Approaching A Decision Point

We posted a new video in YouTube this evening, which you can view by clicking here. We cover the major indices as well as some other ideas, so give it a look. We’re always looking for feedback as well, so let us know via email or Discord if you would like us to cover any aspect of GEX or the markets that you think may be helpful.

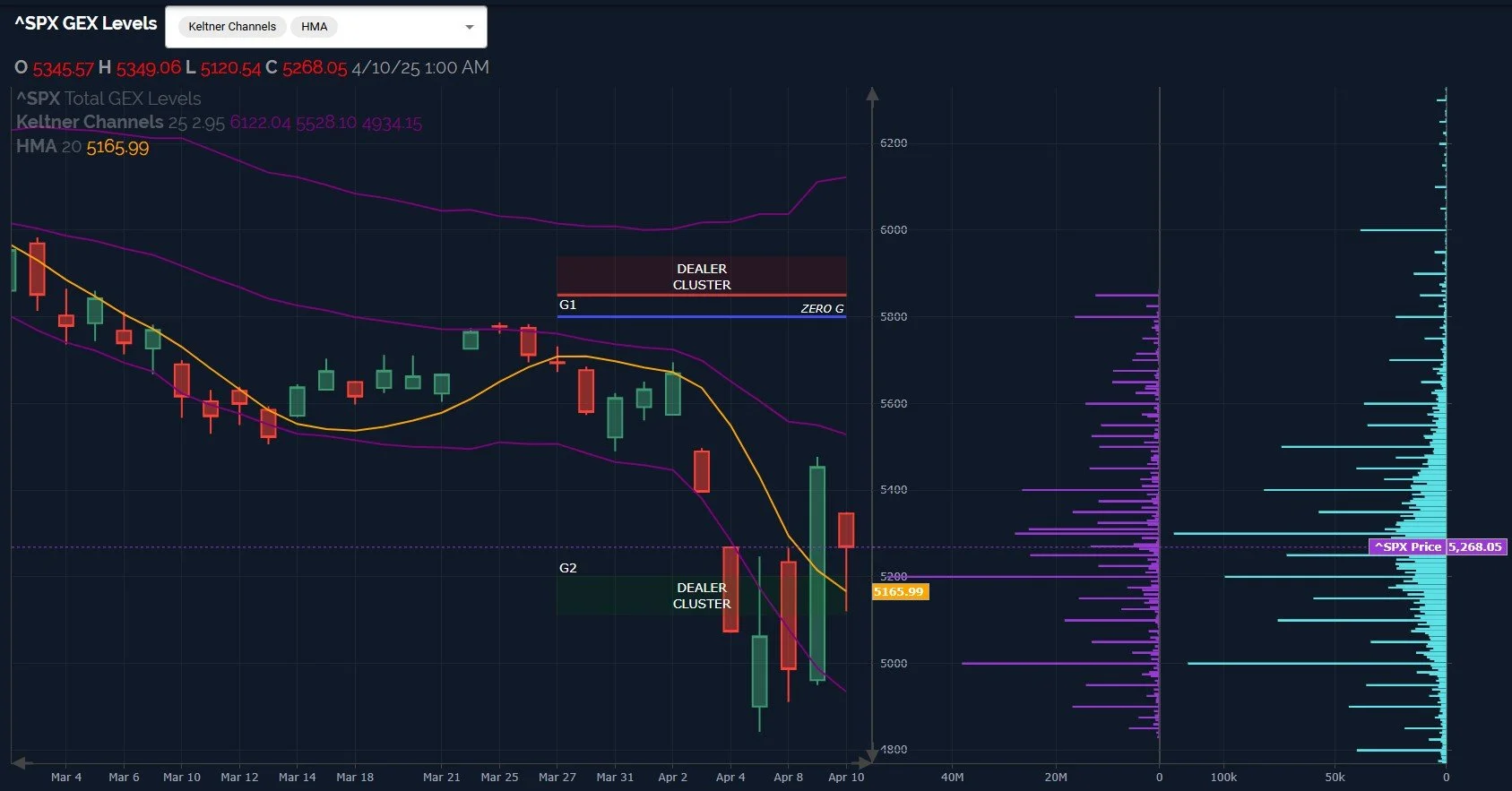

Let’s take a brief look at SPX as we approach Friday. Following yesterday’s monstrous green candle, we gapped down and stayed down today, which shouldn’t be a surprise. We don’t see a lot of clarity though, with mixed signals provided by the close above the Hull Moving Average while still mostly seeing large GEX clusters at lower levels.

