VIX Breakdown: Bulls Unleashed? January 12 Stock Market Preview

We’re offering a New Year special that will end in a few days: $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, the VIX, BTC, GLD, as well as NVDA, so check it out if you have a few short minutes!

The VIX broke its short-term upward ascending pattern, nearly reaching the 16-strike Thursday before Friday’s drop. Of course we now see market futures lower Sunday night, but even before that, my main point was going to be that the VIX has not convincingly closed below the Hull Moving Average, though it did technically Friday.

OpEx week can definitely see some twists and turns, and we have several big financial companies reporting earnings this week (JPM kicks it off Tuesday morning), so an immediate bounce higher for volatility may still end with a drop closer to 14 before the next volatility upswing. Let’s keep an eye on tomorrow’s action.

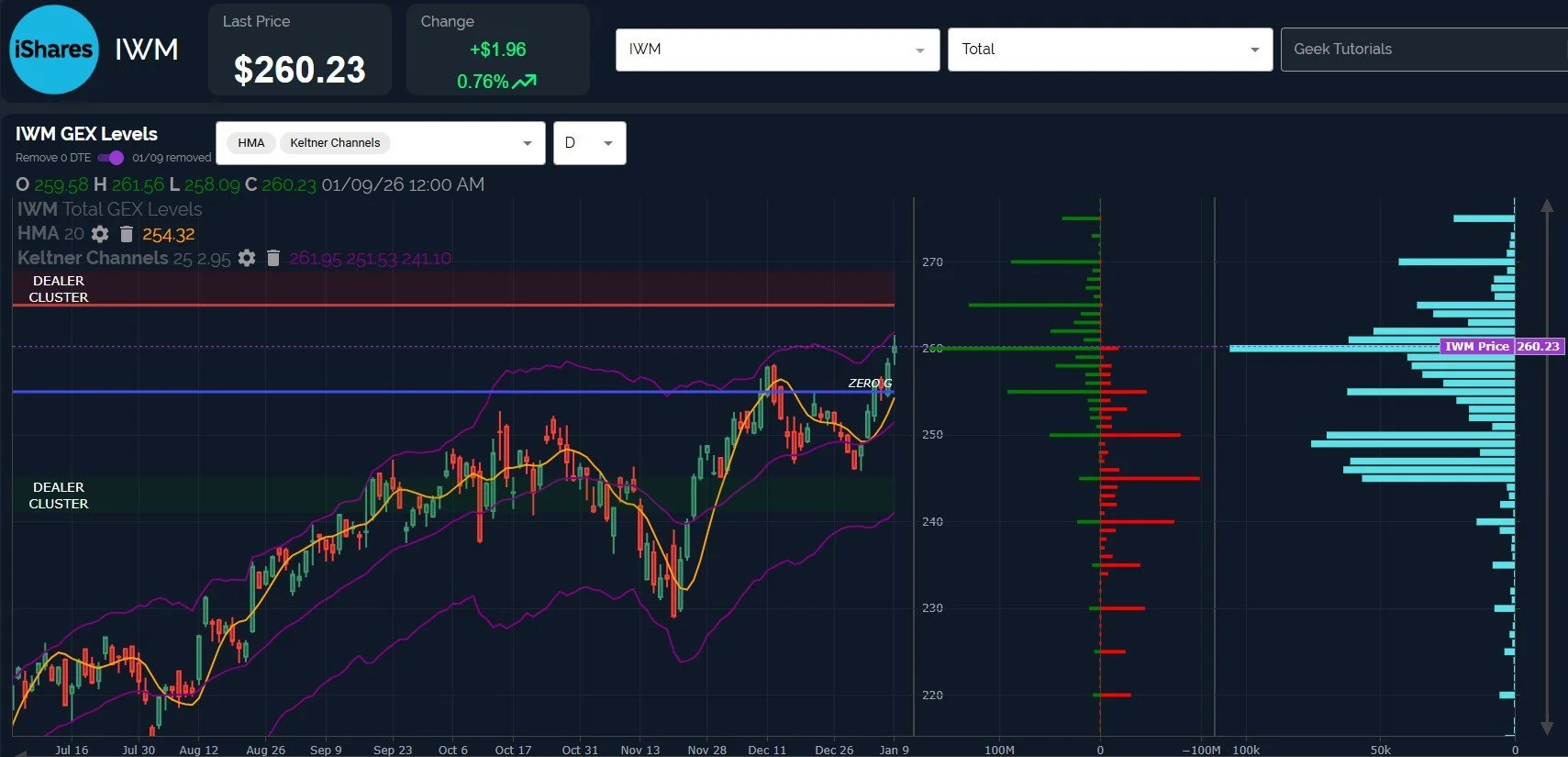

IWM reached our high-conviction 260 target, though the upper Keltner channel is now at 262 and we see potential GEX targets at 265 and 270.

