Opportunity Knocks Twice

Yesterday we said “A retest of the Hull..would be a realistic upside target in a continuation scenario,” and it happened faster than I thought, with all major indices reaching the approximate area of the Hull before lunchtime. GEX gave us a warning that SPX 5100 was a live target once we lost 5200, and it happened like bankruptcy…slowly, then suddenly. What’s next, a trip through the bottom of the floor, or another gap up? Let’s see what the data tells us is probable.

Tonight’s YouTube video (click here to view) covers the big indices and a few ideas not shared in the newsletter, yet both are free, so give it a watch as well. One chart you’ll see in both places is the chart for VVIX (below), showing the index that measures future expected volatility for the VIX. I notice VVIX has finally tagged the upper weekly Keltner channel, which is actually a decent contrarian signal for market bulls that the VIX spike may be near its end. That said, VVIX may also be signaling that the VIX needs more time, though historically we can see spikes over the weekly Keltner rarely last more than 1-2 weeks tops. That can seem like a long time when the market is falling, but the wait can be manageable by trading smaller size and longer expirations with options, at least in my experience.

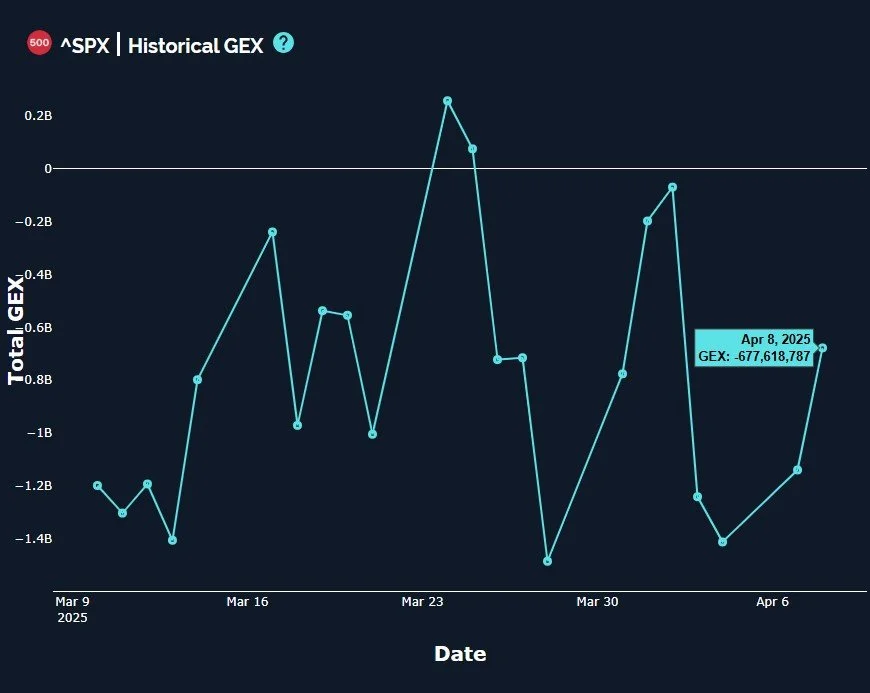

Looking at SPY/SPX, which still show divergent total GEX pictures, we see the first retest of the Hull is complete, and a relatively unsurprising rejection occurred. This places SPY back in the lower Dealer Cluster zone, though SPX is still focused on 4700-4800. My general rule is short below the Hull, long above the Hull, but with conditions this oversold, a tradeable bounce (other than the nearly 10% move we saw yesterday and today) may be near, though that trade is a contrarian trade and not a momentum trade. The current momentum remains generally to the downside.

