Santa Rally On The Ropes? December 30 Stock Market Preview

You can still get $300 off of the annual Portfolio Manager subscription for a few more days, enter code NEWYEARS26 at checkout!

You can view today’s YouTube video here. We take a look at SPX, IWM, the VIX, and TSLA, so check it out if you have a few short minutes!

The VIX gapped well above the daily Hull Moving Average, triggering a long volatility signal, according to my personal methodology. The gap was basically filled by the end of the day, with the VIX still closing one penny above the Hull, maintaining the VIX long signal.

We’ve noted for roughly a week that the VIX showed unusual positive net GEX, even in the face of a declining VIX, and that equal (or consistent) treatment of positive GEX environments- regardless of the instrument or index- means that the VIX decline could be treated as a “buy the dip” opportunity for VIX longs.

I think another concern I have (other than the VIX showing positive GEX, a lack of meaningful GEX below 14, and closing above the Hull) is that SPX wasn’t able to rally despite the VIX crush from 15 back to 14.20, which I personally (and speculatively) interpret to say the VIX is edging closer yet again to a point where it may exert itself to the upside.

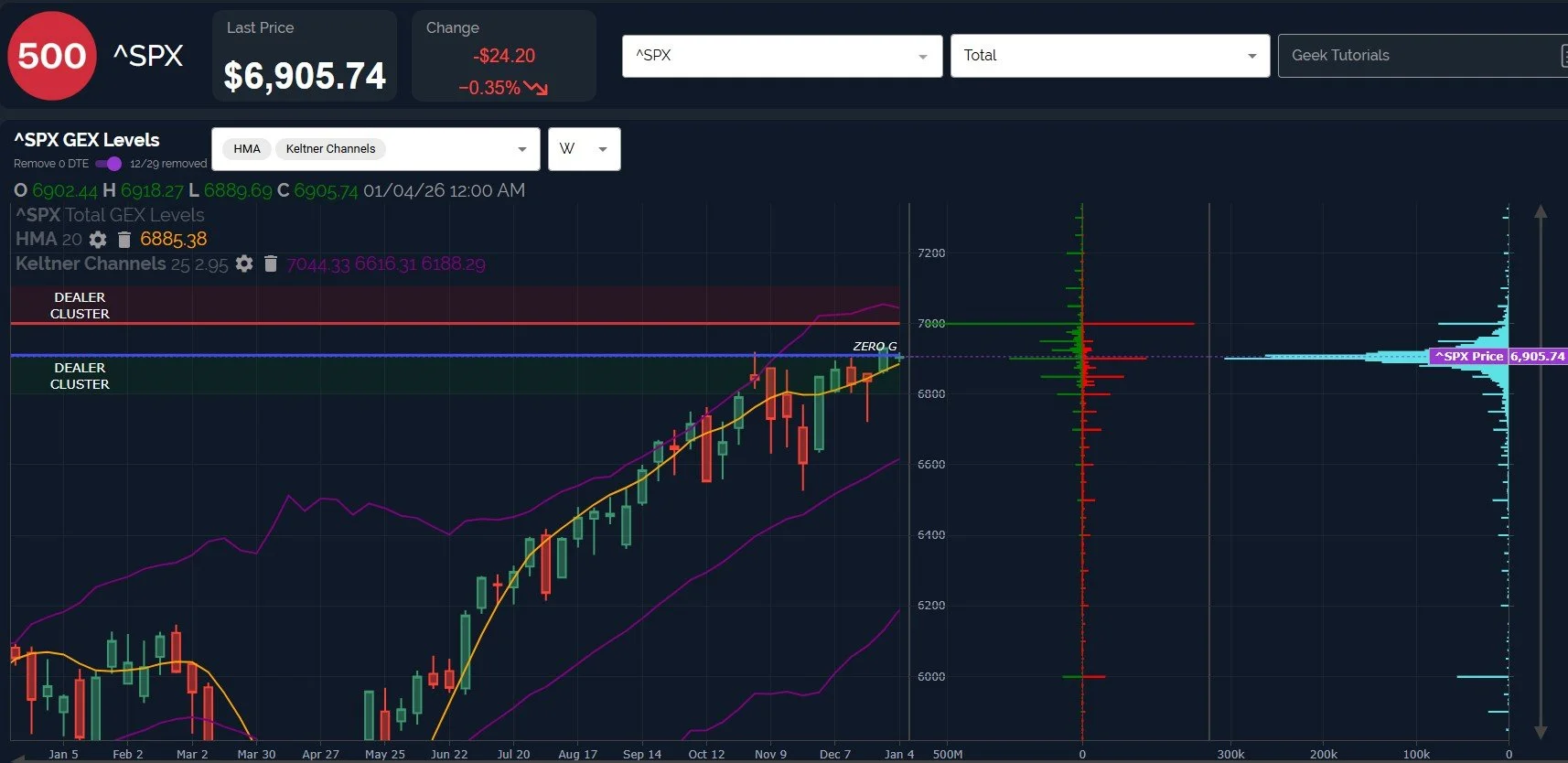

Does this mean SPX is more likely to drop this week? We have the big GEX cluster at 7000 still looming, with a lot of it expiring 12/31, so GEX still suggests good odds of reaching 7000, even though GEX declined overall today (net GEX is still positive for SPX).

