Which Divergence Will Win? December 31 Stock Market Preview

We’re offering a special deal to kick off the new year- $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can view today’s YouTube video here. We take a look at SPX, IWM, ETH, HOOD, and PLTR, so check it out if you have a few short minutes!

Indices continue to trade in a tight range for the most part, while the VIX made its low last week, printing higher lows since then.

The VIX remains above the daily Hull, a positive sign for volatility, yet the Hull is still declining, possibly indicating that attempts by the VIX to rally may not go far for the time being.

GEX remains positive for the VIX, with noteworthy GEX at the 20 strike and higher.

Any near-term VIX spike may find immediate resistance at 20, at least based on the current GEX picture and the upper Keltner channel at 20.06. The VIX rarely respects exact lines and levels, so I think in general terms when identifying targets to the upside and downside for the VIX.

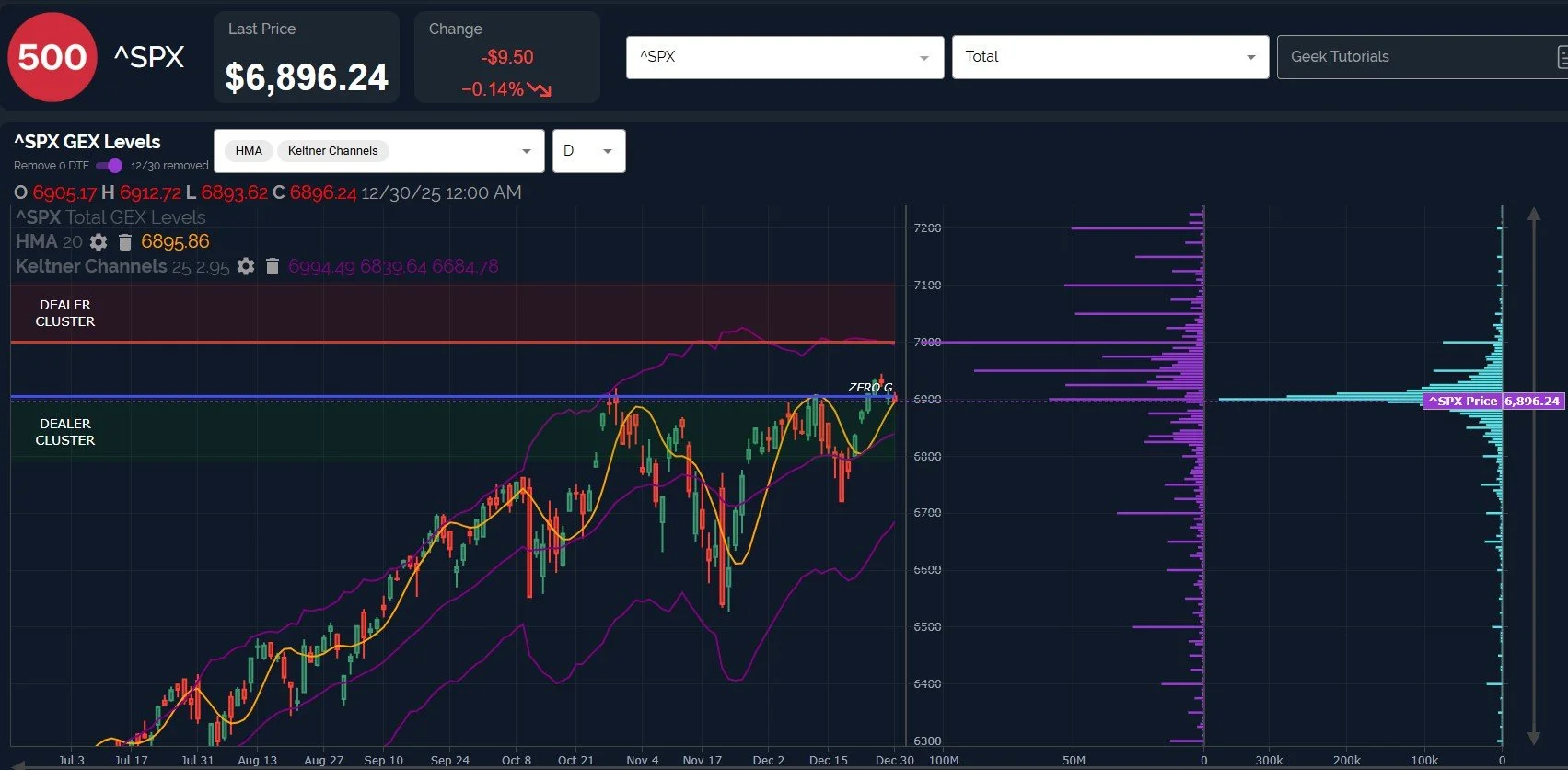

SPX remains one point above the daily Hull, and the net GEX picture shown below (GEX clusters are purple) demonstrates SPX’s skew toward higher strikes.

