Initial Headwinds For SPX: January 5 Stock Market Preview

We’re offering a special deal to kick off the new year- $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can view today’s YouTube video here. We take a look at SPX, the VIX, NVDA, and GOOGL, so check it out if you have a few short minutes!

Let’s start out the New Year with a quick note on seasonality, which we covered more in-depth on a recent live stream, the most recent of which is free and accessible from our homepage.

We’re entering a mid-term election year, and one with a Republican majority in Congress. According to the Stock Traders’ Almanac, this year has a potentially bearish bias between now and mid-January, then either a sideways or slightly upward bias into late Spring, lows near October, then a year-end rally to end in single-digit positive territory. This isn’t a guaranteed roadmap, but rather a possible set of rear-view mirror checkpoints that may be interesting to evaluate after the fact, with our immediate focus on what the market is telling us in terms of GEX and the technical picture to decide where we believe we might be headed next.

The VIX seems to initially support the idea of potential weakness for the market in January. Why do I say that as the VIX has declined into the 14s? We’ve seen positive net GEX for the VIX for the last couple of weeks, and a generally higher trend in the VIX since late December lows.

We don’t see much GEX below 14, and we also see daily volume (in light blue) at mostly higher strikes.

The Hull Moving Average has started to flatten, but we do see the VIX somewhat elevated above that line, implying the potential to see a quick drop toward 13.7-14 (or perhaps the Hull rising to meet the VIX) before a larger VIX spike. The current GEX picture suggests 20 as a potential target in the event we do see the VIX find an excuse to push higher beyond the 16 area, in my view.

