Deeper SPX Pullback In Play? January 15 Stock Market Preview

We’re offering a New Year special that will end tomorrow: $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

We’re finally seeing fulfillment of the VIX pattern and GEX picture that we’ve noted for a couple of weeks, with the rising channel culminating into a VIX spike to the 18 level today.

We may see the spike continue in coming days as long as the VIX remains above the rising Hull Moving Average, currently at 15.45, and rising each day.

The positive GEX at 20 becomes the next area of focus as long as we stay above the Hull, and with monthly VIX options expiring next Wednesday morning pre-market, we may see another pivot occur by that time. We will narrow down our odds-favored scenarios based on the largest positive and negative GEX clusters heading into next week.

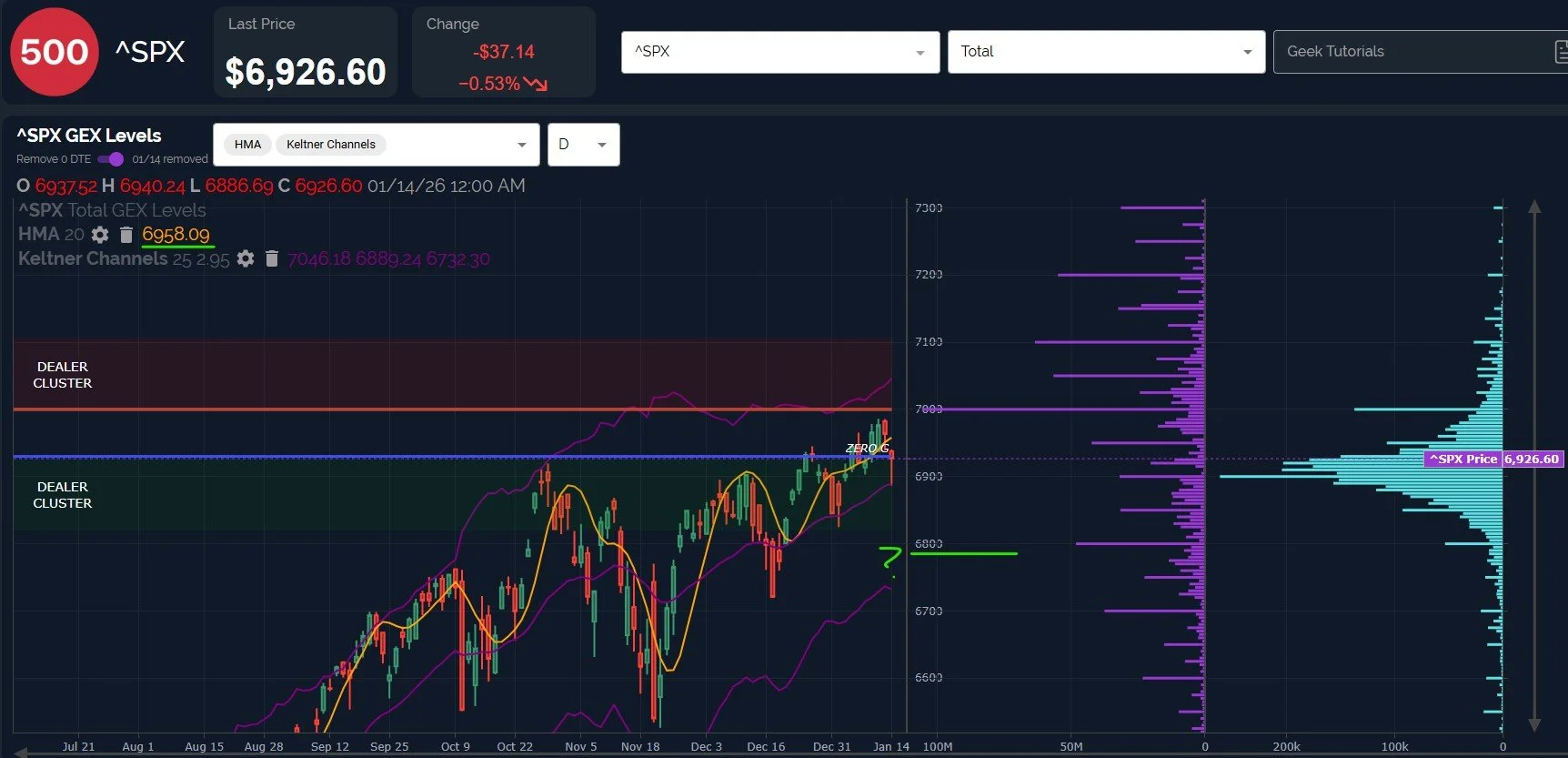

SPX gapped below the daily Hull, the first technical warning sign I’ve seen in several days, preceded by a drift lower in net GEX.

