were seeing, reaching the 35-36 area we said we’d like to see before fading. GEX is still biased toward the upside for the VIX, with 42.5 being the largest net GEX cluster, and high volume at the 50 strike is visible as well. If the market rallies tomorrow, the VIX may once again head toward the important 30 mark, potentially dipping below. Holding below the Hull is bullish for stocks according to my set of rules, but the declining Hull will soon potentially cross beneath the VIX’s price, opening the door for the VIX to begin a move toward the 42.5 strike that has been a big GEX spot for weeks now.

Our current gameplan is to potentially exit longs and/or initiate shorts as a hedge on any meaningful rally in our particular positions, and we’ll also post intraday GEX updates in our Discord 0 DTE channel and Portfolio Manager channel, with the occasional free post in our general chat as well. We’ll look forward to sharing further updates tomorrow in Discord!

Here’s the Discord link if you haven’t joined us yet in our most active social media setting! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we just increased our ANALYST tier subscription to include 600+ tickers, including individual stocks!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.