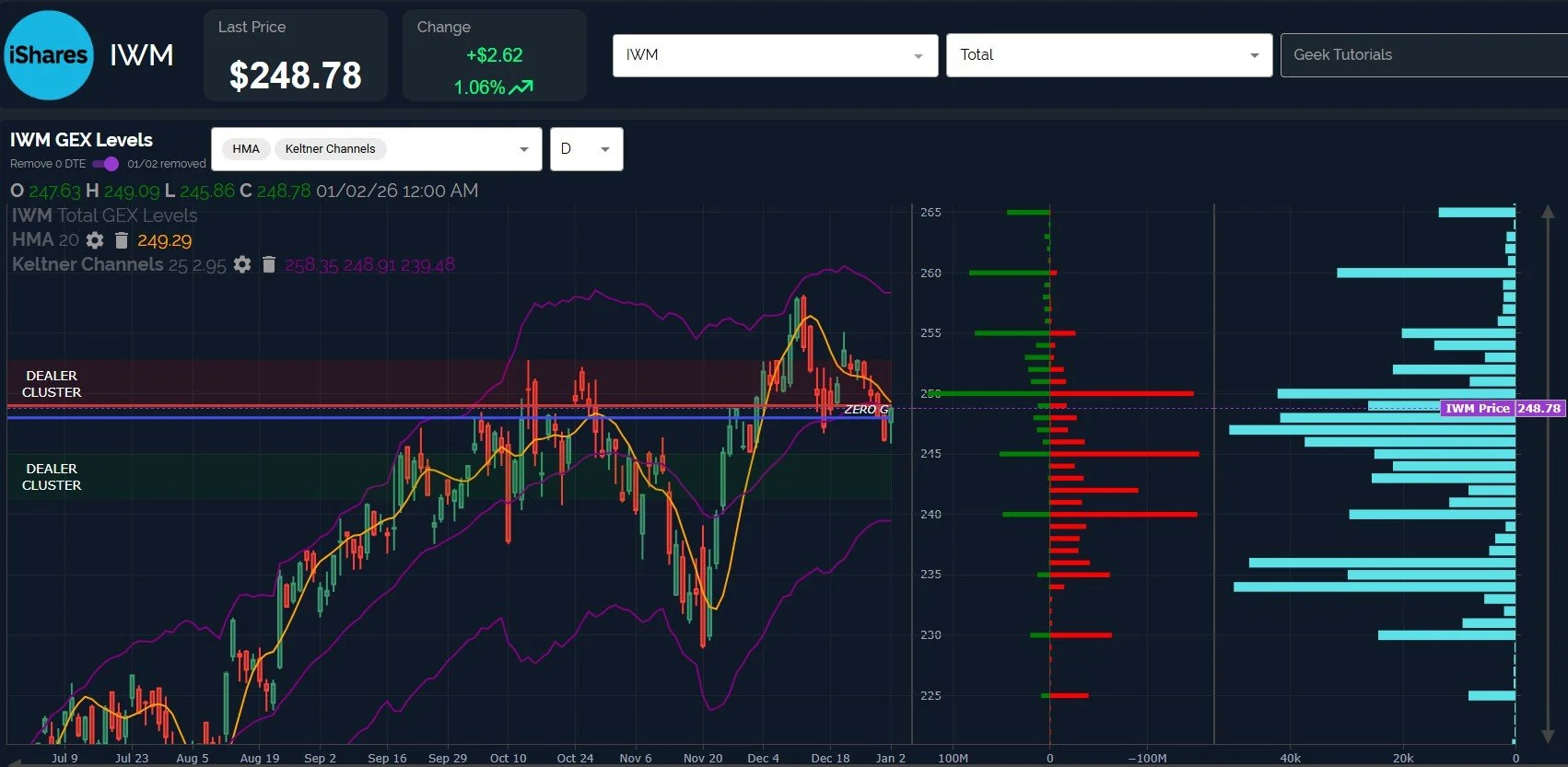

IWM has been stuck in a downtrend since early December, once again leading the way for other indices, though I can argue that recent relative performance and the area it’s reaching technically on the downside may create a stronger “buy-the-dip” case relative to other indices.

We see IWM’s Hull rapidly declining, and IWM rallied Friday after making a lower low compared to Wednesday, now bumping up against that declining Hull.

As long as the large GEX area at 250 acts as resistance, we can expect IWM to head toward the 240-245 strikes, which are large negative GEX clusters.

240-242 currently aligns with the lower Keltner channel, also representing the lower edge of the lower Dealer Cluster zone, where we expect dealers to become buyers, in theory.

I also like that 240 represents roughly halfway back to the start of the large 4-day move up from the November lows.

An immediate break over 250 targets 255-260, where we may look for a lower high compared to December, at least for now.