The daily Keltners indicate possible indecision, with the upper channel flat while the lower channel is rising, though 7000 still appears as a target and odds favorite.

Geeksoffinance.com

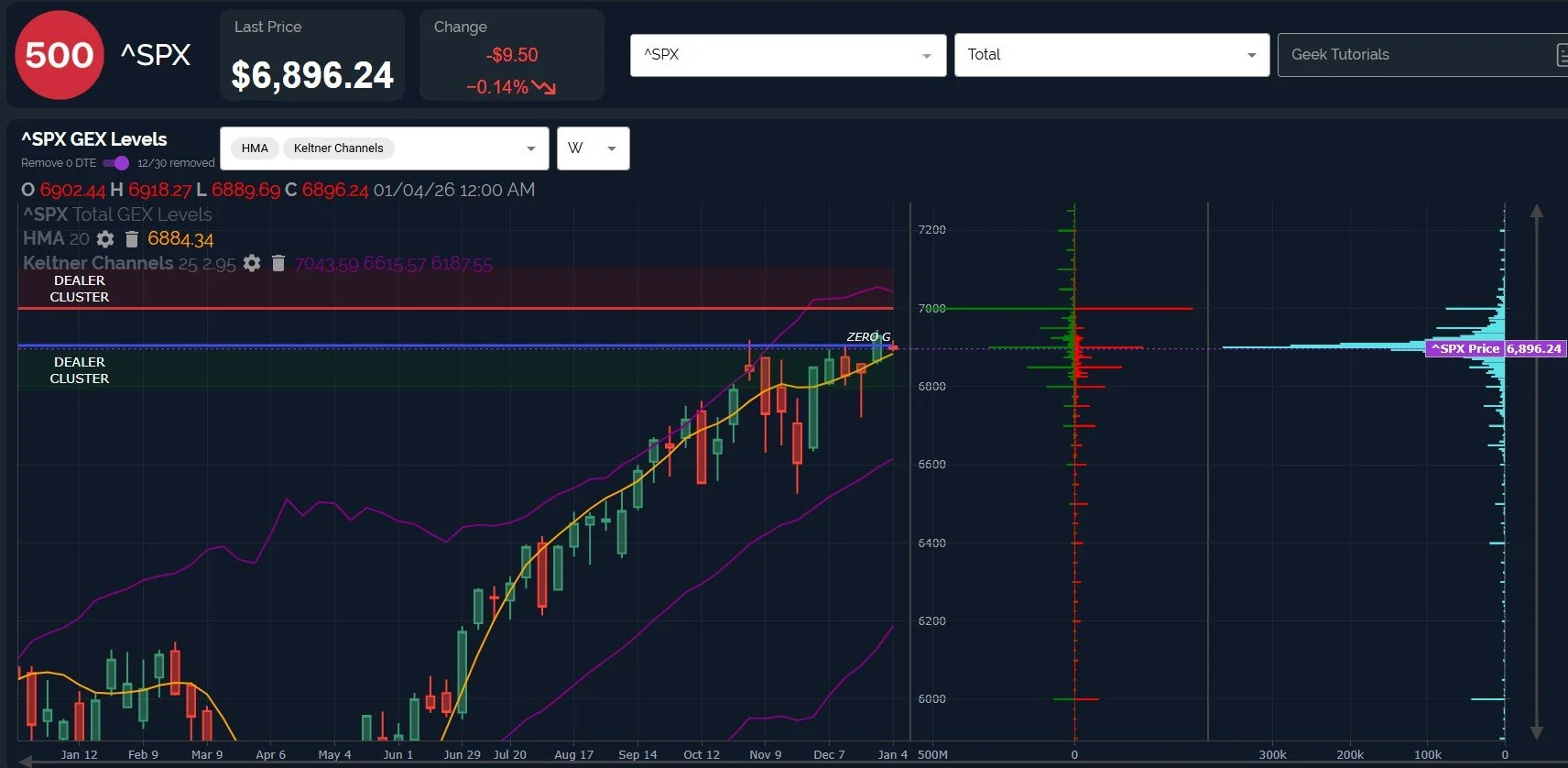

The weekly chart shows SPX is also holding above the weekly Hull at 6884, and areas of potential support can be seendown to 6800, based on GEX.

