Stubborn Negative GEX

NEW ANNUAL SUBSCRIPTION PROMO! We’re now offering $300 off of the annual Portfolio Manager! We have overlayed chart indicators and several backtested algos complete with notifications and we anticipate more near-term improvements. Your needs are our focus, and we want the platform to become indispensable for your trading! Enter code EASTER2025 at checkout to take advantage of this limited time offering.

We posted a new video in YouTube this afternoon, which you can view by clicking here. We cover SPY as well as some other ideas, so give it a look. We’re always looking for feedback as well, so let us know via email or Discord if you would like us to cover any aspect of GEX or the markets that you think may be helpful.

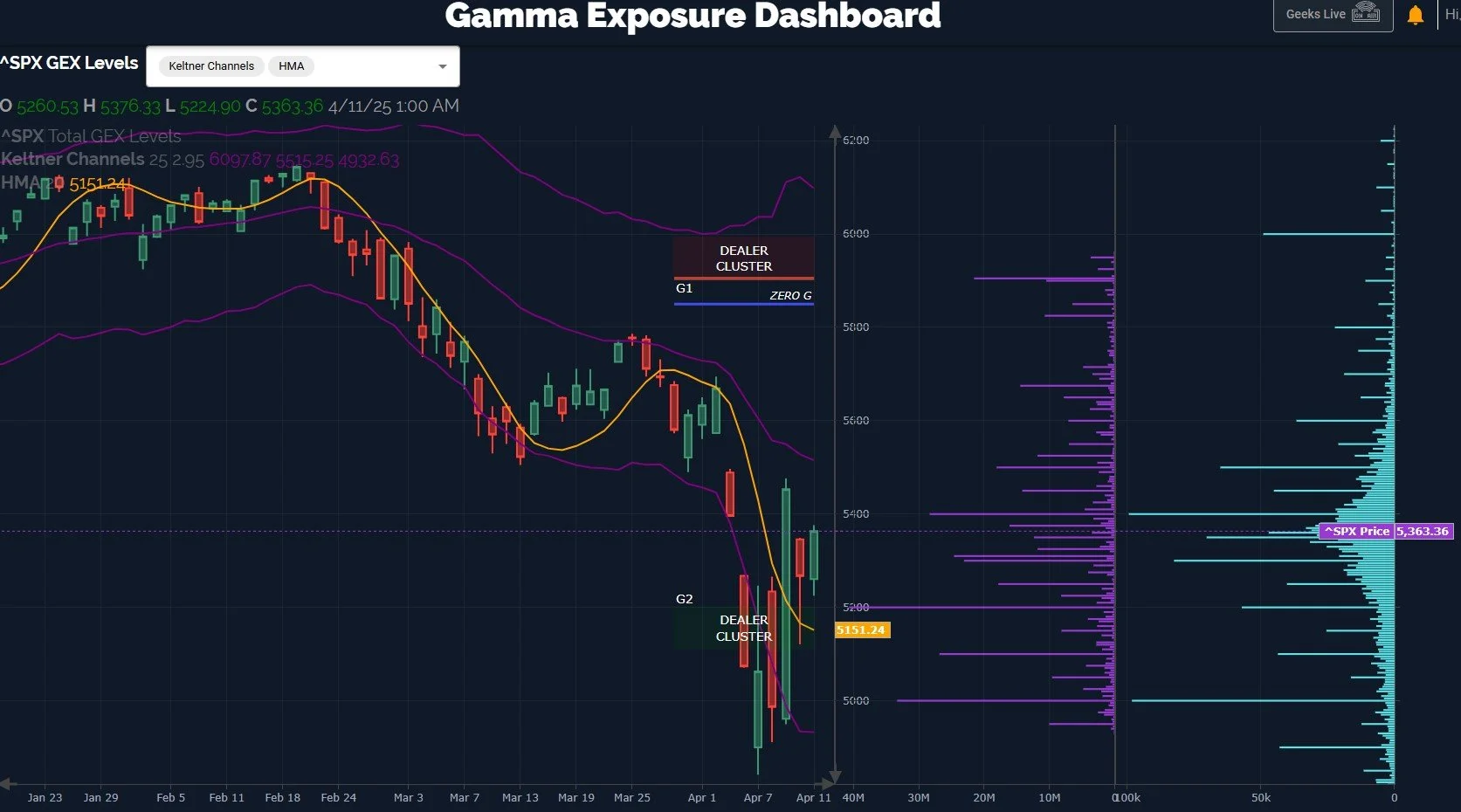

Upside momentum may continue further in the short run, as we have short indicator signals on volatility (both VIX and VVIX closed below the Hull moving average) and we have a combination of positive shifts in the negative total GEX across most indices, as well as positive momentum toward further upside, perhaps the middle Keltner channel for SPX around 5515.

