SPX’s Long-Awaited 7000 Target Is Near: December 29 Stock Market Preview

You can still get $300 off of the annual Portfolio Manager subscription for a few more days, enter code HOLIDAYS2025 at checkout!

You can view today’s YouTube video here. We take a look at SPX, QQQ, the VIX, GLD, and AAPL, so check it out if you have a few short minutes!

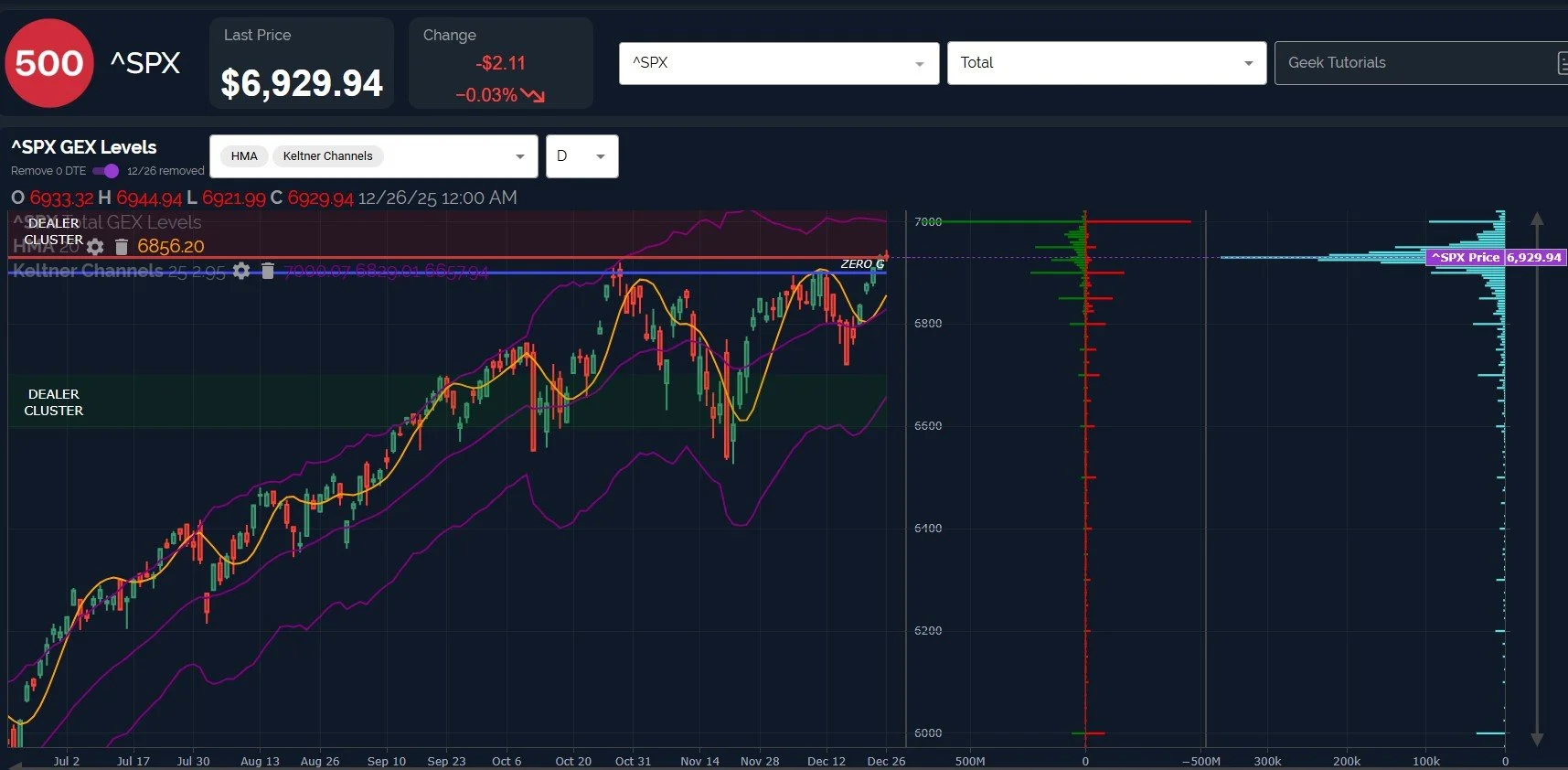

SPX stalled at the lower edge of the upper Dealer Cluster zone Friday, though failing to achieve any meaningful downside. Net positive GEX at 7000 remains elevated for the 12/31 expiry.