SPX net GEX has remained positive (though within a neutral range), and today we saw an increase in net GEX by the close, so it’s hard to get bearish without more technical damage as well as GEX shifts toward the negative side. In the meantime, it’s likely that dips are buying opportunities as opposed to chances to shift net short, in our view.

Geeksoffinance.com

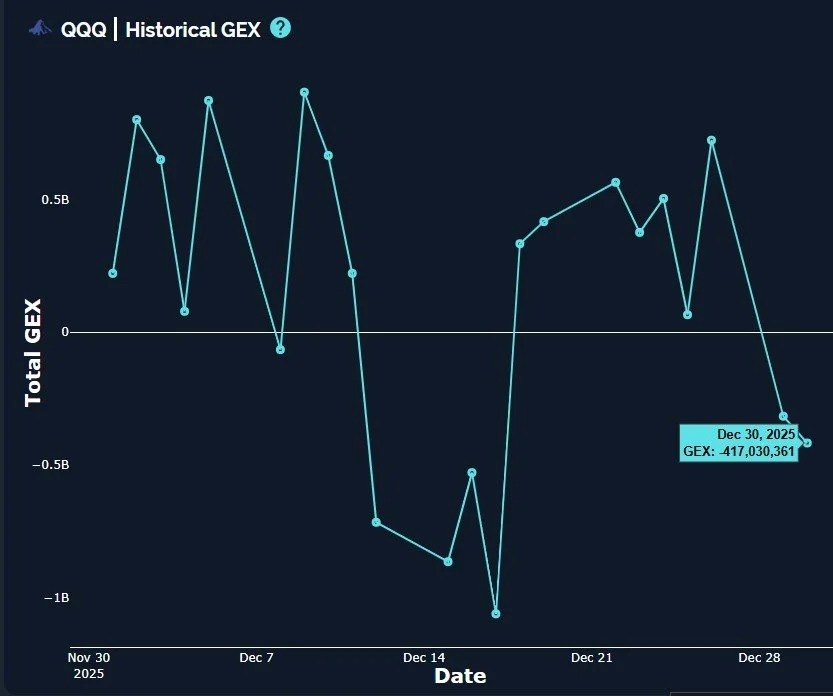

While I prefer to give greater weight toward what we see with SPX, QQQ saw a continued divergent shift toward the negative side in terms of net GEX.

Does this shift imply some sort of upcoming price divergence between QQQ and SPX, or are we seeing a GEX reaction due to retail positioning?