It’s not all unicorn neighs and rainbows though, as you can see the Keltners are still pointing down mostly, and the Hull is still dropping. In fact, I don’t like that we are as far above the Hull as we are. It’s true that I lean toward the long side above the Hull, but over time we tend to revert to at least a closer proximity to the line. After the lengthy drop we saw, I’d expect a period of consolidation or back-and-forth before resuming a sustained climb, though this is certainly not a requirement, the market can do anything.

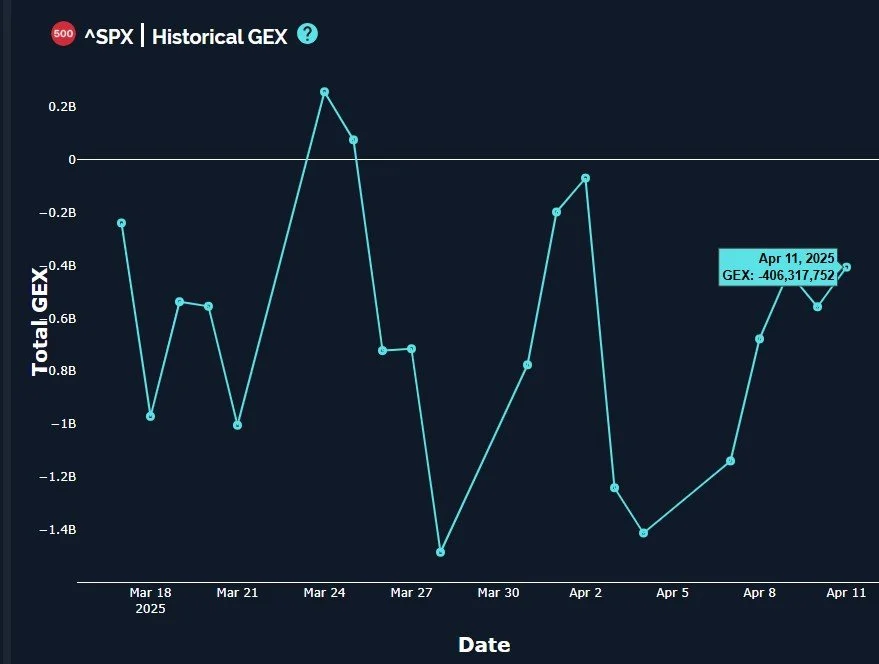

GEX slightly improved, though still over -400M negative.

One last observation on SPX- notice we still have the largest GEX clusters at lower strikes, and while it’s certainly positive that we don’t see large clusters at 4700 and 4800 anymore, 5000 and 5200 are large. Given the current GEX structure, I don’t think it’s unreasonable to reach 5479-5531 in the short term, and as long at 5200 remains, we have an initial risk of retesting that level (we came within 20 points of it Friday, so not quite there). Otherwise, a straight shot to 5479-5531 also runs that risk. We expect more clarity after tomorrow’s cash session open.

QQQ has a lot of similarities in terms of which indicators serve as overhead targets (roughly 460-465 QQQ), and the Keltners are also moderating but still in a downward slope, but the large GEX clusters at 390 and 420 are particularly concerning. We also see very little GEX above 465. Once again, I’m not pouring cold water on the idea of upside continuation, but we need to look ahead so we have a gameplan of where to reassess and potentially protect profits on longs.

By Friday’s close, QQQ arrived very close to the zero total GEX line, which actually marked a top during the March 24-25 timeframe. Will this time mark another pivot back down, or will we enter positive territory and maintain positive GEX?