While this picture is bullish, an immediate pullback toward 254-255 wouldn’t be surprising.

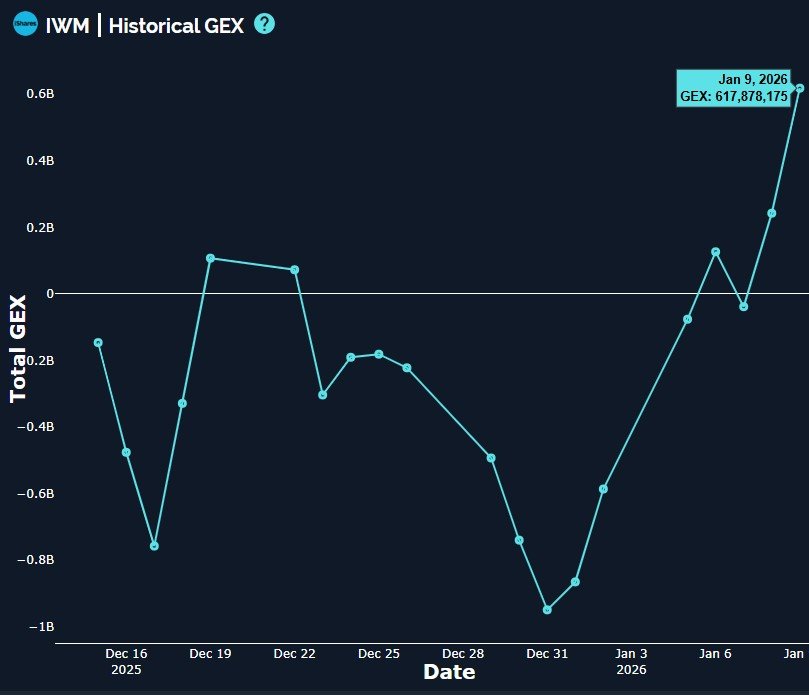

Backing our observations stated above, IWM’s net GEX is skyrocketing into positive territory, a likely positive sign for the intermediate term, though potentially a sign that a short-term top is near.

Prior GEX surges with IWM have often been contrarian, even if not at an extreme, especially considering the positive GEX side of the equation (IWM has spent a lot of time in negative GEX territory).