Geeksoffinance.com

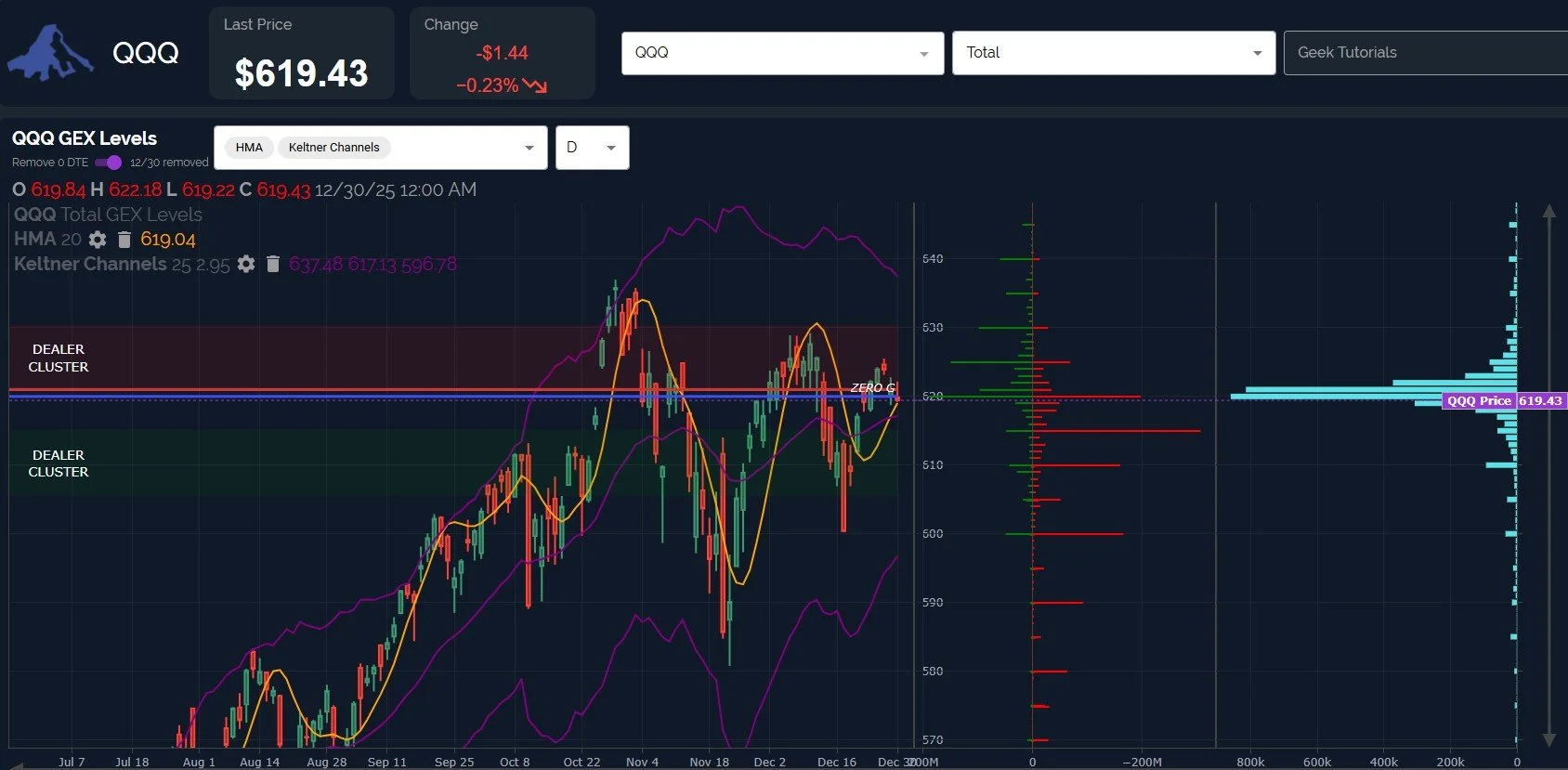

QQQ is also narrowly above the rising daily Hull, technically maintaining the potential to spike higher, despite the shift toward the negative in terms of GEX.

600-610 continue to be the most likely downside targets if we dip further away from 620, at least according to the current GEX picture.

