Looking Beyond VIX Expiration: January 21 Stock Market Preview

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, the VIX, QQQ, GLD, and BTC, so check it out if you have a few minutes!

Today’s gap down resulted in a weak buying attempt, eventually leading to new short-term lows. Indices are now approaching the downside targets we’ve been mentioning as possibilities over the last few days.

The VIX reached 20.97 intraday, closing just over the 20 strike as we approach VIX expiration pre-market Wednesday. With the largest positive GEX cluster represented by the 20 strike, will the VIX open Wednesday’s session below 20? If futures have any say, it looks like there’s a good possibility we see the VIX below 20 by 9 AM ET.

With the Hull Moving Average rising and currently at 17.2, a bounce in volatility can occur from the 17-18 area, with risk of the VIX making a higher high above 21. Market bulls will want to see a daily close below 17 to indicate the VIX is potentially headed back to 14-15, and hopefully we’ll also get clues by watching the VVIX index.

QQQ is well on its way to my “desired” 600 target, which I noted made logical sense to me given the confluence of the very large GEX cluster at 600 and the middle Keltner channel on the weekly chart, which is very close to 600.

The 600 strike also represents a retest of the consolidation zone that QQQ has been stuck in since November.

A loss of 600 may signal a more significant trend change, but given current information, we remain constructive if 600 appears to be holding further decline for QQQ.

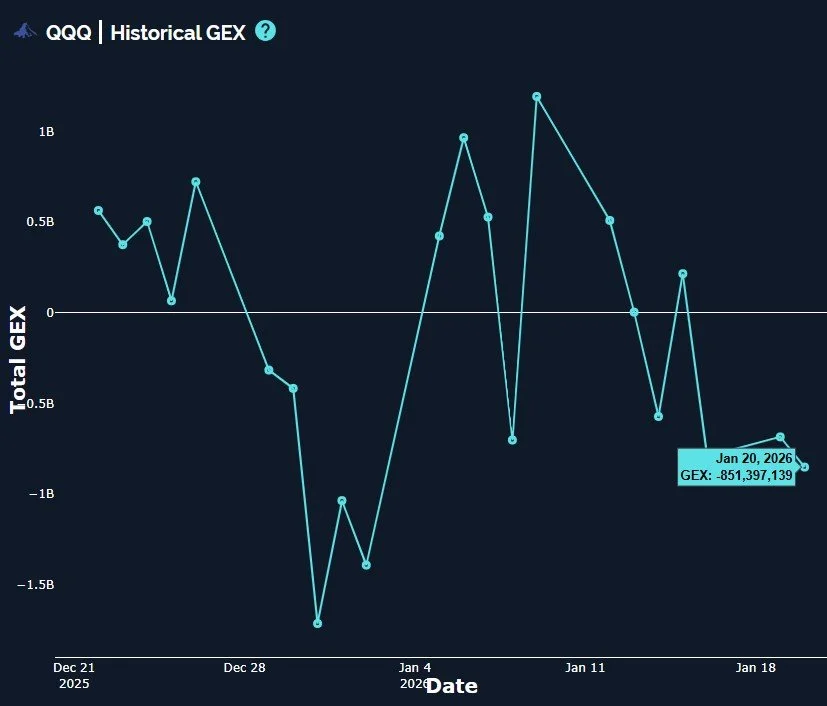

QQQ did see net GEX drop today, but it was a fairly modest drop, seemingly a positive divergence relative to the more dramatic drop in price.

Note that historical GEX gave us a several day heads up between the GEX top and the price top, acting as an advanced warning signal, in this case.

SPX is within the lower Dealer Cluster zone, closing just below 6800, at the high end of where I wanted to see SPX In the event of continued downside.

Risk/reward is diminished at this area for new shorts (in my opinion), so even if we continue lower toward 6700, we expect a bounce, potentially closing the gap left behind after Tuesday’s gap down.

SPX net GEX has reached a reading that we typically consider to be a solid negative reading, so any bounce may end with heightened volatility back down, a risk we need to consider.

SPX net GEX is not yet at the point of extremity relative to GEX readings over the last year, so GEX can decline further before giving us a contrarian signal to potentially buy the fear.

We’ll look for clues in tomorrow’s intraday 0 DTE GEX reading and we hope you’ll join us in Discord where we’ll discuss these observations!

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.