SPX staged a sizable rebound off of intraday lows, but price was unable to finish the day positive, remaining some 21 points below the Hull with a red candle.

The bounce off of the middle Keltner channel at 6889 deserves honorable mention, but we remain below the 6950 GEX cluster and the Hull at 6958, leaving the burden on bulls to prove bears’ efforts futile.

A break (and holding) above the Hull will be a positive sign that 7000 is the next stop, though continuation lower looks a bit unclear, with the next two largest net negative GEX clusters residing at 6850 and 6800, both of which are potential targets. The lower Dealer Cluster zone stretches from 6800-6900, so technically, we have entered the zone, potentially indicating that entering new shorts may not be the best risk/reward in the near-term. We will monitor changes intraday and share in Discord.

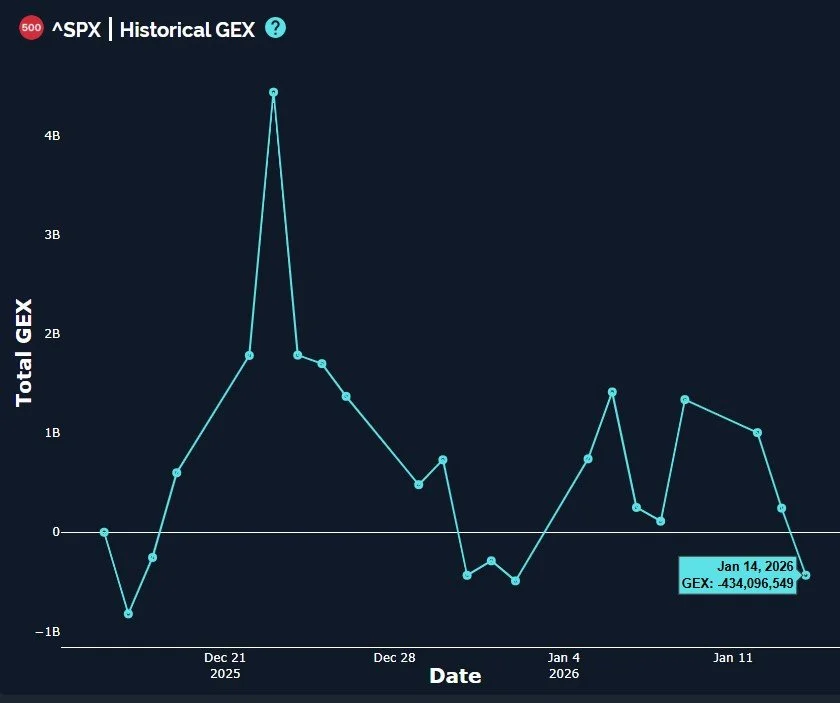

SPX continued lower in terms of net GEX for the 3rd day in a row, reaching an area that has marked approximate low readings for GEX in the 2nd half of December. While the trend is clearly negative, it’s hard to draw any actionable conclusions from today’s reading, given that GEX needs to go even lower to mark a negative extreme, though the trend is certainly negative, and negative GEX tends to result in exacerbated moves in both directions (more volatility) in the very short term.

