VIX Divergences Approaching VIX Expiration Wednesday

NEW ANNUAL SUBSCRIPTION PROMO! We’re now offering $300 off of the annual Portfolio Manager! We have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code EASTER2025 at checkout to take advantage of this limited time offering.

We face a shortened yet possibly eventful week, with VIX monthly options expiration Wednesday premarket, monthly option expiration for broader indices Thursday, and the market is closed Friday. Short weeks allow fewer chances for selling, right? Let’s see what GEX data says as of today’s close. We aren’t speculating on where the market goes beyond this week, but we want to look at the odds of what happens by Thursday, if we can possibly find some sort of “edge.” We also posted a new video on YouTube this afternoon, which you can view by clicking here.

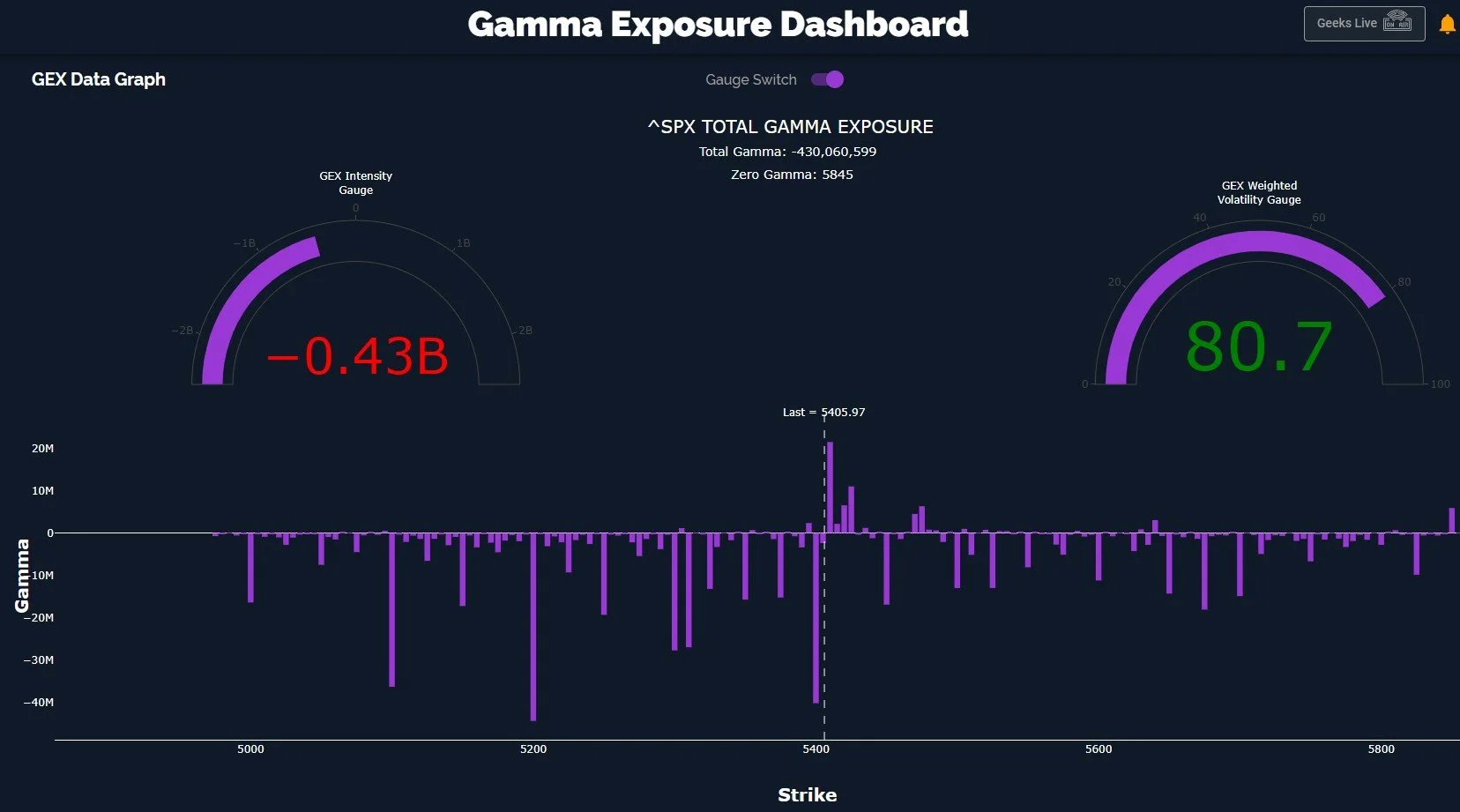

While QQQ reached the middle Keltner channel, falling 0.02 shy of the 465 goal, SPX left a little more room between the opening high and the actually middle Keltner. Regardless, QQQ reaching that area is technically enough, and the Hull has only recently begun turning upward slightly. A lot of room exists between the Hull at 5162.77 and today’s close at roughly 5406, so we need to look at whether it’s more likely that we jump over the middle Keltner or retest the 5200-area at a minimum before more upside. It is positive that we see GEX growing at higher strikes, including the notorious 6000 strike again.

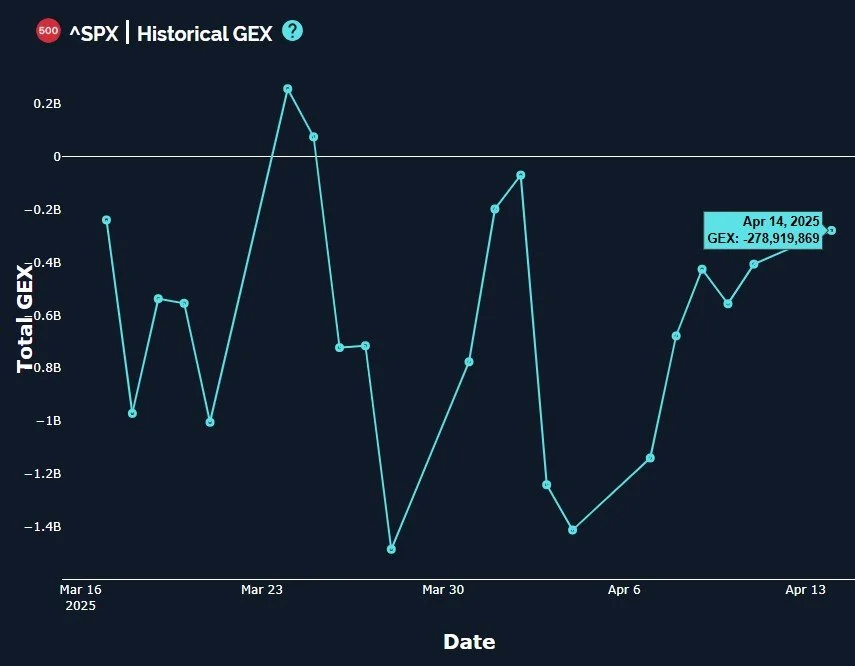

SPX GEX improved to just below -279M, neutral territory in our opinion, though recently, high GEX readings for SPX have been closer to tops than signals of upcoming positive price momentum.