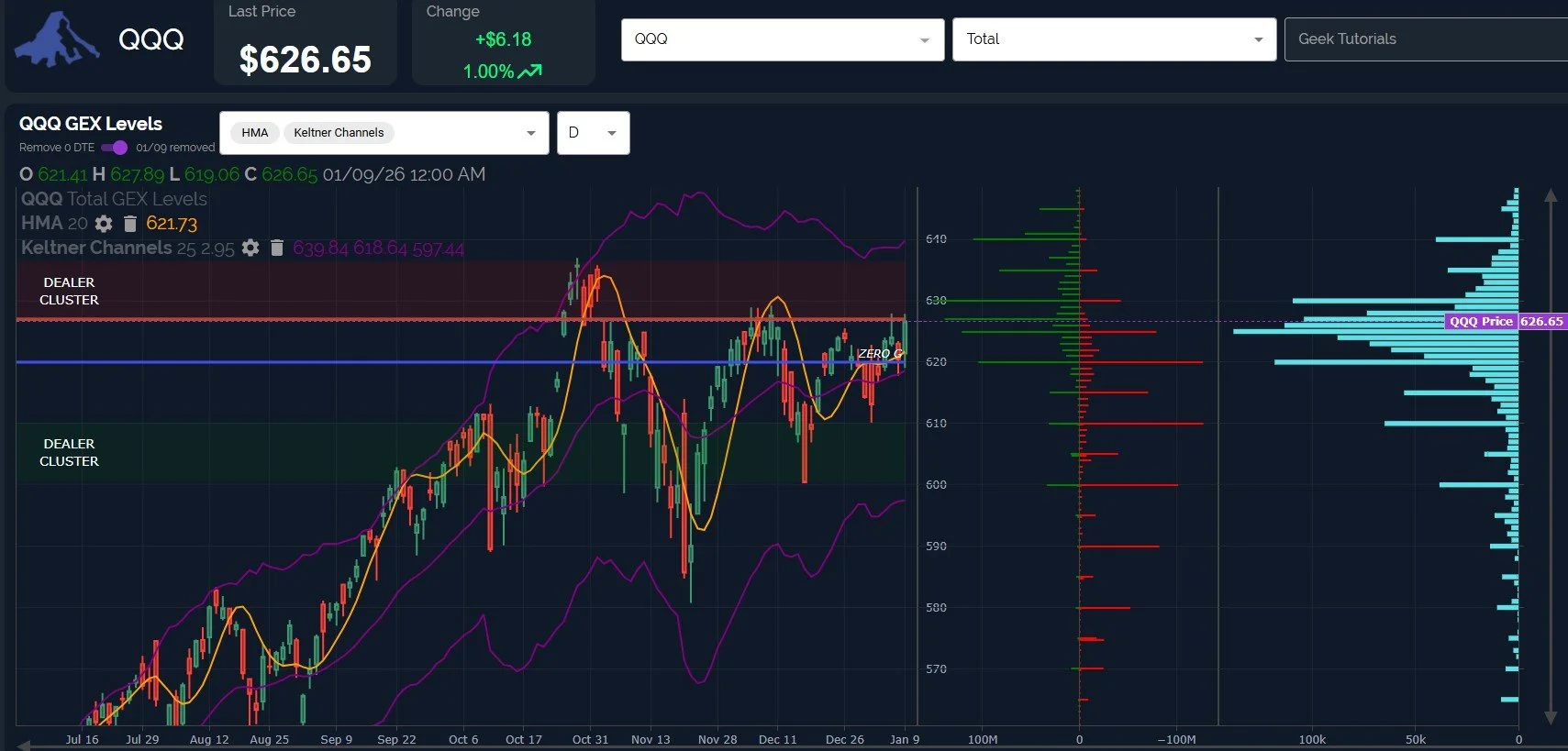

QQQ has been lagging the S&P and IWM, still unable to make a new high, likely due to some of the Unmagnificent Seven heading lower year-to-date.

QQQ has entered the upper Dealer Cluster zone, where we expect dealers might become sellers, though closing above 630 (if we can see such a close this week) does increase the odds of a quick trip to 640.

Later in the newsletter, we’ll look at AAPL, which I view as a potential “late bloomer” that may assist in a push higher this week.

