Entering OpEx Friday: January 16 Stock Market Preview

We’re offering a New Year special that will end tomorrow: $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, QQQ, the VIX, IWM, and BTC, so check it out if you have a few minutes!

I’ve gotten away from my prior pronouncement of more concise newsletters, so tonight I will try to return to my stated goal. Exceptions will be made when I have one of the best jokes you’ll ever hear, especially if I need to provide context beforehand. Thank you for understanding and thank you in advance for thanking me later.

IWM reached 265 today, in fact, the high was 267.05. IWM is within the upper Dealer Cluster zone, representing the largest positive GEX cluster and an area where we expect dealers may become sellers. The Keltner channels look bullish, though the Hull Moving Average leaves little room for advance outside of a parabolic move higher.

Scenario 1 (in order of odds of success, according to my own opinion): IWM consolidates around 265 (presumably while SPX heads for 7000). A pullback begins sometime between tomorrow and Wednesday, targeting 250-260, depending upon GEX movement.

Scenario 2: IWM surpasses 265, reaching 270, failing and retracing back to the border of the upper Keltner channel, which is rising. A pullback likely stops at 255-260 and we continue higher.

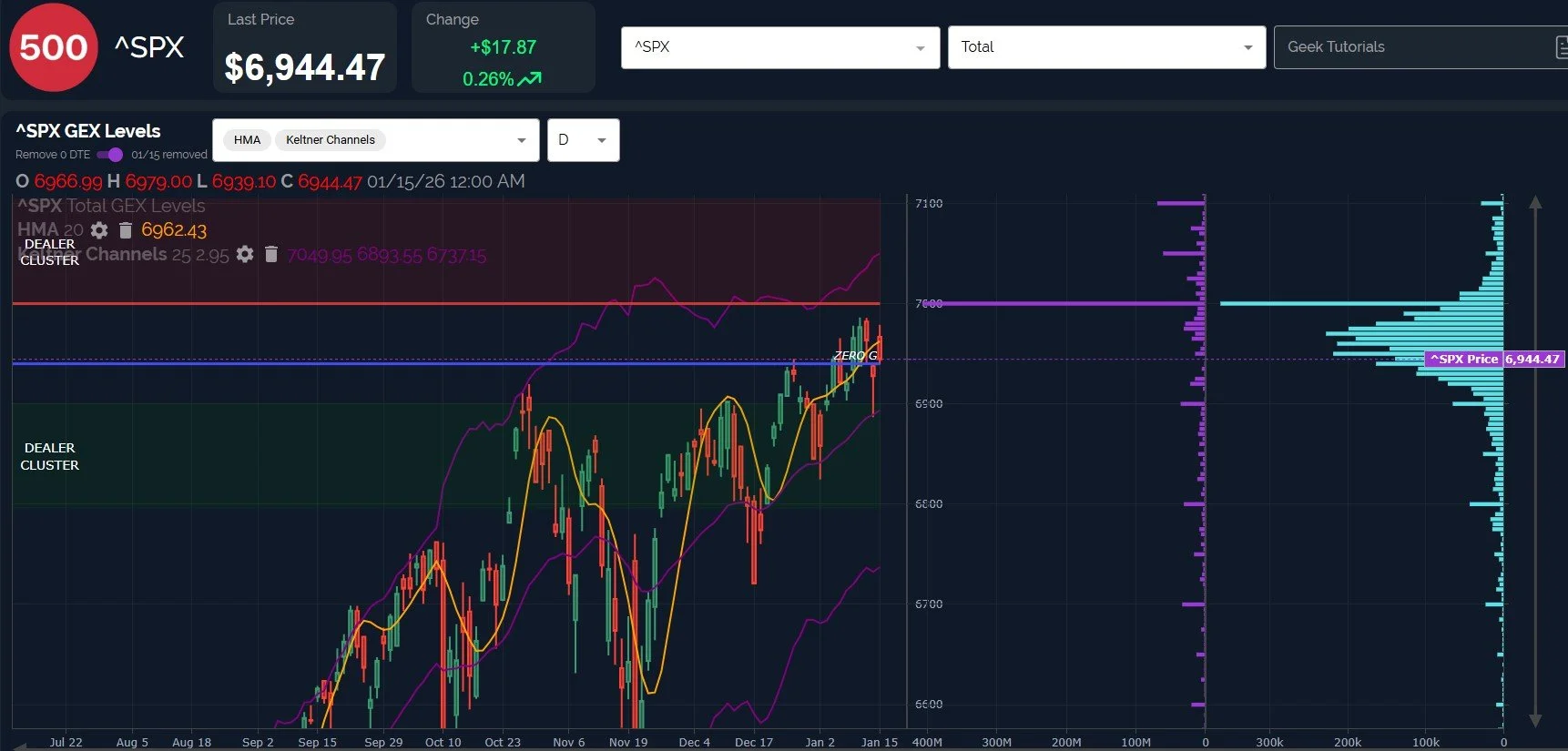

SPX technically looks fairly weak today, closing below the Hull for the 2nd day, though closing higher than yesterday’s close. The Keltner channels look bullish, and we have 7000 overhead as a large positive GEX cluster.

Scenario 1: SPX reaches 7000 tomorrow, then consolidates either sideways or drops in coming days, possibly targeting 6800-6900 before continuing higher into the Spring.

Scenario 2: Today’s failure sees continuation lower tomorrow, targeting a 6900 retest (possibly 6850), the climb to 7000 resumes thereafter.

Scenario 3: Slow grind higher, temporary stop at 7000, GEX shifts higher and we continue toward 7100.

