Testing Important Support

NEW ANNUAL SUBSCRIPTION PROMO! We’re now offering $300 off of the annual Portfolio Manager! We have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code EASTER2025 at checkout to take advantage of this limited time offering.

Tonight will be the last newsletter of the week, given the market’s closure Friday. We’ll resume Sunday night. We will still conduct our relatively new Geek’s Live livestream session mid-morning tomorrow where we’ll discuss specific new ideas and look at what GEX is telling us in real-time, as well as our normal Discord posts. We also posted a new short video on YouTube this afternoon, which you can view by clicking here.

My personal opinion is that tariff headlines no longer have a shock factor in the short run, at least as of this week. It’s basically old news…Now we will potentially see meaningful real-world negative impacts reflected in the data in coming quarters if no deals are reached, and we have downside risk from a myriad of other factors, including escalation with China, but just looking at it logically in the short run, the administration supposedly has upwards of 130 negotiations going on, so what does the market do when we see a handful or more of announcements that deals have been reached? I would guess shorts will be getting tossed overboard. The larger nations will obviously be more impactful toward market moves, but I think the headline risk will shift to something else soon. Nonetheless, I just trade the data and catch up on the headlines later in most cases..Let’s see what the data says.

We’ve been discussing the distance above the Hull moving average for days, and that gap was closed today, with all major US indices reaching or getting very close to touching the Hull. Initial tests held, and we even saw a nice rebound off of the lows today. The big question is what happens next? We view 5200 as an important pivot, and exceeding that area to the downside may open up targets as low as 4800 again.

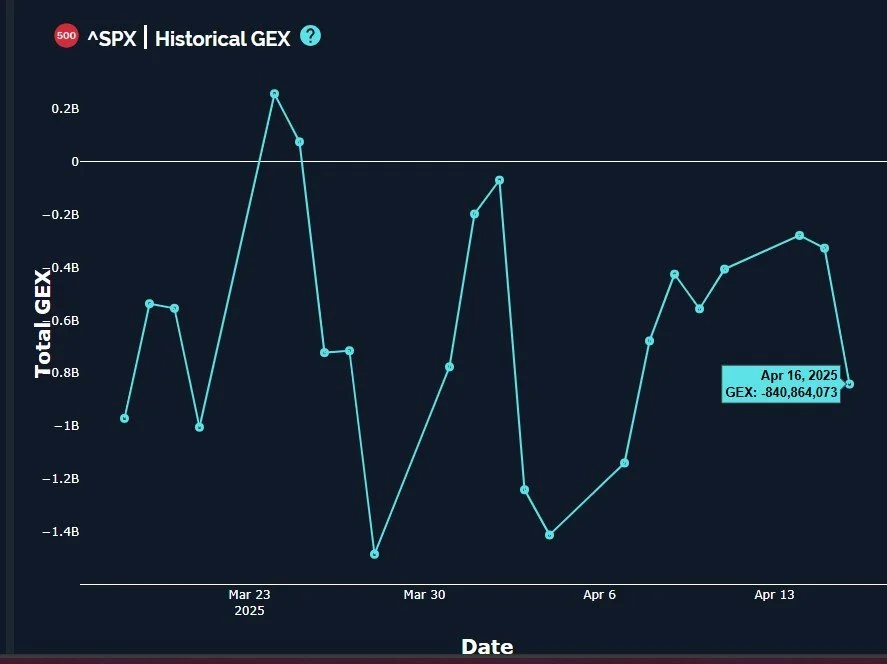

Our historical graph shows total net GEX taking a big dive down to -841B, QQQ net GEX also declined significantly. Is the sharp negative move an OpEx Special or are we beginning the next leg down?