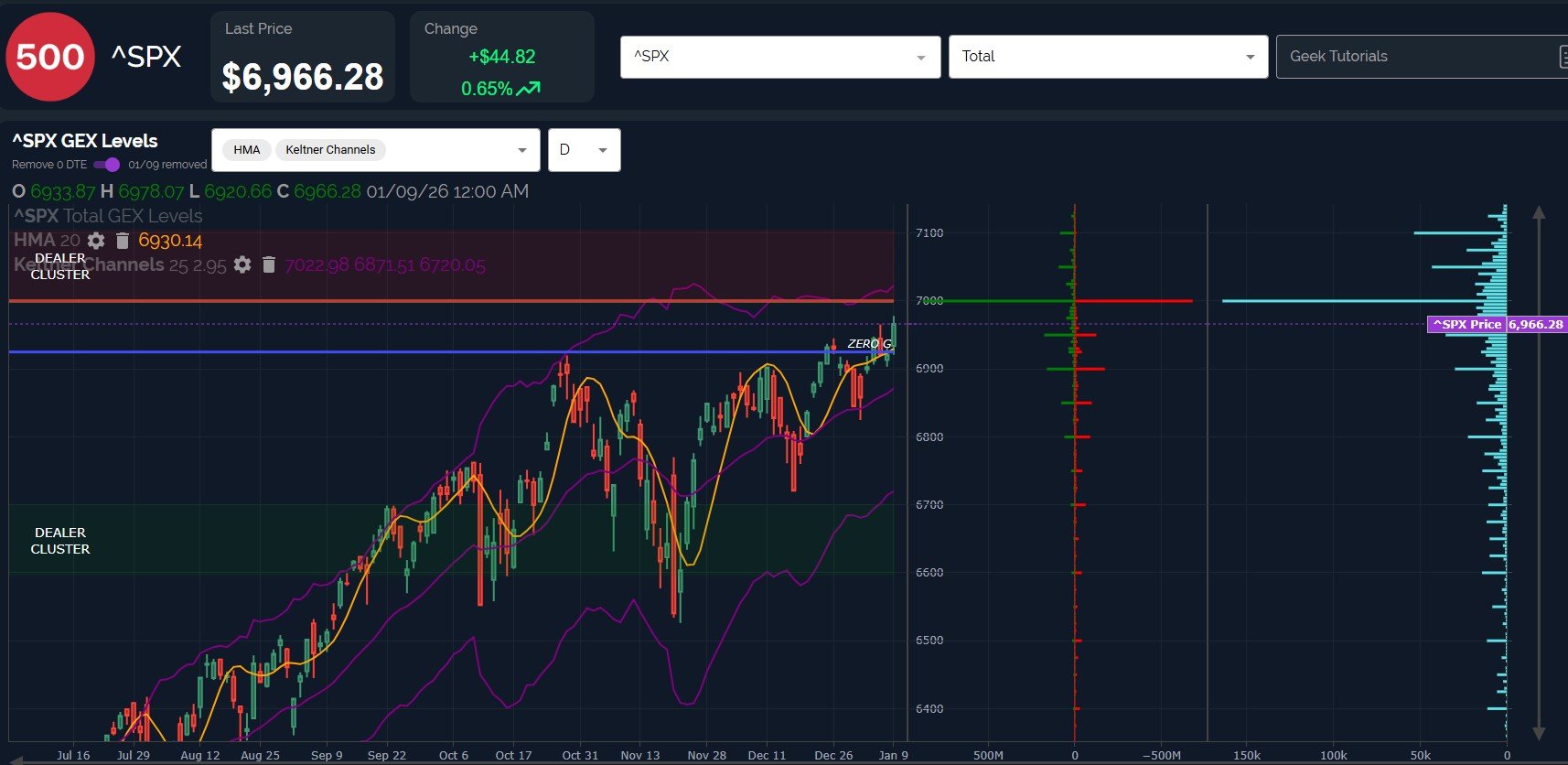

SPX made yet another new high Friday, now within a short distance of 7000.

SPX still doesn’t reflect a lot of GEX above 7000, though we do see volume Friday at 7050 and 7100.

We’re still of the view that even if indices achieve big gains this year, we’re likely to see consolidation or a pullback at 7000, with GEX indicating a “capped upside” scenario being in play for now.

