Never-Ending Divergences: January 9 Stock Market Preview

We’re offering a New Year special that will end in a few days: $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, QQQ, IWM, RBLX, as well as SOFI, so check it out if you have a few short minutes!

The VIX continues its upward trajectory, reaching 15.85 today before fading slightly. The Hull is curling up, GEX diminishes below 14.5, and volume continues to mostly occur at higher strikes, so we’re on watch for a possible VIX spike toward the 18-20 area as long as any drop in the VIX holds the 14.5 area on a daily close.

The VIX can certainly show positive correlation to the indices over shorter timeframes, so let’s look at the indices to see if they appear to have favorable odds toward further upside or imminent downside.

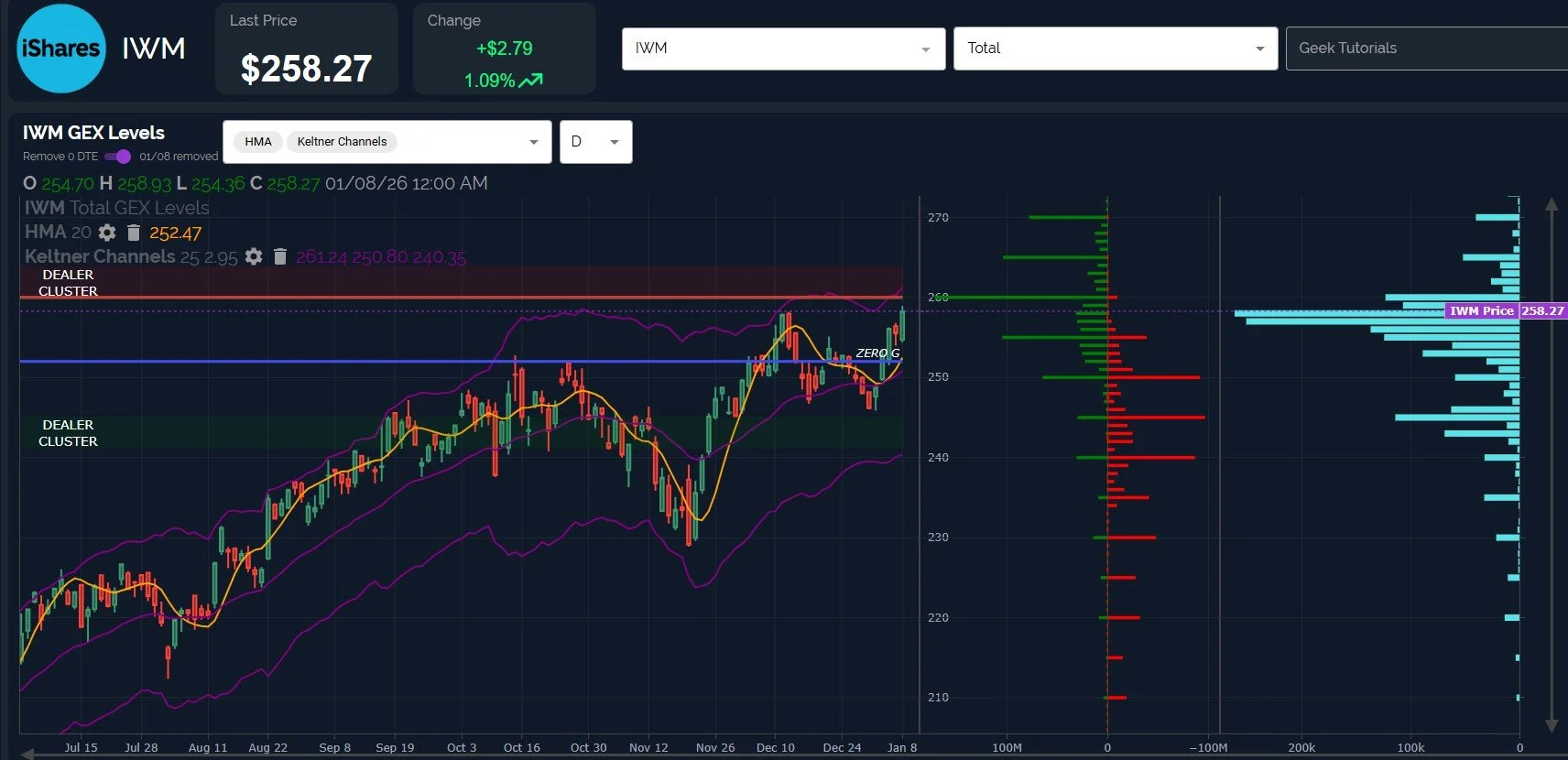

IWM has been the most bullish potential signal for the broader market, making a new high today and nearly reaching the large GEX cluster at 260 we’ve been highlighting.