SPX also closed above the Hull, in conflict with the VIX closing above the Hull as well.

A loss of 6885 on a weekly close may imply trouble ahead, and that level is rising daily, so we’ll want to keep an eye on price action around this line.

Geeksoffinance.com

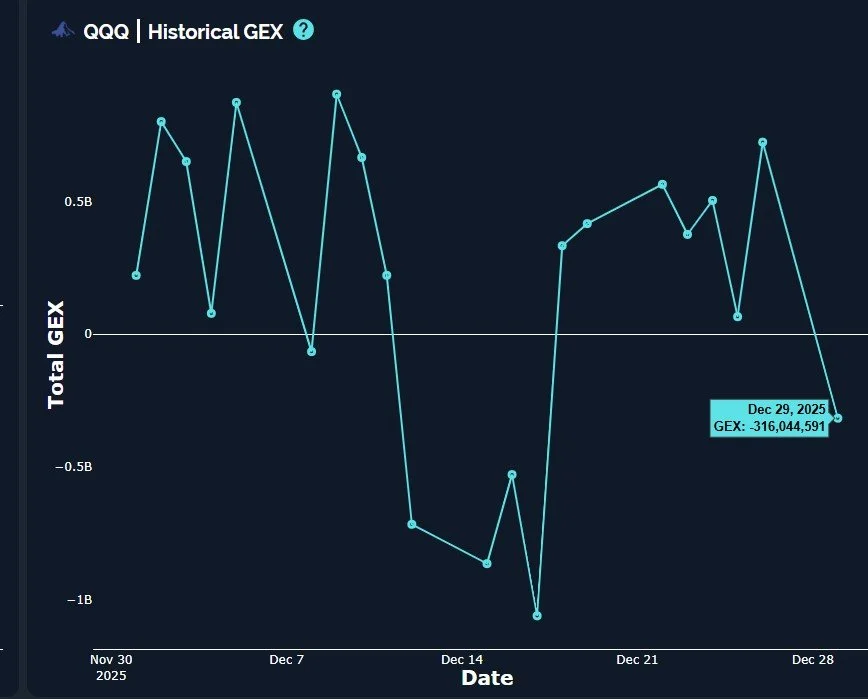

QQQ had a more extreme reaction in terms of GEX, with a significant drop into negative territory.