Geeksoffinance.com

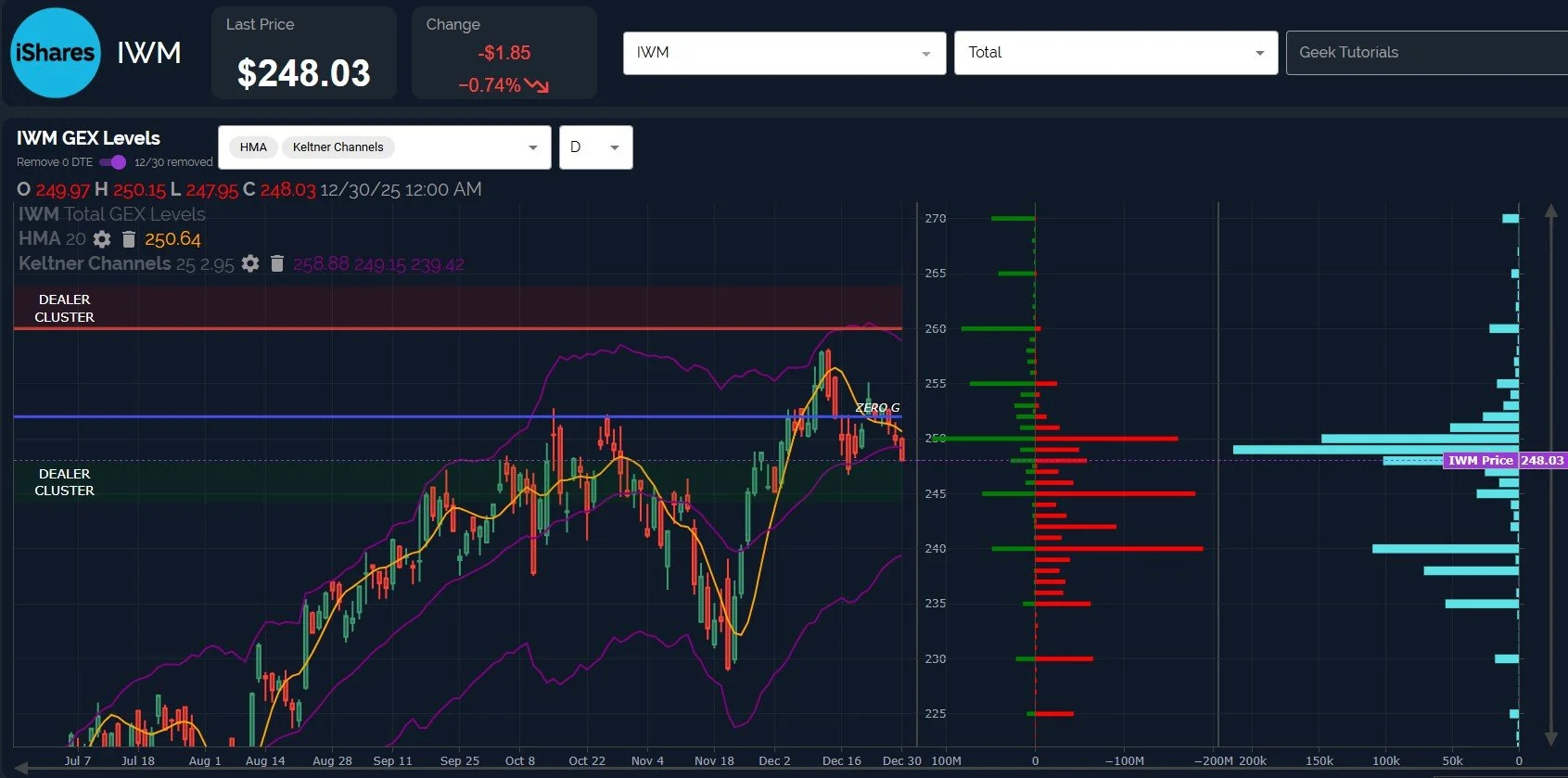

I think IWM paints perhaps the most immediately concerning picture, though I would say it also might be most supportive of the idea that any further dip is likely a buying opportunity. What do I mean?

Well, it’s true that GEX is negative, and we see the daily Hull turning lower, and 240-245 are potential targets in terms of large net negative GEX clusters at those strikes.

tradingview.com

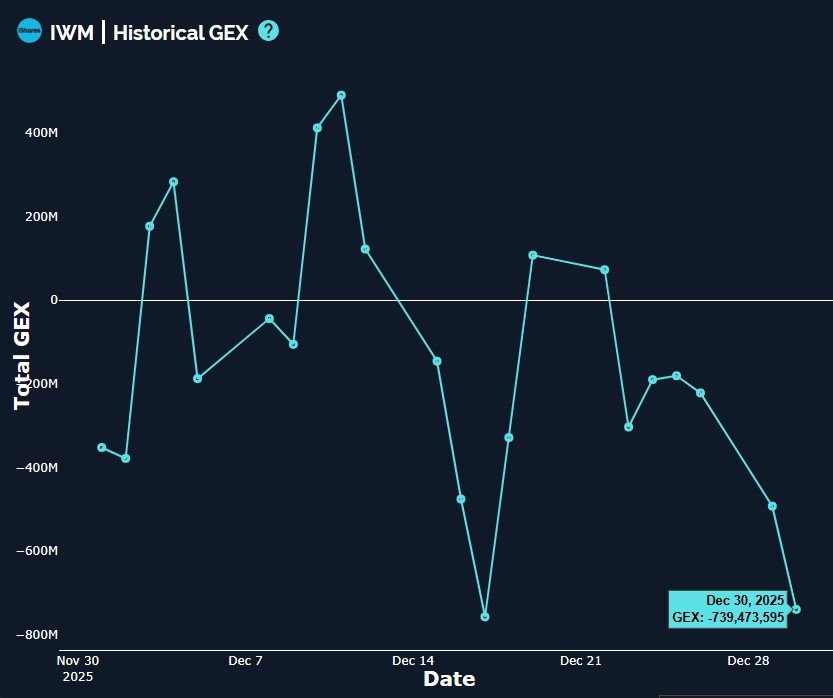

We also see another plunge lower in terms of net GEX, but notice the last time GEX dropped this low on December 17? that happened to be a recent low point. So it’s possible that IWM GEX plunging too far, too fast may be a contrarian signal here.

I’m inclined to view a dip toward 240 to be a buying opportunity, though tagging that area this week may indicate that the move to SPX 7000 is postponed..We will have to see what happens!

We’ll be active in Discord this week, and we’ll share more info in our free channel as we enter the new year, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.