With the Keltner channels pointing higher and the Hull rising, it’s hard to get bearish on IWM without key levels being broken. At this time, any dip that holds above 240 is likely a great dip buying opportunity, and we may even see 250 hold any attempt to sell off. As always, we want to monitor what GEX and the charts are telling us as any potential shift takes hold.

Does IWM’s bullishness portend bullish “catch-up” for the other indices, or will all indices begin dropping as soon as IWM makes a lonely trip to officially tag 260? I don’t know, but I do see mixed signals when I look at QQQ and SPX.

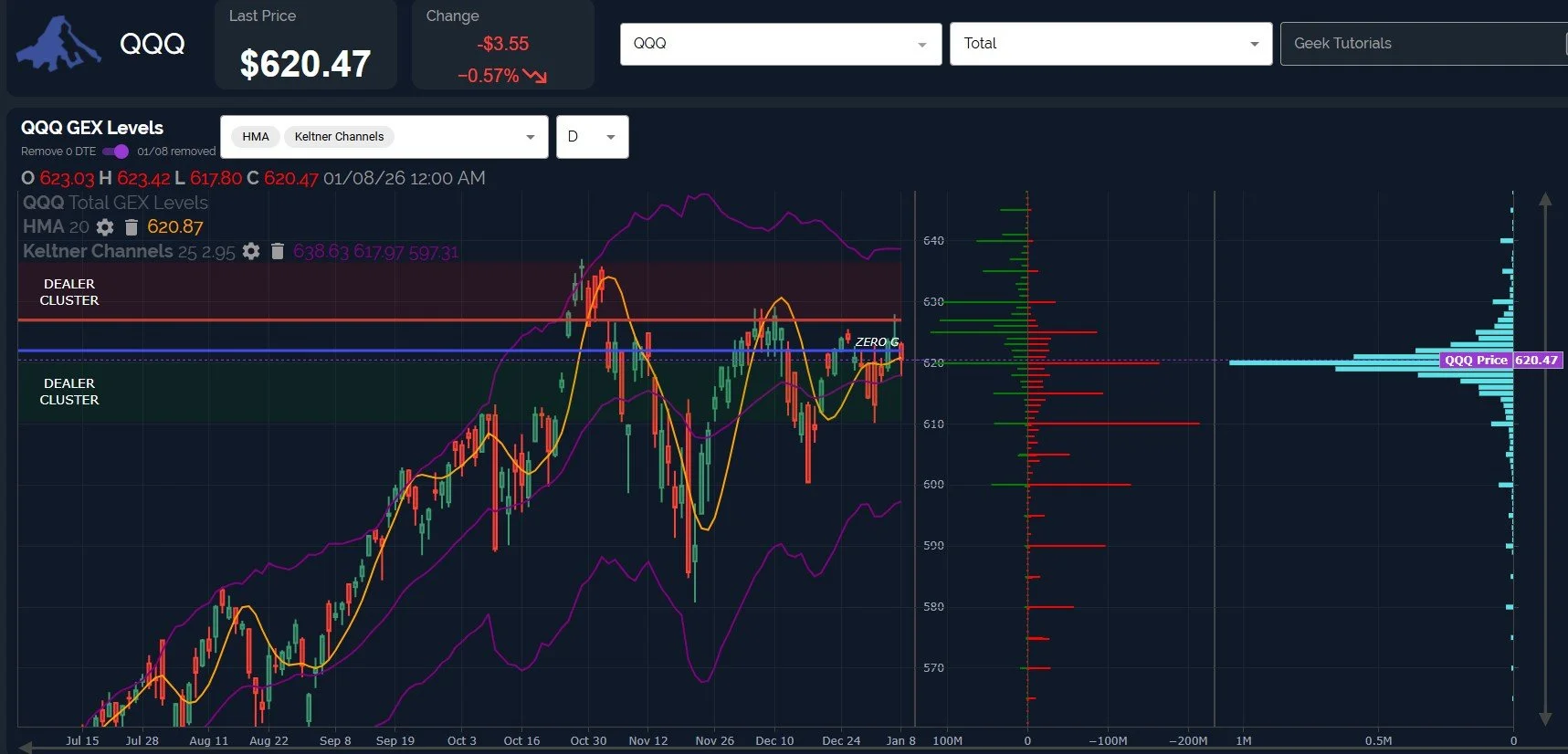

Let’s move to QQQ: Today’s close was virtually right on the Hull, merely .40 below the line. QQQ also holds above the key 620 GEX area, which at least keeps the dream alive for tech bulls to potentially reach 630-640. Losing 620 greatly increases the odds of a retest of 610, and maybe even 600, in my view (a modest drop at that).

