The New Normal?

Seems like every day we’re setting new records one way or another, and today’s records include the largest one-day gain for the Dow Jones, the 3rd largest one-day gain for the Nasdaq, and the largest one-day drop for the VIX in history. And just in case you need a new financial advisor, the President tweeted that it’s a “GREAT TIME TO BUY!!!” not long after the market opened. How many more indicators do you need? Cramer’s Sunday crash warning was a nice (Contrarian) preview as well.

Yesterday, in both the newsletter and YouTube, we noted that VVIX- the index measuring future expected volatility of the VIX- finally reached its upper weekly Keltner channel, an event that can precede final large VIX spikes, but also the last box that may have been necessary to check off to see more of a deflation of the VIX. This process can take days, since the VIX can continue rising after such a spike, but we received fast confirmation today that it’s over (for now), with a further excursion beyond the upper boundary being harshly rejected as the market rallied. The VIX dropped into initial important support around 30, though we still see positive GEX and the largest cluster at 42.5.

SPX, which looked the most bearish yesterday, is perhaps the most short-term bullish index today. We mentioned watching the 4750 GEX cluster, which was large, and it definitely disappeared today, shifting expectations more bullish on our end. That cluster also disappeared in a timely fashion to allow readjustment prior to the time of maximum pain for shorts this afternoon, and intraday (0 DTE) GEX gave plenty of clues as well.

