Extreme GEX Heading Into The Santa Rally? December 24 Stock Market Preview

You can still get $300 off of the annual Portfolio Manager subscription for a few more days, enter code HOLIDAYS2025 at checkout!

You can view today’s YouTube video here. We take a look at SPX, IWM, the VIX, , so check it out if you have a few short minutes!

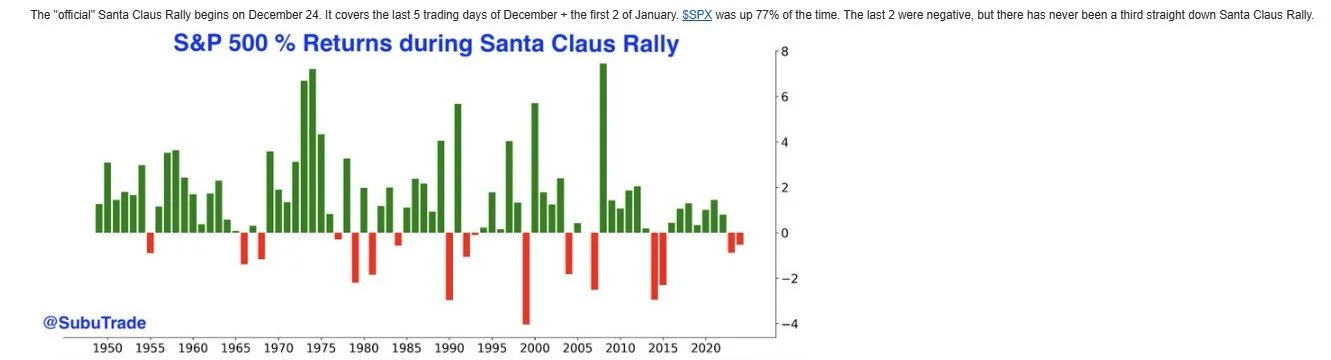

Tomorrow begins the “Santa Rally” into the first two trading days of January, which carries a 77% chance of being positive, according to SubuTrade.

Intriguingly, at a 10-year interval, we’ve had two periods of 2 negative years in a row, but there has never been a third. Well, there’s always a first, right? Sorry, that’s sounding like the optimistic view of a pessimist.