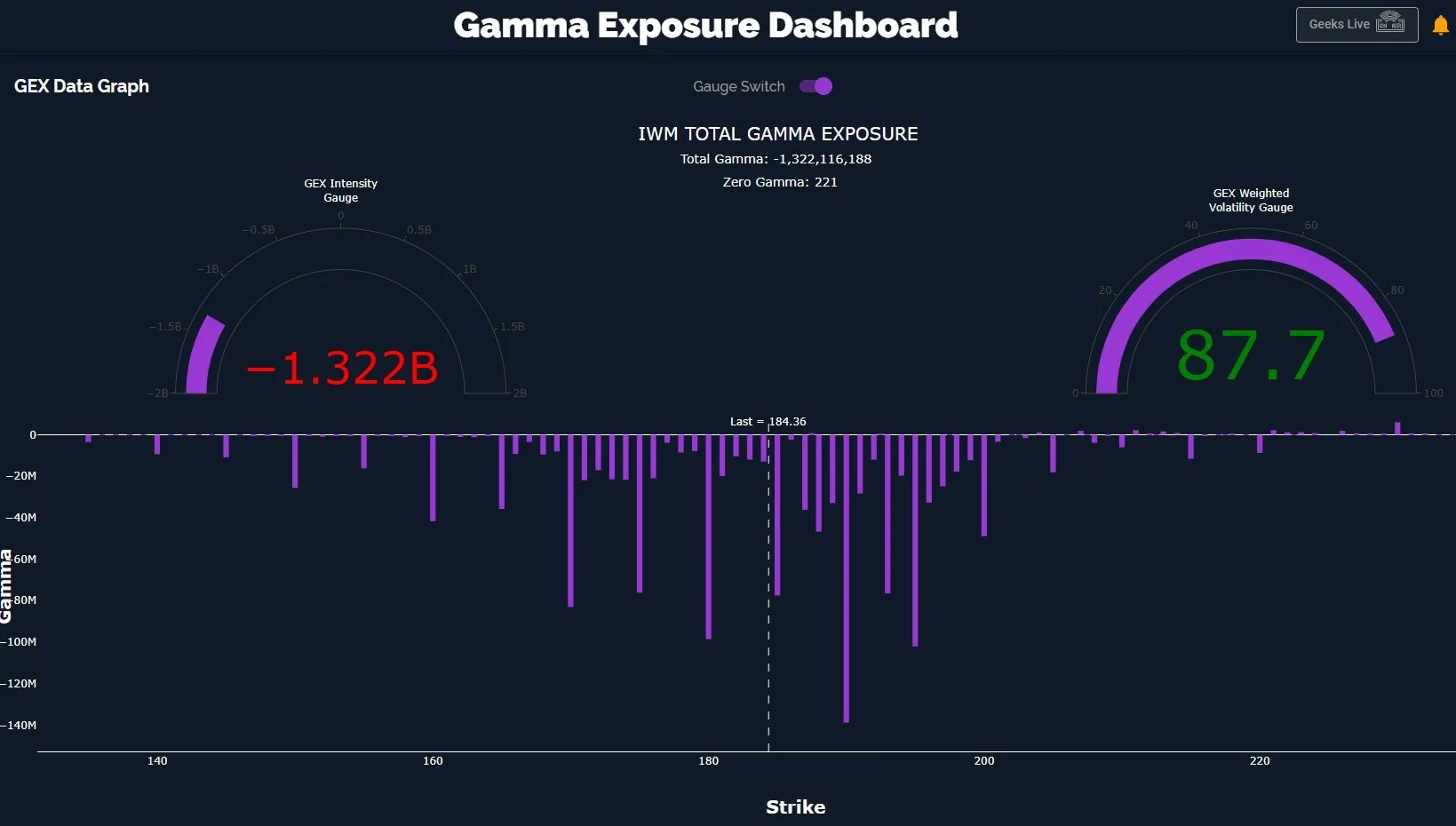

IWM is also somewhat of a contradiction, with solid negative GEX, lagging price action relative to SPX and QQQ, and virtually no GEX above 195. Yet IWM is closest to the Hull and IWM has maintained above the Hull for 3 days, which is a positive short-term sign. Volume was highest on Friday at the 173 strike, interestingly. Perhaps an immediate tag of 195, then more downside? I won’t speculate, but I will reassess intraday tomorrow for an updated view of what appears to be the most likely pathway.

I mentioned 195, but really 190 is the large initial GEX cluster that will have to be overcome. Unless GEX shifts, there’s no reason to consider prices over 195-200 at the moment. IWM in the past has been a fairly good contrarian indicator, reaching its most negative point in terms of GEX and various technical indicators when it’s time to buy, but with consideration of SPX and QQQ also looking suspect, we’ll continue exercising caution until we see more evidence of a larger turn.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way, including an improved mobile experience!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.