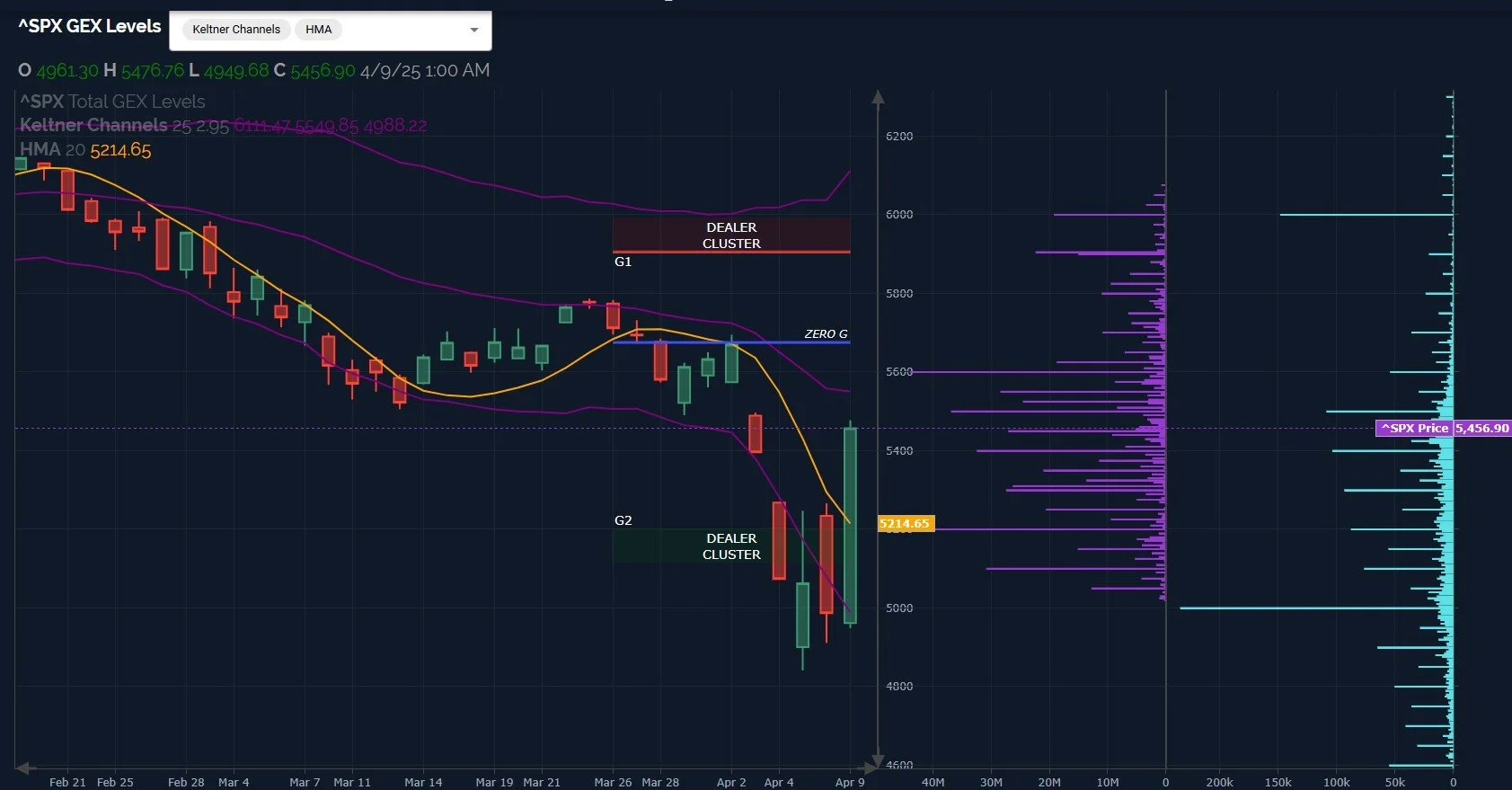

Most indices are already at their middle Keltner channel, which we’ll discuss momentarily, but SPX still has a little room to reach that spot, also coinciding with the approximate location of the downtrend line that goes back to February. Just as we were looking at the Hull yesterday for initial resistance (which proved correct), I now watch for consolidation or reversal at the 5600 area, also a large GEX cluster. Given the large move today, we may immediately decline and retest the Hull (another uncanny coincidence- 5200 is the largest GEX cluster currently), but a game of ping-pong may see both of those areas retested on the upside and downside in coming days.