Geeksoffinance.com

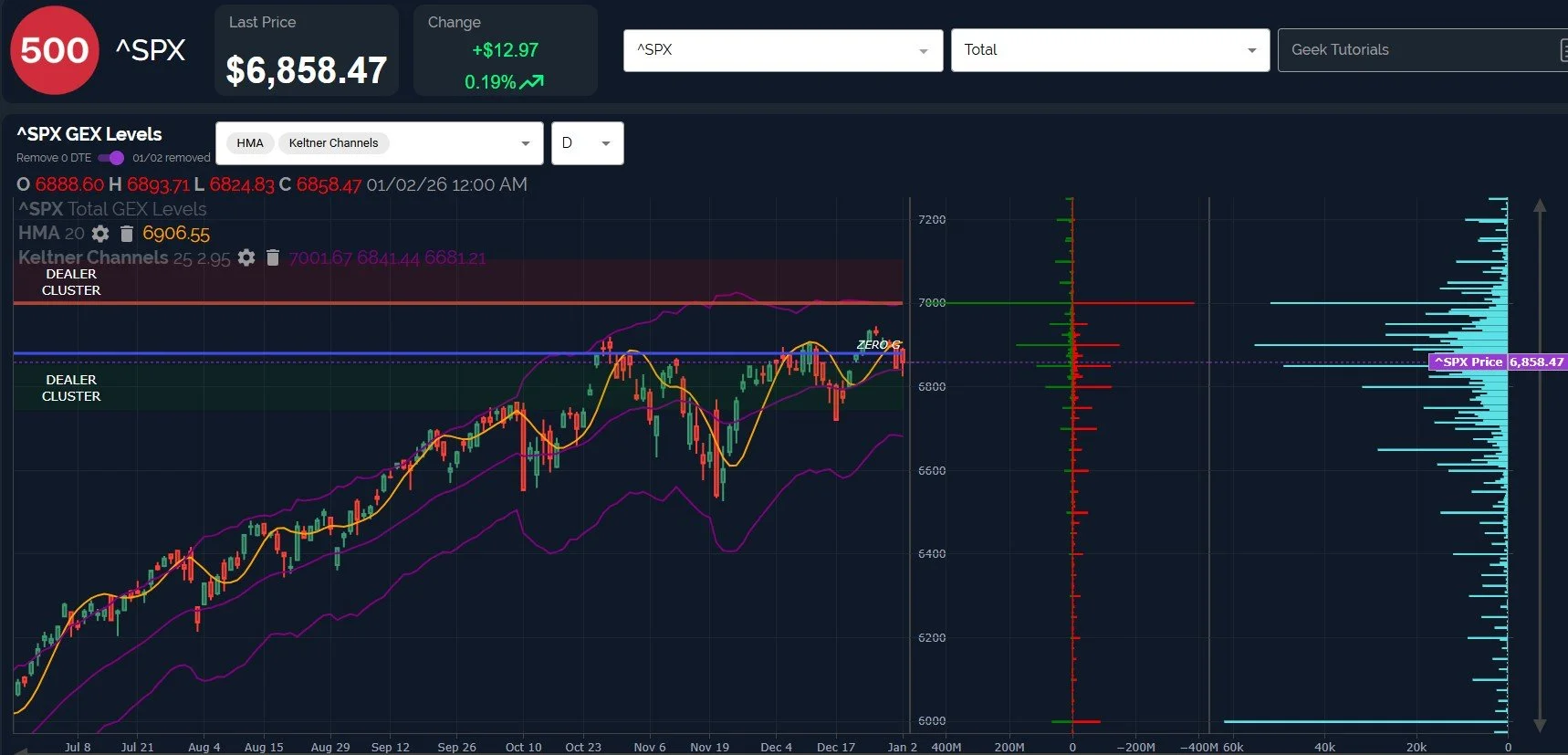

SPX has now closed below the Hull 2 days in a row, and we see the Hull flattening out as it prepares for a possible rollover to the downside. The Hull is currently at 6906.55, representing a line I’ll be watching for a potential pivot toward higher targets (7000 being the big one, still).

SPX refuses to show its hand- or possibly shows a lack of interest- as we look below 6700.

I do think SPX agrees with the VIX in terms of possibly seeing a quick upside move to retest just over 6900 before failing (in theory), at which point the VIX may complete a mini-spike higher toward the 20 area. My speculating aside, we can watch SPX as it attempts to retest the Hull in conjunction with watching the VIX for possible clues as to what comes next.

Geeksoffinance.com

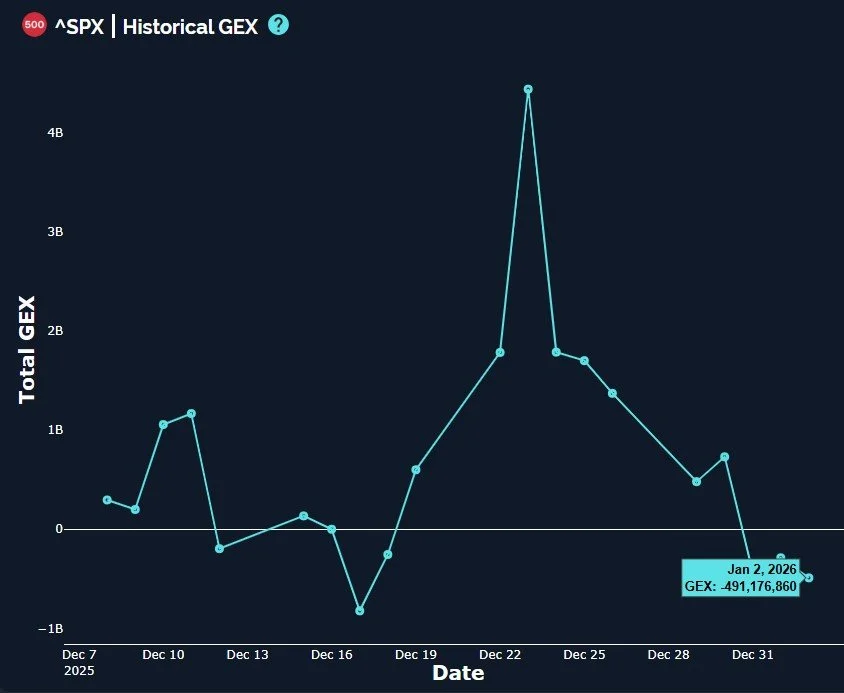

SPX GEX remains net negative, though not strongly negative, implying more of a neutral view toward downside and upside moves in the near-term.

The trend lower is certainly of concern, and may support the idea of January weakness ahead as well.