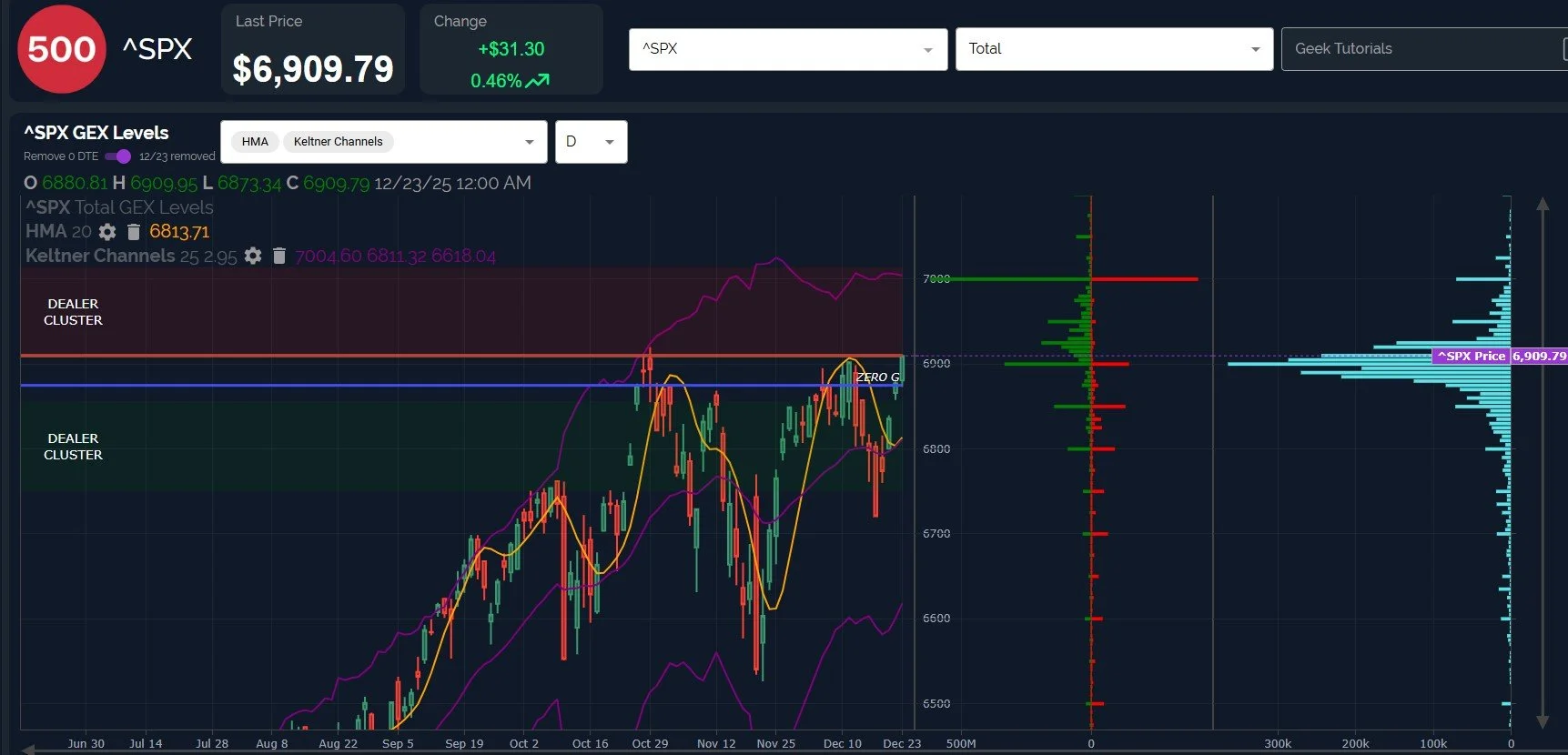

SPX has reached the upper Dealer Cluster zone, which extends to 7000. The Dealer Cluster zones represent the largest net positive and net negative GEX clusters at the time, and we view those zones as likely areas for dealer selling pressure (the upper zone in red) or buying pressure (the lower zone in green).

This upper zone implies that while SPX can continue straight to 7000, such an occurrence is not necessary for a pullback, which can start at any time.

Further analysis of the technical picture shown below reveals SPX’s price to be quite far extended above the Hull Moving Average.

The Hull is beginning to turn upward, currently at 6814 (a bullish sign), but the distance between price and the Hull likely implies a short-term pullback before continuation higher.

Geeksoffinance.com

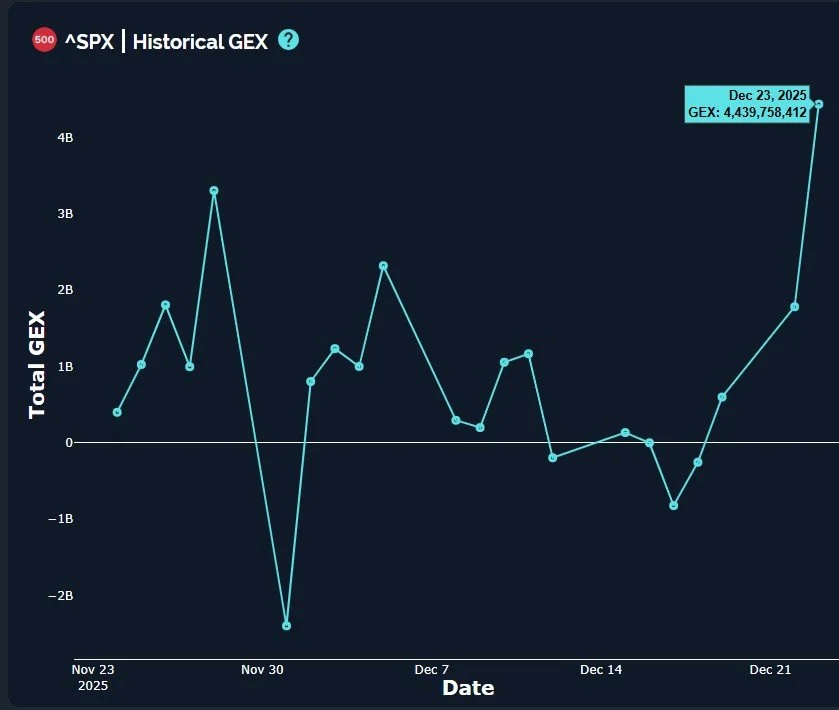

SPX historical GEX is off-the-charts positive, which is actually more of a contrarian signal in the short run, though continued readings above 1B are considered bullish.