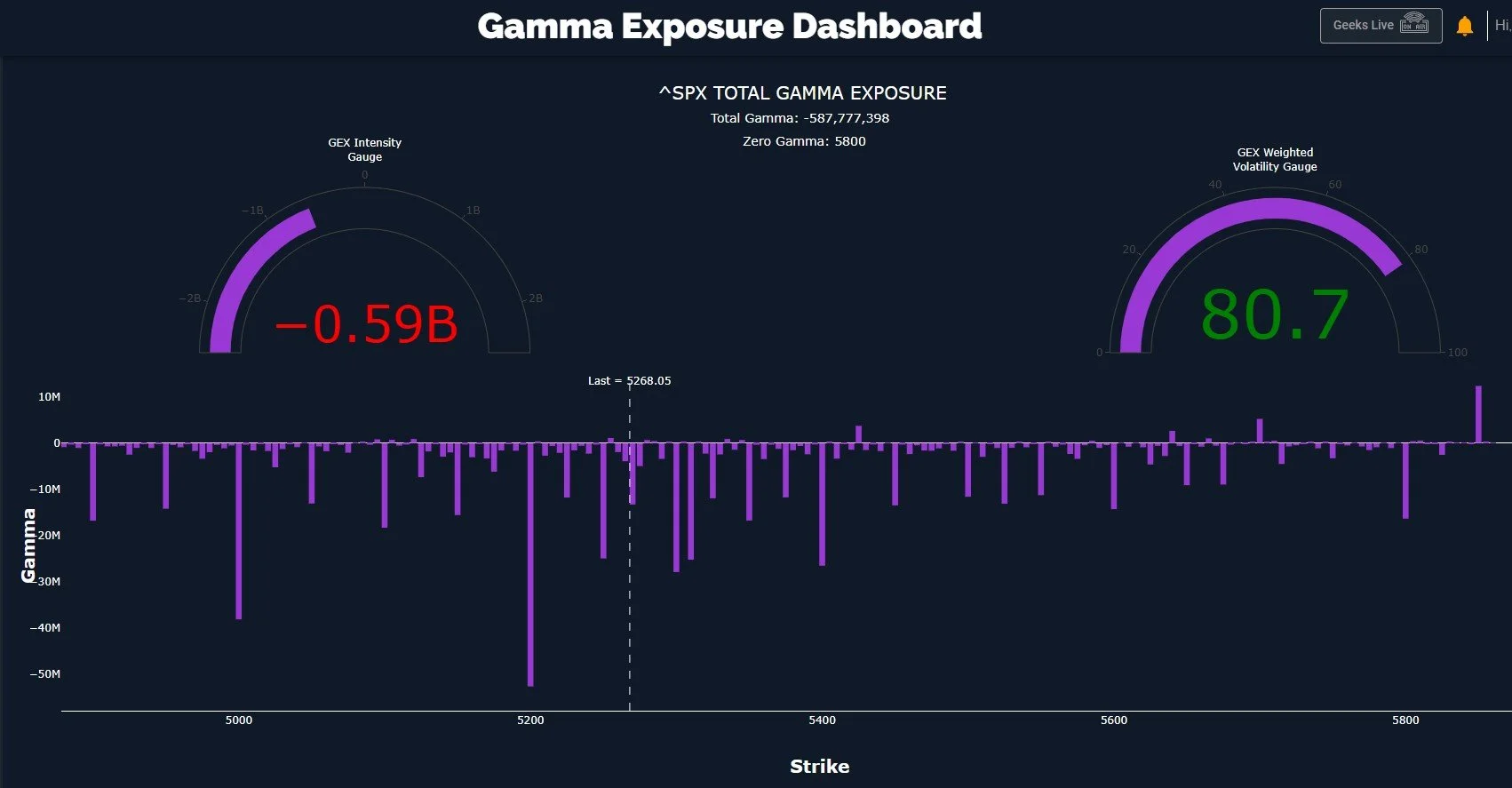

Looking at the GEX data graph, we see nearly all strikes are net negative in terms of GEX, with 5200 and then 5000 as the largest total GEX clusters. While it is true that 5200 may represent meaningful support, as it did today, it’s concerning that we don’t yet see the market shifting to reflect expectations of higher prices in the form of positive GEX at higher option strikes. I’ll also note that while SPY and IWM hit extreme negative GEX several days ago (a potentially bullish contrarian signal), SPX hasn’t yet reached a technical extreme, despite staying in negative territory. 5000 actually increased relative to other strikes today.