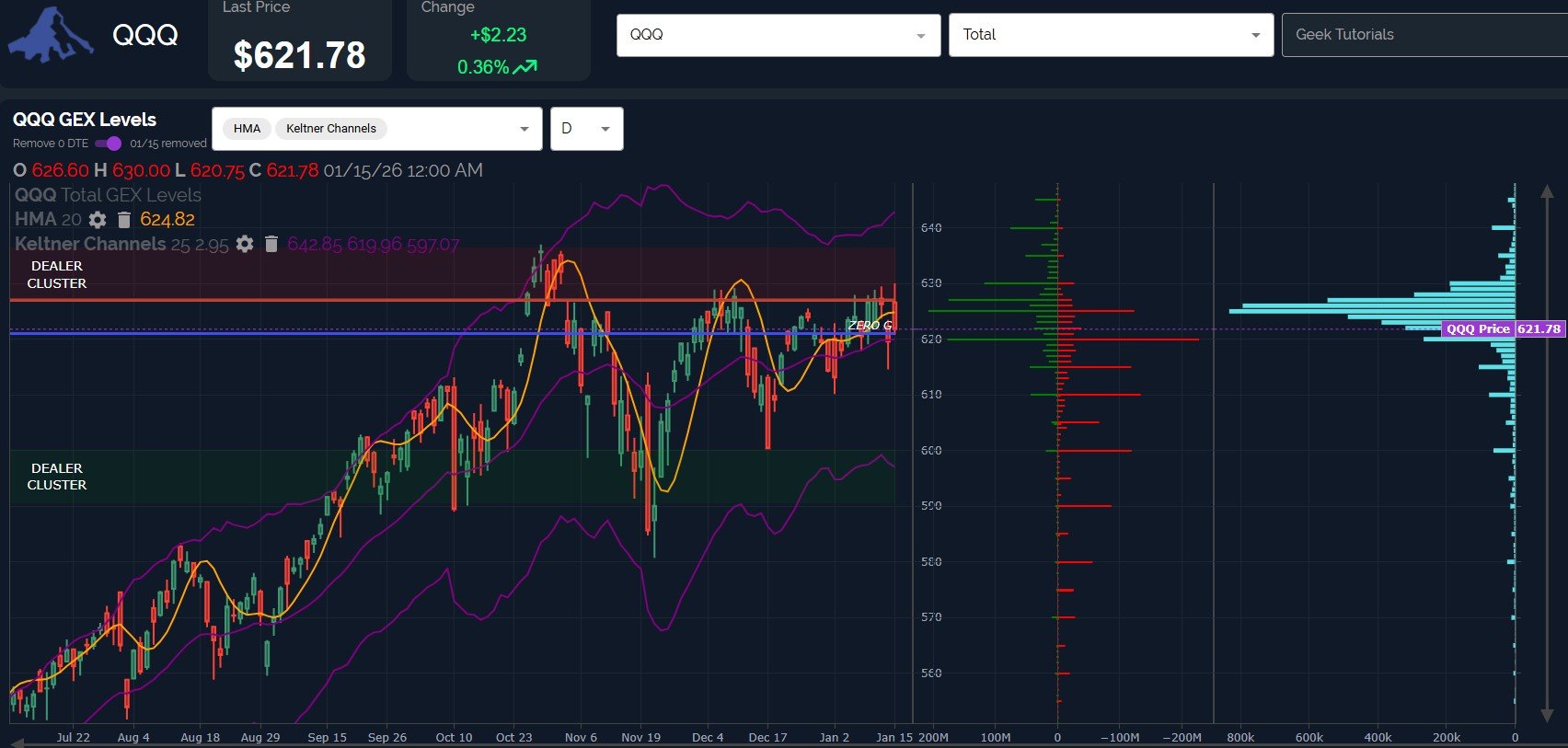

QQQ looks weakest, failing above the Hull and closing back below the important 624-625 area. Despite technical weakness, GEX improved today, back in positive territory. We also see QQQ holding above the important 620 zone.

Scenario 1: QQQ reverses again Friday, targeting 630-640 to conclude OpEx. This also concludes the likely immediate upside given the neutral chart, resulting in a selloff either back to 620 or potentially toward 600.

Scenario 2: Today’s close below the Hull sees weakness down to at least 610, potentially consolidating for another attempt at higher levels.

The VIX gapped down and dropped below the important rising daily Hull at 15.73, though the VIX gained ground from the open and closed above the line, a line that has held all year so far (“all year” sounds like a much longer timeframe than saying “the last 2 weeks”).

Scenario 1: The VIX sees a “false breakdown” toward 14.75, representing the approximate lower 2-hour Keltner channel and the weekly Hull. Next week, the VIX begins a climb toward the 20 strike.

Scenario 2: The VIX rises toward 17 before failing, accompanying a market reversal that traps bulls to make new highs.

Scenario 3: The VIX heads toward 14.75, then falls further, consolidating at 13-14 for a period of time.

The 2-hour VIX chart below shows that the VIX has just regained the Hull, though the Hull is still declining, so even smaller timeframes seem to back the idea of the VIX remaining under pressure at least until 15 is retested.

You can see overall we still have bullish scenarios in play, though we have to deal with the uncertainties of conflicting signals by addressing several scenarios. We will be ready to react at the levels discussed and we’ll incorporate tomorrow’s 0 DTE data into our real-time decisions as well. We hope you’ll join us in Discord, we shared some real-time information today in our free channel and we’ll do so tomorrow as well!

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.