SPX 7000 Within Sight: January 7 Stock Market Preview

We’re offering a special deal to kick off the new year- $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can find today’s YouTube video by going to our homepage and selecting the Community link from the top menu. We take a look at SPX, the VIX, PLTR, and TSLA, as well as the AAII sentiment survey, so check it out if you have a few short minutes!

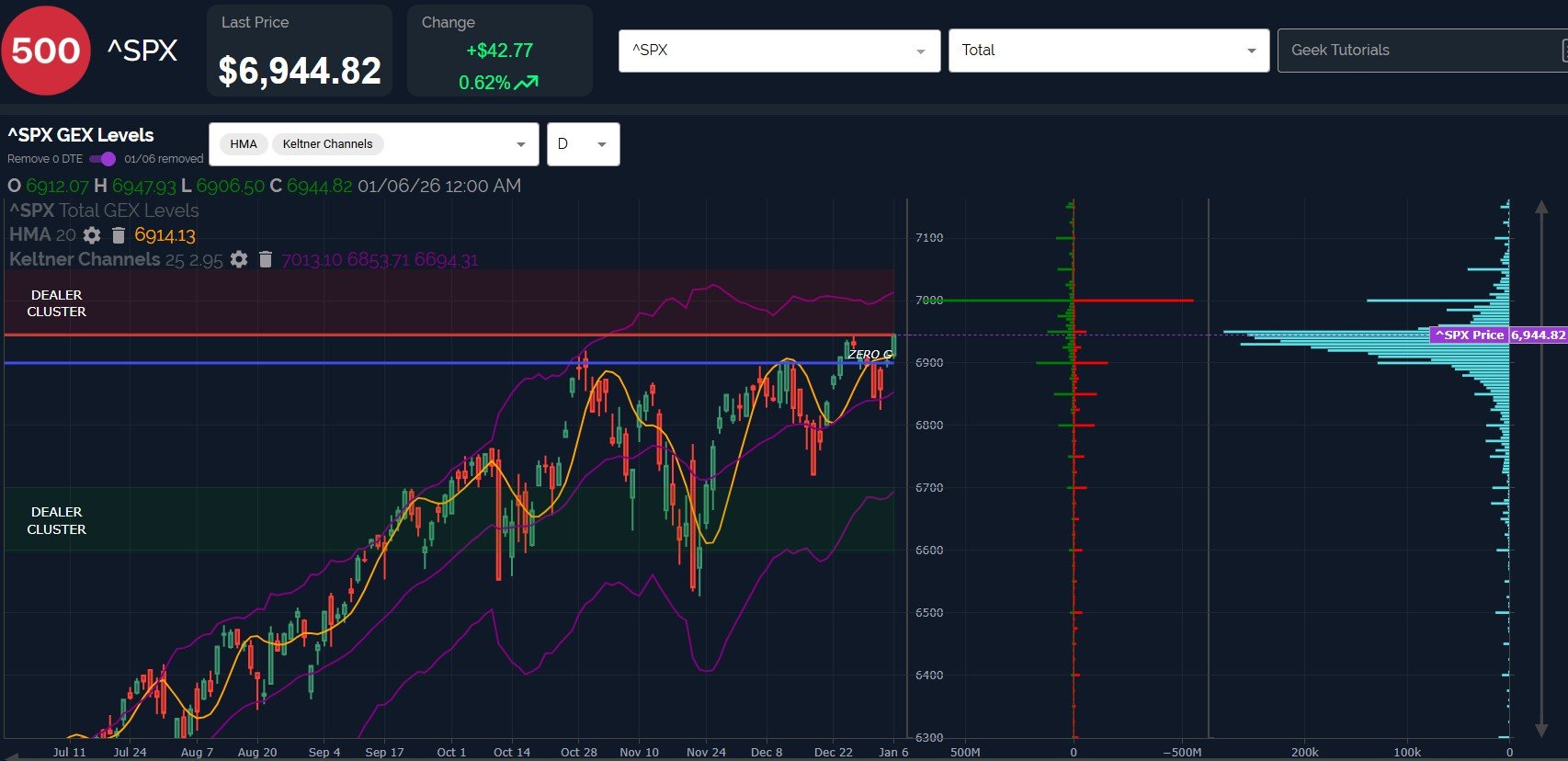

Early this week, we noted that IWM and the VIX tilted our bias toward continued market upside, even if we saw an intermittent pullback (which hasn’t happened, obviously). IWM has surpassed the 255 GEX cluster, possibly heading to 260. The VIX may have a trip down to 14 just ahead, and SPX may be poised to tackle 7000.