Geeksoffinance.com

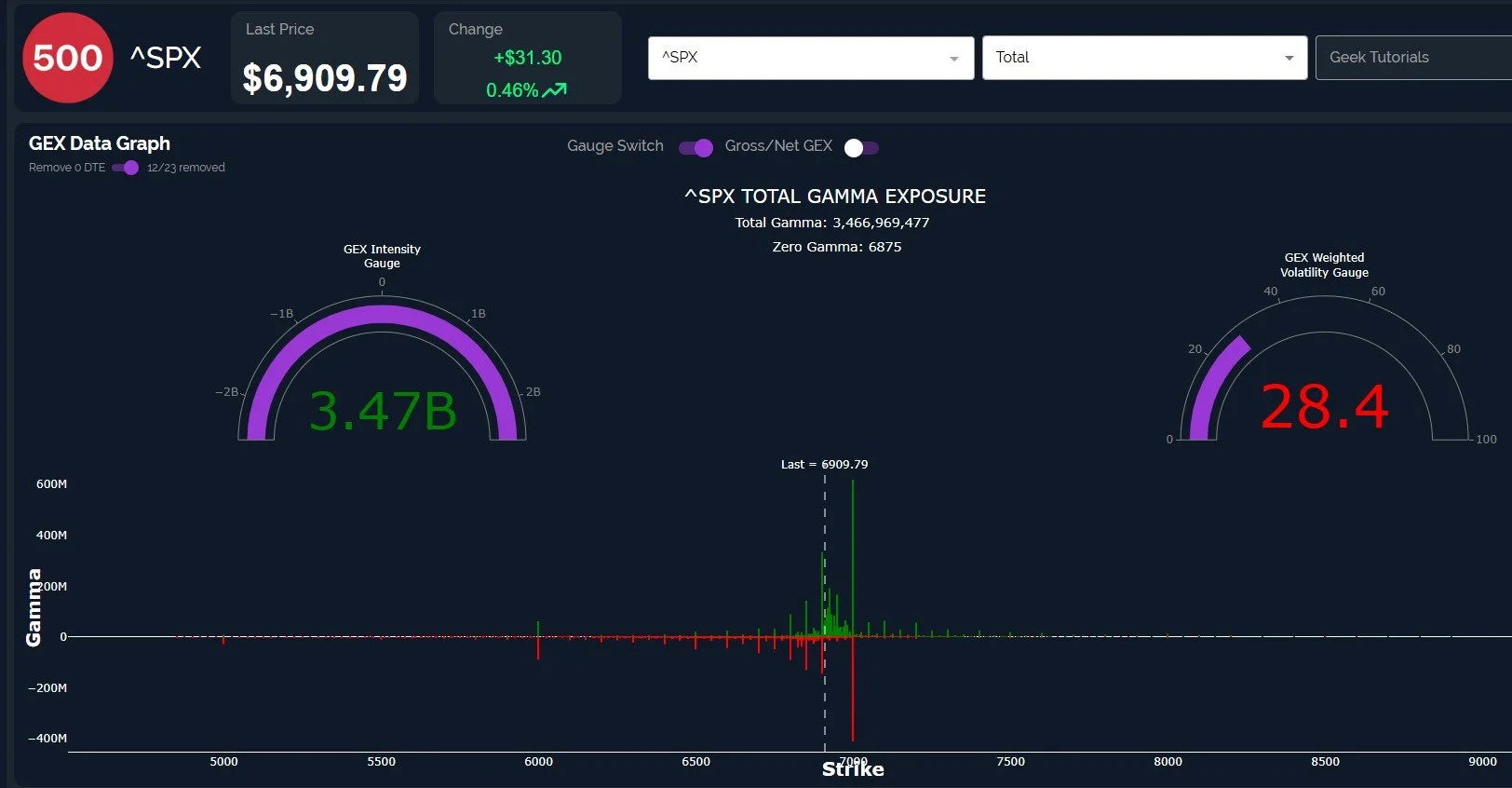

To look at the current net GEX reading from a different perspective: Our GEX intensity gauge compares the current reading (well, the graph above shows the reading at the exact cash close, the one below shows some shifting after market close) with GEX readings over the past 52-weeks, and it’s an extreme reading.

SPX extreme GEX readings do not happen very often, though we may see such readings a small number of times each year, typically at key shorter term turning points. The signal is not an exact timing mechanism for reversal, but we often see a pullback from extreme positive readings within days, not weeks.

Given the last two years of negative Santa Rally performances, could this be an unheard-of 3rd year of decline during this period? If so, I propose we rename the Santa Rally the Grinch Pullback.

Geeksoffinance.com

SPX’s 2-hour chart shows the Keltners rising, which is bullish, yet price is below the Hull, which is about to meet the upper Keltner channel. My guess based on these factors is that we’re about to see a pullback to 6825-6840, but the dip will be a buying opportunity for a move up toward 7000.

The VIX reached the 13s today, yet we see VIX GEX positively increasing, and VVIX was positive today. We don’t have a lot that is new to add to our view of the VIX, but the VIX+SPX both seem to suggest a short-term pullback for indices is due (and a VIX spike), then continuation higher for SPX.

Geeksoffinance.com

Let’s finish with a quick look at AAPL, a huge component of both SPX and QQQ, and one that has been declining through December so far.

AAPL still shows net positive GEX and a strong uptrend since July.

In the short run, we see price crossing over the Hull to the upside, so maybe it’s time for AAPL to take the lead in these last few days, maybe helping to cushion any sort of pullback that may occur. In my opinion, it looks like we have 278-280 as an upside target, and we’re back at this area of consolidation that held from October-November.

Join us in Discord where we’ll be active for the half day of trading tomorrow!

tradingview.com

This will be the last newsletter until Sunday, but join us in our live stream (accessible via our home page) Friday! We hope you have a great holiday week ahead.

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.