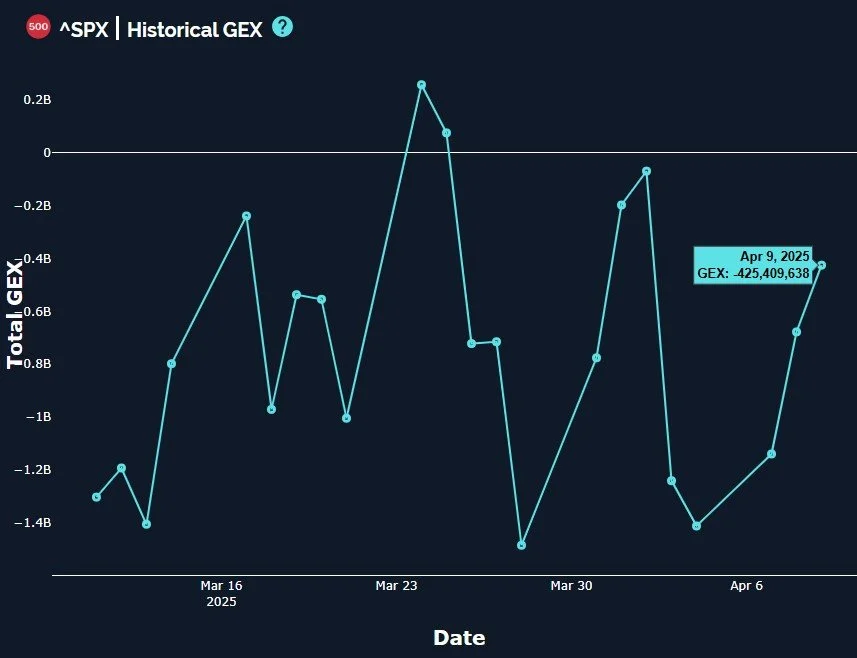

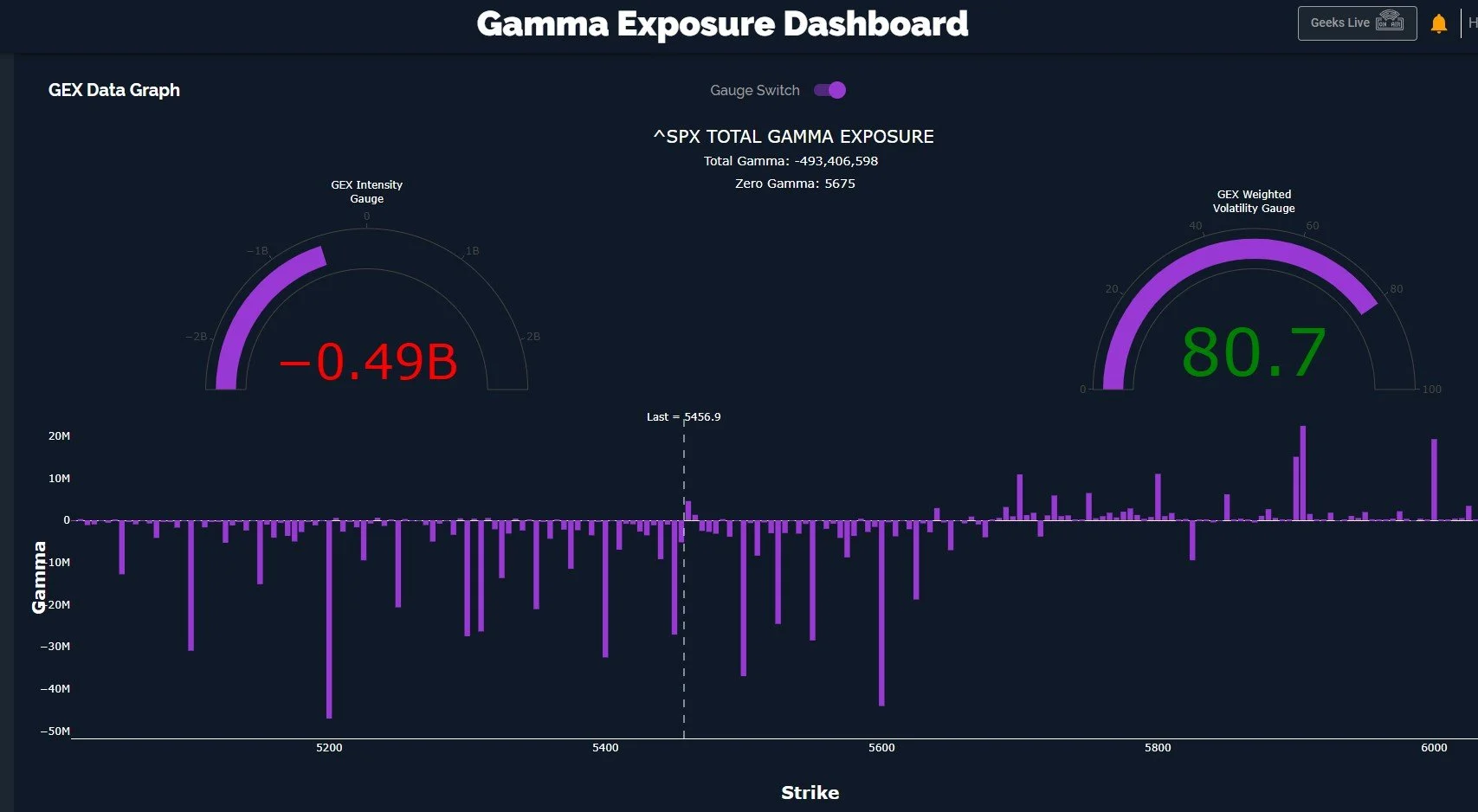

You would think all shorts would be extinct after a day like this, but SPX’s negative GEX only incrementally improved, still negative and about halfway between the zero line and the 1B we consider to be “solid” bearish trend territory.

We have the largest GEX cluster at 5200, as mentioned above, but 5600 is a close 2nd, and 5500 gets honorable mention. These relatively larger clusters can act as resistance/support levels, which we’ve been highlighting in Discord on an intraday basis.

QQQ has already reached the middle Keltner channel, also coinciding with the zero GEX level and a large Dealer Cluster. Once again, it would not be surprising to see a retracement back to the Hull at 435, and holding the Hull will be key to preserving the bullish picture. Hopefully GEX will give us additional clues as well.