Even with continued upside, we still believe the upside will be capped in the near-term, with GEX aligning along the upper Keltner channel and a sharp drop off in positive GEX clusters beyond that point.

SPX, which made a new high today, is already at the doorstep to the upper Dealer Cluster zone, where we expect dealers to potentially become sellers, so a reversal could happen anywhere between 6950-7000.

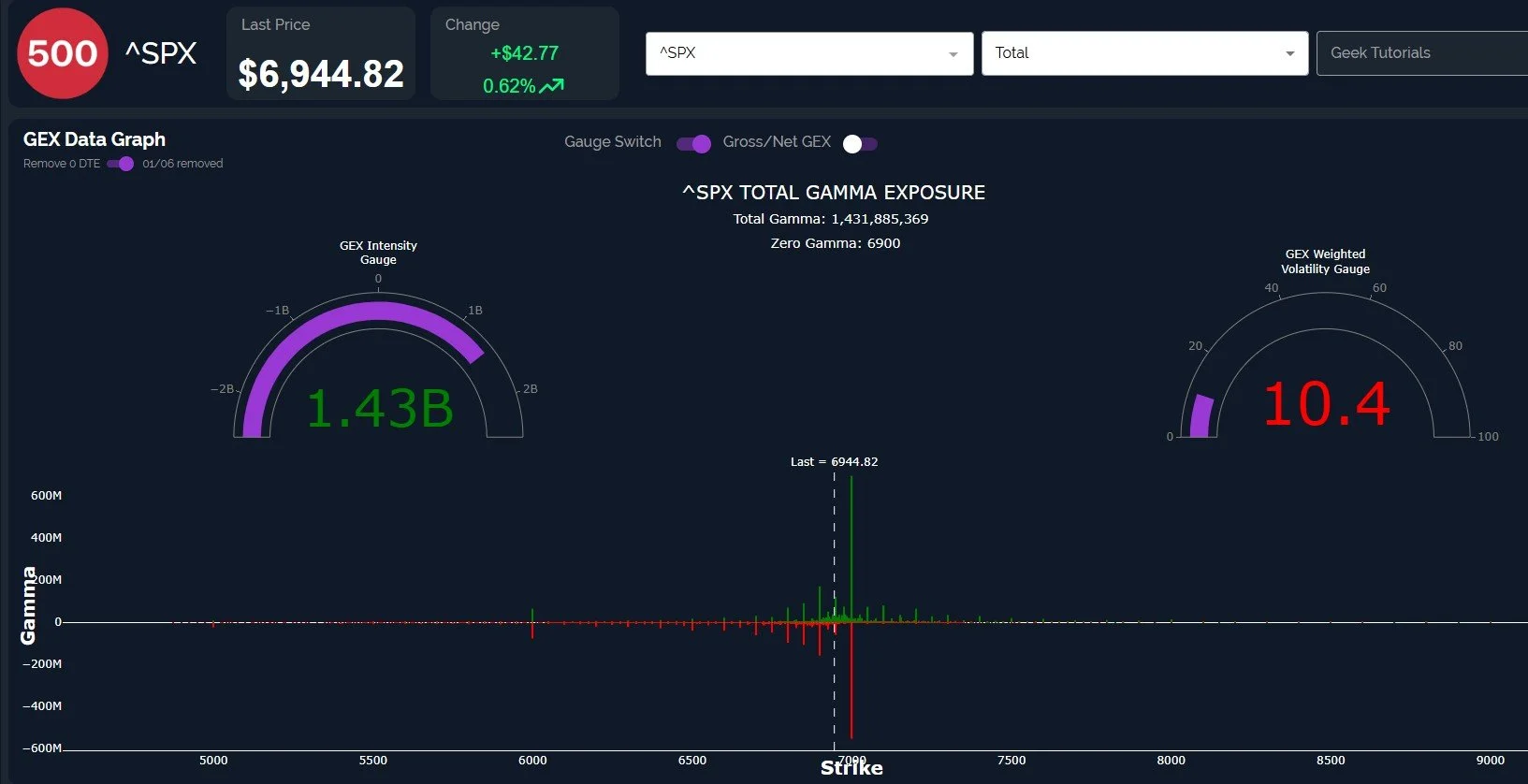

SPX net GEX increased further today, now closer to an extreme reading on our GEX Intensity Gauge. The gauge compares current GEX readings to readings over the prior 12 months on a relative basis. While SPX is near the extreme, there is still some room to go to reach that point, and the gauge is not an exact timing tool, though it may signal that a contrarian reversal or consolidation could happen soon in a general sense (I can think of several instances in recent past that were within a few days).