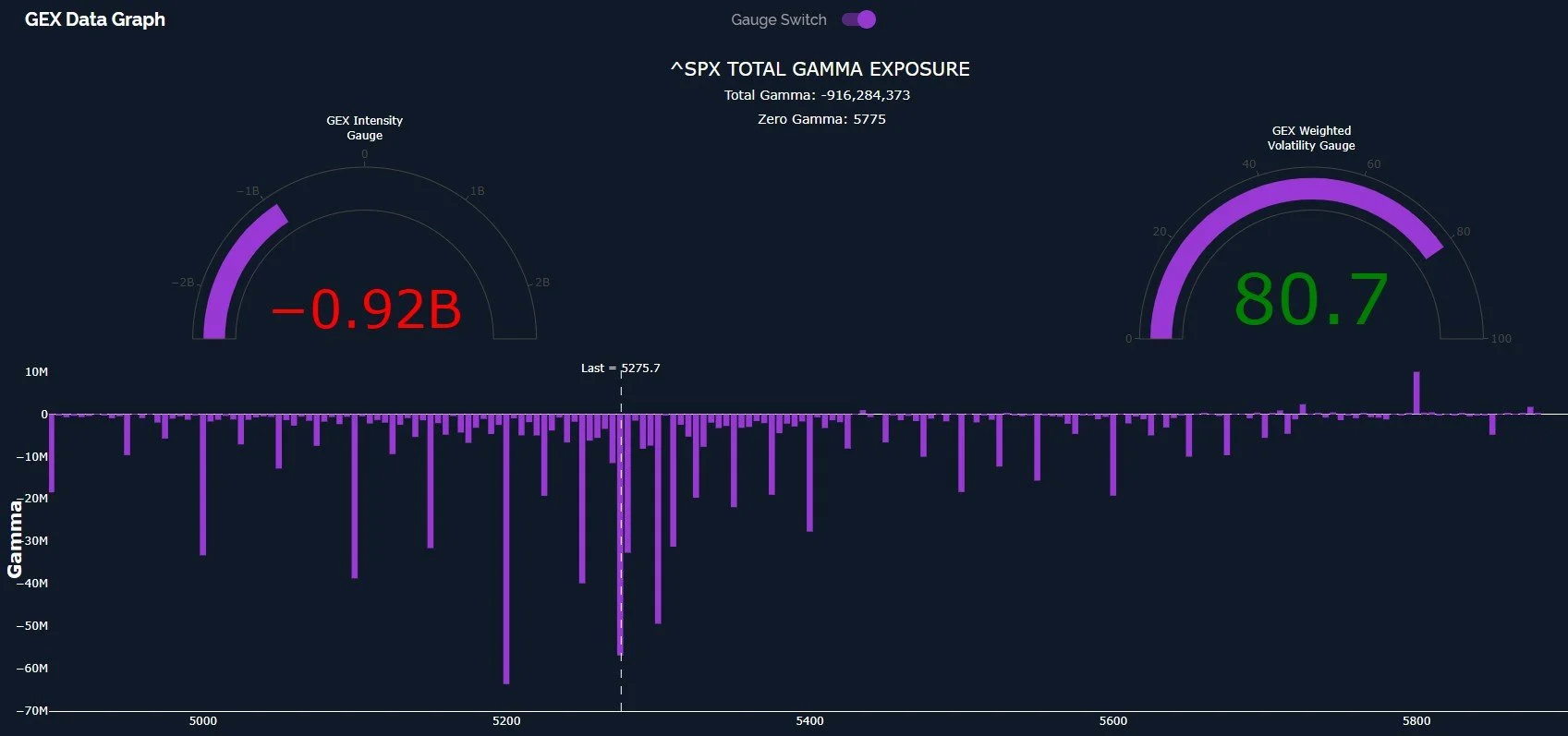

Looking at SPX’s Data Graph, most of the GEX we see is negative, with big negative strikes at 5200, 5100, and even 5000. Very little GEX exists at higher strikes, which does lend credit to an eventual resolution toward lower levels. For context, if we see a prolonged drop, we could still see positive tariff headlines serve as catalysts to reach some of the larger negative GEX clusters at higher strikes, and we have mentioned eventually wanting to see 5500-5600 reached as a test of whether or not the trend will shift. Rejection of the rebounds is confirmation for the bears that we’re either in a lengthy sideways consolidation across a wide range or potentially a brutal slide downward like in 2022 (except I’d guess more brutal, but that’s for another day).

QQQ exceeded the Hull to the downside, reaching almost the exact Hull level displayed yesterday when we mentioned a target for QQQ, but QQQ also recovered off of the lows. We especially see a negative setup for QQQ compared to other indices, with GEX at lower strikes and a very large cluster at 420.

Displaying a similar yet inverted issue that we saw with the indices until today, the VIX is still far from the Hull, and I wouldn’t be surprised to see the gap closed up to the 42-area, possibly as soon as tomorrow. We saw the highest volume of the day at the 42.5 strike, so caution is warranted. Perhaps the positive for market bulls is that we have a shot at the VIX rejecting that retest, which would potentially set the market up for another rally. I find myself in that camp in the short run despite my view that the overall picture still looks solidly negative, so I am looking for an upcoming lower dip to buy to ride what I see as a rally within a bearish move playing out over a longer timeframe. GEX levels continue to work day to day on an intraday basis for us, so join us in Discord if you can!

One last thing, we’ve expanded our Analyst subscription as of tonight, so now Analyst subscribers can see all 600+ tickers on the dashboard! We are working to improve the total package for both subscription tiers on an ongoing basis. Thanks for your feedback!

Here’s the Discord link if you haven’t joined us yet in our most active social media setting! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way, including an improved mobile experience!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.