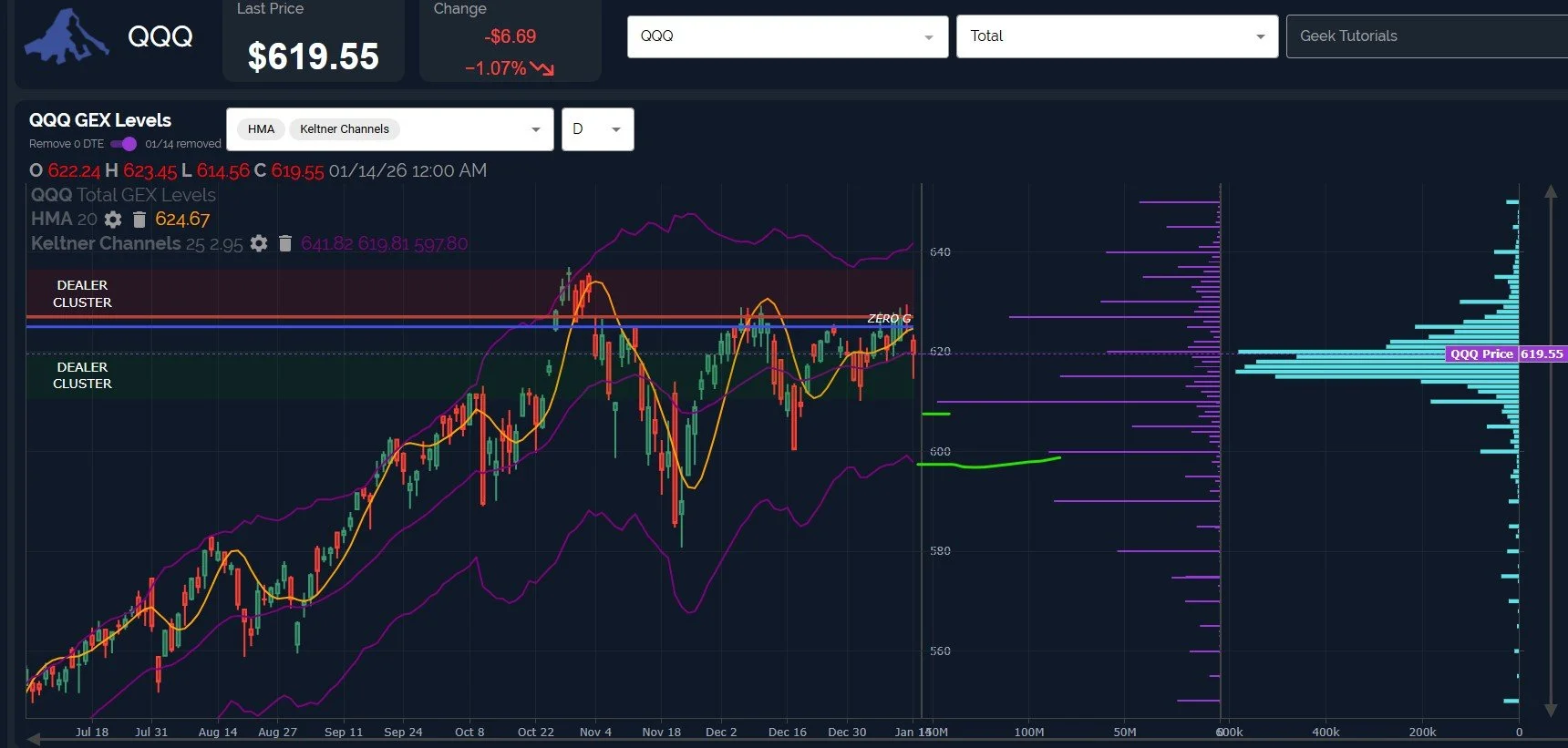

QQQ also saw net GEX decrease, dropping into negative territory.

Technically, QQQ also lost the daily Hull, now roughly 5 points below the line.

While SPX lacks negative GEX clusters that are comparable to the large net positive cluster at 7000, QQQ’s largest GEX cluster (on a net basis) is at 610, making 610 an obvious target. 600 is also meaningful in size, so either of those GEX clusters could mark a reversal area for this pullback.

I particularly like the confluence of the lower Keltner channel with the 600 strike, plus, doesn’t Wall Street love BRNs (Big Round Numbers)?