The persistence of SPX to stay neutral or positive over the last several trading sessions has allowed the Hull Moving Average to curl upward, narrowing the gap between the Hull and SPX’s price.

SPX is still somewhat elevated above the Hull, implying a gap that still may be closed in coming days, but any move lower may find support at the 6860 area.

GEX is still very positive for SPX, but it has declined 3 days in a row following the extreme positive reading at over 4B. The extreme GEX Intensity Gauge reading may prove to be a good contrarian signal, but the timing of any ensuing decline cannot be determined with exactness based on this metric (typically within a few days, though).

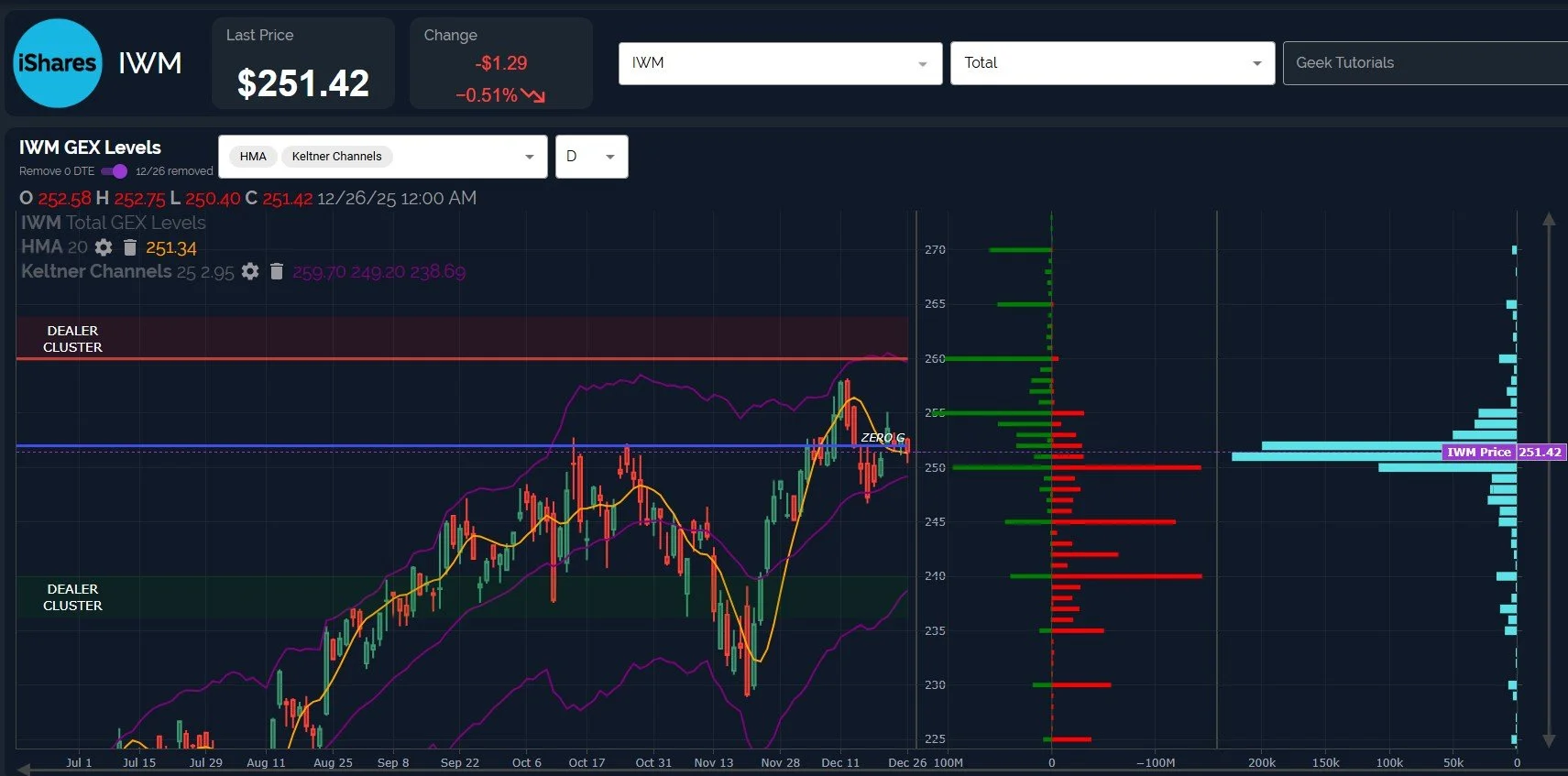

IWM continues holding above key GEX at 250 as well as Hull support at 251.34, and the Keltners continue pointing higher, indicating good odds for a tag of the upper Dealer Cluster at 260.

A loss and close below 250 increases the odds of a drop toward 240, so Monday we will watch action around the 250-251 area for potential clues as we head into Wednesday.