Geeksoffinance.com

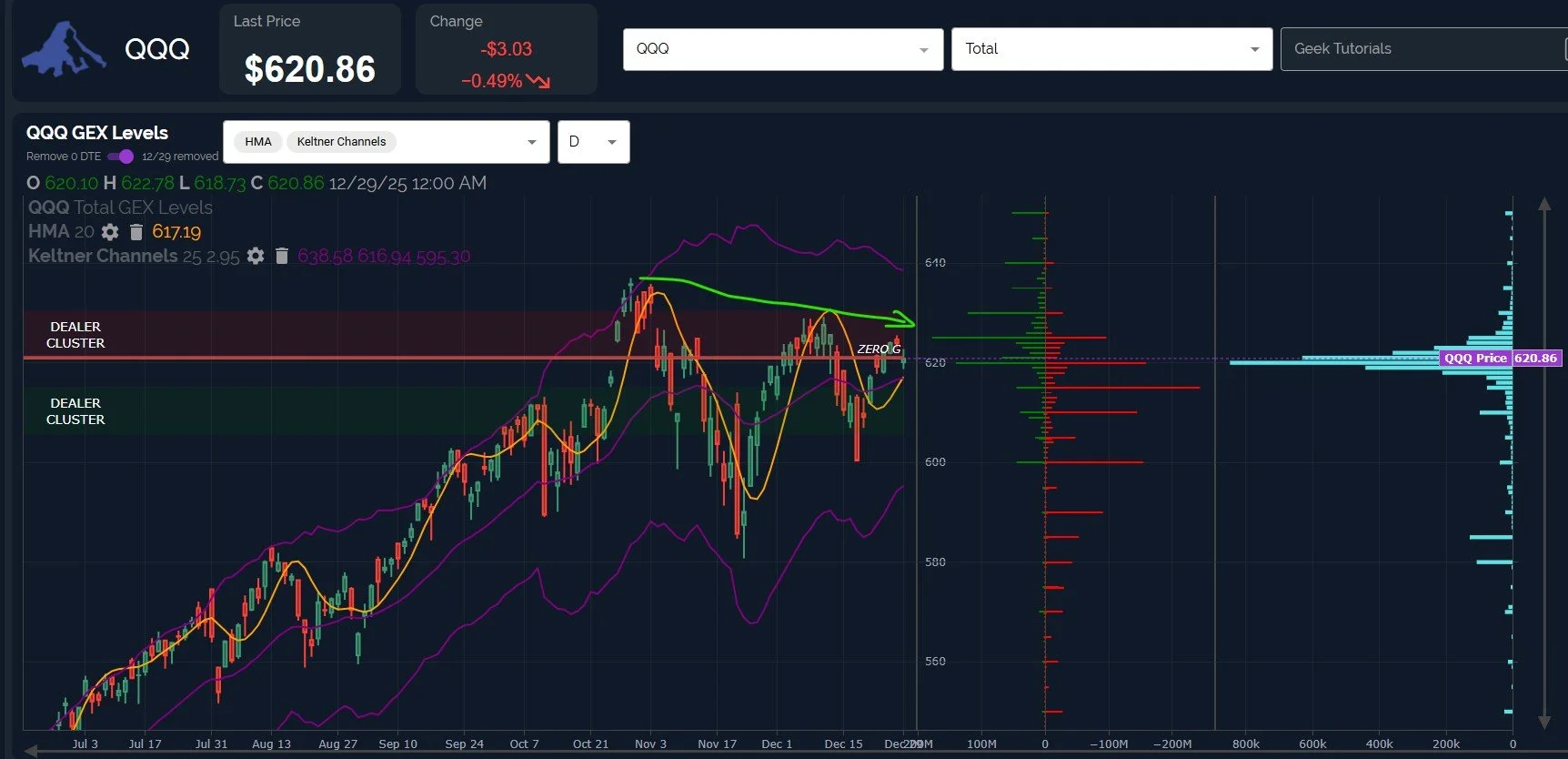

We’ve also been highlighting the concerning pattern of lower highs for QQQ since October, though we should also point out that we’re seeing higher lows, at least since November.

The consolidation pattern is indecisive at best, but also at worst, leading us to conclude that QQQ could break either way, at least judging by some metrics.

The daily Hull is still supportive of higher prices, curling upward, and today’s closing value is still above the 617.19 Hull.

GEX at 620 appears to be a significant area, followed by 610, so GEX doesn’t currently paint a picture of significant downside potential, despite being net negative.

I’m viewing 617-620 as an uncertain “chop” zone, holding above 620 on a daily close suggests to me a potential move to 635, and a loss of 617 implying high odds of 600-610.