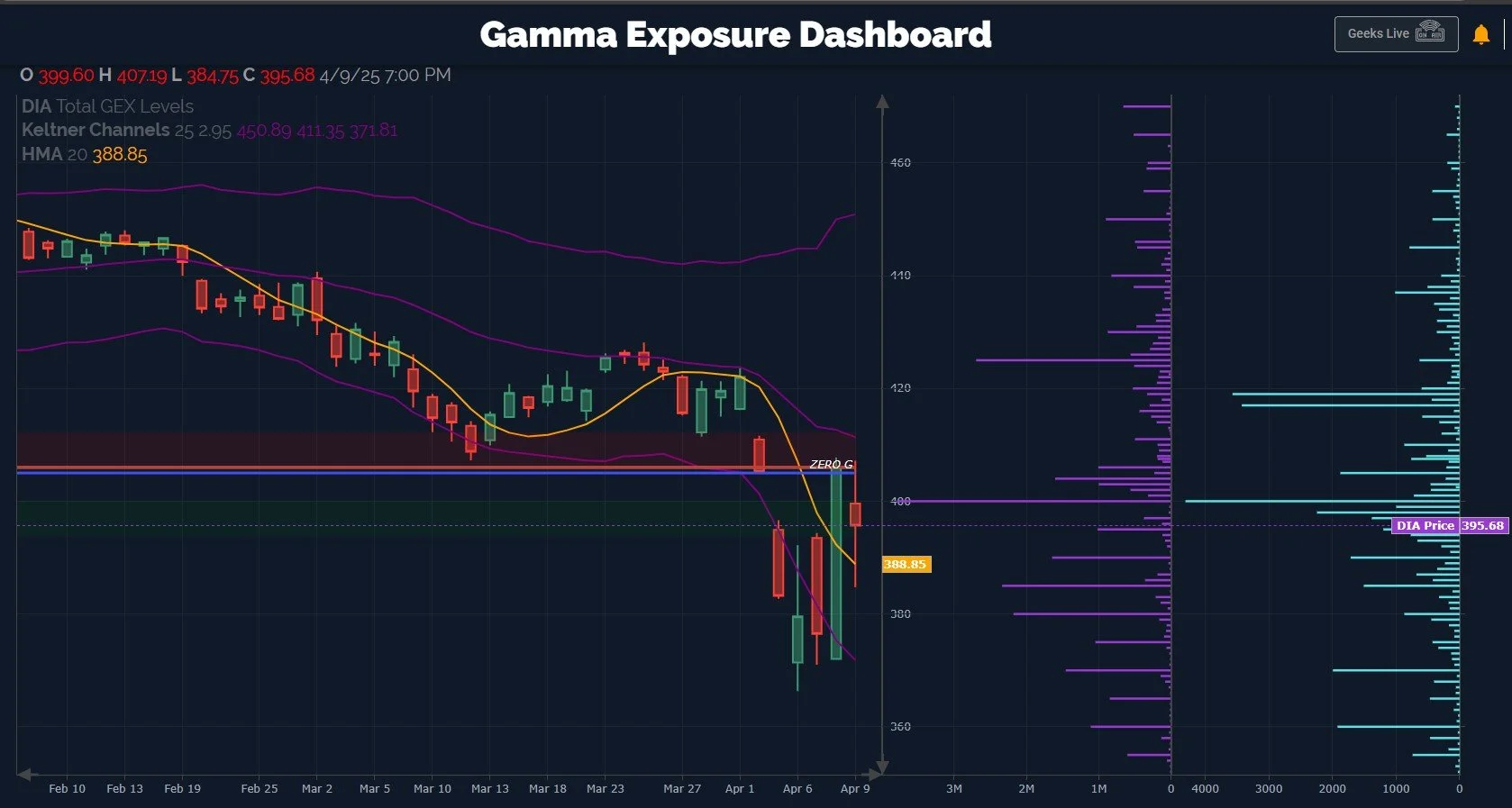

Bulls do have a couple of points in their favor, namely that DIA shows at least two big GEX clusters at 400 and 425, and the highest volume today at higher levels as well, though DIA did reject the attempts beyond 400 so far. The lower Keltner channel continues diving lower, which is bearish, though in DIA’s case, the upper channel is slightly rising. Time will tell if that rise is a temporary effect due to yesterday’s rally or a sign of widening upward moves to follow these large downward moves as well.

While VVIX closed back above the Hull, the VIX closed below the Hull, giving bulls some hope that perhaps the VIX is now on a pathway of lower highs and lower lows for the time being. We need more time to prove this, and as mentioned in today’s YouTube video, massive volume at 80 and 55 warrant some concern that the close under the Hull may be a fakeout. GEX on the VIX is still positive and 42.5 is still a large GEX cluster.

With volatility currently elevated, we plan to continue taking portfolio shifts one day at a time, also incorporating the consistently helpful signals provided by 0 DTE GEX as we go along. We do anticipate a larger positive move soon, but we will pay mind to individual days that may suggest more downside is due first. Join us in Discord and we’ll be sure to share some important observations that we’re seeing at the time.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.