We also need to be observant that the largest GEX clusters are still negative, especially 5100, 5200, and even some noteworthy readings at 5300. This concentration that stubbornly remains in negative territory gives us pause toward any outright bullish predictions at a minimum.

Furthermore, in the short run, SPX closed below the 2-hour Hull moving average, a bearish signal, though the chart itself appears more neutral. Within this context, it wouldn’t be surprising to see SPX drop toward the middle Keltner channel in the 5310-5320 range, also meaningful GEX.

The VIX also closed just above the 2-hour Keltner, a long volatility signal, opening the pathway to VIX 37-38 and possibly higher.

Zooming out to the daily chart for the VVIX, the index measuring future expected volatility for the VIX itself, we see a gap closed back to early April and a test of the middle Keltner channel. VVIX being red today while the VIX was green is also a divergence worth noting, since stacking up several such divergences can be a good predictor of future VIX spikes (general noncorrelation, not necessarily VVIX down/VIX up).

Today was tricky, but GEX played very well from level to level, including the initial rebound today from 5411, the drop to 5360 once we breached 5400, then the rebound back to 5400+ afterward. Unusually active, I would say, but we will continue watching intraday GEX indications with an open mind, since it’s working overall quite well. We hope you’ll join us!

Here’s the Discord link if you haven’t joined us yet in our most active social media setting! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way, including an improved mobile experience!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.