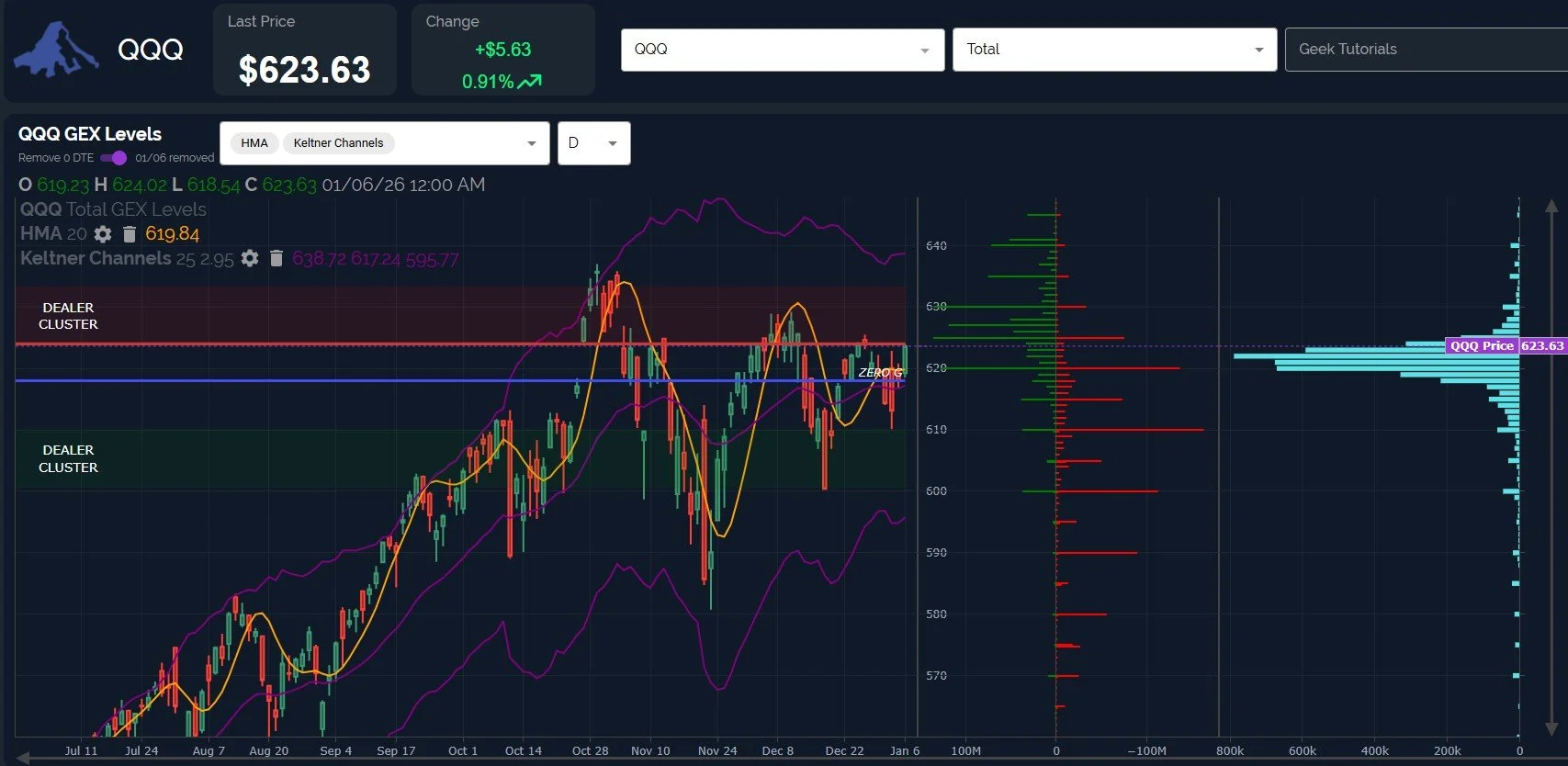

QQQ also saw a bullish move above the Hull Moving Average, reaching the edge of its own upper Dealer Cluster zone.

QQQ is substantially more distant from the upper Keltner channel, which introduces some uncertainty (in my opinion) as to whether QQQ will have a big up day or two and reach the 640 area, or if it will fail beforehand, potentially at the 630 GEX cluster.

Speculation aside, a continued upside move is worth reassessing and monitoring as QQQ reaches 630.

On the downside, QQQ now has important GEX at 620 that should hold any downside moves, if the bullish scenario to 630-640 is to stay intact.

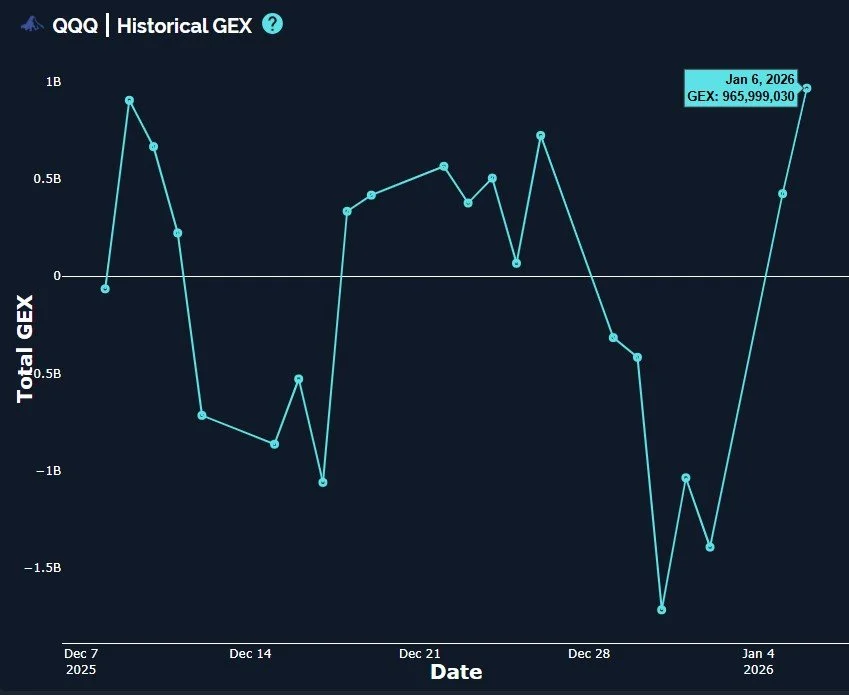

QQQ net GEX also increased today, though I’ll note that the previous GEX highs visible on our historical GEX graph marked 1-2 days before short-term tops.

The VIX appears supportive of the market moving higher, with the VIX showing enough space below to justify a drop toward the 13.75-14 area, to retest the rising Hull.

The VIX does appear to be constructive for volatility beyond a short-term move higher for indices, so we’ll stay nimble in watching for signs of reversals, depending upon the GEX picture and how the VIX handles any retest of the rising Hull. GEX is still largely absent below the 14 strike, and option volume is virtually nonexistent at lower strikes as well, potentially indicating a lack of interest (or belief?) in lower strikes being reached.

We hope you’ll join us in Discord this week, where we’ll share some new developments in real-time in our free general chat channel!

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.