Divergences Continue, After Hours Spilloff Ensues

NEW ANNUAL SUBSCRIPTION PROMO! We’re now offering $300 off of the annual Portfolio Manager! We have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code EASTER2025 at checkout to take advantage of this limited time offering.

Looks like the VIX will likely be entering tomorrow morning’s premarket monthly VIX option expiration within the 30-35 range we discussed recently, barring something unexpected overnight. But what comes next? Will the removal of hedges due to expiration allow the VIX to move more, thus causing the market to wane, or will the big boys & girls keep it together with a successful break above the middle Keltner (and large GEX clusters) by Thursday? We’ll talk about this question in today’s newsletter. We also posted a new short video on YouTube this afternoon, which you can view by clicking here.

I drew an arbitrary line through VVIX’s chart below, showing the current level to be roughly where previous breakout points and turning point highs were marked earlier. If this is a more prolonged rising trend for volatility, perhaps we turn back up around this 115-area. If not, the next place I would watch is the 100 mark, which has been “support” in 2025 so far.

Take a look at the VIX below- notice anything different? We see the VIX printing a green candle while VVIX was red, so we have divergence between the two. Repeated instances of inverse correlation between the two in particular can be a good predictor of a future VIX spike, typically within days, so we need to watch this shift. We also see the VIX printing what can be interpreted as a possible reversal or indecision candle.

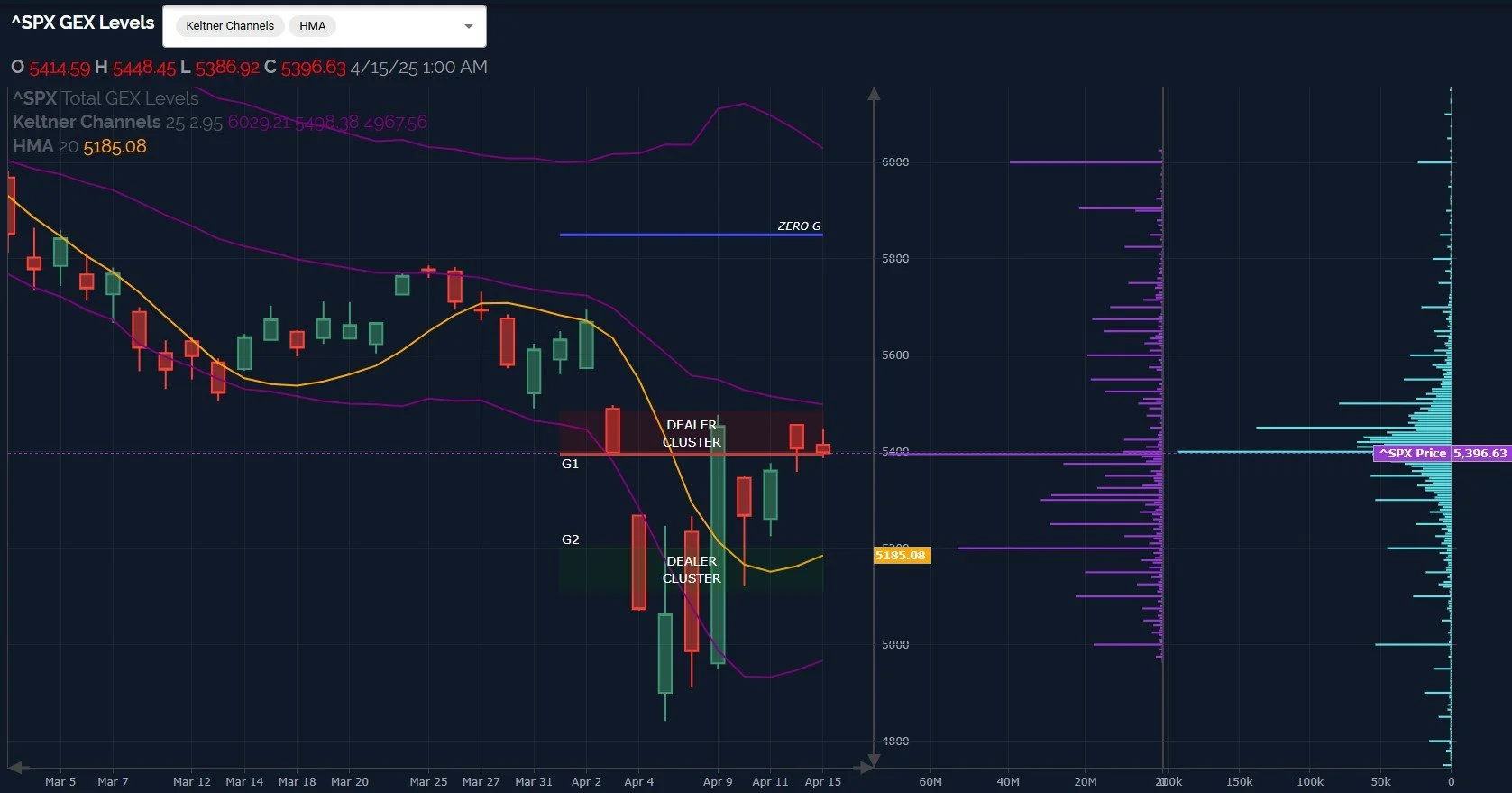

I’ve mentioned the distance between the Hull (yellow) and SPX’s price being a potential short-term issue, since price typically returns closer to the line when it strays too far in one direction or the other. The Hull is currently at 5185, which is interestingly close to the large GEX cluster we see at 5200. This also represents the green lower Dealer Cluster zone, where current positioning indicates dealers may become big buyers. We’re currently sitting in the upper Dealer Cluster zone, just below the middle Keltner channel, so we shouldn’t be surprised to see reversal lower here, and we still don’t see substantial positive GEX clusters at higher strikes despite some improvement in total GEX to the neutral zone (still negative though).

If QQQ also returns to the Hull, such a move implies a drop to the 437-438 area, though QQQ’s large negative GEX at 420 is hard to ignore.

QQQ’s total net GEX has modestly decreased for two days, nothing alarming, but a sign of at least temporarily stalling out in negative GEX territory.

Will these signs of indices struggling at the middle Keltner channel and the other points mentioned play out as an immediate decline into Thursday’s close, or will this move be postponed into next week? The overnight session is already bright red, but the night is long…Tune in with us in Discord tomorrow and we’ll take a fresh look at the intraday GEX first thing in the morning during the cash session. Thanks for joining us!

Here’s the Discord link if you haven’t joined us yet in our most active social media setting! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way, including an improved mobile experience!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.