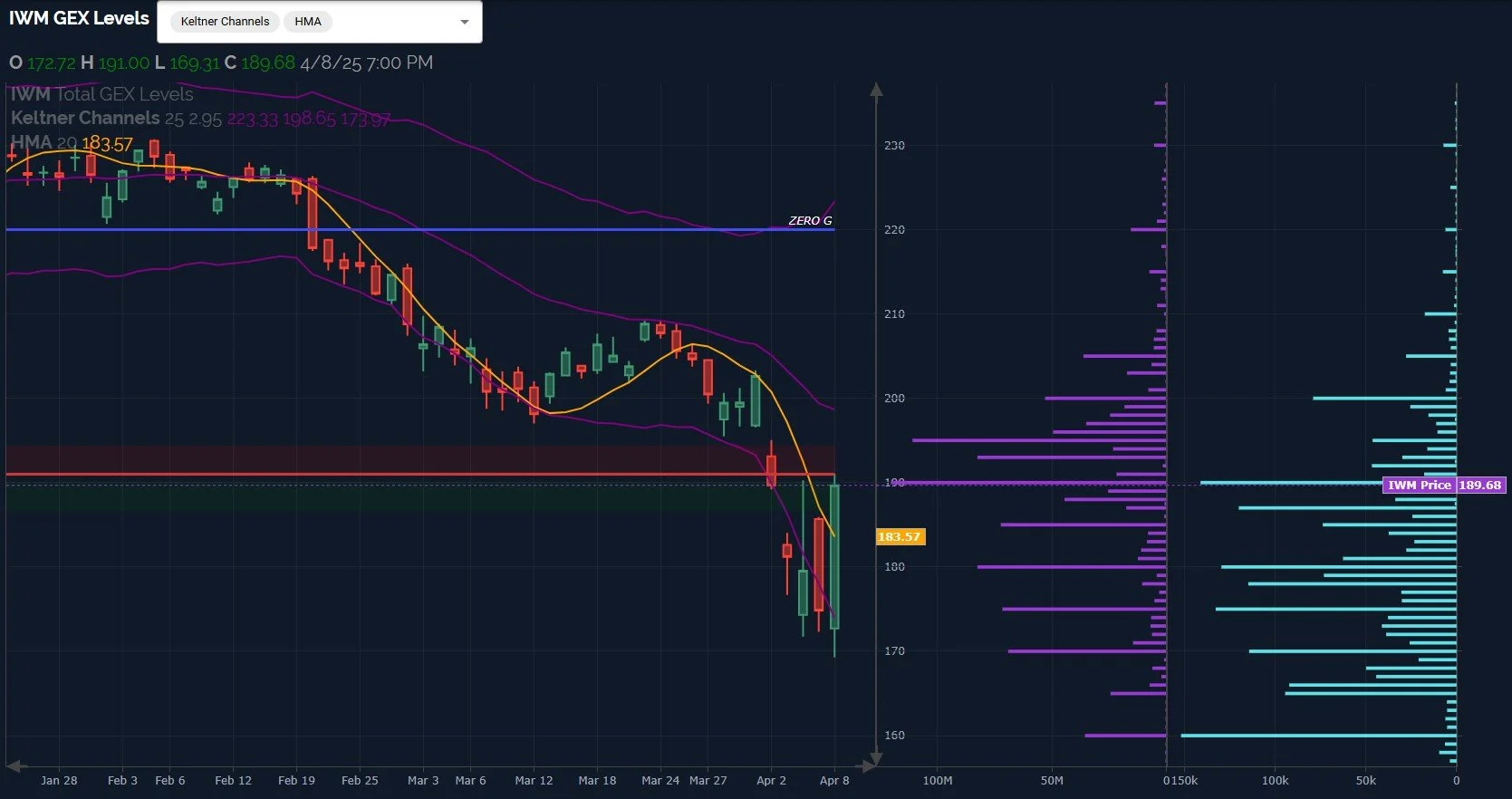

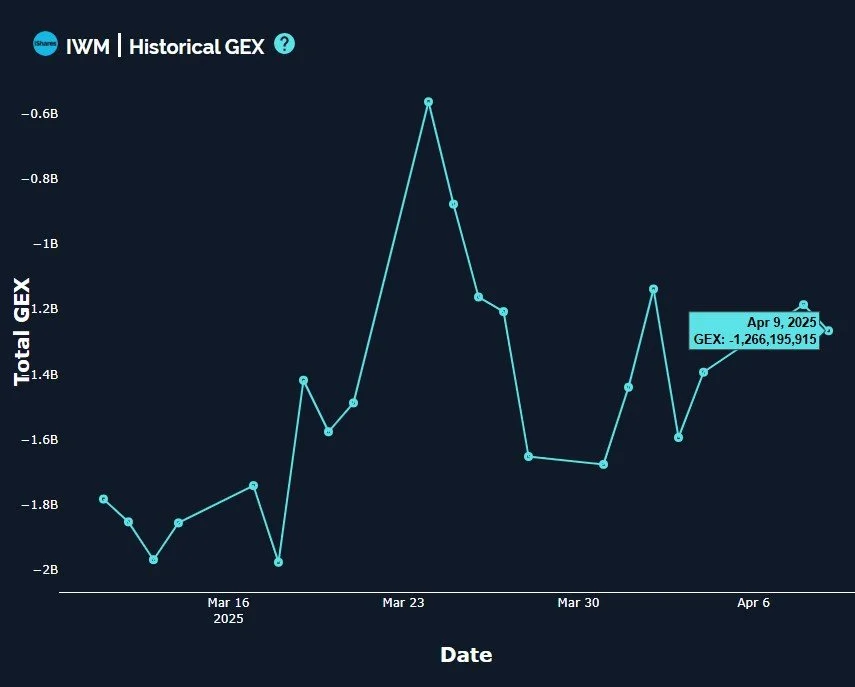

IWM couldn’t even make it past 190, a weak showing in my view. And GEX barely exists above 195, with small clusters at 200 and 205 before it really drops off. The highest volume was at 160 today.

In addition, IWM actually saw a reduction in GEX despite the increase in price. I find this concerning, because one would expect a fairly large reduction in negative GEX if the tide is turning, in theory. My current stance is that we have good odds to retrace soon, perhaps as soon as the CPI report tomorrow, and the next low (whether higher or lower than the recent low) will tell us a lot about what to expect next. Let’s see if SPX reaching its middle Keltner causes a temporary overshoot for other indices, and then we’ll see if GEX appears to be growing at higher strikes, or if SPX will have a potential date with 5200 or lower. Join us in Discord where we’ve been sharing quite a bit of alpha for free every day lately, including from our valued successful subscribers who sometimes post their own trades.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close yesterday (technical glitches impacted today’s recording), and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.