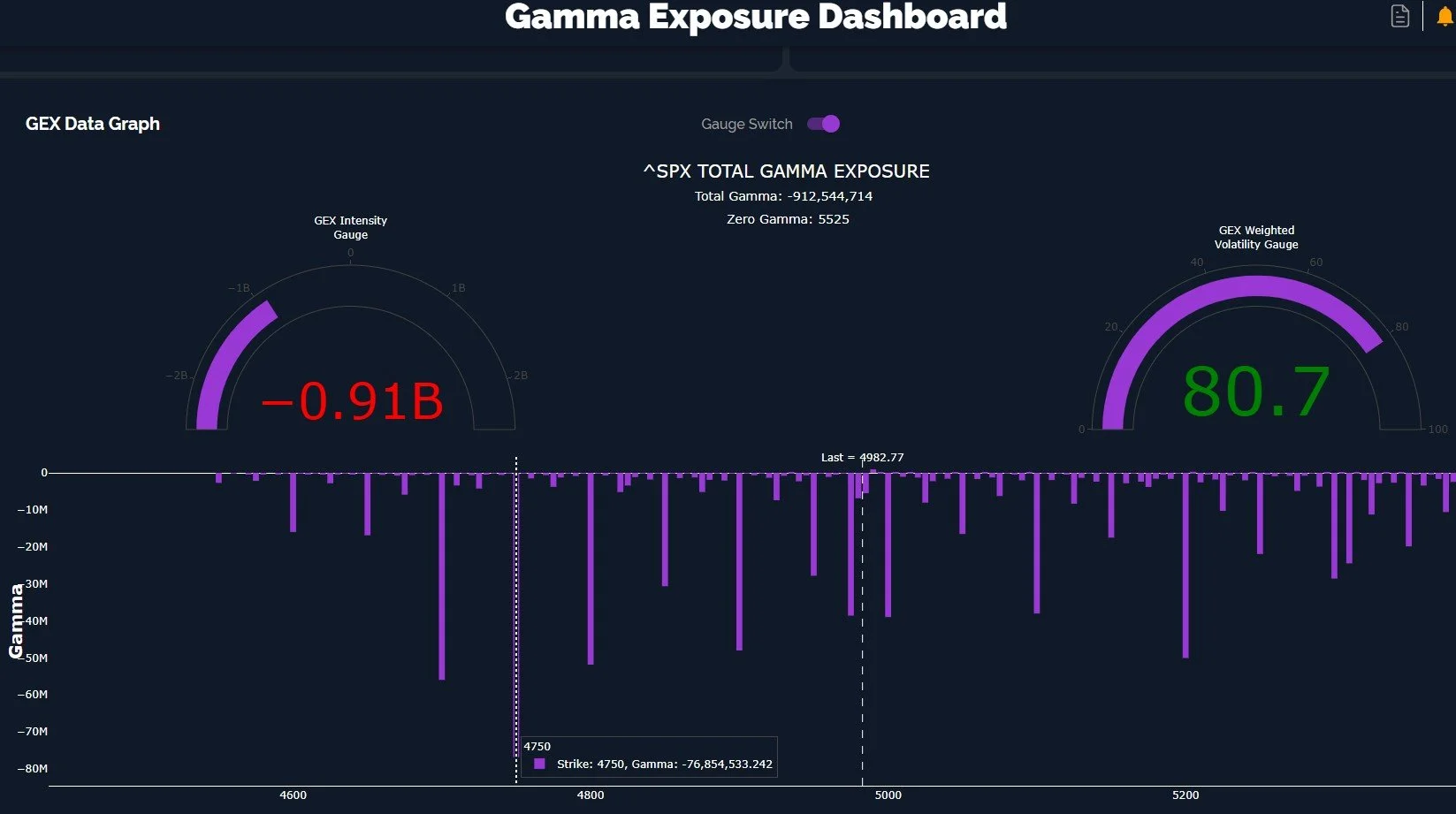

As mentioned above, SPX still shows a stubbornly large GEX cluster at 4750. I will note a positive: We aren’t that far from 4750, and I am glad to not see meaningful GEX below 4700 as of now. The lack of negative GEX below a certain level may imply a lack of expectation or interest in betting that the market will drop below those levels, and potentially mark the low for a move. This idea has held true at times in the past, but it’s always a risk that the future may be different than the past, of course.

Another positive divergence- SPX saw a sharp increase in GEX (decrease in negative GEX) this morning and held onto most of that shift, even in the face of a steep intraday decline. To summarize, GEX is still negative, but it has improved a lot, and we aren’t seeing a lot of new GEX clusters added at lower strikes. 4750 is a large GEX cluster that remains “sticky” the last couple of days, so we may very well see that level soon. It remains to be seen whether we go straight there tomorrow or if we zig zag more beforehand, but as long as SPX shows the largest GEX cluster at 4750, I’m expecting that zone to be tested before all is said and done. Will mark the low for the year?

Before we wrap up, let’s shift to a one-off idea, one that is part of the transport sector, but with a domestic focus, UNP. UNP made a lower low today, and it’s printing red candles seemingly every day. But most of the GEX is at higher strikes, as well as the largest volume. A lot of the GEX is clustered around May/June, so I won’t be too eager to look at short terms strikes (except possibly put selling strategies).

UNP GEX also just went back to positive, so we have a fairly steady GEX picture, even though it doesn’t look super bullish. A rebound is all we need, and GEX seems to suggest UNP has good odds to rebound from this selloff.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.