Geeksoffinance.com

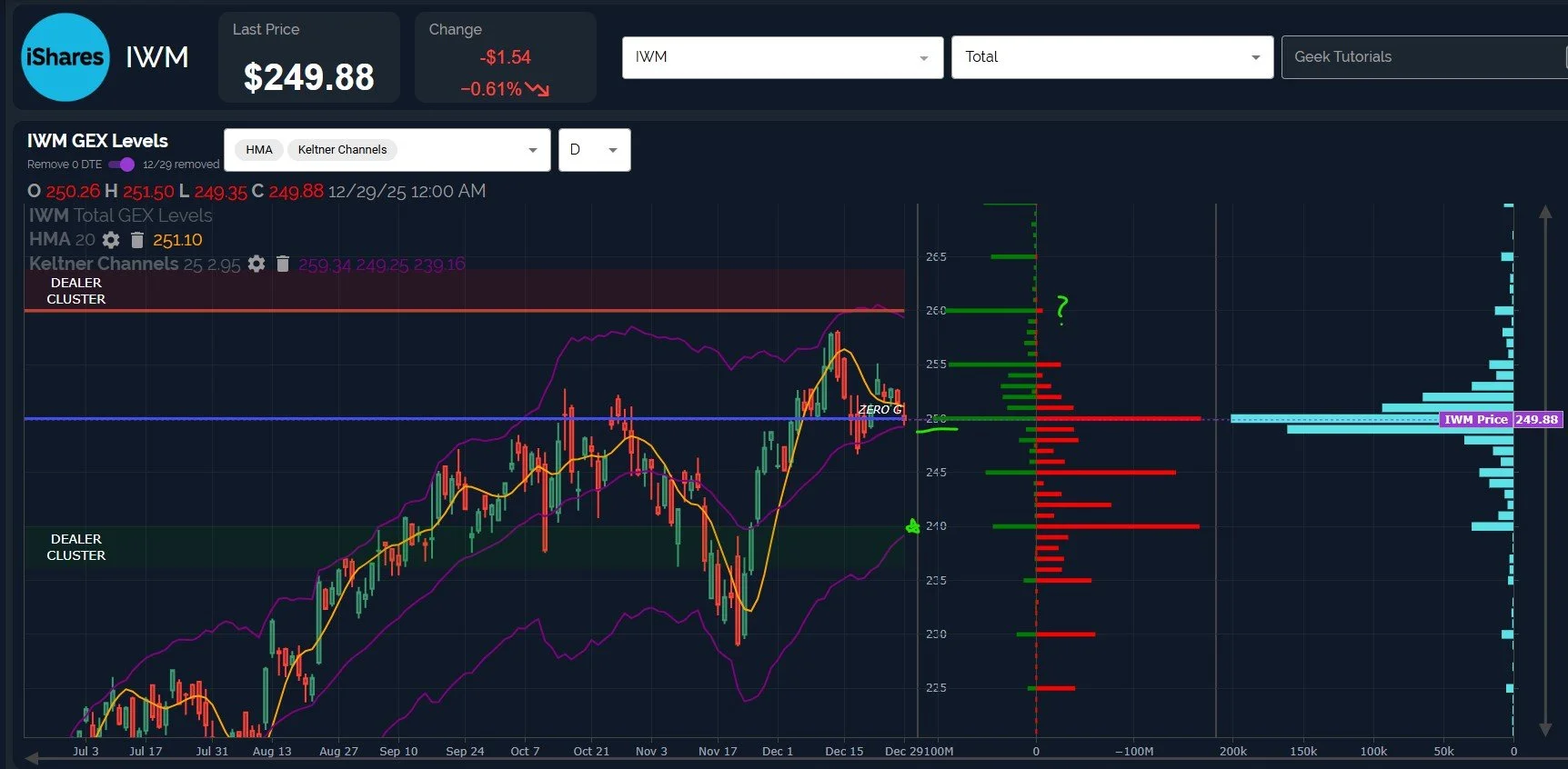

In my view, IWM is better at showing us where we might be headed, while QQQ sometimes reflects where we’ve already been, if that makes sense (maybe because more retail traders gravitate towards QQQ?).

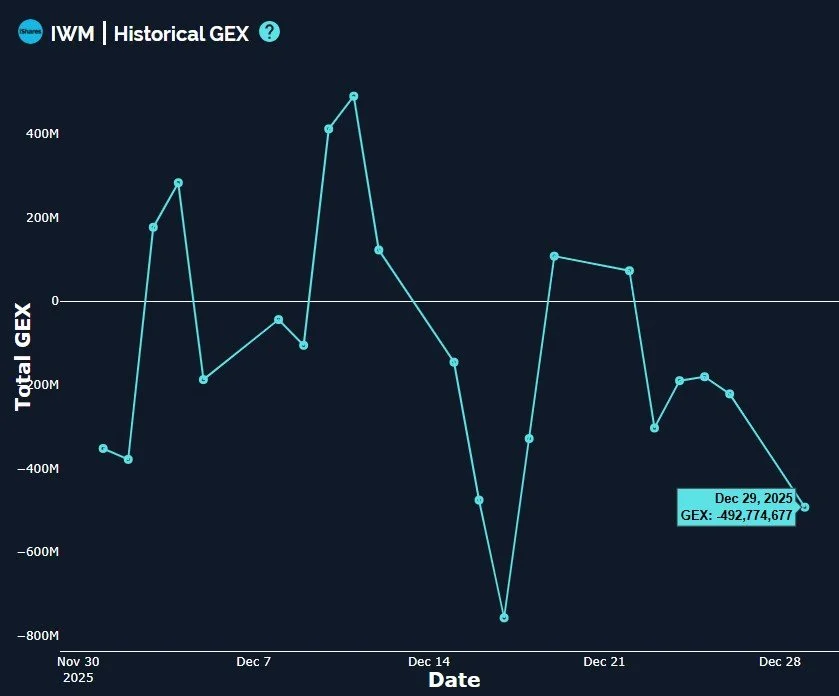

IWM net GEX showed a sharp drop further into negative territory, a trend now in place for over a week, with lower highs going back to early December.

Geeksoffinance.com

IWM’s chart still looks constructive for bulls overall, and I can’t help but think the strong move up since mid-November is setting up for another push higher.

But today we did see a close technically below the big GEX cluster at 250 (though close enough to prevent any sort of confidence on my part), and below the Hull at 251.

Along the lines of what we see with QQQ, IWM is in a general zone of indecision that we’re guessing will resolve in short order as we approach the beginning of the new year, with a daily close above 250 tilting the odds toward a tag of 260, and immediate continuation below 250 implying a potential tagging of the largest net GEX cluster at 240.

tradingview.com

We’ll be active in Discord this week, and we’ll share more info in our free channel as we enter the new year, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.