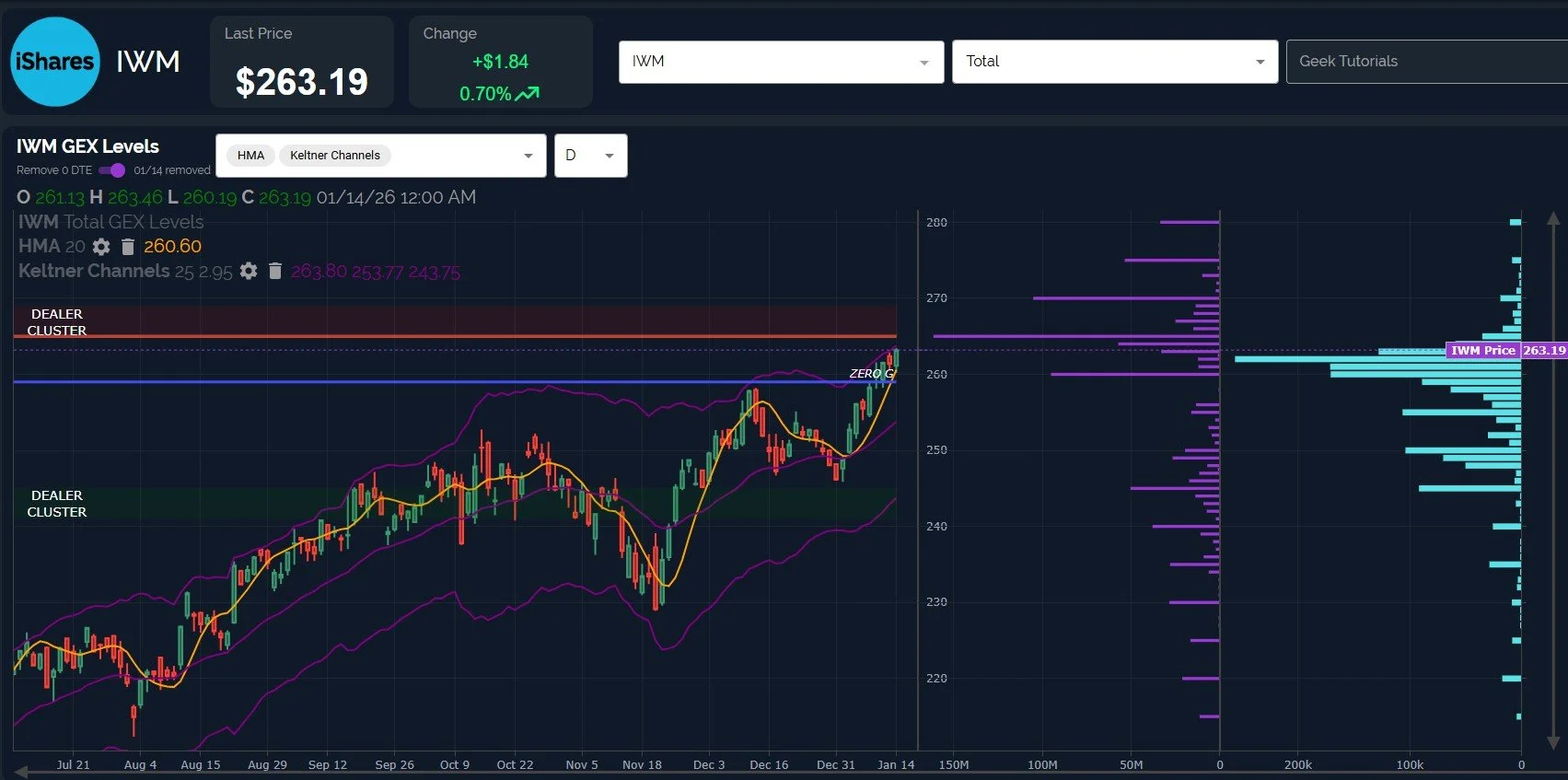

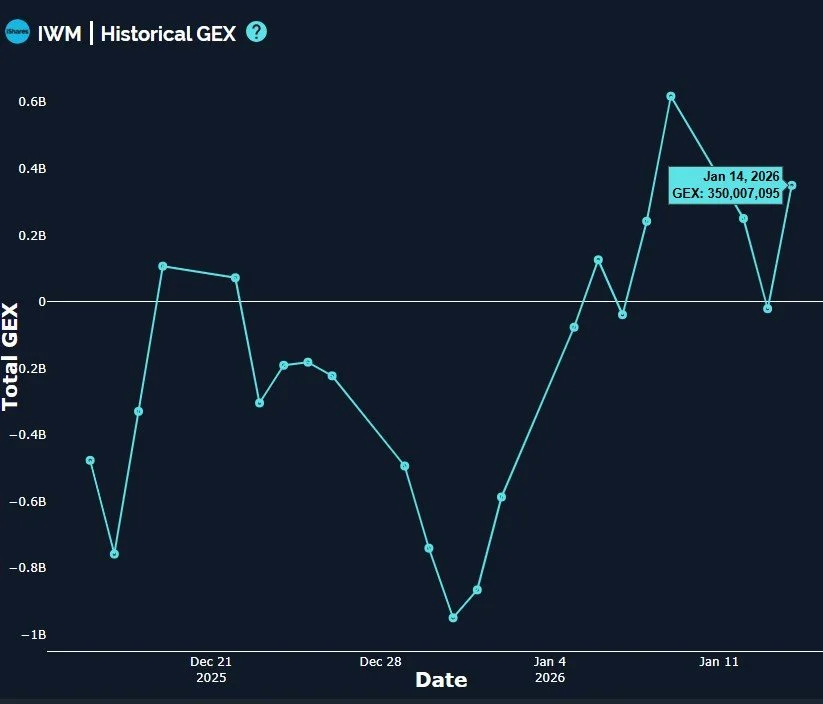

IWM must have been in the eye of the storm, smiling with sunny skies overhead while its neighbors were huddled in the bathtub with a mattress over their heads.

IWM made another high today, reversing from early weakness and inching closer to the big 265 target.

The rising Hull is now at 260.60, so I’m 50/50 (remember, hindsight is 20/20) on how long this rally can last. The Hull will very quickly reach the upper Keltner channel given the steeper angle of the Hull, so I do have some conviction that we can see IWM turn south anywhere from here to 265 (or just over). Does this mean other indices drop even more, or do we see another flip-flop?

IWM’s net GEX rebounded back into positive territory with today’s move, so IWM has been an outlier both in terms of price action and net GEX.

IWM’s strength is noteworthy, but as a bottom feeder (or maybe I should say “relative bargain hunter”), perhaps the names that get beaten up the most in this pullback will be the ones to consider adding on the long side. We aim for diversification amongst long positions as well as asymmetric hedges, so we’ll be busy over the next few days reshaping our current holdings.

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.