Geeksoffinance.com

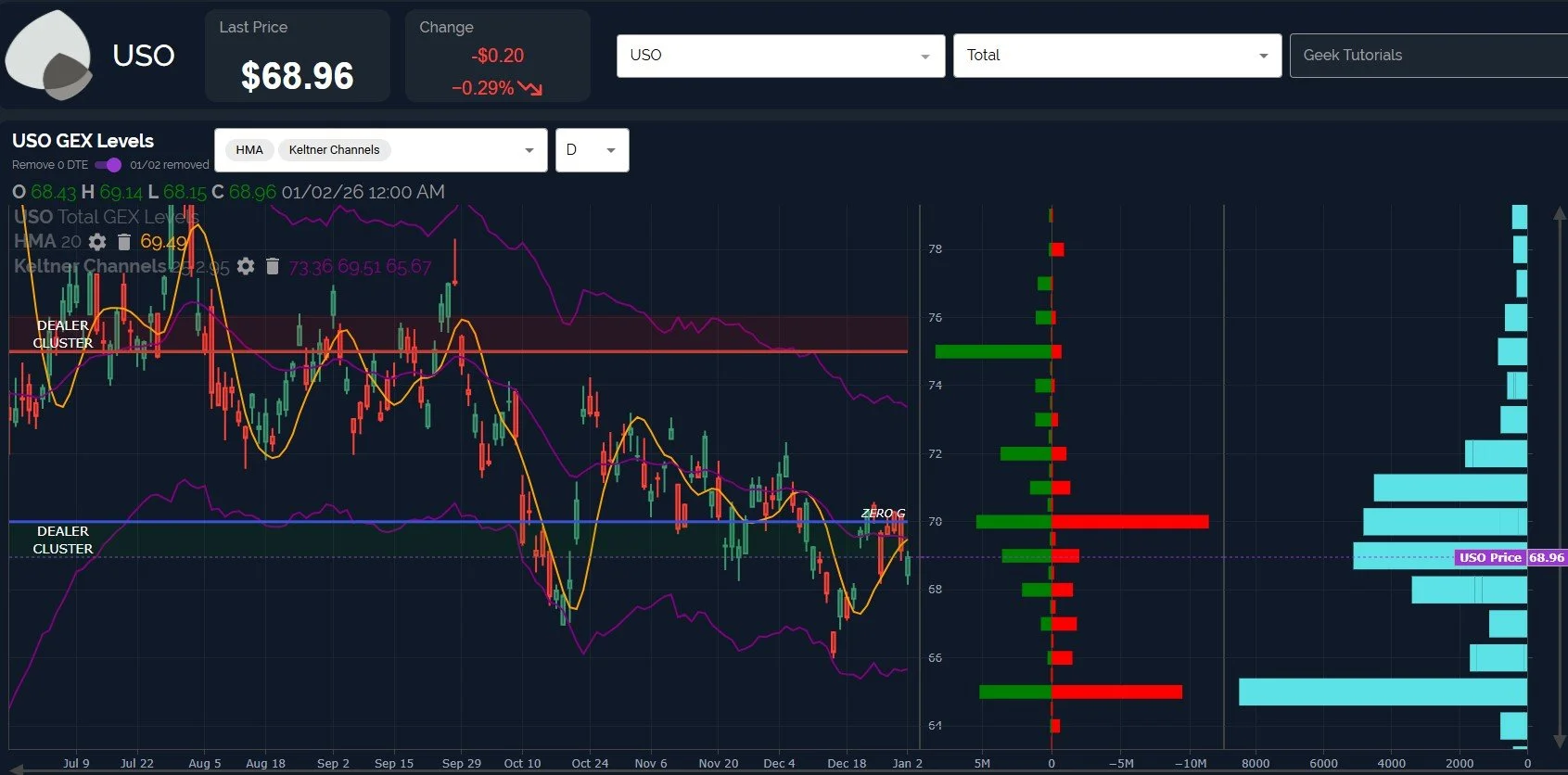

With the rapid shift in the Venezuela situation over the weekend, with a covert mission initiated and concluded within 4 hours, I thought I’d throw oil into the mix with a quick look at USO:

USO interestingly bounced late Friday, still closing red compared to the prior day, but staging a big rally from the larger gap down, almost as if “someone knew” what was coming this weekend.

The problem with that rally- which is fitting for the outcome later this weekend- is that the rally brought USO fairly close to overhead Hull and GEX resistance at 69.49-70. With negative GEX, big option volume Friday at the 65 strike (in spite of the rebound), and large GEX also at 65, I wouldn’t be surprised to see oil drop toward that next negative GEX cluster.

Geeksoffinance.com

We hope you’ll join us in Discord this week, where we’ll share some observations in real-time in our free general chat channel!

Here’s the link to our Discord server if you haven’t yet joined us in Discord. First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.