Dead Cat Bounce Or SPX 7000? January 22 Stock Market Preview

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, the VIX, IWM, and NVDA, so check it out if you have a few minutes!

The VIX got crushed today as stocks rallied, though we still don’t see the gap closed looking back to Friday’s close. I drew an approximate trendline from January 12 showing the confluence of higher lows with the current lower Keltner channel, which may indicate a volatility target of 15.8-16 before another march higher for volatility.

We can also watch the yellow Hull Moving Average to see when it crosses under the VIX again, which should happen sometime in the morning, if the current trajectory holds.

While another move lower for indices and a move higher for the VIX shouldn’t surprise anyone, the key will be what happens gets back to the 20 area, if it reaches that area in the next few days. The “easy” move lower for the VIX from the initial target at 20 is over, now we need to watch what happens at each potential reversal zone, in other words.

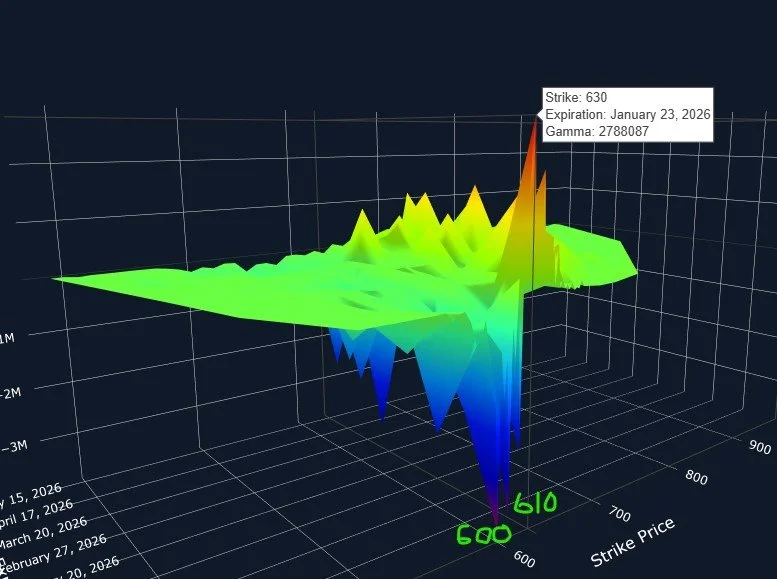

QQQ has been largely consolidating sideways since October, rallying off of a small gap up today and rejecting off of the key 620 GEX cluster and the Hull Moving Average.

The market rarely makes breaks of support or resistance really easy to navigate, so don’t be surprised by another gap tomorrow, possibly over today’s resistance. The question and risk for tomorrow would then become whether or not a gap over resistance means the drop is over, or do we fade back to close below resistance intraday?

600 is still the largest net GEX cluster, and QQQ is still in negative GEX territory, though barely.

All things considered, QQQ leaves us an unclear picture, but we have 620 to watch tomorrow, with 600 appearing to be the magnet below, and 630-640 the targets above.

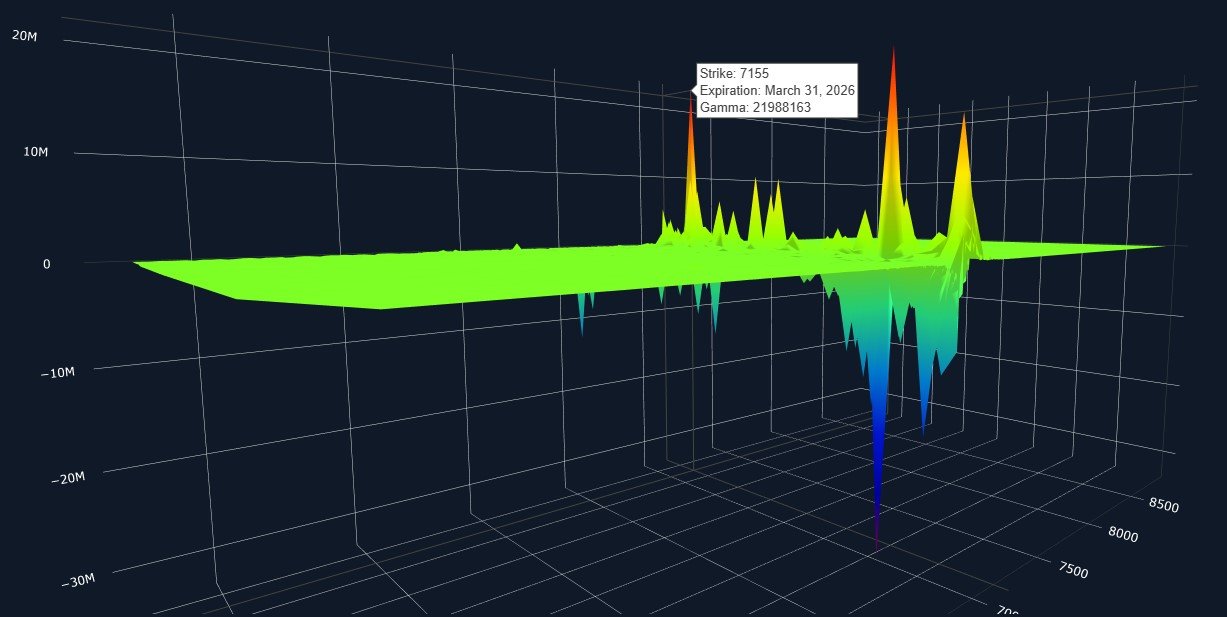

SPX looks similar to QQQ, though overall SPX appears to be slightly more positive. We mentioned 6900-6920 as a potential upside target zone in today’s live stream, and now 6925 appears to be a potentially important resistance area.

We’ve been watching the large GEX at 7000 for quite a number of weeks now, and it remains a potential target if we can see the market sustain above 6925.

On a net GEX basis, 7100-7200 have become relatively larger as well.

One observation backing the mid-term election year seasonality view is the large net positive GEX at 7155 expiring March 31. Could this mean SPX is destined to rally following this pullback, finally surpassing 7000 and achieving 7155? Obviously time will tell, but the GEX at that strike is noteworthy.

IWM has been bullish as can be, making a new high today and closing above the steepy ascending Hull Moving Average.

GEX from 270 all the way up to 280 is visible, and Tuesday saw a tag of 260, the upper edge of our target for the pullback we saw.

The confluence of the Hull with the upper Keltner channel may be a headwind though in the short run, just as we saw back in December when a similar condition appeared.

I’ll be watching IWM for signs of a broader market turn back down again, which may take IWM to 250-255 this time, and potentially new 2026 lows for SPX and QQQ.

IWM may tag 270 before such a pullback, and note that we still view downside moves favorably as long as the current picture sustains itself.

Many of QQQ’s holdings look concerningly weak, but META is one name that may have a chance to do better in the near-term, even if META does end up on a steeper downtrend.

The current tag of the lower Dealer Cluster, the presence of net positive GEX, and a lack of significant GEX targets below 600 give a sense of potentially limited downside, and we’re at the lower Keltner channel as well.

Without making any longer term predictions, I am looking favorably at the odds for a bounce toward 630-650.

Friday’s option expiration also backs a view of limited downside, with 600 and 610 representing META’s largest negative clusters expiring, and 630 representing the largest positive cluster.

Thursday evening’s noteworthy earnings releases come from INTC and CapitalOne, so prepare for a number of potential catalysts that can move markets in either direction before the end of the week.

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our Discord server! First-time guests receive a free 7-day trial of the premium Discord channels and this is where we discuss what’s happening in real-time.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.