Geeksoffinance.com

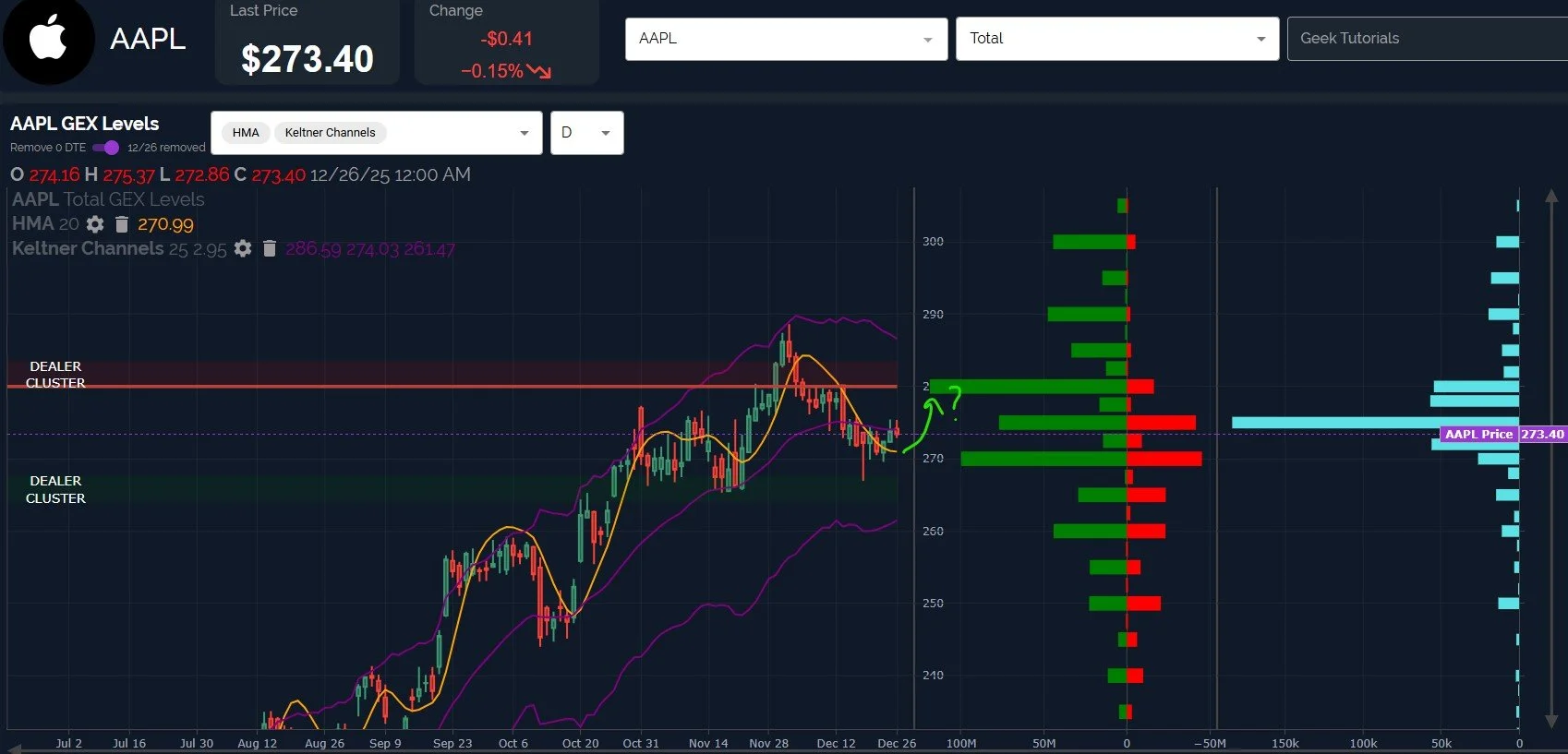

AAPL, though likely rangebound for the immediate future (based on GEX and the chart), still appears to have decent odds of a 280 tag this week. Price has slowly crept higher and the Hull is turning.

As long as AAPL remains above 270, we will look higher, at the moment.

Geeksoffinance.com

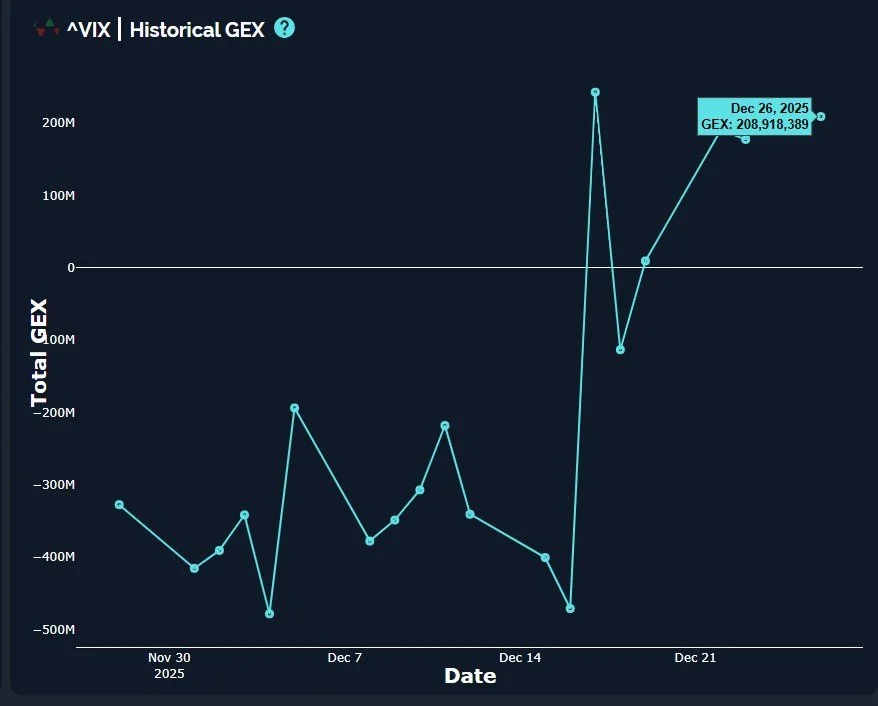

The VIX continues to reflect a GEX position that is at odds with the idea of a new “runaway bull” for indices, despite losing the 14 strike and sitting at lows of the year.

The positive GEX structure is potentially a “buy-the-dip” environment for volatility (or perhaps a different hedge for your portfolio), with obvious positive GEX targets ranging from 20-47.5, and very little GEX below 13.

Geeksoffinance.com

The VIX’s positive GEX has been persistent since mid-December, possibly signaling that (once again) the VIX is reaching a reversal area.

Even so, such a reversal can take time, and low VIX levels can last for quite some time, so we need some tactical references that might help us to narrow down when a reversal may be closer to occurring..

Geeksoffinance.com

I’m watching both the 2-hour and 4-hour charts for assistance with the potential timing of a VIX reversal, as well as the daily chart.

The Hull at 14.61 is heading lower, so we will look for a potential reversal at the point where we see the VIX either exceed and close above that declining line, or if the Hull declines to a point of crossing below the VIX.

tradingview.com

We’ll be active in Discord even during this shortened holiday week, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.