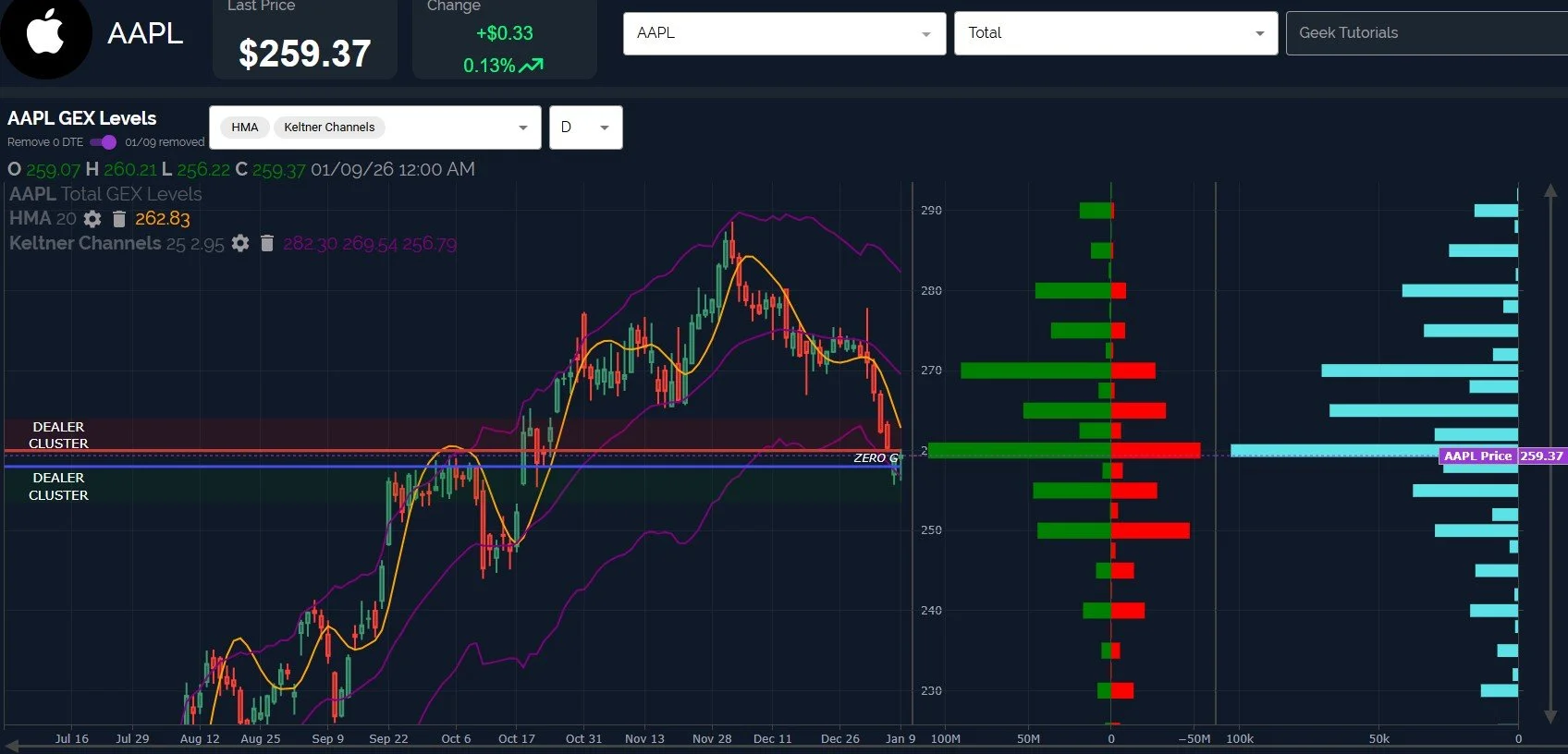

Lastly, AAPL is down nearly 40 points since December, a big drop for what was an important leader, and still a huge weighting in the largest indices.

The last two days saw green candles, and potentially early signs of an upcoming rebound, holding the lower Dealer Cluster zone and showing volume mostly at higher strikes as of Friday.

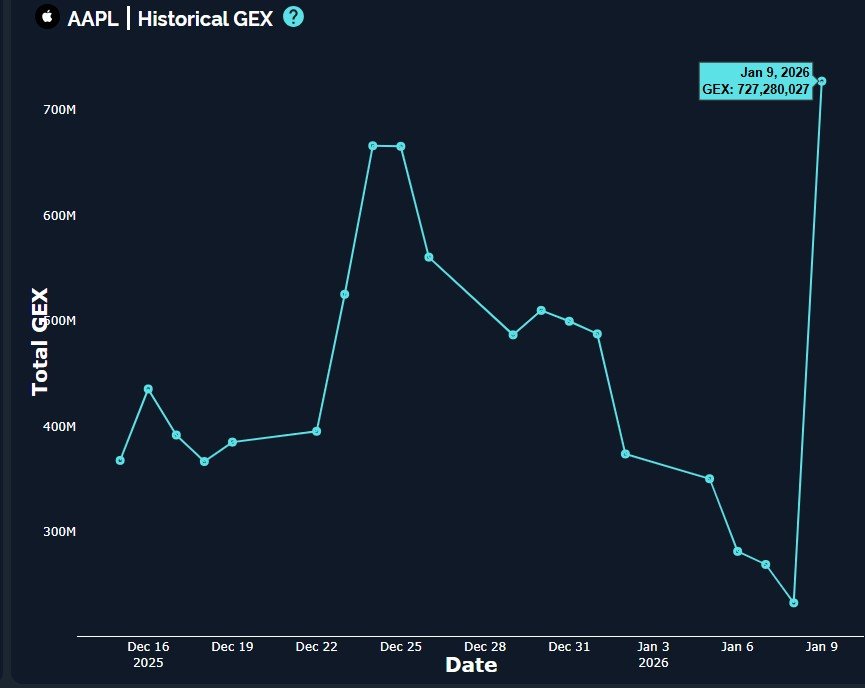

Furthermore, Friday saw a huge increase in positive GEX for AAPL, the largest since late December.

GEX is positive overall for AAPL, and GEX really drops off below 250, with 270 appearing to be the odds favorite target at the current moment.

Without predicting a major trend change for AAPL, we have enough data points to believe a bounce to 270 is likely, even if AAPL continues lower thereafter. We’ll be watching for a potential entry early this week.

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.