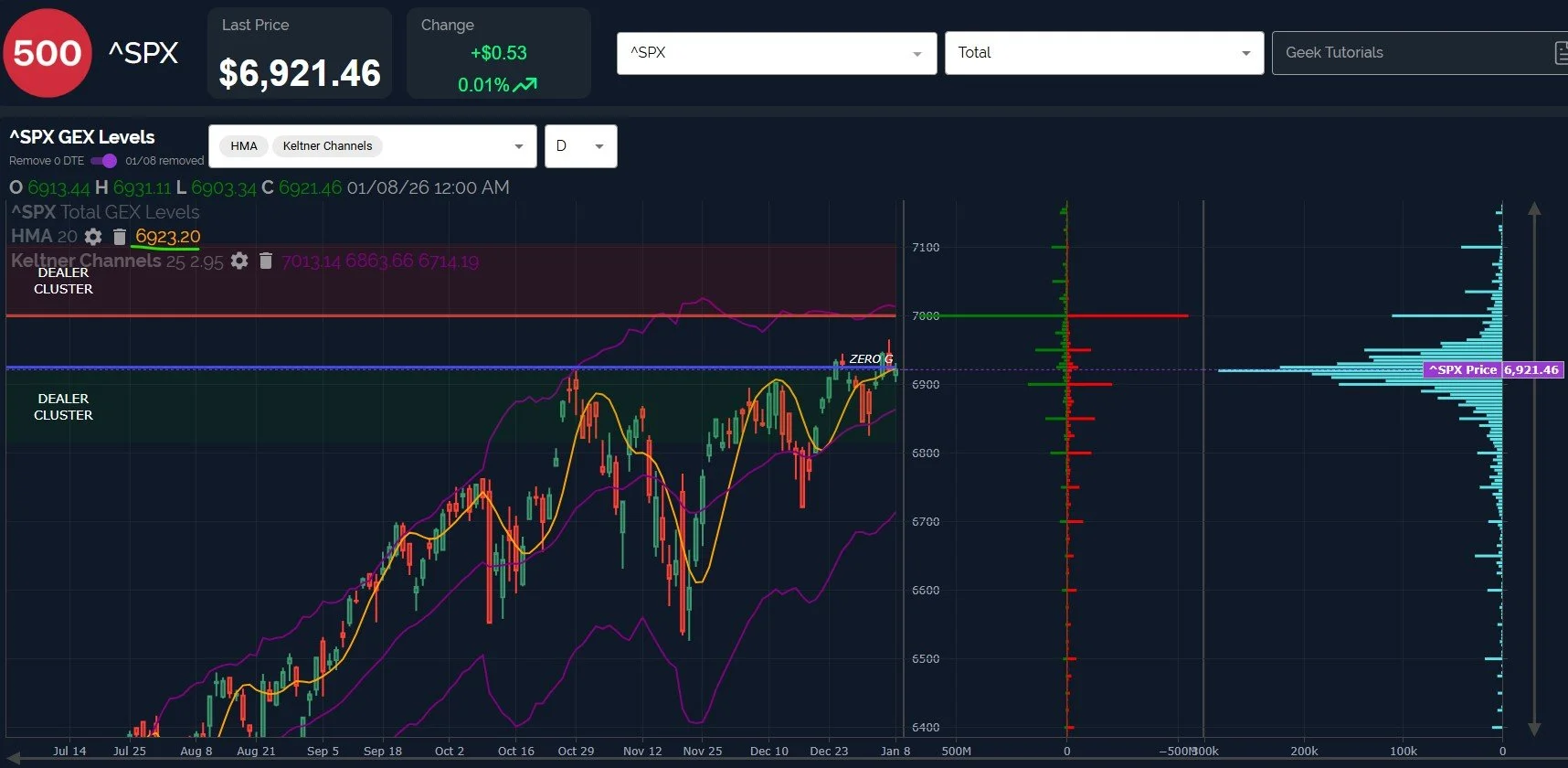

While SPX painted a green candle today (ever so barely), today’s close was below the daily Hull by less than 2 points, not enough of a loss of that key line to consider the close a definitive bearish breach, in my view. So we still price hugging the Hull on both sides as we creep toward the 7000 strike.

Net GEX did decrease for both SPX and QQQ today (more sharply for QQQ, which actually went negative), but nothing seems to be signaling an imminent large decline.

We will watch for intraday signals and shifts in GEX to help steer us in the right direction, but in conclusion for today, it appears that the VIX is flashing some potential warning signals while indices are still favored to reach slightly higher targets. Have your hedges and/or exit plan in place for longs so the unexpected doesn’t derail your trading plan this early in the year!

We hope you’ll join us in Discord this week, where we’ll share some new developments in real-time in our free general chat channel!

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.